Yes, boat insurance is required in Tennessee. Boat owners in Tennessee are required to have boat insurance to protect themselves and others in the event of an accident or damage caused by their boat.

This requirement applies to all motorized vessels, including speedboats, fishing boats, pontoon boats, and personal watercraft. Boat insurance provides coverage for bodily injury, property damage, and theft, as well as liability protection in case of an accident. It is recommended that boat owners in Tennessee carefully review their insurance options and choose a policy that meets their specific needs and budget.

By having boat insurance, owners can have peace of mind knowing that they are financially protected while enjoying their time on the water.

Boat Insurance In Tennessee

Understanding the requirements for boat insurance in Tennessee is important for all boat owners. Let’s delve into the state regulations and penalties for non-compliance.

State Regulations

In Tennessee, boat insurance is not legally required. However, it is highly recommended to protect yourself financially in case of accidents or damages.

- Insurers may offer various coverage options such as liability, property damage, and medical payments.

- Consider your risks and needs to determine the right boat insurance coverage for you.

Penalties For Non-compliance

While boat insurance is not mandatory, not having coverage can lead to financial risks if you are involved in an accident.

| Consequences | Details |

|---|---|

| Fines | If found liable for damages without insurance, you may face hefty fines. |

| Lack of Protection | Without insurance, you are responsible for covering all costs in case of accidents. |

Consider the implications of sailing without insurance in Tennessee to ensure you are adequately protected.

Credit: http://www.lrwlawfirm.com

Types Of Coverage

When it comes to boat insurance in Tennessee, there are several types of coverage you should consider. Each type provides a different level of protection for your boat and can help safeguard you from potential financial losses. Let’s take a closer look at the three main types of boat insurance coverage:

Liability Insurance

Liability insurance is an essential coverage option for boat owners in Tennessee. This type of insurance protects you from financial responsibility in case your boat causes property damage or bodily injury to someone else. It covers the costs of legal defense, medical expenses, and property repairs or replacements resulting from an accident for which you are found at fault. Liability insurance provides you with peace of mind and ensures that you are financially protected in case of any unfortunate incidents.

Collision Insurance

If you want coverage for damages to your own boat resulting from a collision, collision insurance is crucial. This type of coverage pays for the repair or replacement of your boat if it gets damaged in a collision with another boat, object, or even if it capsizes on its own. Collision insurance offers you financial protection for those unexpected accidents that can cause significant damage to your boat. With this coverage, you can have peace of mind knowing that you won’t bear the full cost of repairs or replacements in case of a collision.

Comprehensive Insurance

Comprehensive insurance provides coverage for a wide range of risks, including theft, vandalism, fire, storms, and other non-collision incidents that can damage or destroy your boat. It protects you financially if your boat gets stolen or damaged due to a natural disaster or any other covered event. With comprehensive insurance, you can be confident that your boat is protected against various risks that can cause substantial financial loss.

Factors Influencing Boat Insurance Requirements

Boat insurance requirements in Tennessee are influenced by factors such as the type of boat, its value, and where it will be operated. While boat insurance is not mandated in Tennessee, it is highly recommended to protect both the boat owner and others in case of accidents.

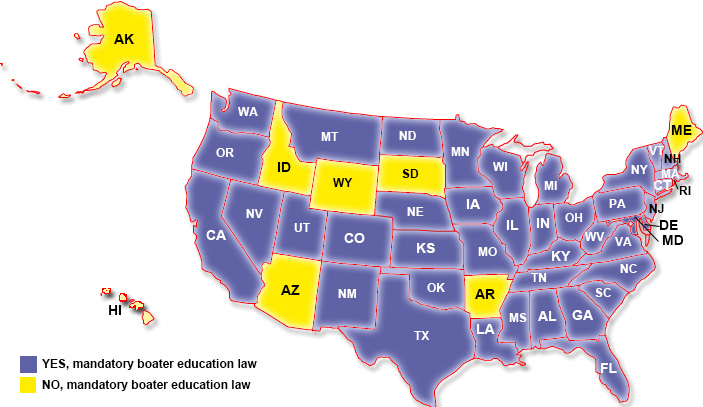

Factors Influencing Boat Insurance Requirements Boat insurance requirements can vary based on several factors, including boat size and type as well as the location of operation. Understanding how these factors influence the need for boat insurance can help boat owners make informed decisions and ensure they are adequately protected. ### Boat Size and Type The size and type of boat play a critical role in determining whether boat insurance is required. In general, larger and more high-powered vessels are more likely to require insurance coverage. This is due to the increased potential for accidents and damage. Additionally, certain types of boats, such as yachts or personal watercraft, may have specific insurance requirements based on their classification. ### Location of Operation The location where a boat will be operated also impacts insurance requirements. For boating in Tennessee, the state’s waterways and lakes may have specific insurance mandates that boat owners must adhere to. Additionally, if the boat will be moored or stored at a marina, the marina may have insurance requirements that must be met. Overall, the factors influencing boat insurance requirements are essential considerations for boat owners in Tennessee. By understanding these factors, boat owners can ensure they have the necessary insurance coverage to protect themselves and their vessels.

Credit: http://www.lrwlawfirm.com

Importance Of Boat Insurance

The importance of boat insurance cannot be overstated, especially for boat owners in Tennessee. Whether it’s for financial protection, liability coverage, or peace of mind while out on the water, having boat insurance is crucial. Let’s delve into the specific areas where boat insurance provides significant benefits.

Financial Protection

Boat insurance provides essential financial protection for boat owners. In the event of an accident, theft, vandalism, or damage to the boat, having insurance can mitigate the financial burden associated with repairs or replacement. This type of coverage acts as a safeguard against unexpected and potentially costly situations that can arise while owning a boat.

Liability Coverage

Liability coverage is a fundamental aspect of boat insurance. It protects boat owners in the event they are held responsible for causing injury to others or damaging someone else’s property while operating the boat. This coverage ensures that the owner is financially protected and not held personally accountable for such incidents.

How To Obtain Boat Insurance

Now that you understand the importance of having boat insurance in Tennessee, it’s time to explore how you can obtain the right coverage for your vessel. Here, we will discuss the insurance providers in the state and the policy options they offer.

Insurance Providers

In Tennessee, there are several insurance providers that offer boat insurance. These companies specialize in providing coverage for various types of watercraft, ensuring that you can find the right policy that suits your needs. Some of the top insurance providers in the state include:

- Company A

- Company B

- Company C

These insurance companies have a solid reputation for offering reliable coverage and excellent customer service. By choosing a reputable insurance provider, you can have peace of mind knowing your boat is protected in case of any unforeseen events.

Policy Options

When it comes to boat insurance in Tennessee, there are several policy options to consider. Understanding these options will help you select the best coverage for your specific needs. Here are some common policy options offered by insurance providers:

- Liability Coverage: This type of coverage protects you in case you cause property damage or bodily injury to another person while operating your boat.

- Collision Coverage: Collision coverage pays for the repairs or replacement of your boat if it gets damaged in a collision with another boat or object.

- Comprehensive Coverage: Comprehensive coverage provides protection for your boat against non-collision-related incidents such as theft, vandalism, or damage caused by fire or severe weather conditions.

- Uninsured/Underinsured Boater Coverage: This coverage safeguards you if you are involved in an accident with a boater who does not have sufficient insurance coverage.

By understanding the different policy options available, you can tailor your boat insurance to provide the level of protection that suits your boating lifestyle and preferences.

Common Misconceptions

Many individuals in Tennessee hold misconceptions about boat insurance coverage.

Coverage For Accidents

Boat insurance provides coverage in case of accidents on the water.

Exclusions And Limitations

It’s essential to understand the exclusions and limitations of boat insurance policies.

Alternatives To Boat Insurance

While boat insurance is highly recommended to protect your investment and provide coverage in the event of accidents or damage, there are alternatives available for those who may not want to purchase a full boat insurance policy. These alternatives can offer some level of protection and financial security, albeit with certain limitations. If you’re considering the options, here are two alternatives worth considering:

Self-insurance

Self-insurance is a viable option for boat owners who are confident in their ability to cover the costs of any potential accidents or damages that may occur. Instead of relying on an insurance provider, self-insurance involves setting aside a designated amount of money specifically for boat-related expenses. By having a sufficient emergency fund, you can have peace of mind knowing that you have the necessary funds to cover unexpected costs.

Limited Liability Coverage

Limited liability coverage is another alternative to traditional boat insurance. This type of coverage typically protects boat owners from certain liabilities that may arise from accidents or injuries caused by their boat. While it may not provide the same level of comprehensive coverage as a full insurance policy, limited liability coverage can still offer some financial protection in case of unforeseen circumstances.

It’s important to note that both self-insurance and limited liability coverage have their own set of pros and cons. Self-insurance requires discipline in setting aside funds and might not be suitable for everyone. On the other hand, limited liability coverage may not cover all potential risks or damages. Therefore, it is essential to evaluate your individual circumstances and the value you place on your boat to determine whether these alternatives are appropriate for you.

Recommendations For Boat Owners

Boat ownership comes with a unique set of responsibilities, including the need for adequate insurance coverage. Tennessee doesn’t legally require boat insurance, but it’s a wise choice for protecting your investment and managing potential risks. As a boat owner in Tennessee, consider the following recommendations to ensure you are adequately prepared.

Consulting Legal Advisors

Before making any decisions about boat insurance, consider consulting legal advisors who specialize in insurance and maritime law. Their expertise can provide critical insights into the types of coverage you may need, as well as any legal requirements specific to Tennessee.

Regular Policy Review

It’s essential for boat owners to regularly review their insurance policies to ensure they have adequate coverage for their watercraft. Changes in your boating habits or updates to state or federal regulations may necessitate adjustments to your policy. Regular policy reviews can help you stay informed and protected.

Credit: http://www.americasboatingcourse.com

Frequently Asked Questions For Is Boat Insurance Required In Tennessee

Is Boat Insurance Mandatory In Tennessee?

Yes. Tennessee law requires all motorized vessels to have liability insurance coverage.

What Does Boat Insurance Cover In Tennessee?

Boat insurance typically covers property damage, bodily injury liability, and medical payments.

How Much Boat Insurance Do I Need In Tennessee?

Minimum boat insurance requirements in Tennessee typically include liability coverage of at least $50,000.

Conclusion

It’s important to remember that boat insurance is not required by law in Tennessee, but it is highly recommended to protect your investment and provide financial security. By having boat insurance, you can have peace of mind knowing that you are protected against accidents, theft, and damage.

While it may seem like an additional expense, the potential cost of repairs or replacement far outweighs the cost of insurance. Ensure you carefully review your policy to understand what is covered and what is not, and choose coverage that suits your needs and budget.

Leave a comment