Flood Zone AE is a high-risk area prone to flooding, making it potentially problematic for property owners. The designation indicates a mandatory flood insurance requirement.

Living in a Flood Zone AE area can pose challenges and financial burdens should flooding occur, necessitating proper protection and preparedness measures. Living in a high-risk flood zone area, such as Flood Zone AE, comes with its own set of challenges and considerations for property owners.

Understanding the implications of this designation is crucial in ensuring the safety and protection of your property and assets. We will explore the significance of Flood Zone AE and provide insights on how to navigate living in such a high-risk flood zone effectively. Let’s delve deeper into the potential risks and measures that can help mitigate the impact of flooding in Flood Zone AE areas.

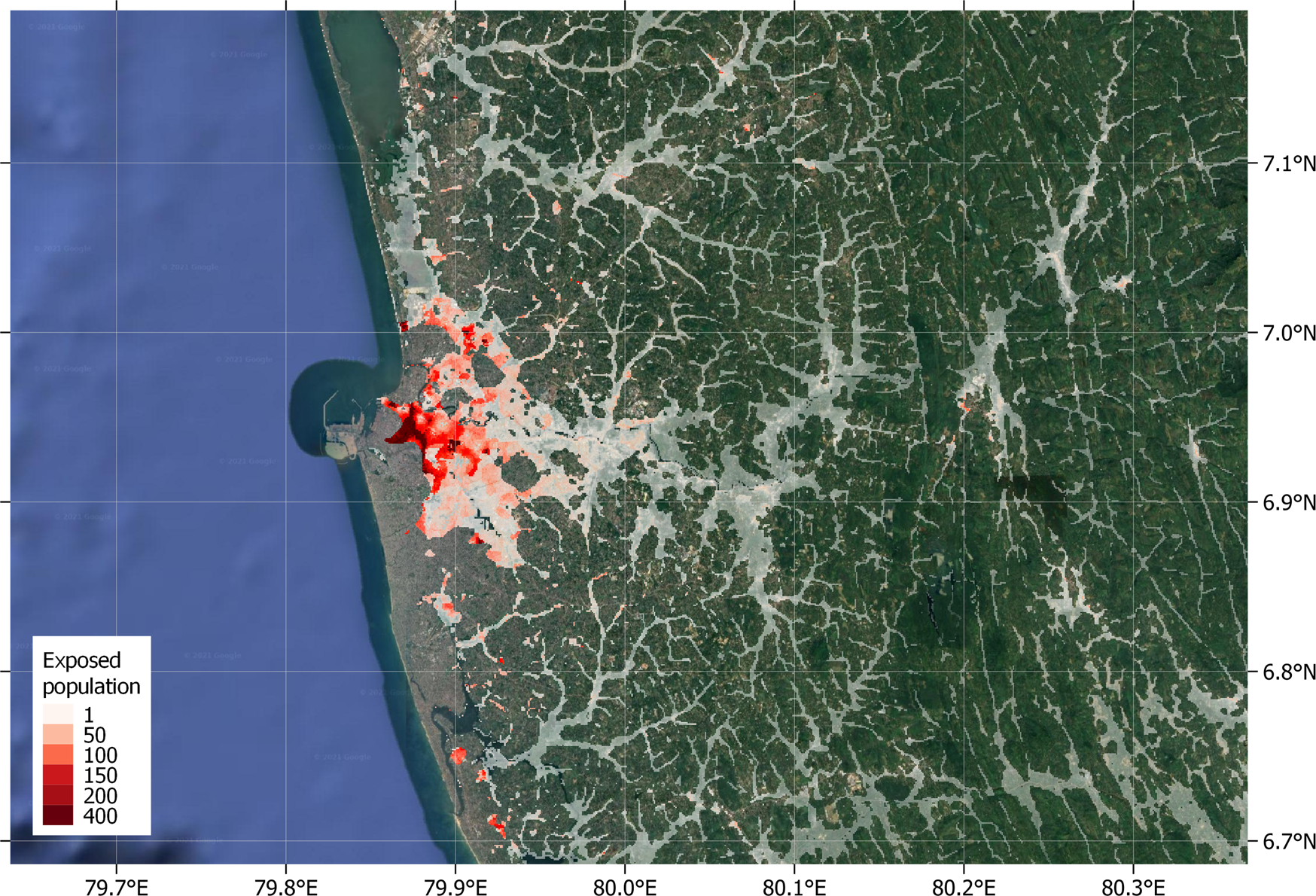

Credit: http://www.pewtrusts.org

What Is Flood Zone Ae?

Flood Zone AE is a designation by the Federal Emergency Management Agency (FEMA) that signifies areas at high risk of flooding.

Definition Of Flood Zone Ae

Flood Zone AE refers to areas with high flood risk due to their proximity to bodies of water, such as rivers, lakes, or oceans.

Location And Frequency Of Flood Zone Ae

Flood Zone AE locations are often found along coastal areas or near large bodies of water, where flooding is more likely to occur.

Understanding Risks Of Flood Zone Ae

Explore the significance of understanding flood risks in Zone AE. Determine the potential impacts and take proactive measures to mitigate unfavorable consequences. Prioritize safety and preparedness in areas prone to flooding events.

Understanding Risks of Flood Zone AE Flood Zone AE indicates a high-risk area prone to flooding; understanding its risks is crucial.Potential Damages and Losses In Flood Zone AE, properties face potential damage from floodwaters, leading to significant financial losses. Impact on Property Value Properties situated in Flood Zone AE may see a decrease in value due to their high susceptibility to flooding. Insurance Coverage and Premiums Insurance coverage in Flood Zone AE may be limited, with premiums typically higher to account for the increased risk.

Why Is Flood Zone Ae Bad?

Living in Flood Zone AE poses risks due to high potential for flooding during storms. Properties in this zone are more prone to damage and insurance costs may be higher. It’s crucial for homeowners in Flood Zone AE to be prepared for potential water-related hazards.

Living in a flood zone AE can have severe consequences. This particular flood zone designation is considered one of the riskiest and most dangerous. Let’s take a closer look at the reasons why flood zone AE is bad.

Increased Likelihood Of Flooding

The primary reason why flood zone AE is deemed bad is the increased likelihood of flooding. With its close proximity to bodies of water, such as rivers, lakes, and coastlines, properties located in this flood zone have a higher chance of experiencing floods.

Flood zone AE is typically characterized by its moderate to high-risk levels, indicating that the area has a 1% annual chance of flooding. This means that for homeowners residing in this zone, there is a considerable probability of flooding occurring each year.

Higher Risk Of Property Damage

The higher risk of flooding in flood zone AE translates to a greater likelihood of property damage. Floodwaters can cause extensive destruction, including structural damage to buildings, the loss of personal belongings, and the need for costly repairs.

When floodwaters enter a property, they can saturate the foundation, weaken the structural integrity of the building, and damage electrical, plumbing, and HVAC systems. Moreover, mold growth may occur due to the excessive moisture, posing a health risk to homeowners.

It is important to note that homeowners’ insurance policies typically do not cover flood damages, so those residing in flood zone AE may need to purchase separate flood insurance to protect their properties.

Challenges For Homeowners

Living in flood zone AE can present significant challenges for homeowners. Apart from the possibility of property damage, individuals residing in this flood zone often face higher insurance premiums due to the increased risk associated with their location.

Additionally, homeowners in flood zone AE may be required to comply with certain building codes and regulations to mitigate the risk of flooding. This may involve elevating buildings, installing flood vents, using flood-resistant materials, or implementing other mitigation measures.

These requirements can add considerable expenses and complications to homeowners looking to build, renovate, or sell their properties. Furthermore, the uncertainty and stress caused by the constant threat of flooding can significantly impact the quality of life for residents in flood zone AE.

Solutions And Precautions

Facing the risk of flooding in AE flood zones requires adequate solutions and precautions to safeguard property and ensure peace of mind. Below, we outline three essential strategies to mitigate the impact of potential flooding.

Flood Insurance Policies

Flood insurance is a crucial safeguard for properties located in flood-prone areas, especially those classified in the AE flood zone. Acquiring a comprehensive flood insurance policy tailored to your specific needs can provide financial protection in the event of flood damage. It’s essential to consult with insurance professionals to ensure you have adequate coverage for your property.

Mitigation Measures

Implementing mitigation measures is vital for minimizing the impact of flooding. This includes strategic measures such as elevating utilities and appliances, and installing flood barriers or sealing basements to prevent water infiltration. Additionally, landscaping adjustments can be made to direct water away from the property. Undertaking these measures can significantly reduce the risk and damage caused by flooding.

Elevation And Structural Upgrades

For properties in AE flood zones, elevation and structural upgrades are essential for mitigating potential flood damage. These upgrades may include elevating the structure itself to a higher elevation, reinforcing the foundation, and installing flood-resistant materials. These measures are critical in reducing the vulnerability of the property to flood-related damage, ultimately minimizing the potential for loss.

Government Initiatives And Programs

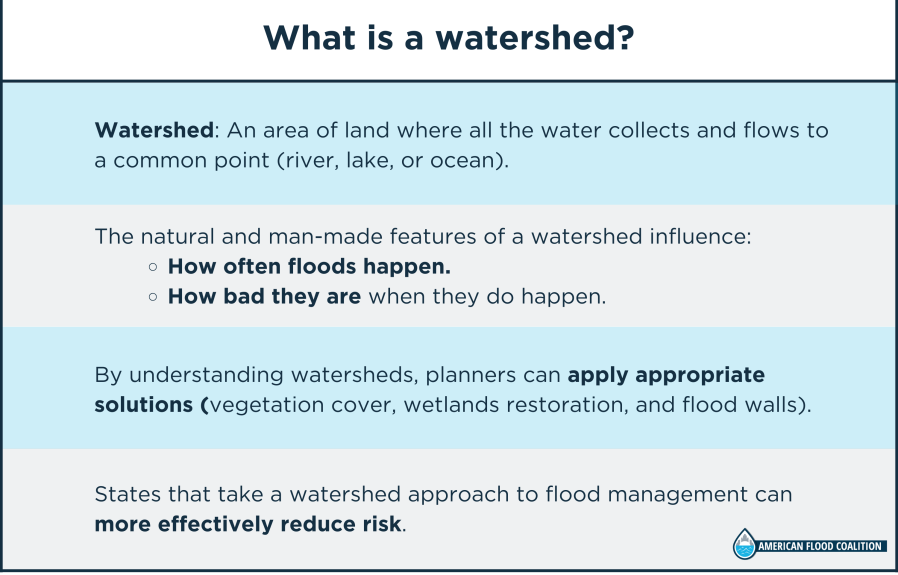

Flood Zone AE, designated by the Federal Emergency Management Agency (FEMA), prompts various government initiatives and programs to mitigate the risks and protect communities. Let’s explore some crucial initiatives and programs aimed at managing flood-prone areas.

Fema’s Flood Zone Ae Regulations

FEMA has established comprehensive regulations for Flood Zone AE, outlining specific requirements for properties located in these high-risk areas. Property owners in these zones are required to adhere to stringent building codes and elevation standards to minimize the impact of flooding. These regulations play a pivotal role in safeguarding communities and ensuring structural resilience against potential flooding events.

National Flood Insurance Program (nfip)

The NFIP offers crucial support to property owners residing in Flood Zone AE by providing affordable flood insurance coverage. Through NFIP, individuals are empowered to safeguard their properties and possessions against the financial repercussions of flooding. By participating in NFIP, homeowners can access essential resources for recovery in the aftermath of a flood, thereby fostering community resilience and stability.

Community Rating System (crs)

The Community Rating System enables communities to actively engage in floodplain management and mitigation efforts. By implementing proactive measures such as floodplain mapping, elevation requirements, and stormwater management practices, communities can earn credits within the CRS program. These credits lead to reduced flood insurance premiums for residents, incentivizing participation in community-wide strategies to mitigate flood risks.

/cloudfront-us-east-1.images.arcpublishing.com/tbt/7T2FX3KRS5A3NK5WWY3VPMBANQ.JPG)

Credit: http://www.tampabay.com

Buying And Selling Property In Flood Zone Ae

Property in Flood Zone AE can pose challenges for buyers and sellers. While it’s not inherently bad, it’s essential to consider potential risks and obtain flood insurance. Understanding the implications of the designation is crucial for making informed decisions in real estate transactions.

When it comes to buying or selling property in a flood zone, there are specific considerations that both buyers and sellers need to be aware of. Flood Zone AE is one of the more common designations given to areas prone to flooding. Understanding the potential risks and regulations associated with this flood zone is crucial for making informed decisions. In this article, we will discuss some key points to consider when buying or selling property in Flood Zone AE.

Considerations For Buyers

As a buyer, it’s essential to thoroughly evaluate the property in Flood Zone AE before making a decision. Here are some considerations to keep in mind:

- Determine the property’s elevation level: Check if the property lies within the Base Flood Elevation (BFE) zone, which indicates the height the floodwater is expected to reach during a severe flood event. A property with a higher elevation may have reduced flood risks.

- Review flood insurance requirements: Understand the mandatory flood insurance requirements for properties located in Flood Zone AE. This insurance can have significant cost implications, so it’s crucial to factor it into your budget.

- Assess the property’s history of flooding: Investigate if the property has experienced flooding in the past. This information can be obtained from local authorities or previous owners. Understanding the property’s flood history is essential in evaluating the potential risks.

- Consider mitigation efforts: Look into any mitigation measures implemented on the property, such as flood barriers or drainage systems. These efforts can help reduce the risk of flooding and provide added protection for your investment.

Disclosures And Property Reports

During the buying or selling process, specific disclosures and property reports are required by law to ensure transparency and protect both parties. Here are some important points to know:

- Flood zone disclosure: Sellers must disclose whether the property is located in a flood zone, including the specific flood zone designation. Buyers need to carefully review this information and ask for additional details if needed.

- Flood elevation certificate: A flood elevation certificate provides valuable information about the property’s elevation in relation to flood zones. It contains data on the property’s BFE, lowest adjacent grade, and other details relevant to flood risks. Requesting this certificate can help assess the property’s vulnerability to flooding.

- Property condition reports: Buyers should request a comprehensive property inspection report that includes an assessment of any existing flood-related damages or potential risks. This report can guide your decision-making process and help you negotiate a fair price.

Negotiating With Sellers

Negotiating the purchase price and terms of a property located in Flood Zone AE requires a strategic approach. Here are some tips to keep in mind:

- Factor in flood insurance costs: Given the mandatory flood insurance requirements for properties in Flood Zone AE, buyers should consider adjusting their offer to compensate for the additional expenses associated with insurance premiums.

- Highlight property improvements: If the property has undergone flood mitigation efforts or other improvements that enhance its resilience against flooding, be sure to highlight these features during negotiations. They can contribute to the property’s value and justify a higher offer.

- Perform a thorough home inspection: Hire a qualified home inspector who specializes in flood zone properties. Their expertise will help identify any potential issues and provide a more accurate assessment of the property’s condition.

As a buyer or seller, navigating the intricacies of buying or selling property in Flood Zone AE requires careful attention to detail. By considering the factors mentioned above, you can make well-informed decisions and ensure a smoother transaction process.

Credit: http://www.nature.com

Frequently Asked Questions Of Is Flood Zone Ae Bad

What Is Flood Zone Ae?

Flood Zone AE is an area at high risk of flooding, often requiring mandatory flood insurance. It indicates potential flooding from overflowing rivers or other water sources.

What Are The Risks Of Living In Flood Zone Ae?

Living in a Flood Zone AE increases the risk of property damage due to flooding. It’s important to be prepared for potential water damage and to have appropriate insurance coverage.

How To Determine If My Property Is In Flood Zone Ae?

You can check your property’s flood zone by using FEMA’s Flood Map Service Center. Enter your address to access flood maps and understand the risks associated with your specific location.

Conclusion

It is crucial to consider the implications of living in a Flood Zone AE. The potential risks and challenges presented by this high-risk flood area should not be taken lightly. It is essential to assess the specific location, understand the flood insurance requirements, and prioritize necessary precautions for protecting life and property.

Consulting with local authorities and experts can provide valuable insights towards making informed decisions in mitigating the risks associated with Flood Zone AE. Stay safe and prepared!

Leave a comment