Disability insurance is not generally taxable in Canada. In Canada, disability insurance benefits received by an individual are usually considered non-taxable income.

However, there are certain instances where disability benefits may be subject to taxes, such as when the premiums are paid by the employer and the employer claims a tax deduction on them. It is important to review the specific circumstances and consult with a tax professional to determine the tax implications of disability insurance in Canada.

Understanding the tax rules and regulations surrounding disability insurance can help individuals make informed decisions about their coverage and potential tax obligations. By being aware of the tax implications, individuals can effectively plan for their financial future while protecting themselves against the risk of disability.

Credit: protectyourwealth.ca

Taxation Of Disability Insurance Benefits

Understanding how disability insurance benefits are taxed in Canada is essential for individuals looking to secure their financial future in case of unexpected circumstances. The taxation of these benefits can vary based on various factors such as the source of the disability insurance, the premiums paid, and the type of benefits received.

Taxability Of Premiums

In Canada, the premiums paid for personal disability insurance are typically not tax-deductible. This means that the individual purchasing the disability insurance cannot claim the premiums as a deduction on their tax return.

Taxability Of Benefits

When it comes to the tax treatment of disability insurance benefits in Canada, the general rule is that benefits received are considered tax-free if the premiums were paid with after-tax dollars. This means that if an individual personally paid for the disability insurance premiums, any benefits received would not be subject to income tax.

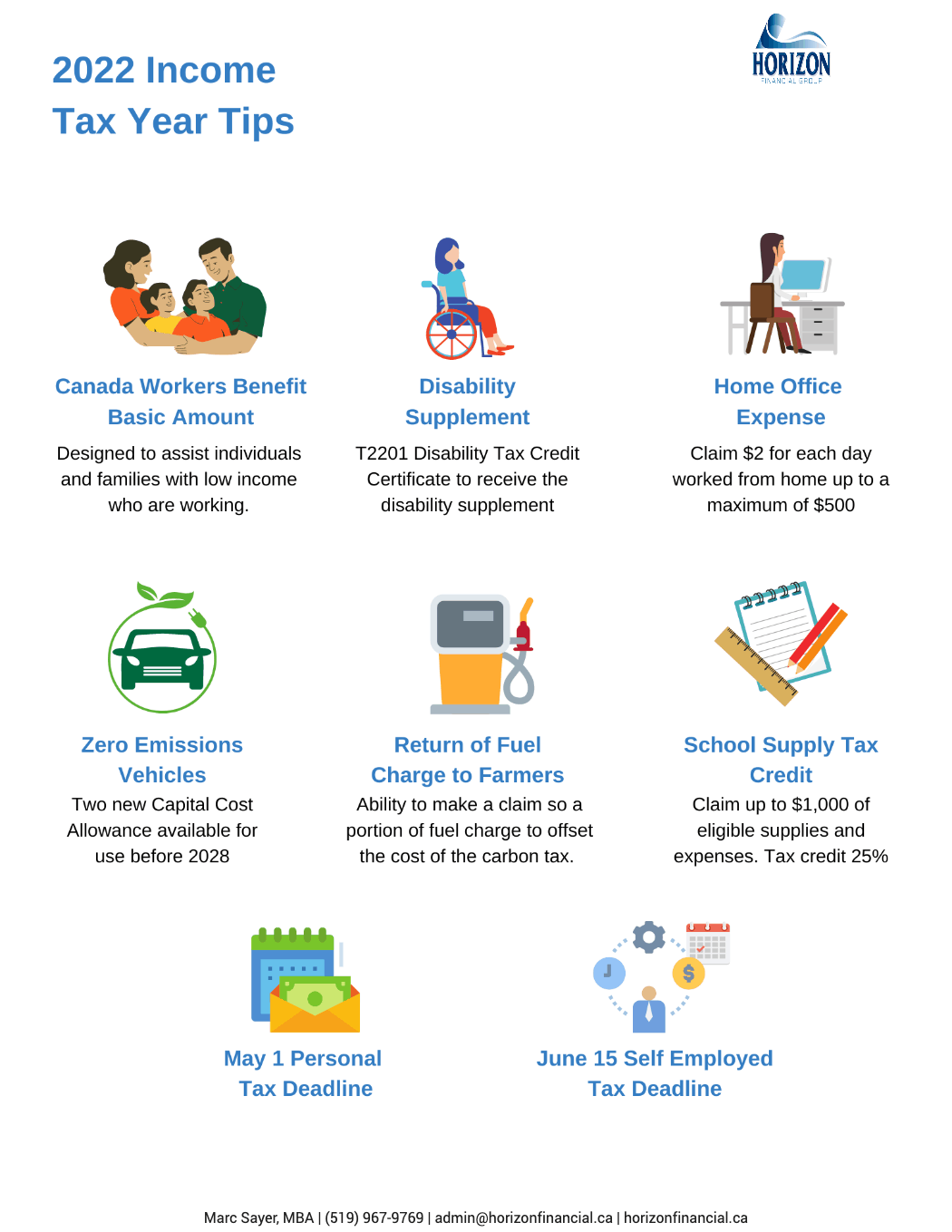

Credit: horizonfinancial.ca

Types Of Disability Insurance In Canada

In Canada, disability insurance is an essential safeguard that provides financial support to individuals who are unable to work due to illness or injury. Disability insurance can be broadly classified into two main categories: Short-Term Disability Insurance and Long-Term Disability Insurance.

Short-term Disability Insurance

Short-term disability insurance, also known as STD insurance, is designed to provide coverage for a limited duration of time. This type of insurance usually covers a portion of an individual’s income for a shorter timeframe, typically up to six months.

Short-term disability insurance plays a crucial role in aiding individuals who are temporarily unable to work due to medical reasons. It ensures that they have a steady stream of income to cover their living expenses during their recovery period.

Some important features of short-term disability insurance include:

- Provides coverage for a shorter duration, typically up to six months.

- Offers a specific percentage of an individual’s income as benefits, usually around 70%.

- Has a shorter waiting period, typically ranging from 0 to 14 days.

- Focuses on disabilities that are expected to be temporary in nature.

Long-term Disability Insurance

Long-term disability insurance, commonly referred to as LTD insurance, offers coverage for a more substantial duration. This type of insurance provides financial support for individuals who are unable to work for an extended period, often beyond six months.

Long-term disability insurance ensures that individuals facing severe illnesses or injuries can maintain their standard of living in the long run. It offers a reliable source of income to help cover essential expenses such as mortgage payments, medical bills, and daily living costs.

Here are some key features of long-term disability insurance:

- Provides coverage for an extended duration, often exceeding six months.

- Offers a fixed percentage of income as benefits, typically around 60% of the insured individual’s salary.

- Has a longer waiting period, usually ranging from several weeks to months.

- Focuses on disabilities that are expected to be long-lasting or permanent.

In summary, disability insurance in Canada comes in two primary forms: short-term disability insurance and long-term disability insurance. While short-term disability insurance provides temporary coverage for a limited duration, long-term disability insurance offers more extended protection for individuals facing long-lasting or permanent disabilities. Both types ensure that individuals are financially supported during challenging times, allowing them to focus on their recovery without the added stress of financial burdens.

Tax Implications For Different Types Of Disability Insurance

When it comes to disability insurance in Canada, understanding the tax implications is crucial. Different types of disability insurance carry varying tax treatments, which can impact your overall financial plan. This article will delve into the tax implications for different types of disability insurance, specifically focusing on the tax treatment of short-term and long-term disability insurance in Canada.

Tax Treatment Of Short-term Disability Insurance

Short-term disability insurance benefits in Canada are generally considered taxable income when the premiums are paid by the employer, and the employer has deducted the premium amount from the employee’s pay. Since the premiums are paid using pre-tax dollars, any benefits received are subsequently treated as taxable income. However, if the employee pays the premiums with after-tax dollars, the benefits received would not be subject to income tax.

Tax Treatment Of Long-term Disability Insurance

In contrast, long-term disability insurance is treated differently for tax purposes in Canada. When the premiums are paid using after-tax dollars, the benefits received are typically not taxable. This distinction can significantly impact the financial implications for individuals who rely on long-term disability insurance coverage. It’s important to note that such tax treatments may also be subject to change based on the specific terms of the policy and any relevant tax laws.

Claims Process For Disability Insurance

When it comes to disability insurance in Canada, understanding the claims process is vital. This process determines whether an individual will receive financial assistance in the event of a disability. Here, we delve into the key steps involved in the claims process for disability insurance.

Filing A Claim

Filing a claim for disability insurance in Canada involves submitting a thorough application to the insurance provider. This application typically includes medical records, documentation from healthcare professionals, and other relevant information. The claims process begins once the insurance company receives and reviews the submitted documents.

Approval And Denial Process

The approval or denial process of disability insurance claims can be quite complex. Once the claim is submitted, the insurance provider undertakes a careful review of the application and supporting documentation. If the claim meets the insurer’s criteria, it is approved, and the beneficiary begins to receive benefits. Conversely, if the claim does not meet the requirements, it is denied. However, this decision can be appealed if the beneficiary believes the denial is unjust. This appeals process involves presenting additional evidence to support the claim and may result in a reversal of the denial.

Considerations Before Purchasing Disability Insurance

When considering purchasing disability insurance, it is essential to understand the various aspects that can affect your coverage and premium costs. By taking these considerations into account, you can ensure that you make an informed decision that meets your needs and provides financial security in the event of a disability.

Policy Coverage

One of the first things to examine before purchasing disability insurance is the policy coverage it offers. Each insurance provider has different policy terms and conditions, so it’s crucial to carefully review them to understand what is covered and what is not. Some key aspects to consider include:

- The definition of disability: Make sure the policy provides coverage for your specific occupation or a broader definition of disability.

- Benefit period: Determine the length of time the insurance benefits will be paid out if you become disabled.

- Waiting period: Understand how long you must wait before receiving disability benefits after becoming disabled.

- Exclusions and limitations: Take note of any specific exclusions or limitations that may affect your ability to make a claim.

Premium Costs

Your premium costs for disability insurance can vary based on a range of factors. Understanding these factors can help you estimate the affordability of the insurance and manage your finances effectively. Consider the following:

- Age and health condition: Generally, younger individuals with better health receive lower premiums.

- Occupation: Some occupations have higher risks of disability, which may result in higher premium costs.

- Benefit amount and period: Higher benefit amounts and longer benefit periods typically lead to higher premiums.

- Additional optional coverage: Some policies offer optional benefits, such as cost-of-living adjustments or future purchase options, which can increase premium costs.

It’s essential to compare quotes from different insurance providers to ensure you get the best coverage for the most reasonable premium costs. Consider reaching out to insurance professionals to assist you in assessing your needs and finding the policy that aligns with your requirements.

Alternatives To Disability Insurance

Alternatives to Disability Insurance: While disability insurance provides crucial financial protection, there are other options to consider in Canada. Exploring different avenues can offer additional layers of coverage and peace of mind.

Government Programs

Government programs serve as a safety net for individuals facing disability or illness in Canada. These programs provide financial assistance to those in need through various initiatives like:

- Canada Pension Plan Disability Benefits

- Employment Insurance Sickness Benefits

- Provincial Disability Support Programs

Savings And Investments

Saving and investing wisely can also act as a form of protection against unforeseen circumstances. Building up a financial cushion can help cover expenses in the event of a disability. Consider options like:

- Emergency Savings Fund

- Registered Disability Savings Plan

- Tax-Free Savings Account

:max_bytes(150000):strip_icc()/diinsurance_v3-bf77d05568264d77a7f79ec956ef3d82.png)

Credit: http://www.investopedia.com

Frequently Asked Questions On Is Disability Insurance Taxable In Canada

Is Disability Insurance Taxable In Canada?

Yes, disability insurance benefits are generally considered taxable income in Canada. However, if both you and your employer contributed to the plan, only the portion paid by the employer is taxable. It’s advisable to consult with a tax professional for specific advice.

What Types Of Disability Insurance Are Taxable In Canada?

Long-term disability insurance benefits received through your employer’s plan are generally taxable in Canada. However, if you personally paid the premiums using after-tax dollars, the benefits are usually tax-free. This is a positive incentive for individuals to secure disability insurance independently.

Are There Any Exemptions For Taxable Disability Insurance In Canada?

Yes, there are certain exemptions for taxable disability insurance benefits in Canada. If you personally paid the premiums with after-tax dollars, any benefits received would typically be tax-free. Additionally, if the insurance premiums were deducted from your pay after-tax, the benefits are usually non-taxable.

However, it’s essential to consult with a tax professional for personalized advice.

Do Self-employed Individuals Need To Pay Tax On Disability Insurance Benefits In Canada?

Yes, self-employed individuals in Canada are generally required to pay tax on disability insurance benefits they receive. It’s essential for self-employed individuals to understand the tax implications of their disability insurance coverage, as well as the potential deductions available for insurance premiums, in order to make informed decisions and effectively manage their tax obligations.

Conclusion

Disability insurance in Canada may be subject to taxation depending on various factors such as the type of policy and how the premiums are paid. It is crucial to understand the tax implications to ensure proper financial planning and to avoid any unexpected tax liabilities.

Consulting with a tax advisor or insurance professional can provide valuable insights tailored to your specific situation. Stay informed and make informed decisions regarding your disability insurance coverage.

Leave a comment