Home flood insurance is a type of insurance that covers damages to your home caused by floods. It provides financial protection and helps you recover from the expenses incurred due to flood-related damages.

Floods can have devastating consequences for homeowners, causing significant damage to properties and belongings. Dealing with the aftermath of a flood can be overwhelming, both emotionally and financially. That’s where home flood insurance comes in. This type of insurance provides homeowners with the necessary financial protection to recover from the damages caused by floods.

It covers repairs, replacement of belongings, and other related expenses. Home flood insurance aims to alleviate the financial burden and provide peace of mind for homeowners in flood-prone areas. Without this insurance, homeowners would be left responsible for footing the bill for extensive repairs and replacements. We will explore the importance of home flood insurance and its benefits.

Understanding Home Flood Insurance

Home flood insurance is crucial for safeguarding your home from potential water damage. It provides financial protection against flood-related losses, covering repair and restoration costs caused by floodwaters. Understanding your policy’s coverage and limitations is essential to ensure adequate protection for your home.

What Is Home Flood Insurance?

Home Flood Insurance protects homeowners from financial losses due to flooding in their homes.

Importance Of Home Flood Insurance

Home Flood Insurance provides peace of mind by covering damages that may not be included in standard home insurance policies.

Credit: http://www.tdi.texas.gov

Coverage Details

Home flood insurance provides comprehensive coverage for damages caused by flooding in your home. Protect your property and belongings from the devastating effects of floods with the right insurance policy. Get peace of mind knowing you’re prepared for unexpected disasters.

What Does Home Flood Insurance Cover?

Floods can cause extensive damage to a home, resulting in expensive repairs and financial strain. A home flood insurance policy is designed to alleviate the financial burden and provide coverage for various aspects affected by a flood. Here are the key coverage details you should know: 1. Dwelling Coverage: This includes the structure of your home, covering damages caused to the foundation, walls, flooring, and electrical systems. It ensures that the repair and restoration costs are covered, allowing you to rebuild your home after a flood. 2. Contents Coverage: Home flood insurance also includes coverage for the contents within your home, such as furniture, appliances, clothing, and electronics. If these items are damaged or destroyed by flooding, your policy will help reimburse you for their value, helping you replace essential items without incurring significant out-of-pocket expenses. 3. Replacement Cost Coverage: Some flood insurance policies offer replacement cost coverage, which means that you will be reimbursed for the full cost of replacing damaged items or rebuilding your home, without considering depreciation. This ensures you can replace items with new ones of similar quality and rebuild your home to its previous condition. 4. Additional Living Expenses: If your home becomes uninhabitable due to a flood, your policy may provide coverage for additional living expenses. This means that you will be reimbursed for costs such as temporary accommodations, meals, and other necessary expenses while your home is being repaired or rebuilt. 5. Basement Coverage: Many standard home insurance policies exclude coverage for basements. However, home flood insurance often includes coverage for basements, including structural elements, appliances, and personal belongings stored in the basement.Exclusions In Home Flood Insurance

While home flood insurance provides valuable coverage, it’s essential to be aware of the exclusions that may limit what is covered. Here are some common exclusions: 1. Gradual Damage: Home flood insurance is meant to cover sudden and accidental flooding, not gradual damage caused by poor maintenance or pre-existing conditions. Any damage resulting from continuous or repeated seepage of water is generally excluded. 2. Water Backup: Standard home flood insurance policies typically exclude coverage for water backup from sewers, drains, or sump pumps. However, you may have the option to purchase additional coverage for this specific risk if you live in an area prone to such issues. 3. Landscaping and Outdoor Property: Home flood insurance generally focuses on the structure of your home and its contents, excluding coverage for landscaping, fences, decks, and other outdoor property. Keep this in mind when assessing your coverage needs. 4. Valuable Items: While home flood insurance covers personal belongings, there may be limits on coverage for high-value items, such as jewelry, artwork, collectibles, or antiques. If you have expensive items, you may need to purchase additional coverage or consider separate insurance options. By understanding the coverage details and exclusions of home flood insurance, you can make an informed decision when selecting a policy that best suits your needs. Protecting your home and belongings from the devastating effects of flooding can provide peace of mind and financial security when you need it most.Benefits Of Home Flood Insurance

Home flood insurance provides essential financial protection and peace of mind to homeowners in high-risk flood areas. By investing in flood insurance, homeowners can shield their properties from the devastating financial impact of flooding, ensuring they have the support they need in the event of a disaster.

Financial Protection

Home flood insurance offers crucial financial protection by covering repair and restoration costs in the aftermath of a flood. This insurance provides homeowners with the necessary funds to rebuild or repair their properties, replace damaged belongings, and cover temporary living expenses during the restoration process. Without flood insurance, homeowners could face overwhelming financial strain and potential loss of their most valuable assets.

Peace Of Mind

Home flood insurance provides peace of mind by offering homeowners the assurance that their properties and belongings are safeguarded against the destructive consequences of flooding. This insurance enables homeowners to rest easy knowing that they are financially prepared to address the aftermath of a flood and can focus on prioritizing the safety and well-being of their families. With flood insurance, homeowners can confidently face the unpredictability of natural disasters, knowing they have reliable protection in place.

Cost Factors

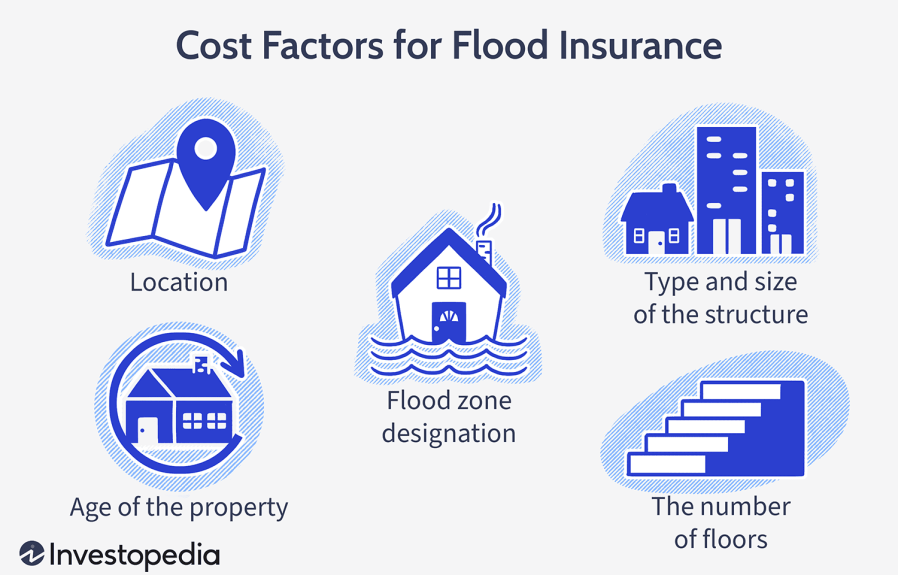

When considering purchasing home flood insurance, it is important to understand the cost factors associated with it. Several elements come into play when determining the cost of flood insurance for a home.

Determining Factors

The cost of home flood insurance is influenced by various factors such as the location of the property, its elevation, the construction of the home, and the coverage amount desired. Properties located in high-risk flood zones are likely to have higher premiums, while those in lower-risk areas may benefit from more affordable rates. Elevation plays a crucial role as homes at higher elevations could experience lower premiums due to reduced risk of flooding. The type of construction and the age of the home also impact the cost, as well as the desired coverage amount.

Cost Savings Tips

- Evaluate your property’s flood risk to determine the most appropriate coverage level.

- Consider mitigation efforts such as elevating utilities and appliances above potential flood levels, which could lead to reduced premiums.

- Check if your community participates in the Community Rating System (CRS), as it could provide discounts for implementing floodplain management practices.

- Review the National Flood Insurance Program (NFIP) for potential cost savings and consider private insurers for competitive rates.

Government Assistance Vs. Private Providers

In determining home flood insurance options, one must weigh the benefits of government assistance versus private providers. Government assistance may offer standardized coverage, while private providers typically provide more customizable policies to meet specific needs. It’s essential to compare both options carefully to secure the right protection for your home.

Government Assistance vs. Private Providers From natural disasters to plumbing mishaps, home flood insurance is crucial for protecting your property and belongings. When it comes to selecting the right coverage, homeowners often find themselves considering government assistance or private providers. Let’s delve into the options available to you.National Flood Insurance Program (nfip)

Backed by the Federal Emergency Management Agency (FEMA), the National Flood Insurance Program (NFIP) provides flood insurance to property owners nationwide. Under the NFIP, homeowners can obtain coverage for their residences, as well as for the contents within. The program aims to reduce the impact of flooding on individuals and communities by offering affordable insurance options. However, it is essential to note that the NFIP has limitations. The coverage it provides is capped at $250,000 for the structure of a home and $100,000 for the contents. Additionally, the claims process can sometimes be lengthy, causing delays in receiving the necessary funds to recover from flood damage.Private Flood Insurance Companies

Private flood insurance companies have emerged as an alternative to government-backed programs like the NFIP. These companies offer customized policies tailored to meet the specific needs of homeowners. By working with private providers, homeowners have the flexibility to choose the coverage limits and deductibles that align with their risk tolerance. One advantage of private flood insurance companies is the potential for higher coverage limits than those offered by the NFIP. Homeowners with high-value properties may find private policies better suited to their needs. Additionally, private providers often offer faster claims processing times, allowing homeowners to begin their recovery process promptly. Of course, like any insurance option, private flood insurance also has its share of considerations. Premiums for these policies can vary significantly depending on factors such as flood risk and property location. It is important to carefully evaluate your options and compare quotes from multiple providers to ensure you are getting the best coverage at a competitive rate. In conclusion, weighing the pros and cons of government assistance versus private providers is essential when it comes to securing home flood insurance. While the NFIP offers reliable coverage and affordable rates, it may have limitations in terms of coverage and claims processing. On the other hand, private providers offer customizable policies and potentially higher coverage limits, but premiums can vary. Ultimately, the decision lies in understanding your specific needs, budget, and risk tolerance to find the right flood insurance solution for your home.:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

Credit: http://www.investopedia.com

Understanding Flood Zones

Living in an area prone to flooding means understanding the various flood zones.

Floodplains: Areas near rivers, lakes, or oceans at risk of flooding.

A Zones: Zones with moderate flood risk; may need flood insurance.

V Zones: High-risk coastal areas where flooding is likely; require flood insurance.

Flood zones significantly influence the cost of home flood insurance.

Lower Risk Zones: Enjoy lower premiums compared to high-risk zones.

Higher Risk Zones: premiums are elevated due to increased likelihood of flooding.

- Consult FEMA’s Flood Insurance Rate Map (FIRM)

- Use online tools like Flood Zone Maps to assess your property’s risk

- Reach out to local authorities for further information

- Elevate utilities and electrical systems

- Install flood vents to prevent structural damage

- Maintain proper drainage systems around your property

By understanding flood zones and their implications on insurance, homeowners can make informed decisions to protect their homes.

Steps To Obtain Home Flood Insurance

Assessment Of Risk

Assess your property’s flood risk by checking FEMA’s flood maps and evaluating historical flooding in your area.

Comparison Of Policies

Compare different flood insurance policies by reviewing coverage limits, deductibles, and premium costs.

Credit: http://www.doi.sc.gov

Frequently Asked Questions Of Is Home Flood Insurance

What Is Home Flood Insurance?

Home flood insurance is a specific type of insurance policy that provides coverage for damages caused by flooding in a residential property. It is designed to protect homeowners from the financial burden of repairing or rebuilding their homes in the event of a flood.

Why Is Home Flood Insurance Important?

Home flood insurance is important because standard homeowners’ insurance policies typically do not cover damages caused by flooding. With the increase in extreme weather events and the risk of floods in many areas, having home flood insurance can provide peace of mind and financial protection for homeowners.

How Does Home Flood Insurance Work?

Home flood insurance works by providing coverage for the structural and personal property damage caused by flooding. It typically covers the repair or replacement costs for items such as flooring, walls, electrical systems, and appliances that are damaged due to flooding.

Who Needs Home Flood Insurance?

Anyone who lives in an area prone to flooding should consider purchasing home flood insurance. This includes homeowners in floodplains, coastal regions, and areas with high rainfall or snowmelt. Even in low or moderate-risk areas, having flood insurance can provide added protection against unexpected flooding events.

Conclusion

It is crucial for homeowners to seriously consider obtaining flood insurance for their homes. With the increasing frequency of extreme weather events and the potential for devastating floods, protecting your investment and ensuring financial stability becomes paramount. By having the right coverage in place, you can have peace of mind knowing that your home is safeguarded against the unpredictable forces of nature.

Don’t wait until it’s too late – take action now and secure the necessary protection for your home.

Leave a comment