Term insurance purchased in India is typically valid only within the country’s borders and does not cover policyholders outside of India. However, there are some insurance providers that offer term insurance plans specifically designed for individuals who live or travel abroad.

These plans usually come with certain conditions and restrictions, so it is essential to carefully review the terms and conditions of the policy to determine its validity outside India. It is advisable to consult with an insurance advisor or the insurance provider directly to obtain accurate information about the coverage and validity of term insurance outside of India.

Legality Of Term Insurance Abroad

When considering term insurance outside India, understanding the regulations and compliance is crucial, along with the concept of cross-border insurance.

Regulations And Compliance

In various countries, regulations govern the validity and operation of term insurance policies. Compliance with these rules ensures the legitimacy of insurance coverage purchased abroad.

Cross-border Insurance

Cross-border insurance pertains to the applicability of an insurance policy in a different country than where it was purchased. Understanding the terms and conditions of such coverage is essential for policyholders.

Credit: phrase.com

Coverage Considerations

When considering coverage options, it’s important to understand if term insurance remains valid internationally for individuals residing outside India. Confirming the policy’s coverage abroad is essential to ensure financial protection regardless of location. Proper research and clarification with the insurance provider can shed light on the policy’s global validity.

Policy Specifics

When it comes to term insurance policies, it’s essential to understand the specific terms and conditions that apply to coverage outside of India. Policy specifics can vary among insurance providers, so it’s crucial to read the fine print and clarify any uncertainties before purchasing a policy.

Here are some key policy specifics to consider:

- Geographical Coverage: Check if your term insurance policy offers coverage outside India. Some policies may limit coverage to within the country. Ensure that the policy you choose includes protection for your loved ones, even when they are abroad.

- Policy Tenure: Verify whether the policy’s duration remains unchanged if you or your loved ones temporarily reside outside of India. Some insurers may require policyholders to notify them or provide additional documentation when residing abroad for an extended period.

- Premium Payments: Confirm if your insurance provider allows premium payments from abroad. It’s essential to ensure that paying premiums from overseas won’t affect your policy’s validity or claim settlement process. Understanding the payment process can prevent any unwanted surprises later on.

Claim Settlement Abroad

Claim settlements are one of the most crucial aspects of any insurance policy, and this holds true for term insurance policies as well. Before purchasing a term insurance policy, especially if you or your loved ones frequently travel or reside outside India, it’s essential to understand the claim settlement process when abroad.

Here are some key considerations for claim settlement abroad:

- Emergency Contact: Ensure that your insurance provider has a designated point of contact for emergencies occurring abroad. This contact should be easily reachable, providing you and your loved ones with the necessary assistance during unexpected situations.

- Documentation Requirements: Familiarize yourself and your loved ones with the necessary documentation required for claim settlement abroad. This includes understanding the process for submitting claims, providing relevant proof, and any additional requirements specific to the country where the incident occurred.

- Foreign Currency Settlement: Consider whether your insurance provider offers claim settlement in foreign currency if the incident occurs abroad. Being financially prepared in case of an emergency can alleviate stress and ensure that your loved ones’ financial needs are adequately taken care of.

Overall, understanding the policy specifics and claim settlement procedures when residing or traveling outside India is crucial for term insurance coverage abroad. By considering the factors mentioned above, you can make an informed decision and choose a policy that protects your loved ones, regardless of their location.

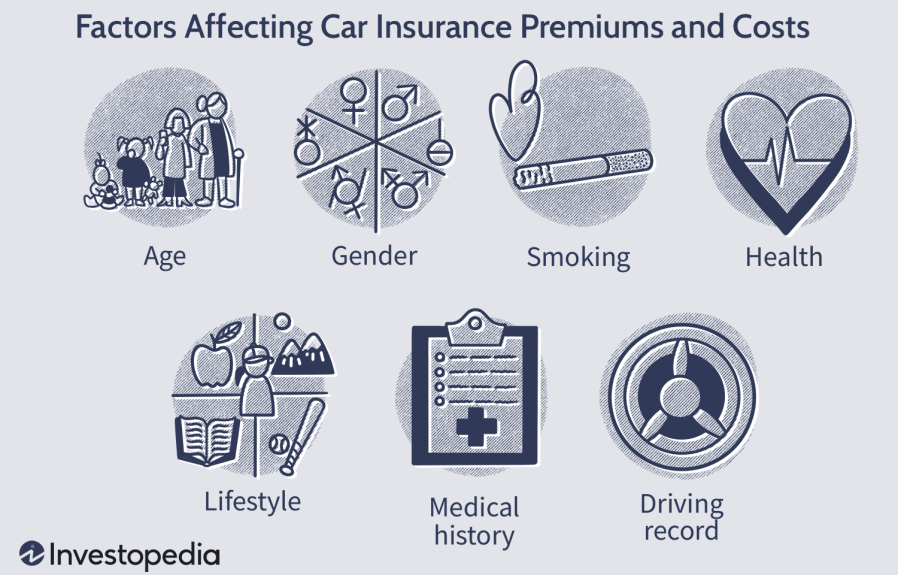

Premiums And Costs

When it comes to term insurance valid outside India, understanding the premiums and costs is crucial for making an informed decision. Several factors, such as currency exchange rates impact and comparative pricing, play a significant role in determining the financial aspect of term insurance outside India.

Currency Exchange Rates Impact

It’s important to consider the impact of currency exchange rates when purchasing term insurance outside India. Fluctuations in exchange rates can directly affect the amount of premiums to be paid. For instance, if the policy is denominated in a currency that is stronger than the Indian rupee, the premiums may be comparatively higher when converted into rupees. Assessing the exchange rate trends and opting for a stable currency can help mitigate the impact of fluctuations on the overall cost of the policy.

Comparative Pricing

Comparative pricing analysis is essential when exploring term insurance options outside India. Different insurance providers offer varying premiums and coverage levels. Comparing pricing from multiple providers allows individuals to identify cost-effective options without compromising on the coverage benefits. Additionally, it’s advisable to consider the tax implications and any additional fees associated with the policy to make an accurate cost assessment.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

Credit: http://www.investopedia.com

Beneficiary Designation

When it comes to term insurance, the designation of beneficiaries is a crucial aspect. It ensures that the policyholder’s loved ones receive the benefits in the event of the policyholder’s demise. The beneficiary designation determines who will receive the policy’s proceeds, and it is essential to make this designation with careful consideration.

International Beneficiaries

Term insurance is valid outside India, and individuals can designate international beneficiaries to receive the policy benefits. When naming international beneficiaries, it is important to provide specific details, including their complete name, address, and contact information. It is also advisable to confirm with the insurance provider regarding any specific requirements for naming international beneficiaries to ensure a smooth claims process. Moreover, consulting a legal professional familiar with international laws can provide additional assurance that the designation is legally valid and enforceable across borders.

Legal Implications

Designating international beneficiaries may present legal implications that need to be carefully considered. It is recommended to seek legal counsel to ensure that the beneficiary designation complies with the laws of both the home country and the international beneficiary’s country of residence. Additionally, understanding the taxation and inheritance laws of the international beneficiary’s location is crucial to avoid potential complications during the claims process. Being aware of any treaty agreements between India and the beneficiary’s country can also impact the distribution of benefits.

Tax Implications

Term insurance is a popular choice for individuals looking to protect their loved ones financially in case of an untimely demise. But what happens to the tax implications of term insurance when you are outside India? In this article, we will discuss the tax treatment of term insurance in different countries and the tax benefits associated with it.

Tax Treatment In Different Countries

Each country has its own tax laws and regulations when it comes to term insurance. It is important to understand the tax treatment of term insurance in the country you are residing in to ensure compliance with local tax authorities. Here is an overview of the tax treatment in different countries:

| Country | Tax Treatment |

|---|---|

| United States | In the United States, the death benefit paid out to the beneficiary is generally tax-free. However, if the policyholder has assigned the policy to a third party for value, a portion of the death benefit may be subject to tax. |

| United Kingdom | In the United Kingdom, the proceeds from a term insurance policy are generally exempt from income tax and inheritance tax. However, it is important to note that any interest or investment growth accumulated within the policy may be subject to tax. |

| Australia | In Australia, the premiums paid for term insurance are not tax-deductible. However, the death benefit received by the beneficiary is generally tax-free. |

Tax Benefits

Term insurance offers several tax benefits in addition to the tax treatment in different countries. Let’s explore some of these tax benefits:

- Income Tax Deductions: In many countries, the premiums paid for term insurance are eligible for income tax deductions. This allows policyholders to reduce their taxable income and save on taxes.

- Exemption from Wealth Tax: In some countries, the death benefit received from a term insurance policy is exempt from wealth tax. This means that the amount received by the beneficiary is not included in their taxable assets.

- Tax-Free Wealth Creation: Term insurance policies that offer investment components provide an opportunity for tax-free wealth creation. The growth of the investment portion of the policy is not subject to taxation, allowing policyholders to accumulate wealth over the long term.

It is essential to consult with a tax advisor or financial expert to understand the specific tax implications and benefits associated with term insurance in your country of residence. Understanding the tax treatment will help you make informed decisions while planning for your financial future.

Health And Medical Requirements

Ensuring your health and meeting medical requirements is crucial when applying for term insurance outside India. Understanding the Health and Medical Requirements can help you navigate the process smoothly.

Medical Examinations Abroad

Medical examinations are often required when applying for term insurance outside India. Seek local healthcare providers for Medical Examinations Abroad to meet the insurer’s requirements.

Pre-existing Conditions

Disclose all Pre-existing Conditions to the insurance provider before purchasing a policy. Failure to do so may lead to claim denials in the future.

“` This HTML snippet provides an engaging section of a blog post focusing on the subheading “Health and Medical Requirements” with specific details under the H3 headings “Medical Examinations Abroad” and “Pre-existing Conditions.” The content is SEO-friendly, concise, and structured for easy understanding.

Credit: http://www.toptal.com

Frequently Asked Questions For Is Term Insurance Valid Outside India

Can I Purchase Term Insurance If I Live Outside India?

Yes, you can purchase term insurance while living outside India. Many insurance providers offer term insurance plans that are valid for non-residents, subject to certain conditions and documentation.

What Documents Do I Need For Term Insurance Outside India?

To purchase term insurance when you live outside India, you typically need to provide documents such as proof of identity, address, income, and nationality. Additionally, you may be required to submit a medical examination report.

Are There Any Limitations On Coverage For Non-resident Policyholders?

Non-resident policyholders may have certain limitations on coverage, such as specific exclusions related to certain countries or high-risk activities. It’s essential to carefully review the policy terms and conditions to understand any limitations that may apply.

Conclusion

Term insurance is a valid option for individuals residing outside India. With advancements in technology and the availability of online applications and services, it has become easier for non-residents to avail term insurance policies. Despite residing abroad, individuals can ensure financial security for their loved ones in India through term insurance plans.

The flexibility and convenience of term insurance make it a suitable choice for NRIs and PIOs looking for comprehensive protection. So, explore your options and make an informed decision to safeguard your family’s future.

Leave a comment