Home insurance is essential to protect your property against unforeseen events such as natural disasters or theft. Without home insurance, you may risk losing your most valuable asset and facing financial hardship.

Securing proper coverage ensures peace of mind knowing your home is safeguarded financially in case of unexpected damages. Home insurance provides a safety net that can help cover repair costs or even rebuild your home in the event of a disaster.

It is a crucial investment that offers protection and security for your family and belongings. Don’t underestimate the importance of home insurance in safeguarding your property and assets from potential risks and losses.

What Is Home Insurance?

Home insurance provides financial protection for your home and belongings from unexpected events such as theft or natural disasters. It is essential to safeguard your investment and provide peace of mind in the event of unforeseen circumstances. Protect your home with the right insurance coverage today.

Coverage For Property Damage

Home insurance provides financial protection against damage to your property, such as natural disasters.Liability Protection

This insurance offers coverage if someone is injured on your property or if you damage someone else’s property. What is Home Insurance?Home insurance is an essential financial safety net that protects your home and belongings from unexpected events.

It provides coverage for various risks like property damage and liability protection, giving you peace of mind.

Home insurance ensures you are financially secured in case of unfortunate incidents like fires, theft, or accidents on your property.

Credit: medium.com

Why Is Home Insurance Important?

Why is Home Insurance Important?

Financial Protection

Home insurance provides financial protection against unforeseen events like natural disasters, theft, or property damage.

Peace Of Mind

Having home insurance provides peace of mind knowing that your home and belongings are safeguarded.

Types Of Home Insurance Policies

When it comes to protecting your home and belongings, having the right insurance policy is essential. Home insurance provides financial coverage and peace of mind in case of unexpected events such as fire, theft, or natural disasters. There are several types of home insurance policies available, each offering a different level of protection and coverage. In this article, we will explore the different types of home insurance policies that you can consider for your property.

Ho-1 – Basic Form

The HO-1 policy, also known as the Basic Form, is the most basic and limited form of home insurance. It provides coverage for specific perils such as fire, lightning, smoke damage, vandalism, theft, and some types of weather-related damage. However, it does not cover natural disasters like earthquakes or floods. While this type of policy offers minimal coverage, it can be a suitable choice for homeowners on a tight budget.

Ho-2 – Broad Form

The HO-2 policy, or Broad Form, offers more comprehensive coverage compared to the Basic Form. It includes protection against a wider range of perils, including natural disasters like storms, hail, wind, and even volcanic eruptions. This type of policy also covers additional hazards such as accidental water damage from plumbing issues. If you live in an area prone to natural disasters or are concerned about specific hazards, the HO-2 policy may be a better option for you.

Ho-3 – Special Form

The HO-3 policy, also known as the Special Form, is the most common and popular type of home insurance. It provides coverage for your dwelling and personal belongings against all perils, except for those specifically excluded in the policy. This means that unless a peril is explicitly mentioned as not covered, it is automatically included in the policy. The HO-3 policy offers extensive coverage and is often recommended for homeowners who want comprehensive protection for their property.

Ho-4 – Renter’s Insurance

If you are a renter rather than a homeowner, you can still protect your personal belongings and liability with an HO-4 policy, commonly known as Renter’s Insurance. This type of insurance covers your possessions against perils such as theft, fire, and vandalism. Additionally, it also provides liability coverage in case someone is injured while visiting your rented property. Renter’s insurance is an affordable way to protect your belongings and mitigate potential financial risks.

Ho-6 – Condo Insurance

If you own a condominium, HO-6 insurance is specifically designed for you. Condo insurance provides coverage for your personal property and the interior of your unit. It also covers liability protection if someone gets injured within your unit. The master policy obtained by the condo association usually covers the building’s structure and common areas. Therefore, it is essential to have an HO-6 policy to protect your personal belongings and any improvements you have made to your unit.

Ho-7 – Mobile Home Insurance

For those who live in mobile homes or manufactured homes, HO-7 insurance is the suitable choice. This policy offers coverage for your mobile home from specified perils such as fire, theft, and certain weather-related damage. It also provides protection for your personal belongings and liability coverage. Mobile home insurance is crucial to safeguard your investment and ensure financial security in case of unexpected events.

In conclusion, there are various types of home insurance policies available to suit different property types and individual needs. Understanding the differences and coverage provided by each policy is essential in choosing the right one for protecting your home and belongings.

Factors To Consider When Choosing Home Insurance

When it comes to protecting your home, choosing the right insurance policy is vital. There are several factors to consider when selecting home insurance to ensure that you have adequate coverage. Understanding the different types of coverage options and their importance can help you make an informed decision.

Dwelling Coverage

Dwelling coverage is crucial as it protects your home’s structure and attached components from covered perils, such as fire, wind, and hail. This coverage should be sufficient to rebuild your home in case of a total loss.

Personal Property Coverage

Personal property coverage protects your belongings within your home, including furniture, appliances, and clothing. It’s essential to ensure that you have enough coverage to replace your personal items in the event of a covered loss.

Liability Coverage

Liability coverage protects you from lawsuits if someone is injured on your property. It also provides coverage for property damage you or your family members may cause to others’ property.

Additional Living Expenses

In the event that your home becomes uninhabitable due to a covered loss, additional living expenses coverage can help pay for temporary living expenses, such as hotel bills and meals, while your home is being repaired.

Policy Deductibles

Policy deductibles are the amount you pay out of pocket before your insurance coverage kicks in. It’s crucial to choose a deductible that you can comfortably afford to pay in the event of a claim.

Premium Costs

Premium costs vary depending on the coverage limits and deductibles you choose. It’s important to balance the cost of premiums with the coverage provided to ensure that you have adequate protection without overpaying for unnecessary coverage.

Common Home Insurance Claims

Common home insurance claims can be a major concern for homeowners, which is why having a comprehensive home insurance policy is essential. Understanding the most common home insurance claims can help you ensure that you have the right coverage to protect your home and belongings.

Fire And Smoke Damage

Fire and smoke damage are among the most devastating events that can occur to a home. From structural damage to loss of personal belongings, the aftermath of a fire can be overwhelming. Home insurance can help cover the cost of repairs or rebuilding, as well as replacing damaged or lost items.

Water Damage

Water damage is another common claim for homeowners and can result from various issues such as burst pipes, flooding, or leaks. Home insurance can provide coverage for repairing water-related damages, including structural repairs and replacement of damaged personal property.

Theft And Burglary

Theft and burglary can leave homeowners feeling violated and vulnerable. Home insurance can offer peace of mind by covering the replacement of stolen items and repairing any damage caused by the break-in.

Wind And Hail Damage

Wind and hail damage are common causes of property damage, especially in regions prone to severe weather. Home insurance can help cover the cost of repairing damage to the home’s structure, as well as replacing or repairing damaged exterior features such as roofs and siding.

Personal Liability

Personal liability claims can arise when someone is injured on your property. Home insurance can protect you from potential lawsuits by covering legal fees, medical expenses, and damages if you are found liable for an injury that occurs on your property.

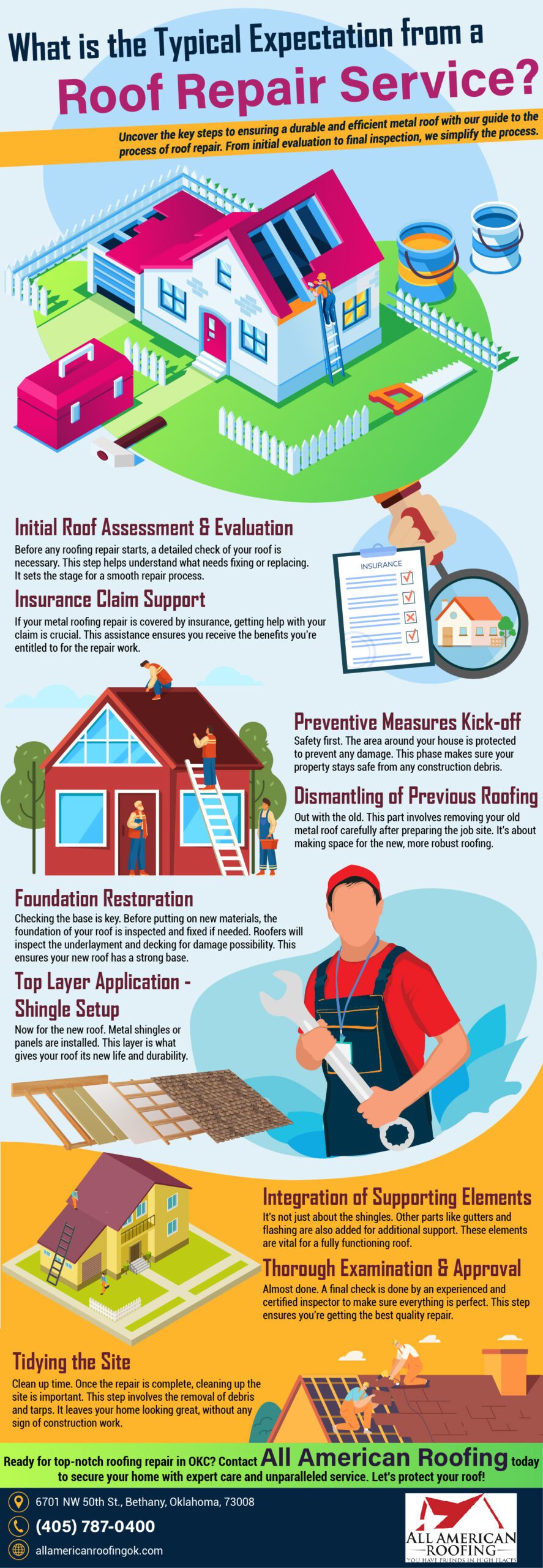

Credit: allamericanroofingok.com

Tips For Lowering Home Insurance Premiums

Lowering your home insurance premiums can help you save money and still protect your home adequately. Here are some tips to consider:

Shop Around For Quotes

Comparing quotes from different insurance providers is one of the easiest ways to save on home insurance. Each insurance company evaluates risks differently, which can result in varying premium rates. By shopping around, you can find the best deal for your specific needs.

Bundle Insurance Policies

Consider bundling your home insurance policy with other insurance policies you may have, such as auto insurance. Many insurance companies offer discounts if you have multiple policies with them. Bundling can help you save money while still enjoying comprehensive coverage.

Increase Your Deductible

Raising your deductible can lower your home insurance premiums. The deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you take on more risk, which insurance companies reward with lower premiums.

Improve Home Security

Enhancing your home security can make your home less risky to insure, resulting in lower insurance premiums. Installing security systems, smoke detectors, and deadbolts can improve the safety of your home and give you peace of mind. Some insurance companies even offer discounts for having these security features in place.

Maintain Good Credit

Believe it or not, your credit score can affect your home insurance premiums. Insurance providers often consider your credit history when determining your premium rates. Maintaining a good credit score can help you secure lower premiums. Paying bills on time, keeping credit card balances low, and not opening unnecessary credit accounts can all contribute to maintaining good credit.

Credit: http://www.facebook.com

Frequently Asked Questions On Is Home Insurance Essential

Is Home Insurance A Legal Requirement?

Home insurance is not a legal requirement, but it’s highly recommended to protect your home and belongings in case of unexpected events like theft, fire, or natural disasters. It offers peace of mind and financial security against potential risks.

What Does Home Insurance Cover?

Home insurance typically covers the structure of your home, personal belongings, liability protection, and additional living expenses if you need to temporarily move out due to a covered event. It provides financial protection against losses or damages caused by various perils.

How Much Home Insurance Coverage Do I Need?

The amount of coverage needed varies based on the value of your home and belongings. Generally, it’s recommended to have enough coverage to rebuild your home and replace your belongings in the event of a total loss. An insurance agent can help determine the appropriate coverage amount.

Conclusion

To sum it up, home insurance is an absolute necessity in safeguarding our most valuable asset. From unforeseen accidents to natural disasters, it provides financial protection and peace of mind. Protecting our homes is not just a wise decision but a responsible one.

So, don’t wait for the worst to happen; get home insurance today and ensure the security of your precious shelter.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Is home insurance a legal requirement?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Home insurance is not a legal requirement, but it’s highly recommended to protect your home and belongings in case of unexpected events like theft, fire, or natural disasters. It offers peace of mind and financial security against potential risks.” } } , { “@type”: “Question”, “name”: “What does home insurance cover?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Home insurance typically covers the structure of your home, personal belongings, liability protection, and additional living expenses if you need to temporarily move out due to a covered event. It provides financial protection against losses or damages caused by various perils.” } } , { “@type”: “Question”, “name”: “How much home insurance coverage do I need?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The amount of coverage needed varies based on the value of your home and belongings. Generally, it’s recommended to have enough coverage to rebuild your home and replace your belongings in the event of a total loss. An insurance agent can help determine the appropriate coverage amount.” } } ] }

Leave a comment