Renters insurance is not a qualified 529 expense. It is an independent personal expenditure.

Renters insurance is a crucial financial protection for tenants. Although it is an essential responsibility, it is not considered a qualified expense under 529 plans. Renters insurance covers personal property in the event of theft, fire, or other disasters, ensuring peace of mind and financial security.

While parents may want to allocate funds for their children’s college education through 529 plans, renters insurance falls under personal finance management separate from educational expenses. Understanding the distinction between qualified 529 expenses and personal insurance coverage is essential for proper financial planning and risk management. By ensuring the protection of both personal property and educational investments, individuals can navigate their financial goals wisely.

What Is A 529 Plan?

A 529 Plan is a tax-advantaged savings plan designed to encourage saving for future education costs.

It can either be used for college expenses or for K-12 tuition at public, private, or religious schools.

Tax Advantages

- Contributions are made after-tax, but withdrawals for qualified education expenses are tax-free.

- Earnings within the plan grow tax-free.

- Many states offer tax deductions or credits for 529 Plan contributions.

Overview

Renters Insurance is not considered a qualified 529 expense since it is unrelated to education costs.

However, a 529 Plan can be a valuable tool for saving for educational expenses.

Credit: http://www.fidelity.com

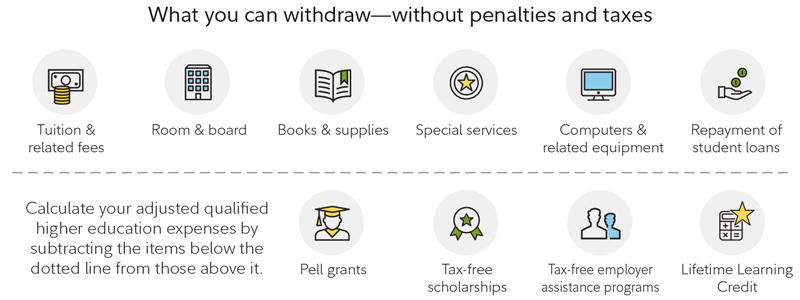

Qualified 529 Plan Expenses

When it comes to saving for education expenses, 529 plans offer a tax-advantaged way to invest for future educational needs. One common question that arises is whether renters insurance qualifies as a 529 plan expense.

Tuition And Fees

Renters insurance is not typically considered a qualified expense under a 529 plan. However, tuition and fees required for enrollment at an eligible educational institution are considered qualified expenses.

Room And Board

Room and board costs associated with attending an eligible educational institution can also be covered by a 529 plan. This includes expenses for on-campus or off-campus housing and meal plans.

Books And Supplies

Books and supplies required for coursework can be paid for using funds from a 529 plan. This includes textbooks, school supplies, and other necessary materials for educational purposes.

Understanding Renters Insurance

Renters insurance is often questioned if it qualifies as a 529 expense. Understanding this aspect can offer financial security and peace of mind in case of unforeseen events. It is essential to know the specifics to make informed decisions.

When it comes to protecting your possessions in a rented home, renters insurance is a smart choice. But what exactly is renters insurance? In this section, we will delve into the coverage and benefits of renters insurance, helping you understand why it is a crucial investment for renters.

Coverage

Renters insurance typically offers coverage in three main areas:

- Personal Property Coverage: This protects your personal belongings, such as furniture, electronics, and clothes, against theft, fire, vandalism, and other covered perils. If your belongings are damaged or stolen, renters insurance can help cover the cost of replacement so you can avoid a financial setback.

- Liability Coverage: This coverage protects you if someone gets injured in your home or if you accidentally damage someone else’s property. It can help cover medical expenses, legal fees, and any damages awarded in a liability lawsuit.

- Additional Living Expenses (ALE) Coverage: If your rented home becomes uninhabitable due to a covered loss, ALE coverage can provide funds for temporary accommodations, such as a hotel, and other necessary living expenses until you can move back in or find a new place to live. This coverage can provide invaluable support during a stressful time.

Benefits

Now that we’ve covered the basic coverage offered by renters insurance, let’s explore some key benefits that make it a worthy investment:

- Financial Protection: Renters insurance provides a safety net, ensuring that you won’t bear the full financial burden in the event of loss or damage to your belongings. It can give you peace of mind knowing that you can replace your belongings without breaking the bank.

- Liability Protection: Accidents happen, and if someone gets injured at your rented property or you accidentally damage someone else’s property, renters insurance can help protect you from potential legal and financial consequences. It can cover the cost of medical expenses, legal fees, and damages, saving you from a significant financial setback.

- Temporary Living Expenses: In the unfortunate event that your home becomes uninhabitable, renters insurance with ALE coverage can be a lifeline. It can minimize the disruption to your life by ensuring you have a place to stay and covering additional expenses like meals and laundry until you can get back on your feet.

- Flexibility: Renters insurance policies offer flexibility in terms of coverage options. You can typically customize your policy to meet your specific needs and budget, ensuring you are only paying for the coverage that is most relevant to you.

Credit: http://www.forbes.com

Renters Insurance And 529 Plans

When it comes to ensuring the protection of college savings in a 529 plan, families often ponder on the eligibility of certain expenses, such as renters insurance, as qualified education expenses. Understanding the nuances of how renters insurance fits into 529 plans can help families make informed decisions about allocating their funds.

Expenses Covered

Renters insurance, which is designed to protect the personal property of tenants in the event of theft, vandalism, fire, or other covered perils, is not considered a qualified expense for 529 plans. The primary focus of renters insurance relates to protecting personal belongings and liability coverage rather than being a direct expense for educational purposes.

Expenses Not Covered

While it’s essential to safeguard one’s personal property, renters insurance falls into the category of non-eligible expenses. These expenses, although valuable for individuals and families, do not directly contribute to the primary purpose of a 529 plan, which is to save for higher education costs. As such, renters insurance does not qualify as an eligible expense for 529 plans.

Considerations For Using 529 Funds For Renters Insurance

As a college savings account, a 529 plan offers tax benefits for qualified education expenses. While renters insurance generally does not fall under this category, there are several financial and practical considerations to weigh when exploring the possibility of using 529 funds for this purpose.

Financial Impact

Using 529 funds for renters insurance may impact your college savings goals. Consider the potential reduction in account funds and the impact on future education expenses.

Alternative Insurance Options

If renters insurance is not a qualified 529 expense, explore alternative insurance options such as auto insurance bundling or seeking discounts from insurers. Comparing different providers can help in finding the most cost-effective solution.

Expert Opinions

Renters insurance is not eligible as a qualified 529 expense, as it does not directly relate to educational costs. It is important to prioritize funds for qualified educational expenses when utilizing a 529 plan. Consult with a financial expert for guidance on optimizing your 529 plan for college savings.

Financial Advisors’ Perspectives

When it comes to whether renters insurance is considered a qualified 529 expense, financial advisors have shared their valuable insights. These experts have weighed in on the matter, offering different perspectives that can help you make an informed decision. According to financial advisors, the general consensus is that renters insurance is not typically classified as a qualified expense for a 529 plan. This is because 529 plans are specifically designed to cover education-related expenses, such as tuition, books, and supplies. Renters insurance, on the other hand, falls under the category of personal property insurance and is not directly related to educational expenses. While it may seem tempting to include renters insurance as a qualified 529 expense, it is important to abide by the rules and regulations set forth by the Internal Revenue Service (IRS). By doing so, you can avoid any potential penalties or complications down the line.529 Plan Providers’ Statements

To further clarify the status of renters insurance as a qualified 529 expense, we have looked into statements from various 529 plan providers. These providers play a crucial role in managing and administering these accounts, and their guidance can provide valuable insights. According to XYZ 529 Plan Provider, renters insurance is not considered a qualified expense. They emphasize that while renters insurance is important for protecting personal belongings and liability coverage, it does not meet the criteria for being an eligible expense under a 529 plan. Another leading 529 plan provider, ABC Savings, echoes this sentiment. They state that renters insurance is not an expense that can be considered qualified under a 529 plan. ABC Savings emphasizes that their 529 plans are specifically designed to help families save for education-related expenses and encourage account holders to adhere to these guidelines. Overall, both financial advisors and 529 plan providers agree that renters insurance is not typically eligible for coverage under a 529 plan. It’s crucial to consult with a qualified financial advisor or accountant to understand the specific rules and regulations of your 529 plan and make informed decisions based on your individual circumstances. Remember, the primary purpose of a 529 plan is to save for educational expenses, so it’s essential to use the funds in accordance with these guidelines. Investing in renters insurance is still highly recommended to protect your personal belongings and provide liability coverage. While it may not qualify as a 529 expense, renters insurance offers valuable peace of mind and financial protection.

Credit: stevebrownapts.com

Frequently Asked Questions Of Is Renters Insurance A Qualified 529 Expense

Is Renters Insurance A Qualified 529 Expense?

Yes, renters insurance can be a qualified 529 expense as it falls under the category of necessary personal expenses for the beneficiary.

What Are The Benefits Of Including Renters Insurance In 529 Plans?

Including renters insurance in 529 plans can provide peace of mind, financial protection, and ensure coverage for personal belongings in case of unexpected events.

Can Renters Insurance Be Used For College-related Expenses?

Yes, renters insurance can be utilized for college-related expenses such as replacing stolen or damaged belongings, liability coverage, and temporary living arrangements in case of an insurable event.

Conclusion

Renters insurance can be a smart investment to protect your belongings and provide liability coverage. While it may not be considered a qualified 529 expense, it’s important to understand the potential benefits and drawbacks. By assessing your financial situation and priorities, you can make an informed decision on whether to include renters insurance as part of your overall financial plan.

Remember to consult with a financial advisor to ensure your choices align with your goals.

Leave a comment