Umbrella insurance provides extra liability coverage that extends beyond the limits of your existing policies, such as auto or home insurance. It helps protect you from large lawsuits and claims.

With the increasing number of lawsuits and the potential for large settlements, having umbrella insurance is becoming more important. This type of insurance provides an additional layer of liability coverage that goes beyond your primary policies, such as auto or home insurance.

Umbrella insurance works by providing extra protection in the event that you are sued for a substantial amount that exceeds the limits of your underlying policies. For example, if you are at fault in a car accident and the resulting damages exceed your auto insurance limits, umbrella insurance can help cover the remaining costs. It can also provide coverage for situations not typically covered by your other policies, such as libel or slander claims. Having umbrella insurance can give you peace of mind knowing that you have an additional layer of protection against unexpected and potentially devastating financial loss. By adding this type of coverage, you are safeguarding your assets and future earnings from the potential risk of a lawsuit.

Credit: http://www.fidelity.com

Coverage Details

Primary Coverage Limitations

Umbrella insurance extends beyond basic policies, providing extra liability protection.

Types Of Incidents Covered

Umbrella insurance covers a wide range of incidents not included in standard policies.

:max_bytes(150000):strip_icc()/Accidental-Death-and-Dismemberment-ADD-Insurance-v3-745262583fd74ebf9964311fd9bcaf29.png)

Credit: http://www.investopedia.com

Benefits Of Umbrella Insurance

Umbrella insurance is an additional type of coverage that offers extended liability protection and adds an extra layer of security to your existing insurance policies. It provides added peace of mind by filling in the gaps where your standard policies fall short. Let’s take a closer look at the benefits of umbrella insurance.

Extended Liability Protection

With umbrella insurance, you gain extended liability protection, which goes beyond the limits of your primary insurance policies. This means that if you face a lawsuit or a substantial claim that exceeds the coverage provided by your home, auto, or other policies, your umbrella insurance kicks in to cover the remaining amount. It acts as a safety net, shielding your assets from being wiped out due to a single accident or incident.

Protection Beyond Standard Policies

Unlike your standard policies, which usually have specific coverage limits, umbrella insurance provides additional protection against various liabilities. Whether it’s for personal injury, property damage, or even libel and slander, umbrella insurance offers a wide range of coverage options that are not typically found in basic insurance policies. This comprehensive coverage ensures that you are safeguarded against unforeseen circumstances that may arise.

The primary objective of umbrella insurance is to provide extra financial protection in situations where the costs surpass your existing policies. It acts as a backstop, preventing you from bearing the brunt of hefty legal expenses or the depletion of your assets due to a legal judgment. Moreover, umbrella insurance can also cover legal defense costs, even if the lawsuit turns out to be baseless.

Cost And Considerations

When considering insurance options, cost and careful considerations play a crucial role. Here, we’ll delve into the factors influencing the cost of umbrella insurance and determine the instances when acquiring this type of insurance is essential.

Factors Affecting Cost

Several factors influence the cost of umbrella insurance:

- Personal Risk Profile

- Liability Limits

- Existing Coverage

- Location

- Claim History

- Insurance Company

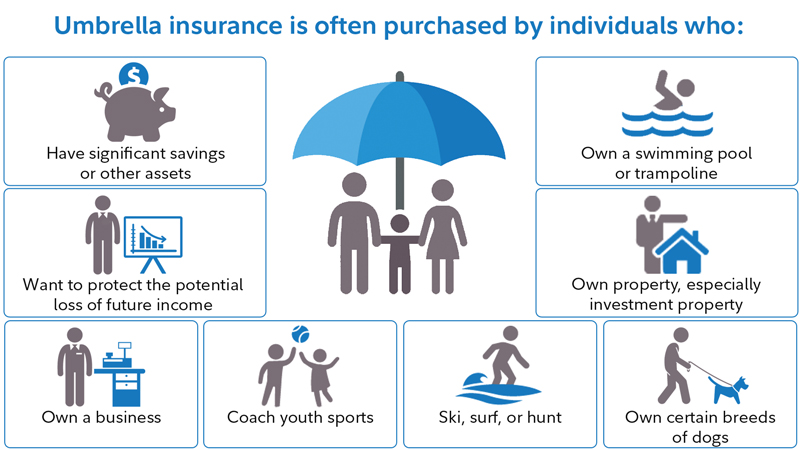

When To Consider Umbrella Insurance

Umbrella insurance is essential when:

- You Own Property

- You Have Significant Assets

- You Engage in High-Risk Activities

- You Want Peace of Mind

Credit: http://www.noyeshallallen.com

Policy Exclusions

Understanding the exclusions of an umbrella insurance policy is crucial for full comprehension of the coverage it provides. Policy exclusions outline specific scenarios that are not included in the coverage, highlighting the limits of protection. By being aware of these exclusions, policyholders can make informed decisions regarding additional supplemental coverage options to fill potential gaps.

Common Exclusions

Umbrella insurance typically does not cover intentional acts of harm, contractual liabilities, and business-related losses. Moreover, it may exclude damages not covered by underlying policies, such as intentional or criminal acts. Additionally, losses arising from uninsured or underinsured property may not be covered, as well as professional liabilities and employment-related practices. In addition, auto-related incidents involving vehicles not covered by the underlying policy may also be excluded from umbrella coverage.

Supplemental Coverage Options

Considering the common exclusions, it’s essential to explore supplemental coverage options that can address these limitations. Some additional coverage options include personal injury liability coverage, uninsured/underinsured motorist protection, and endorsements for specific liabilities not covered under standard policies. Moreover, an umbrella policy can be customized to incorporate these supplemental options, providing a broader scope of protection.

Claim Process

When it comes to umbrella insurance, understanding the claim process is essential. This process outlines the steps you need to take in order to file a claim and how your claim will be settled.

Filing A Claim

When you encounter a situation where you need to make a claim, the first step is to notify your umbrella insurance provider. This can typically be done by contacting them through phone or email. It is important to provide all necessary details about the incident, such as the date, time, and location, as well as any supporting documents or evidence.

Once the claim is filed, an insurance adjuster will be assigned to assess the situation and determine the validity of the claim. The adjuster may request additional information or documentation to fully understand the circumstances surrounding the incident. It is crucial to cooperate and provide any requested information in a timely manner to ensure a smooth claims process.

Claim Settlement

After the claim has been assessed and deemed valid, the next step is the claim settlement. This is the process where the insurance company determines the amount of compensation you are eligible to receive for the covered losses. The settlement can include expenses such as medical bills, property damage, and legal fees.

| Claim Settlement Process | Description |

|---|---|

| Evaluation of Loss | The insurance company evaluates the losses incurred, taking into account the policy coverage and limitations. |

| Negotiation | If necessary, negotiation may occur between the insured and the insurance company to reach an agreed-upon settlement amount. |

| Payment | Once the settlement amount has been agreed upon, the insurance company will issue a payment to the insured. This payment usually covers the actual expenses or damages incurred. |

It is important to note that the claim settlement process may vary depending on the insurance company and individual policy terms. Understanding the specific terms and conditions of your umbrella insurance policy is crucial to ensure you receive the appropriate compensation for your claim.

Choosing A Provider

When it comes to choosing a provider for your umbrella insurance policy, it is crucial to research insurance companies and compare quotes. This step is essential to ensure you get the best coverage at the most competitive rates.

Researching Insurance Companies

Before selecting an insurance provider for your umbrella policy, research various companies. Look into their reputation, financial stability, customer reviews, and their experience in handling umbrella insurance claims.

Comparing Quotes

Obtain quotes from multiple insurance companies to compare coverage options and prices. Make sure to evaluate the limits, deductibles, and additional benefits offered by each provider to find the most suitable policy for your needs.

Frequently Asked Questions Of How Umbrella Insurance Works

What Is Umbrella Insurance?

Umbrella insurance provides additional liability coverage to protect you from major claims and lawsuits. It can extend beyond the limits of your existing policies, providing an extra layer of protection.

Why Do I Need Umbrella Insurance?

You should consider umbrella insurance if you want extra protection against lawsuits, significant assets to protect, or engage in high-risk activities. It provides peace of mind and safeguards your finances.

How Much Umbrella Insurance Do I Need?

The amount of umbrella insurance you need depends on your assets and potential risks. It’s recommended to have coverage equal to your net worth to protect your assets adequately.

Does Umbrella Insurance Cover Intentional Acts?

No, umbrella insurance typically doesn’t cover intentional acts or criminal activities. It’s designed to provide additional liability coverage for accidents and unexpected incidents.

Conclusion

Umbrella insurance offers an added layer of protection that can shield you from unexpected financial risks. By extending the coverage of your existing policies, it acts as a safety net when their limits are exceeded. With its broad coverage and affordable premiums, umbrella insurance is an excellent way to safeguard your assets and provide peace of mind.

Don’t leave your future to chance – consider the benefits of umbrella insurance today.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is Umbrella Insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Umbrella insurance provides additional liability coverage to protect you from major claims and lawsuits. It can extend beyond the limits of your existing policies, providing an extra layer of protection.” } } , { “@type”: “Question”, “name”: “Why Do I Need Umbrella Insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “You should consider umbrella insurance if you want extra protection against lawsuits, significant assets to protect, or engage in high-risk activities. It provides peace of mind and safeguards your finances.” } } , { “@type”: “Question”, “name”: “How Much Umbrella Insurance Do I Need?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The amount of umbrella insurance you need depends on your assets and potential risks. It’s recommended to have coverage equal to your net worth to protect your assets adequately.” } } , { “@type”: “Question”, “name”: “Does Umbrella Insurance Cover Intentional Acts?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “No, umbrella insurance typically doesn’t cover intentional acts or criminal activities. It’s designed to provide additional liability coverage for accidents and unexpected incidents.” } } ] }

Leave a comment