Yes, private flood insurance is a legitimate option for individuals seeking additional coverage beyond what is provided by the National Flood Insurance Program (NFIP). Private policies are offered by insurance companies and provide customizable options for policyholders.

Private flood insurance has become a viable alternative for homeowners looking for additional protection against flood damage. While the National Flood Insurance Program (NFIP) remains the primary source of flood coverage, private insurance policies offer unique advantages and customizable options.

With the increase in flood-related incidents and the limitations of NFIP coverage, it becomes crucial to explore the legitimacy of private flood insurance. We will delve into the legitimacy of private flood insurance, its benefits, and considerations for homeowners seeking comprehensive coverage. With private insurance industry participants flooding the marketplace, evaluating the legitimacy of private flood insurance can help homeowners make informed decisions about protecting their properties. Explore whether private flood insurance is a legitimate option in the following sections.

The Basics Of Private Flood Insurance

Private flood insurance offers an alternative to federal programs. While it may seem unfamiliar to some, private flood insurance is a legitimate option to protect properties.

What Is Private Flood Insurance?

Private flood insurance is coverage provided by private insurers rather than the government. It offers similar protection as federal flood insurance but with some key differences.

How Does It Differ From Federal Flood Insurance?

- Customized Policies: Private insurers can tailor coverage options to fit individual needs.

- Potentially Lower Costs: Private policies may offer competitive rates compared to federal programs.

In conclusion, private flood insurance is a legitimate and valuable option to consider for protecting your property from flood risks.

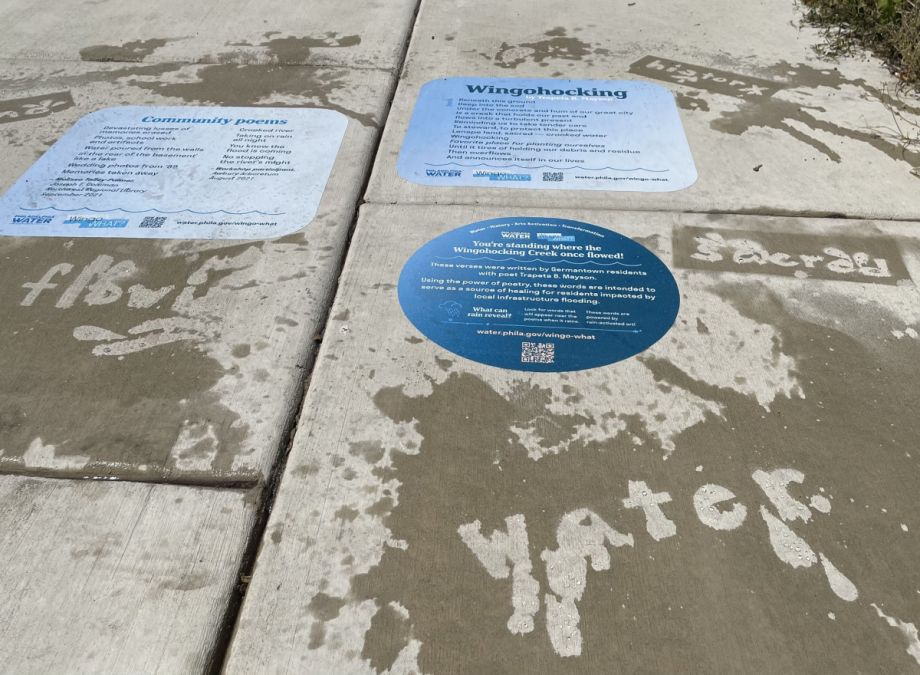

Credit: nextcity.org

Pros And Cons Of Private Flood Insurance

Private flood insurance is gaining popularity as a viable alternative to the National Flood Insurance Program (NFIP). It offers several advantages and disadvantages that homeowners should consider before making a decision. Let’s explore the pros and cons of private flood insurance to help you make an informed choice.

Advantages Of Opting For Private Flood Insurance

Private flood insurance provides numerous benefits that make it a legitimate option for homeowners. Here are some advantages to consider:

- Enhanced Coverage: Private flood insurance often offers more comprehensive coverage compared to the standard policies provided by the NFIP. This means you have better protection for your property and belongings in the event of a flood.

- Faster Claim Processing: Unlike the NFIP, which is often overwhelmed during disaster situations, private insurance companies typically have quicker and more efficient claims processing. This means you can expect a faster resolution and reimbursement for any flood damages you may experience.

- Flexible Coverage Options: Private flood insurance allows you to customize your coverage to meet your specific needs. You have the flexibility to choose the amount of coverage and add additional protection for items that may not be covered by the NFIP.

Disadvantages To Consider Before Choosing Private Flood Insurance

While private flood insurance offers compelling advantages, it’s essential to evaluate the potential drawbacks. Here are some key disadvantages to consider:

- Higher Premiums: Compared to the NFIP, private flood insurance policies can sometimes come with higher premiums. However, it’s important to weigh this against the advantages and the enhanced coverage private insurance offers.

- Varied Policy Options: With private flood insurance, policy options can vary significantly between different insurance providers. It is crucial to research and compare multiple quotes to find the policy that best suits your needs.

- Limited Availability: Private flood insurance may not be available in all areas, particularly in high-risk flood zones. Before considering private insurance, ensure that providers offer coverage in your location.

Considering the advantages and disadvantages of private flood insurance is crucial when determining the right insurance coverage for your home. Assess your individual needs and weigh the potential benefits against any drawbacks to make an informed decision.

Legitimacy Of Private Flood Insurance

Private flood insurance is a legitimate and viable alternative to the federal flood insurance program, offering reliable coverage and a smooth claims process. Let’s delve into the factors that attest to the legitimacy of private flood insurance.

Regulation And Oversight Of Private Flood Insurance Companies

Private flood insurance companies are subject to thorough regulation and oversight to ensure the legitimacy and solvency of their operations. State insurance regulators monitor these companies to protect policyholders and ensure compliance with stringent financial standards. They are required to meet strict requirements for capital reserves and claims paying ability.

Comparison Of Claim Processes Between Private And Federal Flood Insurance

When it comes to the claim process, private flood insurance often provides more efficient and streamlined services compared to the federal flood insurance program. Private insurers typically feature rapid claims processing, direct communication, and personalized support, whereas federal flood insurance might entail longer waiting periods and limited scope for individual attention to policyholders.

Credit: variety.com

Factors Influencing Choice

Cost Considerations

When looking at private flood insurance, cost is a primary factor that influences decision-making. Unlike federal flood insurance, private options may come with variable pricing structures based on the specific coverage, property location, and risk evaluation. Policyholders should carefully compare quotes from different providers to ensure they are getting competitive rates without sacrificing essential coverage.

Policy Customization Options

One of the advantages of private flood insurance is the ability to customize policies to suit individual needs. This typically includes the provision of additional coverage options, such as loss of use or property replacement cost, which are not always available through government-backed programs. The flexibility to tailor the policy according to the property’s specific flood risk profile can be a decisive factor for many property owners considering private insurance.

Consumer Experiences And Feedback

Private flood insurance offers legitimate coverage for consumers seeking protection from flood damage. Positive feedback from policyholders highlights the efficiency and reliability of this insurance option, ensuring peace of mind when it comes to safeguarding personal property from unforeseen natural disasters.

Case Studies On Private Flood Insurance Claims

Private flood insurance has gained popularity in recent years as an alternative to the National Flood Insurance Program (NFIP). Consumers have been eager to explore the options and benefits of this private coverage. To gauge the reliability and legitimacy of private flood insurance, looking at real-life case studies of claims can provide valuable insights.Customer Satisfaction Ratings

One way to gauge the legitimacy of private flood insurance is by looking at customer satisfaction ratings. These ratings serve as a testament to the quality of service, claims handling, and overall customer experience. By examining the feedback from policyholders, you can gain a better understanding of how private flood insurance companies perform when it matters most – during a claim. In recent surveys, policyholders who made claims on private flood insurance policies reported high levels of satisfaction. Not only did they feel their claims were handled efficiently and professionally, but many also expressed gratitude for the personalized support they received throughout the process. This positive feedback speaks volumes about the legitimacy and reliability of private flood insurance. When comparing private flood insurance with the traditional NFIP, it is evident that customer satisfaction rates tend to be higher for private policies due to their tailored approach and focus on individual needs. Furthermore, private insurers often offer additional benefits and features that provide enhanced protection and peace of mind for policyholders.Case Study Example:

To illustrate the efficacy of private flood insurance, let’s consider the case of Mr. Johnson, a homeowner in a flood-prone area. When his basement was severely damaged by a flood, Mr. Johnson filed a claim with his private flood insurance provider. The insurance company acted promptly, dispatching a claims adjuster to assess the damage within 24 hours. Upon confirming the legitimacy of the claim, the private insurer swiftly provided Mr. Johnson with financial support to cover the costs of repairs and restoration. The insurance company also offered guidance and assistance throughout the rebuilding process, ensuring Mr. Johnson’s complete satisfaction. His positive experience with the private flood insurance provider highlights the legitimacy of these policies and their ability to deliver on their promises to policyholders. In conclusion, consumer experiences and feedback play a crucial role in determining the legitimacy and reliability of private flood insurance. Through case studies and customer satisfaction ratings, potential policyholders can make informed decisions about their flood insurance coverage, recognizing the advantages of private alternatives over the traditional NFIP. By prioritizing individual needs and offering exceptional service, private insurers have proven themselves to be legitimate providers of flood insurance.

Credit: http://www.amazon.com

Risk Assessment And Management

Private flood insurance is a legitimate option for risk assessment and management. It provides individuals with an alternative to government-backed coverage, offering tailored protection against flood-related losses. With private insurance, individuals can ensure their assets are safeguarded in the event of a flood.

Risk Assessment and Management Flood risk assessment is crucial for private insurers to provide legitimate flood insurance policies.How Do Private Insurers Assess Flood Risks?

Strategies For Managing Flood Risk With Private Insurance

– Implement flood-resistant construction techniques – Conduct regular property inspections for potential vulnerabilities – Invest in early warning systems for immediate action – Education on evacuation procedures for clients Overall, strategies of risk management mitigate flood impacts effectively.Future Trends In Flood Insurance

Future Trends in Flood InsuranceFlood insurance is vital in safeguarding properties from devastating flood damage. Stay informed about the upcoming technological advancements and potential shifts in the flood insurance market.

Technological Advancements In Assessing Flood Risk

New technologies are revolutionizing how flood risk is evaluated, enhancing precision and reliability.

- Emerging remote sensing technologies

- Advanced modeling techniques

- Real-time monitoring systems

Potential Shifts In The Flood Insurance Market

| Shifts | Impact |

|---|---|

| Digitalization of insurance processes | Streamlined claims processing |

| Usage-based pricing models | Personalized premium rates |

| Increased focus on resilience measures | Encouraging preventive actions |

Frequently Asked Questions On Is Private Flood Insurance Legitimate

What Is Private Flood Insurance?

Private flood insurance is a legitimate alternative to the National Flood Insurance Program (NFIP). It is provided by private insurers and offers similar coverage to NFIP policies. However, private flood insurance may provide additional benefits and can be more cost-effective for certain properties.

How Does Private Flood Insurance Work?

Private flood insurance works by providing coverage for properties at risk of flooding. Policyholders pay premiums to the private insurer, which then pays out claims for flood damage. These policies may offer more flexibility in coverage options and pricing compared to the NFIP, and they can be a viable option for property owners.

What Are The Benefits Of Private Flood Insurance?

Private flood insurance offers various benefits, such as customizable coverage options, potentially lower premiums, and faster claims processing. Additionally, some policies may offer coverage for properties that are not eligible for NFIP coverage. It’s vital to assess the specific benefits offered by different private insurers.

How Can I Determine If Private Flood Insurance Is Legitimate?

To ensure the legitimacy of private flood insurance, it’s essential to research and verify the insurer’s credentials and financial stability. Look for reputable insurance companies with a history of providing reliable coverage. Consider consulting with a trusted insurance agent to discuss the legitimacy of private flood insurance options.

Conclusion

Private flood insurance is a legitimate option to consider when protecting your property against potential damages caused by floods. With its flexibility, competitive pricing, and potential for tailored coverage, private insurers offer an alternative to the National Flood Insurance Program.

Conducting thorough research and consulting with an insurance professional will help determine the best insurance solution for your specific needs. Stay informed, make an informed decision, and safeguard your property against flooding risks.

Leave a comment