A term life insurance calculator helps you determine the amount of coverage you may need. By factoring in your age, income, and debts, the calculator provides an estimate of the protection you should consider.

With the unpredictability of life, it’s crucial to plan for the future by securing adequate term life insurance. Utilizing a term life insurance calculator can offer valuable insights into identifying the right coverage amount and ensuring financial security for your loved ones.

This tool considers various financial aspects, such as outstanding debts and income replacement needs, allowing you to make an informed decision tailored to your specific circumstances. Ultimately, utilizing a term life insurance calculator can be a pivotal step in securing your family’s future and providing peace of mind.

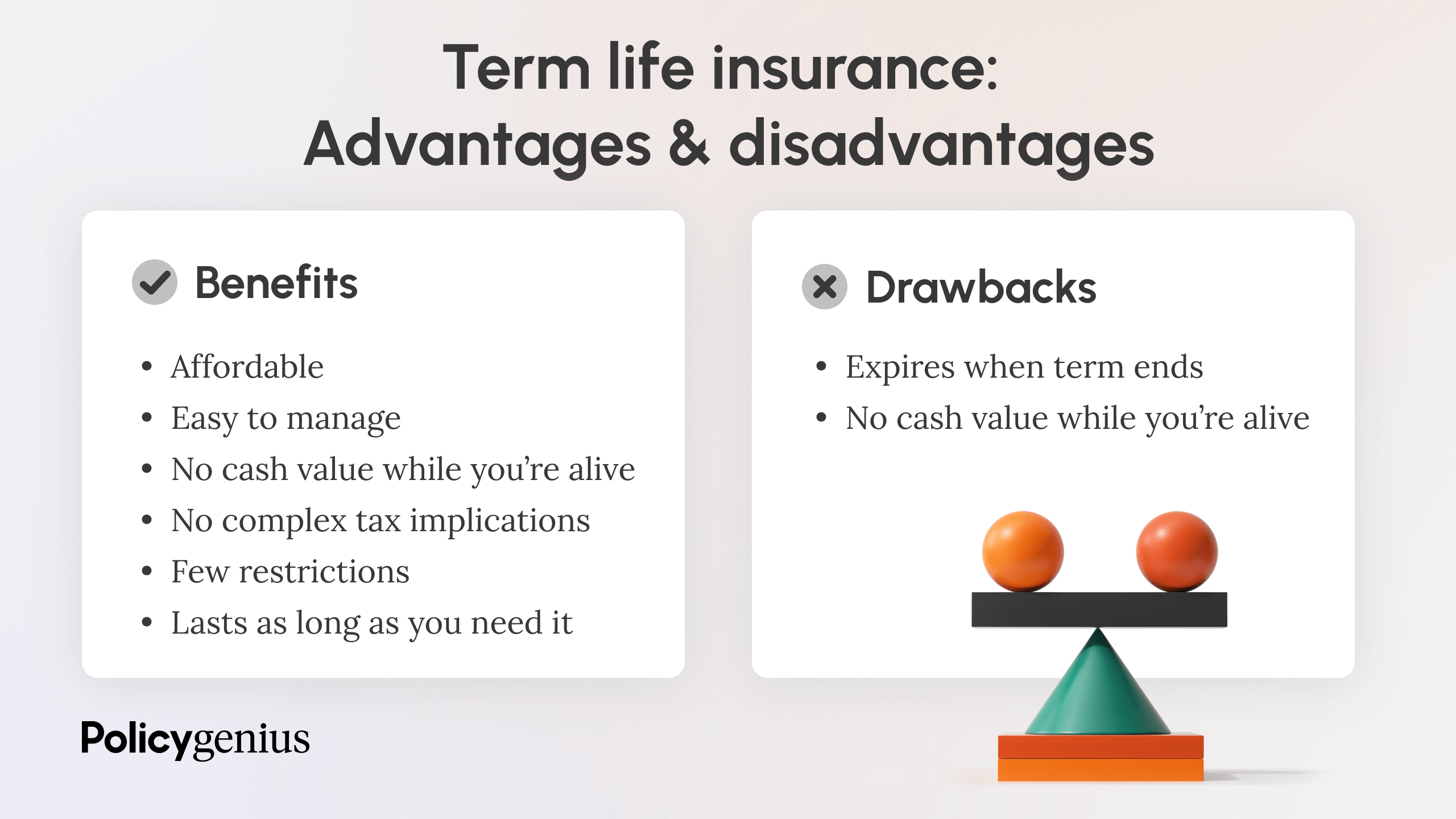

Credit: http://www.policygenius.com

The Importance Of Term Life Insurance

Calculate term life insurance needs using an easy online tool to ensure adequate coverage for your family’s financial security. By analyzing factors such as income, expenses, and debts, you can determine the right amount of coverage with a term life insurance calculator.

Safeguard your loved ones’ future today.

What Is Term Life Insurance?

Term life insurance provides coverage for a specific period, offering financial protection to your loved ones in the event of your death.

Why Should You Consider Term Life Insurance?

- Affordable: Term life insurance is cost-effective compared to other types of life insurance.

- Flexible: You can choose the term that aligns with your needs, whether it’s 10, 20, or 30 years.

- Peace of Mind: Knowing your family will be financially secure gives you peace of mind.

Common Myths About Term Life Insurance

- It’s expensive: Term life insurance is affordable and provides essential coverage.

- Not Necessary: It’s crucial to protect your family’s financial future with term life insurance.

- Complex: Term life insurance is straightforward and easy to understand.

Understanding Term Life Insurance Calculators

What Is A Term Life Insurance Calculator?

A term life insurance calculator is a tool that helps individuals determine the coverage amount needed based on their financial situation and needs.

How Do Term Life Insurance Calculators Work?

Term life insurance calculators use inputs such as age, income, debts, and desired coverage length to estimate the appropriate policy amount.

Benefits Of Using Term Life Insurance Calculators

- Accurate Coverage: Ensures you get the right amount of coverage for your needs.

- Cost-Efficient: Helps you avoid overpaying for excessive coverage.

- Time-Saving: Quickly provides estimates without the need for manual calculations.

Factors To Consider When Using A Term Life Insurance Calculator

In order to determine the amount of coverage you need and the length of your policy when using a term life insurance calculator, you must consider several important factors. These factors will help you make an informed decision and ensure that you choose a policy that meets your specific needs and circumstances. The following are vital factors:

Age And Gender

Age and gender play a significant role in determining the cost of your term life insurance policy. Typically, younger individuals and females tend to pay lower premiums compared to older individuals and males. This is because younger individuals are considered to be at a lower risk of developing health issues, and females generally have a longer life expectancy than males. Therefore, it’s important to input your accurate age and gender when using a term life insurance calculator to get an estimate.

Health Condition

Your health condition directly affects the cost of your life insurance policy. Insurance providers assess your health to determine the level of risk involved in insuring you. Factors such as chronic illnesses, pre-existing conditions, and a history of medical issues may result in higher premiums. On the other hand, if you are in good health and lead a healthy lifestyle, you may be eligible for lower premiums. When using a term life insurance calculator, be sure to consider your current health condition to obtain an accurate estimate.

Smoking And Alcohol Consumption

Smoking and alcohol consumption are considered high-risk behaviors in the insurance industry. Tobacco use and excessive alcohol consumption can have long-term detrimental effects on your health, leading to various health issues. Insurance providers may charge higher premiums for individuals who smoke or regularly consume alcohol. Therefore, it’s important to disclose any tobacco or alcohol use accurately when using a term life insurance calculator to get an accurate quote.

Policy Length And Coverage Amount

The length of your policy and the amount of coverage you need are important factors to consider when using a term life insurance calculator. The length of your policy should align with your financial obligations and the timeframe during which your dependents will need financial support. Additionally, the coverage amount should be sufficient to cover outstanding debts, funeral expenses, future education expenses, and provide financial security to your loved ones. Consider these factors carefully when using a term life insurance calculator to ensure you select the right length and coverage amount.

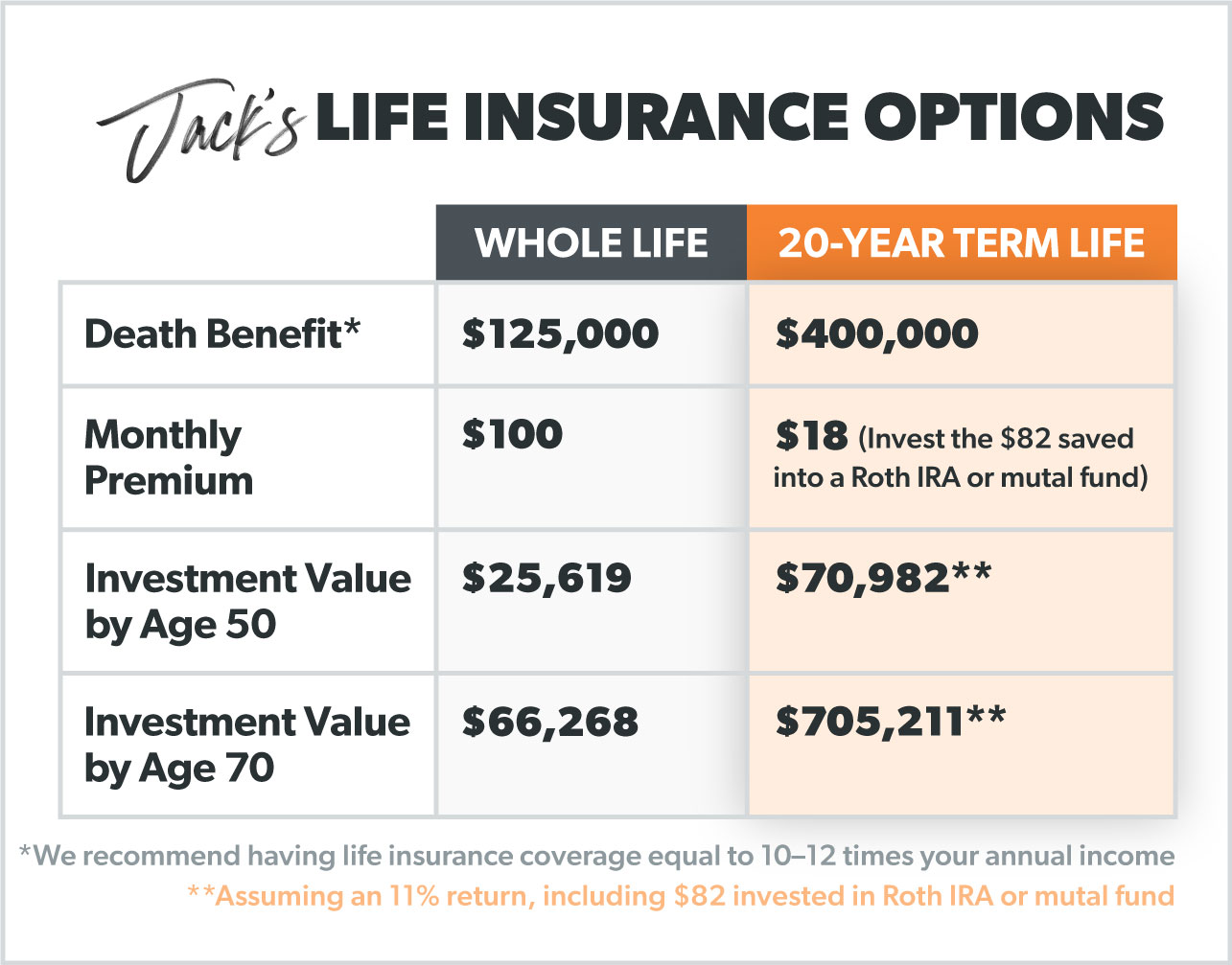

Credit: http://www.ramseysolutions.com

How To Use A Term Life Insurance Calculator

When it comes to planning for your family’s financial security, term life insurance is an essential consideration. If you’re looking to determine the amount of coverage you need, a term life insurance calculator can be an invaluable tool. It provides a quick and reliable way to gauge the estimated coverage required to safeguard your loved ones.

Gather Relevant Information

Before using a term life insurance calculator, it’s important to gather the necessary information. You will need to know your annual income, outstanding debts, and future financial obligations. Additionally, you should consider factors like education expenses, mortgage payments, and funeral costs.

Input The Information Into The Calculator

Once you have the required information, input it into the term life insurance calculator. These calculators are typically user-friendly, allowing you to enter the relevant details with ease. The calculator will then process the data to provide an accurate estimate of the coverage amount needed.

Review And Compare Quotes

After receiving the estimate, it’s crucial to review and compare quotes from different insurance providers. By doing so, you can ensure that you are getting the best possible deal. This step is essential in choosing the right policy that aligns with your family’s needs and budget.

Understanding The Results From A Term Life Insurance Calculator

When using a term life insurance calculator, it’s important to understand the results. The calculator provides an estimate of how much coverage you may need based on your financial situation and family’s needs. By inputting your details, you can gain insight into the appropriate level of coverage for your circumstances.

Understanding the Results from a Term Life Insurance Calculator Term life insurance is a vital financial decision, and using a term life insurance calculator can help you determine the coverage that best fits your needs. However, understanding the results from the calculator is key to making an informed decision. Here’s a breakdown of what to look for in the results to ensure you choose the right policy.Premium Amount

When reviewing the results from a term life insurance calculator, the premium amount is the cost of the policy. This is an essential factor to consider when determining the affordability of the coverage. Understanding how the premium amount is calculated and how it fits into your budget can help you make an informed decision about which policy to choose.Policy Length And Coverage Amount

The policy length and coverage amount are crucial components of the results from a term life insurance calculator. These factors determine how long the policy will last and the amount of insurance coverage provided. Assessing the implications of different policy lengths and coverage amounts can help you tailor the policy to meet your specific needs.Policy Options And Riders

Policy options and riders suggested by the term life insurance calculator can enhance your policy with added benefits or features. Understanding these options and riders in the results can help you customize a policy to better protect your beneficiaries. Review these options carefully to see if they align with your needs and financial situation. In summary, understanding the results from a term life insurance calculator is crucial in making an informed decision about your insurance coverage. By carefully examining the premium amount, policy length and coverage amount, as well as policy options and riders, you can ensure that the policy you select provides the protection your loved ones need.Additional Resources For Term Life Insurance

When it comes to term life insurance, it’s crucial to choose the right insurance provider, understand the fine print of the policy, and seek professional advice. These additional resources can help you navigate the complexities of term life insurance and make informed decisions. Let’s explore each aspect in detail.

Choosing The Right Insurance Provider

Choosing the right insurance provider is the foundation of a solid term life insurance policy. With so many options available, it can be overwhelming to make the best choice. Remember that not all insurance providers are created equal, so it’s essential to do thorough research before committing to a policy.

Consider the following factors when selecting an insurance provider:

- Financial Stability: It’s vital to opt for an insurance company with a strong financial background. This ensures that they will be able to fulfill their obligations in case of a claim.

- Reputation and Customer Reviews: Look for insurance providers with a positive reputation and excellent customer reviews. This indicates their level of customer satisfaction and reliability.

- Term Life Insurance Options: Determine whether the insurance provider offers a wide range of term life insurance options to fit your specific needs.

- Rate Comparisons: Compare rates from different insurance providers to find the most affordable policy without compromising on coverage.

Understanding The Fine Print Of The Policy

Before finalizing any term life insurance policy, it’s crucial to carefully read and understand the fine print. The policy document contains important information about coverage, exclusions, premiums, and other details that affect your benefits. Here’s what to look out for:

- Coverage Details: Understand the coverage amount, term length, and any specific exclusions mentioned in the policy.

- Premium Payments: Familiarize yourself with the premium payment schedule and options available. Be aware of any penalties or consequences for late payments.

- Renewal and Conversion Options: Check whether the policy offers renewal options or the ability to convert to a permanent life insurance policy in the future.

- Additional Riders: Explore any additional riders available with the policy, such as critical illness riders or disability coverage.

- Claim Process: Understand the procedure for filing a claim and make sure you’re aware of any documentation required.

Seeking Professional Advice

While gathering information and understanding the fine print is essential, seeking professional advice from insurance experts is highly recommended. An insurance professional can guide you throughout the process, helping you assess your needs, understand policy terms, and find the best solution for your specific circumstances.

An insurance agent or financial advisor can provide valuable insights, answer your questions, and assist you in making an informed decision. They can help tailor a term life insurance policy based on your financial goals, family situation, and budget.

Remember, term life insurance is a significant investment in your family’s financial security. By utilizing these additional resources, including choosing the right insurance provider, understanding the fine print, and seeking professional advice, you can ensure that you make the best decision for you and your loved ones.

How To Make An Informed Decision

Making an informed decision about how much term life insurance to get can be done easily with the help of a life insurance calculator. This tool allows you to assess your needs and determine the right coverage for your specific situation, ensuring you make a well-informed choice.

Evaluate Your Personal Circumstances

Assess your current financial needs and determine the coverage amount required.

Compare Quotes From Multiple Providers

Receive quotes from various companies to find the best rates and policies for you.

Consider Future Financial Goals

Think about your future financial goals such as college savings or mortgage payments.

Credit: http://www.canarahsbclife.com

Frequently Asked Questions On How Much Term Life Insurance Calculator

How Can I Calculate The Amount Of Term Life Insurance I Need?

To calculate the amount of term life insurance you need, consider factors such as income, debts, and future expenses. Start by using an online term life insurance calculator to get an estimate of the coverage amount. It’s also advisable to consult with a financial advisor for a more accurate assessment.

Why Is A Term Life Insurance Calculator Important For Financial Planning?

A term life insurance calculator is crucial for financial planning as it helps determine the appropriate coverage needed to safeguard your family’s financial future. By inputting relevant details such as income, expenses, and debts, the calculator provides a tailored estimation, ensuring you secure the right amount of coverage.

What Factors Should I Consider When Using A Term Life Insurance Calculator?

When using a term life insurance calculator, consider factors such as your annual income, outstanding debts, mortgage balance, and future expenses. Additionally, take into account any college savings or other financial obligations. By inputting accurate information, you can obtain a reliable estimate for your insurance coverage needs.

How Accurate Are The Results From A Term Life Insurance Calculator?

The results obtained from a term life insurance calculator are accurate provided that you input precise and up-to-date financial information. While the calculator provides an estimate, it’s advisable to seek professional guidance from insurance experts or financial advisors to ensure the coverage aligns with your specific circumstances and requirements.

Conclusion

A term life insurance calculator is an invaluable tool that can help you determine the appropriate amount of coverage you need to protect your loved ones. By considering factors such as your age, income, debt, and financial goals, you can make an informed decision that provides financial security in the event of your untimely death.

Don’t underestimate the importance of this crucial step in securing your family’s future. Get started with a term life insurance calculator today and gain peace of mind.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “How can I calculate the amount of term life insurance I need?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To calculate the amount of term life insurance you need, consider factors such as income, debts, and future expenses. Start by using an online term life insurance calculator to get an estimate of the coverage amount. It’s also advisable to consult with a financial advisor for a more accurate assessment.” } } , { “@type”: “Question”, “name”: “Why is a term life insurance calculator important for financial planning?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A term life insurance calculator is crucial for financial planning as it helps determine the appropriate coverage needed to safeguard your family’s financial future. By inputting relevant details such as income, expenses, and debts, the calculator provides a tailored estimation, ensuring you secure the right amount of coverage.” } } , { “@type”: “Question”, “name”: “What factors should I consider when using a term life insurance calculator?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “When using a term life insurance calculator, consider factors such as your annual income, outstanding debts, mortgage balance, and future expenses. Additionally, take into account any college savings or other financial obligations. By inputting accurate information, you can obtain a reliable estimate for your insurance coverage needs.” } } , { “@type”: “Question”, “name”: “How accurate are the results from a term life insurance calculator?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The results obtained from a term life insurance calculator are accurate provided that you input precise and up-to-date financial information. While the calculator provides an estimate, it’s advisable to seek professional guidance from insurance experts or financial advisors to ensure the coverage aligns with your specific circumstances and requirements.” } } ] }

Leave a comment