Travel insurance provides coverage for unexpected events or mishaps that may occur during your trip, such as trip cancellations, medical emergencies, or lost luggage. It is essential for protecting yourself financially and ensuring peace of mind while traveling.

With travel insurance, you can enjoy your journey knowing that you have protection against unforeseen circumstances, allowing you to focus on making lasting memories and exploring new destinations. Whether you’re planning a vacation, business trip, or international adventure, having travel insurance is a smart and responsible decision.

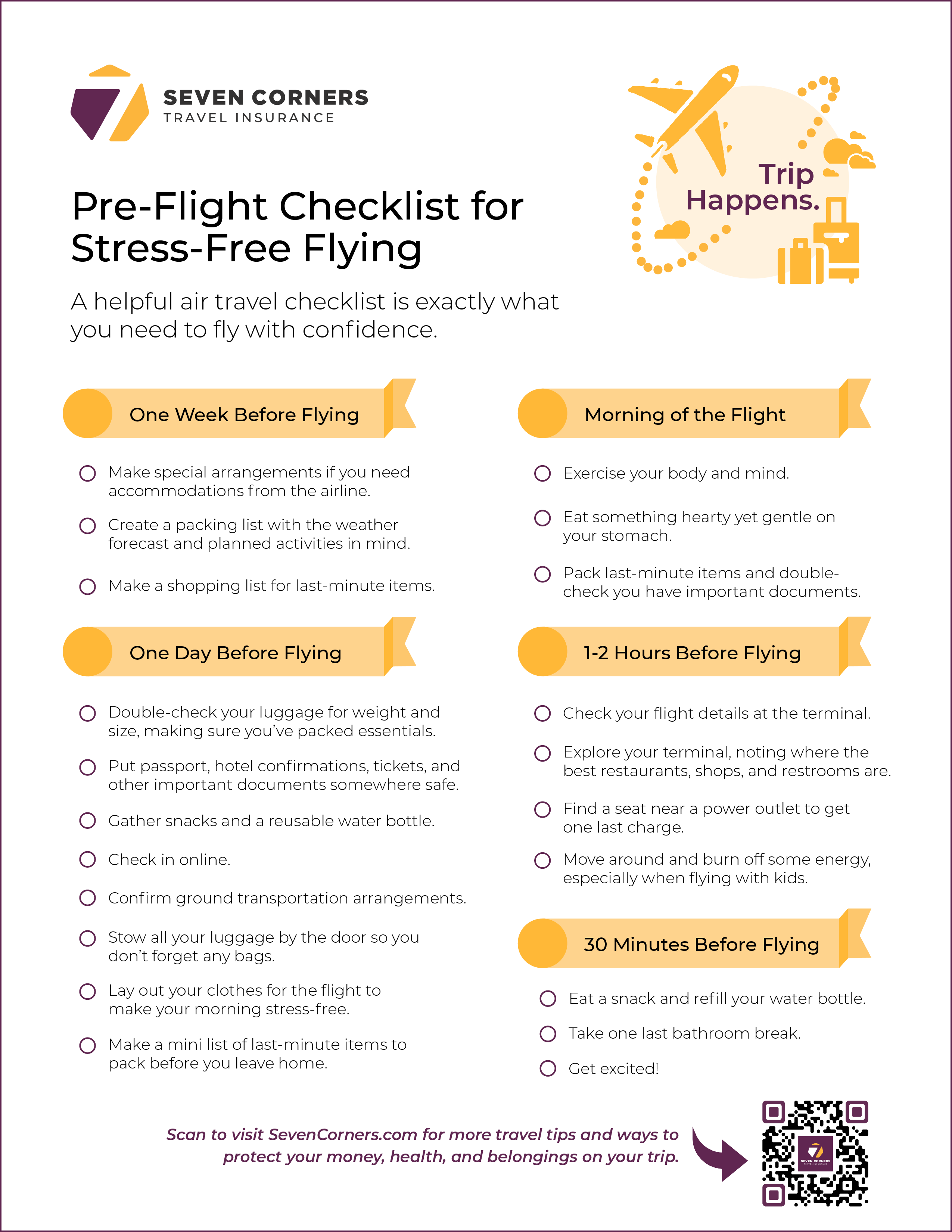

Credit: http://www.sevencorners.com

Importance Of Travel Insurance

Travel insurance proves critical in unforeseen circumstances providing financial and emotional security to travelers. Despite meticulous planning, travel emergencies can occur, making insurance indispensable.

Coverage For Medical Emergencies

In the event of unexpected medical needs, travel insurance ensures coverage for treatment and hospitalization expenses worldwide.

Protection Against Trip Cancellations

Travel insurance offers compensation for non-refundable trip costs due to cancellations or interruptions caused by unforeseen circumstances.

Credit: http://www.remotetribe.life

Choosing The Right Policy

When it comes to travelling, it is always better to be safe than sorry. That’s why having travel insurance is crucial. However, choosing the right policy can be a daunting task with so many options available in the market. To make things easier, we have outlined a few key factors to consider when selecting a travel insurance policy.

Understanding Inclusions And Exclusions

Before settling on a travel insurance policy, it is essential to carefully review and understand the inclusions and exclusions. Inclusions refer to the coverage provided by the policy, while exclusions specify the situations or circumstances that are not covered. By familiarizing yourself with these details, you can ensure that the policy aligns with your specific travel needs. Some common inclusions to look for include:

- Emergency medical expenses

- Trip cancellation or interruption

- Lost or delayed baggage

- Travel delays or missed connections

On the other hand, exclusions may vary from policy to policy, but they typically include:

- Pre-existing medical conditions

- Acts of terrorism or war

- Participation in risky activities

Understanding these inclusions and exclusions will help you choose a policy that provides the necessary coverage for your travel plans, while excluding any activities or circumstances that may not be covered.

Consideration Of Adventure Activities Coverage

If you are an adventure enthusiast and enjoy thrilling activities such as scuba diving, bungee jumping, or skiing, it is essential to consider the adventure activities coverage provided by your travel insurance policy. Not all policies automatically cover these high-risk activities, so make sure to review the policy details to see if they are included. If not, you may need to purchase additional coverage or find a policy that specifically caters to adventure sports.

When evaluating adventure activities coverage, pay attention to the following points:

- The types of activities covered

- Any restrictions or limitations

- Required certifications or qualifications

By considering adventure activities coverage, you can ensure that you have adequate protection during your adrenaline-fueled escapades.

Key Factors To Consider Before Purchasing

When it comes to purchasing travel insurance, there are several key factors that individuals should consider before making a decision. By carefully evaluating these factors, travelers can ensure that they select a policy that provides adequate coverage for their specific needs and circumstances.

Duration And Destination Of Travel

The duration and destination of your travel are crucial factors that should influence your choice of travel insurance. Consider the length of your trip and the locations you plan to visit, as certain policies may have limitations based on these factors. For instance, adventure sports, extreme activities, or visits to high-risk destinations may require specialized coverage options.

Pre-existing Medical Conditions

Individuals with pre-existing medical conditions should pay close attention to how these conditions are addressed in a travel insurance policy. Some policies may have exclusions or limitations related to pre-existing conditions, while others may offer coverage with additional premiums. It’s important to disclose all pre-existing conditions accurately to ensure adequate coverage and avoid potential claim denials.

Tips For Making A Claim

When it comes to travel insurance, knowing how to make a claim is crucial. The process can be overwhelming, especially if you’re dealing with unexpected travel mishaps. But with the right knowledge and preparation, you can make the claims process smooth and efficient. In this guide, we’ll cover essential tips for making a claim on your travel insurance policy, including documentation requirements, claims procedure, and timelines.

Documentation Requirements

When making a claim on your travel insurance, proper documentation is essential. To ensure your claim is processed without any hiccups, make sure to have the following documents in place:

- Travel insurance policy details and documents

- Copies of all receipts and invoices related to your claim

- Police reports or incident reports, if applicable

- Medical certificates and bills for any medical expenses incurred during your trip

- Proof of travel, such as flight tickets, boarding passes, or hotel reservations

Claims Procedure And Timelines

Understanding the claims procedure and timelines is crucial for a hassle-free experience. Here are some key points to keep in mind:

- Contact your insurance provider as soon as possible after the incident occurs.

- Follow the specific instructions provided by your insurance company for filing a claim.

- Provide all necessary documentation and information promptly to expedite the claims process.

- Be aware of the timelines for filing a claim and adhere to the deadlines set by your insurance provider.

Importance Of Reading The Fine Print

When planning for a trip, it’s easy to get caught up in the excitement of exploring new places and creating unforgettable memories. However, amidst the anticipation, it is crucial not to overlook one essential aspect of travel preparations – travel insurance. While many people recognize the importance of having travel insurance, they often overlook the importance of reading the fine print. Failing to understand the details and terms of your policy can lead to unpleasant surprises when you need it the most. In this blog post, we will delve into two significant aspects of travel insurance policy that are worth scrutinizing – policy limits and deductibles, as well as understanding emergency assistance services.

Policy Limits And Deductibles

Policy limits and deductibles are two critical elements of your travel insurance policy that should not be overlooked. When it comes to policy limits, it refers to the maximum amount your insurance provider will reimburse you for any covered expenses. These expenses can include medical costs, trip cancellations, lost baggage, or any other unforeseen circumstances that may disrupt your travel plans. It is essential to carefully review the policy limits to ensure they adequately cover your potential expenses.

On the other hand, deductibles are the amount you need to pay out of pocket before your insurance coverage kicks in. It’s imperative to understand the deductibles associated with your policy to avoid any sudden financial burden. Keep in mind that lower deductibles typically mean higher premiums, while higher deductibles can result in lower premiums. Consider your budget and travel requirements before deciding on the deductible that suits your needs.

Understanding Emergency Assistance Services

One of the primary reasons for having travel insurance is to ensure you receive prompt and reliable assistance during emergencies. Emergency assistance services provided by insurance companies can include medical evacuation, repatriation, and even access to 24/7 helplines for immediate support. Understanding the extent of these emergency services and what situations they cover is crucial.

Here are some key questions to consider:

- Does the insurance cover medical evacuation in case of a severe illness or injury?

- What are the provisions for repatriation if the need arises?

- Is there a helpline available 24/7 to assist you in emergencies?

By reading the fine print, you can ensure that you have a clear understanding of what emergency assistance services are available to you and have peace of mind knowing that you will receive the help you need when you need it the most.

Credit: http://www.linkedin.com

Reviewing Your Existing Coverage

Assessing your current travel insurance plan is crucial. Review your coverage, ensuring it aligns with your specific needs and provides adequate protection. Regularly evaluating your policy helps guarantee comprehensive and tailored insurance for your travel adventures.

Credit Card Insurance Benefits

Health Insurance Abroad

When it comes to travel insurance, reviewing your existing coverage is crucial. Check your credit card insurance benefits and clarify health insurance abroad firsthand.

Credit Card Insurance Benefits

Examine your credit card agreement for travel insurance perks such as trip cancellation protection and rental car coverage.

Health Insurance Abroad

Verify if your existing health insurance extends coverage abroad and covers medical emergencies during travel.

Maximizing The Benefits Of Travel Insurance

Travel insurance serves as a safety net during unpredictable journeys. Understanding how to maximize its benefits is crucial for a worry-free trip.

Utilizing Concierge Services

Concierge services offered through travel insurance can enhance your travel experience. From booking reservations to planning activities, they are there to assist you.

Concierge services can help with restaurant recommendations, event tickets, and local insights, making your trip stress-free.

- Make use of concierge services for ease of travel planning.

- They are there to help with any travel hiccups or requests you may have.

Emergency Travel Assistance

In times of emergency, having access to travel assistance can be a lifesaver. Quick response and support ensure you are never stranded.

Emergency travel assistance provides medical guidance, evacuation services, and communication support when needed.

- Know how to reach emergency assistance in case of any unforeseen events.

- Keep your travel insurance details handy for easy access to help when required.

Frequently Asked Questions Of How Travel Insurance

What Is Travel Insurance?

Travel insurance is a protection plan that covers unexpected events such as trip cancellations, medical emergencies, and lost baggage while traveling. It provides financial security and peace of mind for travelers.

Why Do I Need Travel Insurance?

Travel insurance is essential to protect yourself from unforeseen circumstances, such as flight cancellations, medical emergencies, or lost luggage. It provides financial reimbursement for any unexpected expenses during your trip.

What Does Travel Insurance Typically Cover?

Travel insurance typically covers medical emergencies, trip cancellations, lost luggage, travel delays, and emergency evacuation. It offers peace of mind by providing financial protection against unforeseen events during your trip.

When Should I Buy Travel Insurance?

It is advisable to buy travel insurance as soon as you make your initial trip deposit. This ensures that you are covered for any unexpected events that may occur before your trip, such as trip cancellations or interruptions.

Conclusion

In a nutshell, travel insurance is an essential investment for any traveler, providing peace of mind and protection against unforeseen circumstances. By covering medical expenses, trip cancellations, lost baggage, and other mishaps, it ensures a worry-free journey. With its wide range of coverage options and affordable premiums, travel insurance is a must-have for every traveler, allowing them to enjoy their adventures without any stress.

So, before you embark on your next trip, make sure to consider the benefits of travel insurance and choose the plan that best suits your needs.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is travel insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Travel insurance is a protection plan that covers unexpected events such as trip cancellations, medical emergencies, and lost baggage while traveling. It provides financial security and peace of mind for travelers.” } } , { “@type”: “Question”, “name”: “Why do I need travel insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Travel insurance is essential to protect yourself from unforeseen circumstances, such as flight cancellations, medical emergencies, or lost luggage. It provides financial reimbursement for any unexpected expenses during your trip.” } } , { “@type”: “Question”, “name”: “What does travel insurance typically cover?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Travel insurance typically covers medical emergencies, trip cancellations, lost luggage, travel delays, and emergency evacuation. It offers peace of mind by providing financial protection against unforeseen events during your trip.” } } , { “@type”: “Question”, “name”: “When should I buy travel insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “It is advisable to buy travel insurance as soon as you make your initial trip deposit. This ensures that you are covered for any unexpected events that may occur before your trip, such as trip cancellations or interruptions.” } } ] }

Leave a comment