Disability insurance is mandatory in New Jersey. New Jersey requires all employers to provide disability insurance coverage to their employees.

In the state of New Jersey, disability insurance is a requirement for all employers. This means that employers must provide disability insurance coverage to their employees in order to comply with the law. Disability insurance is designed to provide financial protection to workers who are unable to work due to an injury or illness.

It can help replace a portion of the worker’s income during the period of disability, ensuring that they can still meet their financial obligations. This requirement ensures that employees have some level of protection in the event of a disabling condition, providing them with peace of mind and financial security. We will explore the details of disability insurance in New Jersey, including who is eligible, how the coverage works, and what employers need to know to comply with the law.

Overview Of Disability Insurance In New Jersey

Exploring disability insurance in New Jersey sheds light on the crucial aspects of protecting one’s income in the event of an unexpected disability. Understanding the mandatory and optional coverage options, as well as the key features of disability insurance, can provide individuals with the necessary information to make informed decisions.

Mandatory Vs. Optional Coverage

Disability insurance in New Jersey can be either mandatory or optional, depending on the type of policy and the individual’s circumstances. Mandatory coverage typically refers to disability benefits provided through state programs like Temporary Disability Insurance (TDI).

Key Features Of Disability Insurance

- Income Protection: Disability insurance provides a portion of your income if you are unable to work due to a disability.

- Accident and Illness Coverage: It covers disabilities caused by accidents or illnesses that prevent you from working.

- Waiting Period: There is usually a waiting period before benefits are paid out, ranging from a few days to several months.

- Benefit Duration: Benefits can vary in duration, with some policies offering short-term coverage and others providing long-term benefits.

- Benefit Amount: The amount of benefits you receive is usually a percentage of your pre-disability income.

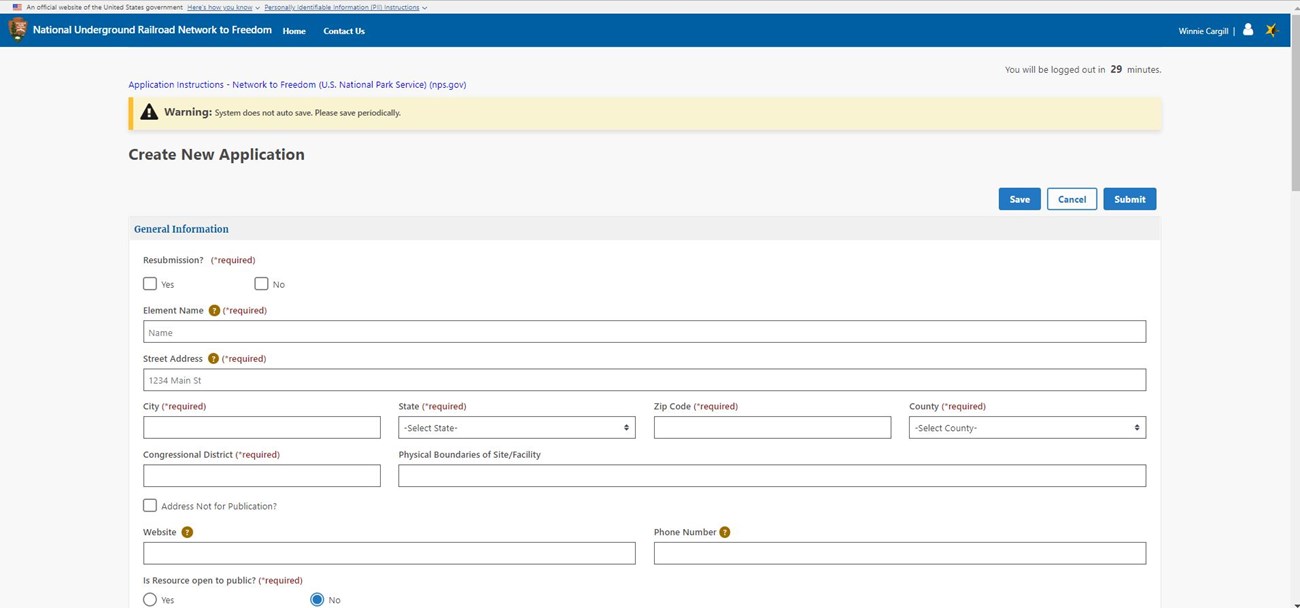

Credit: http://www.h2hhc.com

Understanding New Jersey Disability Insurance Laws

New Jersey does not mandate private disability insurance, but employers may offer it. Understanding New Jersey’s disability insurance laws can help individuals and businesses navigate coverage options effectively. It is essential to know the requirements and benefits to make informed decisions.

In New Jersey, disability insurance plays an essential role in providing financial protection for workers who find themselves unable to work due to an illness, injury, or other qualifying conditions. To ensure a comprehensive understanding of the topic, it’s crucial to delve into the state regulations on disability insurance and the exceptions and exemptions that apply within the system.State Regulations On Disability Insurance

In accordance with New Jersey state laws, employers are required to provide temporary disability benefits to their employees. This mandate ensures that individuals who experience a non-work-related illness or injury resulting in temporary disability receive the necessary support. Employers are prohibited from charging their employees for these benefits, as they are considered necessary for maintaining financial stability during times of incapacity. What sets New Jersey apart is the framework through which disability insurance benefits are provided. The state operates the Temporary Disability Insurance (TDI) program, which provides coverage for individuals who are unable to perform their regular work duties due to a qualifying condition. This program, administered by the state’s Department of Labor and Workforce Development, aims to alleviate the financial burden that follows when an employee cannot work due to illness or injury.Exceptions And Exemptions

While disability insurance is mandatory for most individuals in New Jersey, there are some exceptions and exemptions to be aware of. Certain categories of workers may be exempt from the requirement of contributing to the disability insurance fund. These include federal employees, members of religious orders, certain agricultural employees, and independent contractors who do not choose to opt-in. Additionally, employees covered under a collective bargaining agreement may receive disability benefits through an alternative system negotiated by their union. However, it’s important for employees falling under these exemptions to familiarize themselves with the specific provisions outlined in their contracts and agreements. To ensure compliance, employers must report their employees’ wages to the New Jersey Division of Temporary Disability Insurance. Failing to comply with these reporting requirements can result in penalties and fines. Therefore, it is crucial for both employees and employers to stay informed about the nuanced regulations surrounding disability insurance in New Jersey. By understanding New Jersey’s disability insurance laws, both employees and employers can navigate the system efficiently and ensure the necessary financial safeguards are in place. Whether it’s complying with the mandatory coverage or exploring possible exceptions, staying informed about disability insurance regulations is essential for the well-being of all individuals involved.Importance Of Disability Insurance

Discover the importance of disability insurance in New Jersey. While not mandatory, having disability insurance safeguards your financial well-being in case of unexpected disabilities. Protect yourself and your income with this valuable coverage option.

Financial Protection

Disability insurance provides financial protection by replacing a portion of your income if you become disabled and are unable to work. This coverage is crucial as it ensures that you and your family are financially secure in the event of an unforeseen disability. By having disability insurance, you can avoid the financial strain that may arise from loss of income due to a disability.

Peace Of Mind For Individuals And Families

Having disability insurance offers peace of mind to individuals and their families. It provides a safety net in the event of a disability, assuring you that your income will be supplemented, allowing you to focus on recovery without the stress of financial instability. This coverage provides a sense of security, knowing that you have the necessary financial support in place if you are unable to work due to a disability.

Credit: http://www.nps.gov

Is Disability Insurance Mandatory In New Jersey?

Is disability insurance mandatory in New Jersey? Understanding the state’s requirements and penalties for non-compliance is crucial for both individuals and businesses. Let’s delve into the specifics to gain clarity on this important topic.

State Requirements

Under New Jersey law, employers are required to provide temporary disability insurance (TDI) coverage for their employees. TDI benefits provide partial wage replacement to eligible workers who are unable to work due to non-work-related illness, injury, or childbirth. This coverage is essential for employees to have financial protection during times of unexpected disability.

Additionally, employees in New Jersey have the option to purchase supplemental disability insurance (SDI) to enhance their coverage and ensure broader protection against income loss due to disability.

Penalties For Non-compliance

Non-compliance with New Jersey’s disability insurance requirements can result in significant penalties for employers. Failure to provide TDI coverage may lead to fines, legal action, and potential harm to the employer’s reputation. It’s essential for businesses to adhere to the state’s regulations to avoid facing severe consequences.

Benefits Of Having Disability Insurance

As a resident of New Jersey, you may be wondering if disability insurance is mandatory in your state. While the answer is no, it is highly recommended to have disability insurance due to the numerous benefits it provides. Let’s explore the benefits of having disability insurance in New Jersey:

Income Replacement

One of the primary benefits of having disability insurance is income replacement. In the event that you suffer from a disability that prevents you from working, disability insurance can provide a portion of your income to help cover your expenses. This financial support ensures that you can maintain a certain standard of living, pay your bills, and support your loved ones during your recovery period.

Medical Coverage And Support Services

Another valuable benefit of disability insurance is that it often includes medical coverage and support services. This means that if you become disabled, you’ll have access to the necessary medical treatments, therapies, and rehabilitation services without having to worry about the hefty costs. Additionally, disability insurance may also offer support services such as vocational rehabilitation, which can help you return to work after your disability.

Overall, disability insurance plays a crucial role in protecting your financial stability and ensuring that you receive the necessary medical care and support services during a period of disability. Though disability insurance is not mandatory in New Jersey, having this coverage can provide peace of mind and safeguard your financial future. Consider reaching out to an insurance provider to explore options that fit your needs and budget.

Options For Obtaining Disability Insurance In New Jersey

Disability insurance provides essential financial protection for individuals who are unable to work due to a disability. In New Jersey, residents have several options for obtaining disability insurance to safeguard their income in case of unforeseen circumstances.

Employer-sponsored Plans

Employer-sponsored disability insurance plans in New Jersey offer coverage typically as part of employee benefits packages. These plans are often more affordable than individual policies and may provide a higher level of coverage.

Individual Plans And Private Providers

For those who are self-employed or do not have access to employer-sponsored plans, individual disability insurance policies can be purchased from private providers. These plans allow individuals to customize their coverage based on their specific needs and financial situation.

Common Misconceptions About Disability Insurance

Disability insurance is not mandatory in New Jersey, contrary to common misconceptions. However, it is highly recommended to protect yourself financially in the event of a disability.

When it comes to disability insurance, there are several common misconceptions that can prevent individuals from obtaining the coverage they need. Understanding the truth behind these misconceptions is essential for making informed decisions about your insurance needs.

Costly Premiums

One of the most prevalent misconceptions about disability insurance is that it comes with high and burdensome premiums. However, the cost of premiums for disability insurance in New Jersey depends on various factors such as the age, occupation, and health of the individual, as well as the coverage amount and waiting period chosen. While premiums may vary, the peace of mind and financial protection that disability insurance provides outweighs the cost.

Coverage Limitations

Another misconception surrounding disability insurance relates to its coverage limitations. Some people believe that disability insurance only covers severe and catastrophic injuries or illnesses. However, disability insurance can help replace a portion of your income if you are unable to work due to both short-term and long-term disabilities.

Short-term disability insurance typically covers temporary disabilities, such as recovery from surgery or short-term illnesses. On the other hand, long-term disability insurance can provide financial support if you sustain a debilitating injury or develop a chronic illness that renders you unable to work for an extended period.

It is important to note that disability insurance does have specific criteria that must be met to qualify for benefits. These criteria may vary depending on the policy and the definitions of disability outlined in the insurance contract. A thorough review of the policy terms and conditions is crucial to understanding the coverage limitations.

Credit: http://www.rwjf.org

Conclusion And Recommendations

In New Jersey, disability insurance is mandatory for most employees. Employers are required to provide disability insurance coverage or workers can purchase it through the state plan. It is important to consider the specific needs of individuals and make informed decisions based on their unique circumstances.

Importance Of Evaluating Disability Insurance Needs

When it comes to evaluating disability insurance needs, it’s crucial to consider factors such as your financial obligations, lifestyle, and family’s needs. Disability insurance provides a financial safety net in case you are unable to work due to an injury or illness. By carefully assessing your situation, you can ensure that you have the right amount of coverage to protect your income and provide for your loved ones.

Resources For Further Information

If you’re seeking more information about disability insurance in New Jersey, there are various resources available to help you make informed decisions. You can consult with insurance agents, financial planners, or legal professionals who specialize in disability insurance. Additionally, the New Jersey Department of Banking and Insurance offers valuable resources and information on disability insurance requirements and options in the state. Be sure to explore these resources to gain a comprehensive understanding of disability insurance in New Jersey.

Frequently Asked Questions Of Is Disability Insurance Mandatory In New Jersey

Is Disability Insurance Mandatory In New Jersey?

In New Jersey, disability insurance is not mandatory for individuals, but it is mandatory for employers to provide temporary disability insurance coverage for their employees. It offers valuable protection in case of injury or illness that prevents you from working, providing financial support when you need it most.

What Does Disability Insurance In New Jersey Cover?

Disability insurance in New Jersey covers a portion of your income if you are unable to work due to a disability, illness, or injury. It provides financial support, covering medical expenses, household costs, and other essential expenses, offering peace of mind during challenging times.

How Do I Qualify For Disability Insurance In New Jersey?

To qualify for disability insurance in New Jersey, you must have earned enough wages and worked for a certain period to be eligible for benefits. Additionally, you need to have a qualifying disability that prevents you from working. It’s essential to review the specific requirements and process to ensure eligibility.

Can I Purchase Disability Insurance As An Individual In New Jersey?

Yes, individuals in New Jersey can purchase disability insurance independently to protect themselves from the financial impact of a disability. It offers a safety net, covering a portion of your income if you are unable to work due to a disability, providing crucial protection for you and your loved ones.

Conclusion

Disability insurance in New Jersey is not mandatory for all residents, but it is highly recommended to protect individuals in the event of unforeseen circumstances. By understanding the benefits and coverage options available, individuals can make informed decisions to ensure financial security and peace of mind.

Whether it is through employer-sponsored plans or individual policies, disability insurance offers a safety net that can alleviate the financial burden of disability. Don’t wait until it’s too late – consider the importance of disability insurance today.

Leave a comment