Assurant Renters Insurance offers reliable coverage and has a good reputation in the insurance industry. Renting a home or apartment comes with its own set of risks and uncertainties.

By obtaining renters insurance, you can protect your belongings and have peace of mind in case of theft, fire, or other unforeseen events. Assurant Renters Insurance is a trusted provider that offers comprehensive coverage options to meet your needs. With its strong reputation and reliable customer service, Assurant can be a good choice for renters looking for affordable and dependable insurance coverage.

Whether you’re a student, young professional, or starting a family, insuring your possessions with Assurant Renters Insurance can provide the protection you need. Don’t take the risk of going without renters insurance – consider Assurant for your coverage needs.

Coverage Options

When considering renters insurance, exploring the coverage options is key to ensure you are adequately protected. Assurant renters insurance offers a variety of coverage options to meet the diverse needs of renters. Let’s delve into the standard coverage and additional options provided by Assurant.

Standard Coverage

The standard coverage provided by Assurant renters insurance includes protection for personal belongings in the event of theft, fire, or damage. It also offers liability coverage if someone is injured in your rental property.

Additional Coverage Options

Assurant offers additional coverage options for renters looking for extra protection. These options may include flood insurance, earthquake coverage, and identity theft protection.

Moreover, you can opt for reimbursement for temporary living expenses if your rental becomes uninhabitable due to a covered event.

Cost And Affordability

Affordability plays a crucial role when choosing renters insurance. Understanding the cost of insurance and the various options for discounts can help you make an informed decision. In this article, we will explore the cost and affordability of Assurant renters insurance, with a focus on premium rates and the discounts available.

Premium Rates

One of the key factors to consider when assessing the affordability of any renters insurance is the premium rates. Assurant offers competitive rates that can fit within your budget. Their premium rates are determined by several factors, including the location of your rental property, the coverage limits you choose, and your deductible amount.

Assurant provides a user-friendly interface on their website where you can easily obtain a free quote. Simply enter your information, and Assurant will provide you with an estimate of their premium rates tailored to your specific needs. The transparency and ease of obtaining a quote make it convenient for potential policyholders to compare and evaluate the affordability of Assurant renters insurance.

Discounts Available

Assurant understands the importance of providing cost-effective options for their policyholders. They offer various discounts that can help you save on your renters insurance premiums. These discounts are designed to reward responsible behavior and mitigate risks, ultimately making your coverage more affordable.

When considering Assurant renters insurance, keep an eye out for the following discounts:

- Multi-Policy Discount – By bundling your renters insurance with other insurance policies, such as auto or life insurance, you can enjoy a discount on your premiums.

- Claims-Free Discount – Assurant rewards policyholders who have not filed any claims with a discount on their premiums. This discount encourages policyholders to practice preventative measures and minimize risks.

- Protective Devices Discount – Installing safety features or security systems in your rental property can lower the risk of theft or damage. Assurant offers discounts to policyholders who have protective devices installed.

- Auto-Pay Discount – Opting for automatic payments can make the insurance process more convenient for both you and Assurant. In return, they offer a discount on your premiums.

These are just a few examples of the discounts available with Assurant renters insurance. By taking advantage of these discounts, you can reduce your premium rates and make your coverage even more affordable.

Claims Process

When it comes to choosing a renters insurance policy, the claims process is a crucial aspect to consider. Filing a claim and the ease of claims processing are key factors in determining the reliability of an insurance provider. Assurant renters insurance has gained a reputation for its straightforward claims process, offering peace of mind to renters in the event of unexpected mishaps.

Filing A Claim

Filing a claim with Assurant renters insurance is a streamlined process designed to alleviate stress during already challenging situations. To initiate a claim, renters can simply contact the claims department either by phone or through the online portal. The claim will then be assigned to an experienced claims adjuster, who will guide the policyholder through the necessary steps and documentation required for a resolution.

Ease Of Claims Processing

The ease of claims processing sets Assurant renters insurance apart from its competitors. The company strives to expedite the process, facilitating quick resolutions for policyholders. Whether it’s a minor incident such as a broken electronic device or a major event like theft or property damage, Assurant prioritizes prompt and efficient claims handling to provide renters with the support they need in times of distress.

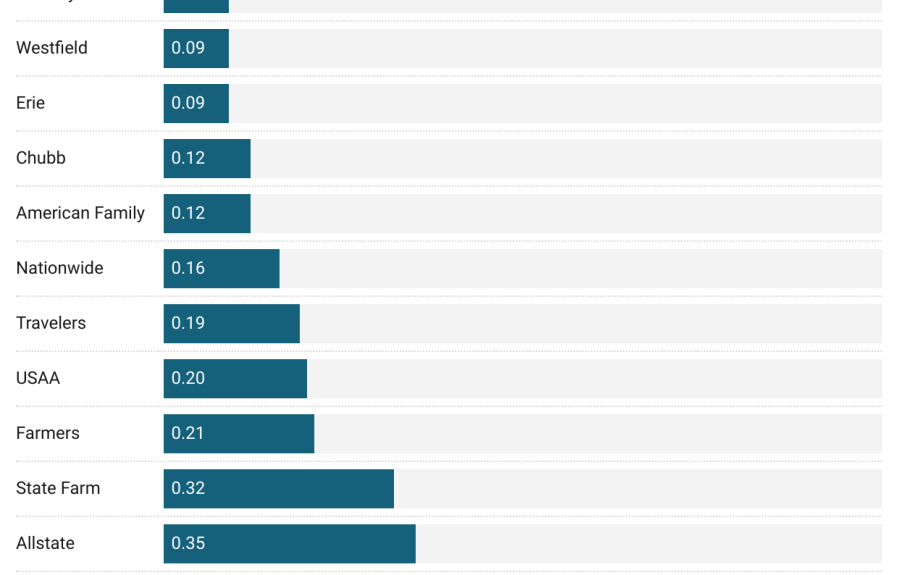

Credit: http://www.forbes.com

Customer Satisfaction

When it comes to renters insurance, customer satisfaction is a pivotal aspect that determines the reliability and trustworthiness of an insurance provider. Assurant Renters Insurance has garnered a reputation for its commitment to customer satisfaction, ensuring policyholders feel secure and valued. Let’s delve into the details to understand how their customer satisfaction reflects the quality of their services.

Reviews And Ratings

Assurant Renters Insurance has consistently received positive feedback from its customers, as evidenced by their stellar reviews and ratings. The majority of policyholders express satisfaction with the coverage options, claims process, and overall customer experience. These positive reviews and ratings highlight the company’s dedication to meeting the needs and expectations of their clients.

Customer Service

One of the defining factors of Assurant Renters Insurance is their exceptional customer service. Policyholders often emphasize the prompt and attentive assistance they receive from the company’s representatives. The responsive nature of their customer service team contributes significantly to the overall satisfaction of the clients, as it ensures that concerns and inquiries are addressed efficiently and effectively.

Pros And Cons

Assurant renters insurance offers several advantages and drawbacks for those looking to protect their belongings and personal liability. Before making a decision, it’s important to consider both sides of the coin. Let’s take a closer look at the pros and cons of Assurant renters insurance.

Advantages Of Assurant Renters Insurance

Assurant renters insurance comes with a range of benefits that can give you peace of mind in case of unforeseen events. Here are some advantages to consider:

- Comprehensive coverage: Assurant renters insurance provides coverage for various perils, including theft, fire, and water damage. This comprehensive protection ensures that your belongings are safeguarded against unexpected situations.

- Flexible coverage options: Assurant allows you to customize your coverage based on your specific needs. Whether you require additional coverage for high-value items or want to adjust your policy limits, Assurant offers flexibility to accommodate your requirements.

- Additional living expenses: In the event that your rental unit becomes uninhabitable due to a covered loss, Assurant renters insurance can help cover the additional living expenses you may incur while finding or waiting for alternative accommodations.

- Liability protection: Assurant also provides liability coverage, offering financial protection in case someone gets injured on your rented property and files a lawsuit against you.

- Easy claims process: Assurant aims to simplify the claims process, making it easier and more convenient for policyholders to file their claims and receive compensation when it matters most.

Drawbacks To Consider

While Assurant renters insurance offers numerous advantages, it’s essential to be aware of the potential drawbacks. Here are some factors to consider:

- Premium costs: Compared to other insurance providers, Assurant renters insurance premiums may be relatively higher. It’s important to weigh the cost of coverage against the protection provided to determine if it fits within your budget.

- Availability: Assurant renters insurance may not be available in all locations. Before considering Assurant, ensure that their coverage is offered in your area.

- Policy limitations: Like any insurance policy, Assurant renters insurance has certain limitations and exclusions. Familiarize yourself with the policy terms to understand what is covered and what is not.

- Deductibles: Assurant renters insurance requires policyholders to pay a deductible when filing a claim. It’s important to consider the deductible amount and how it may impact your out-of-pocket expenses.

- Customer service: Some customers have reported less-than-optimal experiences with Assurant’s customer service. It’s advisable to research and read reviews to ensure you understand the quality of service provided before making a decision.

Considering both the advantages and drawbacks of Assurant renters insurance is crucial in making an informed decision. Assess your unique needs, evaluate the costs, and compare the coverage with other options available to find the renters insurance that best suits you.

Credit: hdinsure.com

Comparison

Assurant Vs. Competitors

Assurant’s renters insurance is a solid option in comparison to its competitors. Let’s take a closer look:

How Assurant Stands Out

Assurant stands out in the renters insurance market for several reasons:

- Affordable Premiums: Assurant offers competitive rates for renters insurance.

- Broad Coverage: Assurant provides comprehensive coverage for personal belongings, liability, and additional living expenses.

- Flexible Policy Options: Assurant offers various options to customize your renters insurance policy.

- Easy Claims Process: Assurant has a streamlined claims process for quick resolution.

Credit: http://www.forbes.com

Frequently Asked Questions For Is Assurant Renters Insurance Good

What Does Assurant Renters Insurance Cover?

Assurant renters insurance typically covers personal property, liability, and additional living expenses in case of covered events like theft, fire, or vandalism. It also provides protection against medical payments for others injured in your rental property.

How Much Does Assurant Renters Insurance Cost?

The cost of Assurant renters insurance can vary based on factors such as the coverage limits, location, and deductible. On average, renters insurance from Assurant can cost between $15 and $30 per month, making it an affordable option for tenants.

Is Assurant Renters Insurance Good For Students?

Assurant renters insurance is a beneficial option for students living off-campus. It offers coverage for personal belongings, liability protection, and additional living expenses if their rental unit becomes uninhabitable due to a covered loss. It provides peace of mind for students and their families.

Conclusion

Assurant renters insurance offers comprehensive coverage with competitive rates. With its strong financial stability and 24/7 customer support, it provides peace of mind for tenants. The customizable policy options ensure that your personal belongings are protected from theft, damage, or natural disasters.

Its user-friendly website and hassle-free claims process make it a top choice for renters seeking reliable coverage. Make the smart choice and secure your rental property today with Assurant renters insurance.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What Does Assurant Renters Insurance Cover?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Assurant renters insurance typically covers personal property, liability, and additional living expenses in case of covered events like theft, fire, or vandalism. It also provides protection against medical payments for others injured in your rental property.” } } , { “@type”: “Question”, “name”: “How Much Does Assurant Renters Insurance Cost?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The cost of Assurant renters insurance can vary based on factors such as the coverage limits, location, and deductible. On average, renters insurance from Assurant can cost between $15 and $30 per month, making it an affordable option for tenants.” } } , { “@type”: “Question”, “name”: “Is Assurant Renters Insurance Good for Students?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Assurant renters insurance is a beneficial option for students living off-campus. It offers coverage for personal belongings, liability protection, and additional living expenses if their rental unit becomes uninhabitable due to a covered loss. It provides peace of mind for students and their families.” } } ] }

Leave a comment