Umbrella insurance provides additional liability coverage beyond the limits of your existing policies, protecting you from unexpected financial losses. In today’s litigious society, it is essential to have umbrella insurance to safeguard your assets and protect yourself from potential lawsuits.

Umbrella insurance is designed to kick in when your primary insurance coverage is exhausted, providing an extra layer of protection. It covers various liability claims such as personal injury and property damage. Having umbrella insurance can give you peace of mind, knowing that you are adequately covered in case of any unforeseen circumstances.

It is a smart investment for anyone looking to maximize their protection against potential liability claims. Don’t wait until it’s too late – get umbrella insurance today.

What Is Umbrella Insurance?

When you think about protecting your assets and safeguarding your financial future, Umbrella Insurance is a crucial consideration. So, what exactly is Umbrella Insurance?

Definition

Umbrella Insurance serves as an extra layer of liability coverage beyond your traditional policies like auto or home insurance.

Coverage

With Umbrella Insurance, you have additional protection if you face a lawsuit due to an accident where you are at fault.

Benefits Of Umbrella Insurance

Umbrella insurance provides additional liability coverage beyond the limits of your existing insurance policies, offering an extra layer of protection for you and your assets. Let’s delve into the specific benefits of umbrella insurance.

Extended Liability Coverage

Umbrella insurance extends the liability coverage of your existing policies, such as auto and homeowners insurance. In the event of a lawsuit or significant claim, an umbrella policy offers extra financial protection, stepping in when the limits of your primary policies have been exhausted. This safeguard can save you from substantial financial loss in the event of a lawsuit or liability claim.

Protection Of Assets

With umbrella insurance, your assets are shielded from potential lawsuits and claims that exceed the coverage limits of your primary insurance. This additional coverage can protect your home, savings, investments, and other valuable assets from being at risk in the event of a costly liability claim. It acts as a safety net, preserving your hard-earned assets from being at stake.

Importance Of Having Umbrella Insurance

When it comes to protecting your assets and future financial security, umbrella insurance is a vital safety net that goes beyond the coverage of basic policies. Unexpected accidents or lawsuits can quickly exhaust the liability limits of your auto or homeowners insurance, leaving you vulnerable to financial ruin.

Limitations Of Basic Policies

Traditional insurance policies such as auto and homeowners usually have limited liability coverage. In case of a severe accident or lawsuit, these limits may not be enough to cover all expenses, leaving you exposed to financial risks.

Peace Of Mind

With umbrella insurance, you can enjoy peace of mind knowing that you have an extra layer of protection against unexpected events. This policy provides additional liability coverage above the limits of your existing insurances, ensuring your assets and savings are safeguarded.

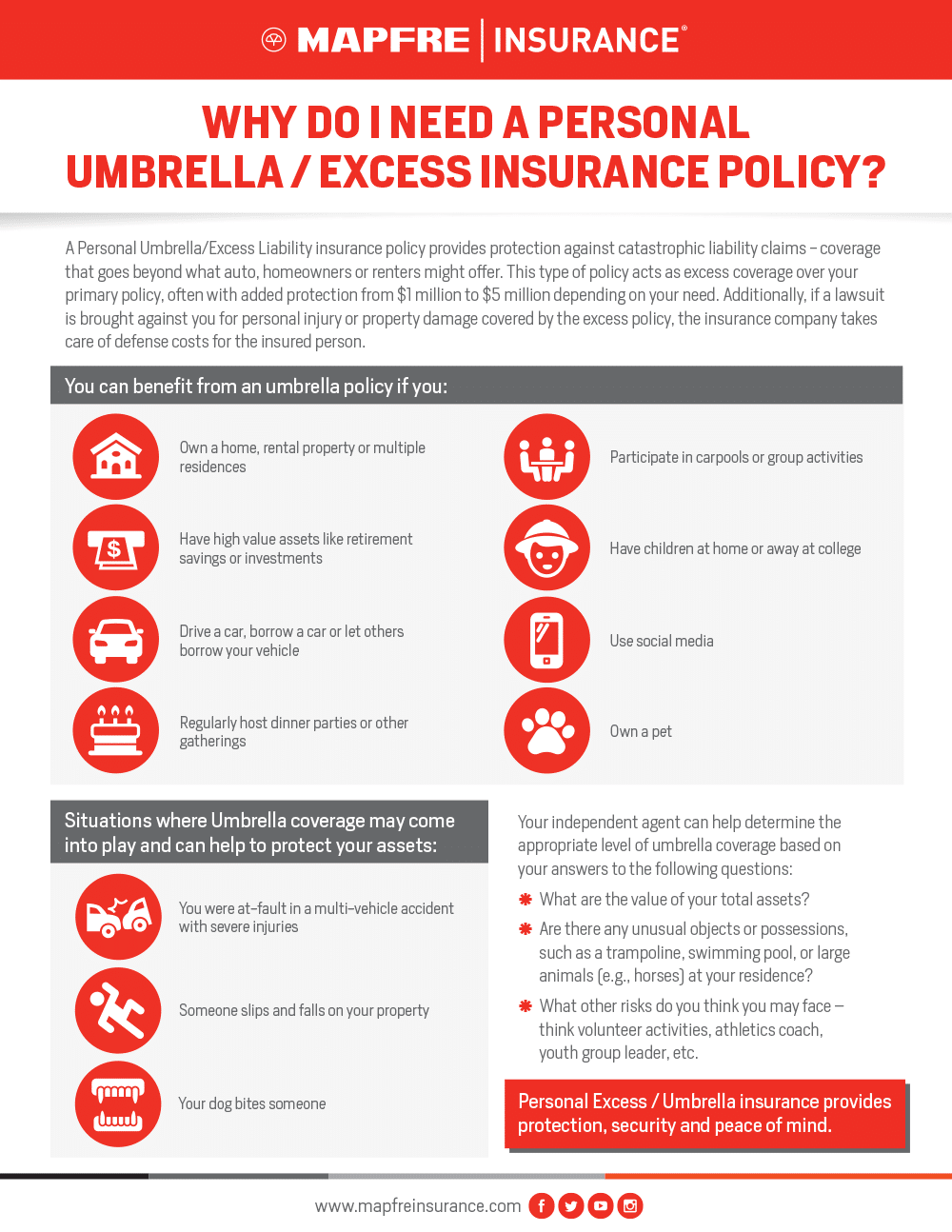

Credit: http://www.mapfreinsurance.com

Who Needs Umbrella Insurance?

Umbrella insurance provides an extra layer of liability coverage, extending beyond the limits of your standard home or auto insurance. It’s designed to protect you and your assets in the event of a costly lawsuit or judgment against you. But who actually needs umbrella insurance? Let’s take a closer look at the specific demographics that can benefit the most from this additional coverage.

High Net Worth Individuals

High net worth individuals, such as those with significant assets and savings, can greatly benefit from umbrella insurance. In the face of a lawsuit, their substantial wealth may make them a target for larger claims. With an umbrella policy, they can safeguard their assets and avoid the risk of devastating financial loss.

Homeowners With Assets

Homeowners with assets are also prime candidates for umbrella insurance. If you own a home and have valuable possessions, you could be at risk of being sued for an amount that exceeds your existing coverage. Umbrella insurance provides an added layer of protection, ensuring that your assets and financial well-being remain secure in the face of unforeseen legal challenges.

Determining Your Umbrella Insurance Needs

Determining your umbrella insurance needs can be a complex process that requires careful consideration of your assets and potential risks. By assessing your personal and financial situation, you can better understand the coverage you require to protect yourself and your assets from unforeseen liabilities.

Determining Your Umbrella Insurance Needs Evaluating Liability Risks Assessing Asset Value When considering umbrella insurance, it’s essential to evaluate your liability risks and asset value to determine the coverage you need. Evaluating Liability Risks: – Identify potential risks like accidents or property damage. – Consider scenarios where your standard insurance may not provide enough coverage. Assessing Asset Value: – Calculate the total value of your assets including home, vehicles, savings, and investments. – Determine the potential assets at risk in case of a liability claim exceeding your standard coverage. By analyzing your liability risks and asset value, you can make an informed decision about the amount of umbrella insurance you may need.

Credit: oxygenfinancial.com

Cost Of Umbrella Insurance

When it comes to protecting yourself and your assets, umbrella insurance is a valuable coverage option. While it provides an extra layer of protection beyond your primary insurance policies, one common concern is the cost of umbrella insurance. Understanding the factors that affect premiums and how to compare quotes can help you make an informed decision about this essential coverage.

Factors Affecting Premiums

Several factors come into play when determining the cost of umbrella insurance. It’s important to understand these factors to ensure you receive an accurate quote. Here are the key factors that may affect your umbrella insurance premiums:

- Personal Liability Limits: The higher your underlying liability limits on your existing policies, such as homeowners or auto insurance, the lower your umbrella insurance premiums may be. Having adequate primary coverage can reduce the risk for insurance companies and potentially lower your costs.

- Number of Properties and Vehicles Owned: If you own multiple properties or vehicles, you may require higher coverage limits, which can increase your premiums. Insurance companies consider the number of assets you own when calculating the risk associated with covering you.

- Driving Record: Your driving history plays a crucial role in determining your umbrella insurance premiums. Any traffic violations or accidents on your record might label you as a high-risk individual, which can lead to higher premiums.

- Personal Factors: Some personal factors, such as age, occupation, and credit history, can impact your umbrella insurance premiums. Insurance companies assess these factors to evaluate your level of risk and determine your premium amount.

- Risk Exposure: Insurance companies consider your level of risk exposure when setting premiums. Factors such as owning a pool, having a high net worth, or participating in high-risk activities can increase your umbrella insurance costs.

Compare Quotes

Comparing quotes is crucial when shopping for umbrella insurance to ensure you get the best coverage at an affordable price. Here’s a guide on how to compare quotes effectively:

- Gather Information: Collect all relevant information, including your existing insurance policies and their liability limits, your personal information, and any additional assets you need to cover.

- Research Reliable Providers: Look for reputable insurance providers that offer umbrella coverage. Check their financial stability, customer reviews, and claim settlement records to ensure you choose a reliable company.

- Request Quotes: Reach out directly to the insurance providers you’ve shortlisted and request quotes for your desired umbrella coverage. Provide accurate details to receive accurate quotes.

- Compare Coverage and Limits: Review the quotes carefully, comparing the coverage provided, policy limits, and any additional benefits. Ensure you understand the terms and conditions, exclusions, and deductibles before making a decision.

- Consider Cost-Benefit Ratio: While price is a significant factor, prioritize the coverage provided and the value it offers compared to the cost. Cheaper premiums may come with limited coverage, so strike a balance between affordability and adequate protection.

- Consult an Insurance Professional: If you’re unsure about which policy to choose, seek advice from an insurance professional who can guide you through the process and help you make an informed decision.

How To Purchase Umbrella Insurance

When it comes to protecting your assets, umbrella insurance is a smart choice. Umbrella insurance provides an extra layer of liability coverage that goes beyond the limits of your standard insurance policies, such as auto or homeowners insurance. It helps protect you financially against unexpected accidents, lawsuits, or damages that can result in large financial losses. In this blog post, we will discuss how to purchase umbrella insurance, so you can ensure that you have the right coverage for your needs.

Contacting Insurance Providers

Before purchasing umbrella insurance, it’s important to reach out to insurance providers to get quotes and compare coverage options. The following steps can help you in the process:

- Make a list of insurance companies you want to contact.

- Gather all the necessary information about your existing insurance policies, including their coverage limits.

- Find the contact information of the insurance providers on your list. This can usually be found on their websites or by calling their customer service numbers.

- Reach out to each insurance provider on your list and inquire about umbrella insurance. Provide them with the details of your existing policies and ask for a quote.

- Compare the quotes and coverage options provided by different insurance providers. Take note of any additional benefits or discounts they may offer.

Reviewing Policy Details

Once you have obtained quotes from different insurance providers, it’s essential to carefully review the policy details to ensure that you are selecting the right coverage for your needs. Consider the following:

- Policy Limits: Check the coverage limits of the umbrella policy to ensure they are sufficient to protect your assets.

- Deductibles: Find out if the policy has any deductibles that you would need to pay out of pocket before the coverage kicks in.

- Coverage Exclusions: Understand any exclusions or limitations in the policy that may affect your coverage.

- Add-Ons and Optional Coverages: Inquire about any additional coverages you can add to your umbrella policy for added protection.

- Policy Cost: Compare the costs of the umbrella policies from different providers and consider the value you will be getting for the price.

By carefully reviewing the policy details, you can ensure that you have a comprehensive understanding of the coverage and make an informed decision.

Once you have compared quotes, reviewed policy details, and found the right umbrella insurance policy for your needs, you can proceed with the purchasing process. Contact the insurance provider you have chosen and follow their instructions to complete the purchase. With umbrella insurance in place, you can have peace of mind knowing that you have an extra layer of protection to safeguard your assets.

Credit: http://www.cnn.com

Tips For Maximizing Umbrella Insurance Benefits

Umbrella insurance offers additional liability coverage beyond the limits of your existing policies, providing peace of mind and financial protection. To maximize its benefits, consider these essential tips:

Regular Policy Reviews

Regularly reviewing your primary insurance policies, such as auto, homeowners, and boat insurance, is crucial when maximizing your umbrella coverage. Ensure that your underlying policies provide sufficient liability limits to align with your umbrella coverage. By conducting periodic policy reviews, you can identify potential gaps and make necessary adjustments to enhance your overall protection.

Understanding Coverage Exclusions

It’s essential to understand the exclusions within your umbrella policy. While umbrella insurance provides extended coverage, it may have exclusions that could leave you vulnerable. Take the time to comprehend the specific scenarios and liabilities that may not be covered by your umbrella insurance. By gaining clarity on these exclusions, you can explore additional coverage options to fill any potential gaps in protection.

Frequently Asked Questions Of How Umbrella Insurance Xi

What Does Umbrella Insurance Cover?

Umbrella insurance provides additional liability coverage beyond the limits of your standard policies. It protects you from major claims and lawsuits, offering peace of mind knowing you’re covered against unexpected events.

How Much Umbrella Insurance Do I Need?

The amount of umbrella insurance you need depends on your assets, potential risks, and lifestyle. It’s recommended to have enough coverage to protect your assets and future earnings, ensuring you’re well-prepared for any unforeseen circumstances.

Is Umbrella Insurance Worth It?

Yes, umbrella insurance is worth it for those seeking extra protection. It offers an added layer of security, safeguarding your assets and finances in case of liability claims or lawsuits. With potentially large coverage amounts, it’s a valuable investment for your financial stability.

Conclusion

Umbrella insurance provides an additional layer of protection for unexpected events and liability claims that may exceed your existing policies. It offers peace of mind and financial security by covering gaps in coverage, such as legal fees and medical expenses.

By considering the potential risks and evaluating your individual needs, you can make an informed decision about acquiring umbrella insurance. Ensure you consult with a trusted insurance professional to determine the right coverage for your specific circumstances.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What does umbrella insurance cover?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Umbrella insurance provides additional liability coverage beyond the limits of your standard policies. It protects you from major claims and lawsuits, offering peace of mind knowing you’re covered against unexpected events.” } } , { “@type”: “Question”, “name”: “How much umbrella insurance do I need?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The amount of umbrella insurance you need depends on your assets, potential risks, and lifestyle. It’s recommended to have enough coverage to protect your assets and future earnings, ensuring you’re well-prepared for any unforeseen circumstances.” } } , { “@type”: “Question”, “name”: “Is umbrella insurance worth it?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, umbrella insurance is worth it for those seeking extra protection. It offers an added layer of security, safeguarding your assets and finances in case of liability claims or lawsuits. With potentially large coverage amounts, it’s a valuable investment for your financial stability.” } } ] }

Leave a comment