Fire insurance is not typically included in homeowners insurance policies. It is a separate coverage you may need to purchase for protection against fire-related damages.

Homeowners insurance offers essential coverage for your property and personal belongings. However, it may not include specific perils like fire damage unless explicitly stated in your policy. Adding fire insurance can provide an extra layer of protection and peace of mind in case of fire incidents.

It’s crucial to review your insurance policy carefully to understand the extent of your coverage and consider additional policies to fill any potential gaps. By ensuring you have the right insurance in place, you can safeguard your home and belongings from unforeseen fire hazards.

Credit: http://www.latimes.com

1. What Is Fire Insurance

The possibility of a house fire can be a worrisome thought for any homeowner. 1. What is Fire Insurance exactly? Let’s dive into the details.

1.1 Understanding Fire Insurance:

Fire insurance is a specific type of insurance coverage that provides financial protection against damages caused by fires.

1.2 Importance Of Fire Insurance:

Fire insurance is vital for homeowners as it offers security and peace of mind in case of fire-related disasters.

Credit: http://www.atlanticcoastmortgage.com

2. Homeowners Insurance Coverage

2. Homeowners Insurance Coverage

2.1 Basics Of Homeowners Insurance

Homeowners insurance is a crucial protection that provides financial security in case of loss or damage to your home.

2.2 Common Types Of Coverage

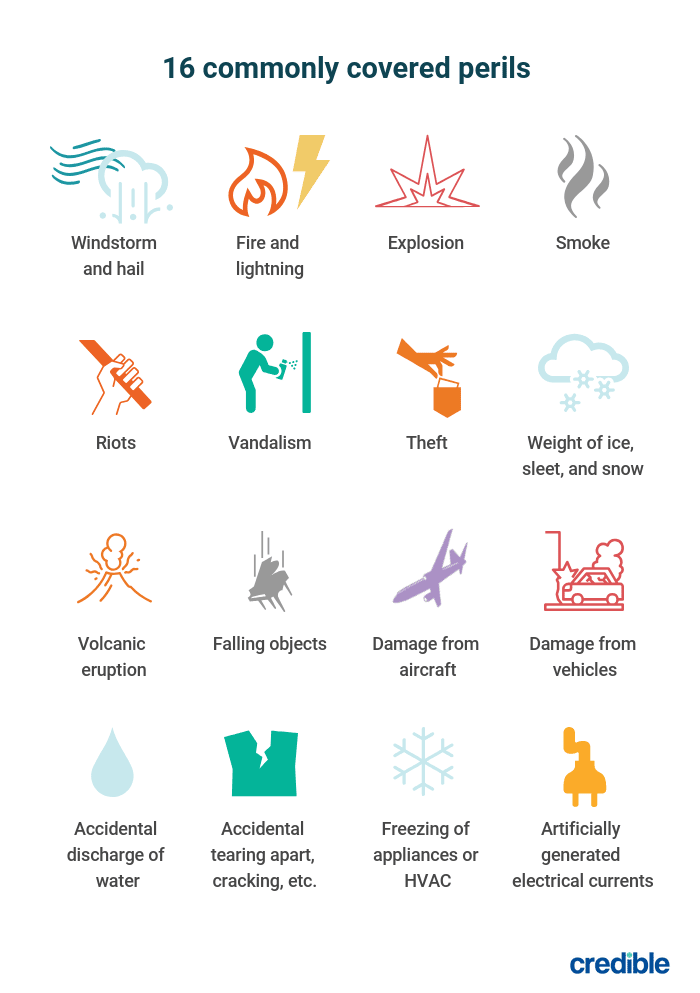

- Dwelling Coverage: Protects the structure of your home against covered perils like fire, theft, and vandalism.

- Personal Property Coverage: Covers your belongings inside the house in case of theft or damage.

- Liability Coverage: Provides financial protection if someone is injured on your property.

- Additional Living Expenses: Pays for temporary accommodation if your home is uninhabitable due to a covered event.

Understanding these coverage types can help you make informed decisions when selecting a homeowners insurance policy.

3. Fire Insurance And Homeowners Insurance

3. Fire Insurance and Homeowners Insurance

When it comes to protecting your home, homeowners insurance is essential. It provides coverage for various perils, including fire, theft, and natural disasters. But what about fire insurance? Is it included in homeowners insurance? Let’s find out.

3.1 Fire Coverage In Homeowners Insurance

In homeowners insurance, fire coverage is typically included as part of the policy. This means that if your home is damaged or destroyed due to a fire, your insurance policy will compensate you for the repairs or rebuilding costs.

Furthermore, fire coverage also extends to the belongings inside your home. If your furniture, electronics, or other personal belongings are damaged or destroyed by fire, your insurance will help cover the cost of replacing them.

However, it’s important to note that fire insurance coverage may vary depending on your insurance provider and the specific policy you have. It’s crucial to review your policy documents or speak with your insurance agent to understand the extent of your fire coverage.

3.2 Is Fire Insurance Included?

Yes, fire insurance is typically included in homeowners insurance. But why is it necessary to have fire coverage as part of your policy? Here are a few reasons:

- Protection Against Unforeseen Circumstances: Accidents happen, and fires can rapidly cause extensive damage to your home and belongings. Having fire insurance ensures that you have financial protection in such unforeseen circumstances.

- Rebuilding and Repair Costs: Rebuilding or repairing a home after a fire can be expensive. Fire insurance helps cover the costs, allowing you to get your life back on track as quickly as possible.

- Peace of Mind: Knowing that you are financially protected in the event of a fire provides peace of mind. You can focus on other aspects of recovery and rebuilding without worrying about the financial burden.

While fire insurance is typically included in homeowners insurance, it’s always a good idea to review your policy and ensure that you have adequate coverage. Keep in mind that certain factors, such as the age and condition of your home, may impact your insurance premium and coverage options.

Credit: http://www.credible.com

4. Additional Fire Insurance Options

When it comes to protecting your home from potential fire damage, it’s crucial to understand the additional fire insurance options available to homeowners. In addition to the standard fire coverage in your homeowners insurance policy, there are supplemental fire insurance options that provide added protection in case of a fire-related event.

4.1 Separate Fire Insurance Policies

Separate fire insurance policies are a distinct form of coverage that can be purchased as a standalone policy or as an endorsement to your existing homeowners insurance. By obtaining a separate fire insurance policy, you can secure enhanced financial protection against fire damage that may not be fully covered by your standard homeowners insurance.

4.2 Supplemental Fire Coverage

Supplemental fire coverage refers to additional endorsements or riders that can be added to your existing homeowners insurance policy to increase the level of protection in the event of a fire. These supplemental options may include coverage for replacement costs, smoke damage, and temporary living expenses in the aftermath of a fire.

5. Evaluating Fire Insurance Needs

When it comes to safeguarding your home from fire-related risks, evaluating your fire insurance needs is crucial. This involves assessing property risks and determining adequate coverage to protect your home and belongings.

5.1 Assessing Property Risks

Assessing property risks involves identifying potential fire hazards within and around your home. This includes evaluating the proximity to fire-prone areas, the condition of electrical wiring, heating systems, and the presence of flammable materials. By assessing these risks, you can better understand the level of protection your property requires.

5.2 Determining Adequate Coverage

Determining adequate coverage involves calculating the replacement cost of your home and belongings in the event of a fire. This encompasses the value of the structure, personal possessions, and additional living expenses. By ensuring that you have adequate coverage, you can mitigate the financial hardships that may arise from fire damage.

6. Claims Process For Fire Insurance

If you ever find yourself in the unfortunate situation of experiencing a fire at your home, having fire insurance can provide some much-needed financial assistance during the recovery process. Understanding the claims process for fire insurance is essential to ensure you receive the compensation you deserve in a timely manner.

6.1 Filing A Fire Insurance Claim

Filing a fire insurance claim can seem like a daunting task, but with the right information and guidance, it can be a straightforward process. When a fire occurs, your first step is to contact your insurance provider as soon as possible. Remember to provide accurate and detailed information about the incident, including the date, time, and location of the fire, as well as any evidence or documentation available.

Once you have reported the fire and submitted all the necessary information, the insurance company will assign an adjuster to assess the damages. The adjuster will evaluate the extent of the loss and determine the coverage provided by your policy. It is crucial to cooperate fully with the adjuster and provide any additional documentation or proof they may require.

6.2 Handling Fire Insurance Disputes

In some cases, disputes may arise between the homeowner and the insurance company regarding the fire insurance claim. These disputes can be due to various reasons, such as coverage disagreements or differences in valuation.

If you find yourself in a fire insurance dispute, it is essential to handle the situation carefully and seek professional advice if necessary. Here are some steps you can take to resolve the dispute:

- Review your policy: Carefully review your insurance policy to understand the coverage and ensure you have a clear understanding of your rights and obligations.

- Document the damages: Take photographs and keep detailed records of all damages caused by the fire. This evidence will help support your claim and strengthen your position in the dispute.

- Seek professional help: If the dispute persists, consider consulting with an attorney or a public adjuster who specializes in fire insurance claims. They can provide valuable advice and advocate for your rights during the negotiation process.

Remember, it is always important to maintain open and clear communication with your insurance provider throughout the claims process. Resolving disputes amicably and efficiently will help ensure a smooth and fair resolution, allowing you to focus on rebuilding and recovering from the fire.

7. Tips For Obtaining Fire Insurance

7. Tips for Obtaining Fire Insurance

When it comes to protecting your home, fire insurance is crucial. Here are some important tips to help you obtain the right coverage:

7.1 Researching Insurance Providers

Begin by researching various insurance providers to find a reputable company that offers fire insurance.

- Contact local agencies for recommendations.

- Check online reviews and ratings for feedback.

- Look for insurers with a good track record in handling fire insurance claims.

7.2 Comparing Fire Insurance Quotes

It’s essential to compare quotes from different providers before making a decision.

- Request quotes from at least three insurance companies.

- Compare coverage limits, premiums, and deductible amounts.

- Consider additional benefits offered, such as wildfire protection.

8. Fire Safety Measures For Homeowners

Fire safety is a crucial aspect of homeownership to protect your property and loved ones. As a responsible homeowner, it is essential to be aware of fire safety measures that can help prevent devastating fires and minimize the risks associated with fire incidents in your home.

8.1 Preventive Measures To Avoid Fires

- Keep flammable materials away from heat sources.

- Regularly inspect and clean chimneys and heating systems.

- Install smoke alarms in key areas of your home.

8.2 Importance Of Maintaining Safety Equipment

- Test smoke alarms monthly and replace batteries annually.

- Have fire extinguishers readily accessible and regularly serviced.

- Regularly maintain and inspect electrical systems.

Frequently Asked Questions On Is Fire Insurance Included In Homeowners

Is Fire Insurance Included In Homeowners Insurance?

Fire insurance is typically included in standard homeowners insurance policies. It provides coverage for damage caused by fire to your home and personal belongings, as well as additional living expenses if your home is uninhabitable. Check your policy to understand the specific coverage details.

What Does Fire Insurance Cover Under Homeowners Insurance?

Fire insurance under homeowners insurance covers damage to your home and personal belongings caused by fire. It also provides coverage for additional living expenses if your home is uninhabitable due to fire damage. It’s important to review your policy to understand the extent of your coverage.

What Are The Typical Exclusions Of Fire Insurance In Homeowners Insurance?

While fire insurance under homeowners insurance provides extensive coverage, typical exclusions may include intentional acts of arson, damage caused by war, and certain types of neglect. It’s important to review your policy to understand the specific exclusions of your fire insurance coverage.

How To Ensure Adequate Fire Insurance Coverage For My Home?

To ensure adequate fire insurance coverage for your home, it’s crucial to assess the replacement cost of your home and personal belongings. Additionally, regularly reviewing and updating your policy to reflect changes in property value and possessions is essential to maintaining adequate coverage.

Conclusion

Fire insurance is an essential component of homeowners’ insurance coverage since it protects property owners against the risk of fire damage to their homes. Without fire insurance, homeowners face potentially devastating financial consequences. It’s important to review your homeowners’ policy carefully to ensure that fire insurance is included, as not all policies automatically provide this coverage.

By being proactive and acquiring adequate fire insurance, homeowners can have peace of mind knowing that their most valuable asset is protected from fire-related perils.

Leave a comment