Yes, umbrella insurance is necessary for added financial protection against unforeseen events or liability claims. It provides broader coverage beyond the limits of your existing policies, safeguarding your assets and future earnings.

Umbrella insurance offers an extra layer of protection that goes beyond the coverage limits of your primary policies. It is designed to shield you from potential financial losses resulting from unexpected incidents or liability claims. While your existing insurance policies might offer a certain level of coverage, they often have limitations.

If a lawsuit, accident, or other unforeseen events exceed the coverage provided by your auto, home, or other policies, umbrella insurance steps in to bridge the gap. In this world of uncertainty, having umbrella insurance can provide peace of mind and protect your assets and future earnings from potential financial ruin.

Understanding Umbrella Insurance

What Is Umbrella Insurance?

Umbrella insurance is extra liability insurance that goes beyond the limits of your standard policies.

How Does Umbrella Insurance Work?

Umbrella insurance kicks in when your other insurance policy limits are exhausted.

Credit: http://www.noyeshallallen.com

Benefits Of Umbrella Insurance

Umbrella insurance offers additional liability coverage that can protect your assets and future income. It’s crucial for safeguarding against unforeseen lawsuits and major financial losses. With its affordable premiums, umbrella insurance is a valuable investment for anyone wanting extra peace of mind.

Benefits of Umbrella InsuranceUmbrella insurance provides essential coverage that can protect you from potential financial disaster. By offering additional liability coverage on top of your existing insurance policies, umbrella insurance ensures that you are adequately protected in the event of unforeseen accidents or lawsuits. Let’s explore some of the key benefits of having umbrella insurance:

Personal Liability CoverageUmbrella insurance offers invaluable personal liability coverage, extending beyond the limits of your primary insurance policies. In today’s litigious society, lawsuits arising from accidents or injuries can quickly exceed the limits of traditional coverage, leaving you vulnerable to significant financial losses. With umbrella insurance, you gain an extra layer of protection that shields your assets and provides peace of mind.

Coverage for Legal ExpensesLegal expenses can quickly pile up during a lawsuit, regardless of whether you are found liable or not. Umbrella insurance not only provides coverage for potential damages awarded to the injured party but also covers your legal defense costs. From attorney fees to court expenses, umbrella insurance ensures that you are protected financially, allowing you to focus on navigating the legal process without the added stress of financial burden.

Additionally, umbrella insurance can cover certain expenses that are not typically included in standard insurance policies. This includes liability claims such as slander, libel, or invasion of privacy. By having umbrella insurance in place, you safeguard yourself against unexpected situations that could have a significant impact on your personal finances.

Consider the following scenario: you accidentally cause a car accident that results in severe injuries to the other party. Your auto insurance policy may cover a portion of the damages, but it might not be enough to fully compensate the injured party for medical bills, lost wages, and pain and suffering. Without umbrella insurance, you could be held personally responsible for the remaining costs, which could potentially lead to bankruptcy.

With umbrella insurance, you can rest assured that your assets are protected and your exposure to financial risk is minimized.

Ultimately, umbrella insurance serves as an essential safeguard against unforeseen accidents or lawsuits that can leave you financially devastated. Invest in umbrella insurance today to enjoy the peace of mind and security it provides.

Determining Your Umbrella Insurance Needs

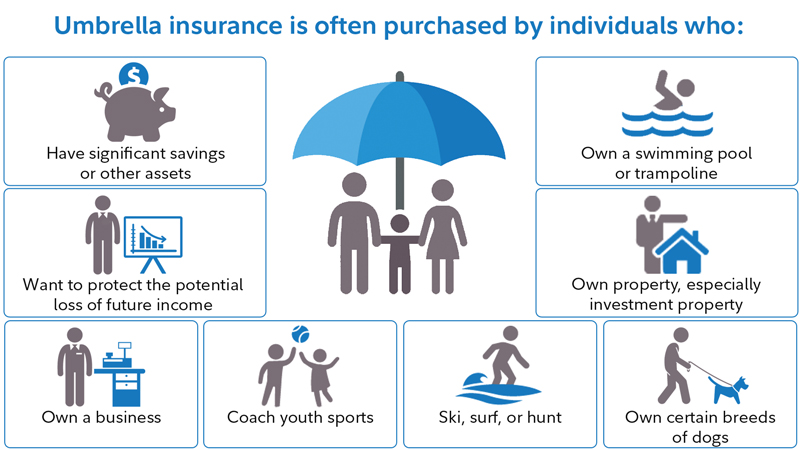

When it comes to determining your umbrella insurance needs, it’s essential to assess your assets and evaluate your risks. Umbrella insurance provides an extra layer of liability coverage beyond the limits of your existing policies, offering protection in case of costly lawsuits or claims against you. Determining the right amount of coverage can be based on your assets and potential risks, helping you secure the financial protection you need.

Assessing Your Assets

Begin by taking stock of your assets, including your home, vehicles, investments, and savings. These assets could be at risk in the event of a lawsuit or major claim, making it crucial to consider the value and potential exposure of each asset. Assessing your assets will give you a clear picture of the level of coverage needed to protect them effectively.

Evaluating Your Risks

Next, evaluate the potential risks you may face based on your lifestyle, profession, and activities. Factors such as owning a swimming pool, hosting social gatherings, or engaging in high-liability activities can contribute to increased risk. Evaluating these risks will help you understand the likelihood of facing significant claims and the extent of coverage required.

Common Misconceptions About Umbrella Insurance

When it comes to understanding umbrella insurance, there are some common misconceptions that often lead people to overlook its importance. Let’s debunk some of these myths and shed light on the true value of umbrella insurance.

Only For The Wealthy

Contrary to popular belief, umbrella insurance is not exclusively for the wealthy. In fact, it provides additional liability coverage that can benefit individuals from all income brackets. Whether you’re a homeowner, renter, or vehicle owner, an umbrella policy can offer crucial financial protection in the face of unforeseen accidents or lawsuits. It’s an affordable way to secure peace of mind for you and your loved ones.

Redundant With Other Policies

Some may assume that umbrella insurance is redundant if they already have other insurance policies in place, such as auto or homeowners insurance. However, this is a common misconception. Umbrella insurance goes beyond the coverage provided by these policies, offering an extra layer of protection that may prove invaluable in the event of a major liability claim. It complements your existing policies and fills in the gaps, providing broader coverage and higher liability limits.

Cost Considerations

Umbrella insurance is important due to cost considerations as it provides additional liability coverage beyond standard policies, potentially saving you from expensive lawsuits. In the event of a major incident, umbrella insurance can help protect your assets and future financial stability.

Factors Affecting Cost

When considering the purchase of umbrella insurance, there are several factors that can affect the cost. Understanding these factors will enable you to make an informed decision that aligns with your financial goals and risk tolerance.

First and foremost, the amount of liability coverage you choose will greatly impact the cost of your umbrella policy. It’s important to evaluate your current assets and potential for future assets to determine an appropriate coverage limit.

Another significant factor is your personal risk profile. Insurance companies will assess your risk level based on factors such as your driving record, credit history, and occupation. The higher the perceived risk, the higher the premium.

Furthermore, the number of properties or vehicles you own can affect the cost of umbrella coverage. Each additional property or vehicle increases the overall liability exposure and subsequently raises the premium.

Cost-benefit Analysis

Carrying an umbrella insurance policy offers substantial benefits, but it’s important to weigh these benefits against the associated cost. Conducting a cost-benefit analysis will help you determine if umbrella insurance is a necessary expense for your financial situation.

When evaluating the cost, consider the potential loss you could face without umbrella coverage. Legal expenses, medical bills, and property damages resulting from a lawsuit can easily surpass the coverage limits of your primary policies.

By paying a relatively small premium for umbrella insurance, you can protect yourself from these unpredictable and potentially devastating financial burdens. It provides an additional layer of security, giving you peace of mind and safeguarding your hard-earned assets.

Ultimately, the decision to purchase umbrella insurance is contingent upon your risk tolerance and financial goals. However, considering the potential costs and benefits will help you make an informed choice that aligns with your specific circumstances.

Credit: http://www.fidelity.com

How To Purchase Umbrella Insurance

So, you’ve realized the importance of umbrella insurance and are now ready to take the next step by learning how to purchase it.

Choosing The Right Coverage Amount

When considering choosing the right coverage amount for umbrella insurance, evaluate your assets and the potential risks involved.

Start by calculating your net worth, including assets like savings, investments, and property to determine a suitable coverage amount.

Selecting A Reputable Insurer

Selecting a reputable insurer is crucial in ensuring reliable coverage and excellent customer service.

Research different insurance companies, read customer reviews, and check financial stability ratings to pick a trustworthy insurer.

Real-life Examples

Get insights into the necessity of umbrella insurance through real-life examples. Discover how this additional coverage safeguards assets and offers peace of mind. Understanding the importance of umbrella insurance is key to comprehensive financial protection.

Case Studies On Benefit Of Umbrella Insurance

– In a case study, a homeowner faced a hefty lawsuit from a guest who fell on their premises. – Umbrella insurance covered the excess $500,000, protecting the homeowner’s assets.Avoiding Financial Devastation

– Another example involves a car accident where the driver caused severe injuries to multiple individuals. – Without umbrella insurance, the driver would have faced personal liability for medical expenses. – In both instances, umbrella insurance shielded individuals from financial ruin and provided peace of mind.

Credit: smartasset.com

Frequently Asked Questions For Is Umbrella Insurance Necessary

Is Umbrella Insurance Necessary For Everyone?

Umbrella insurance is essential for anyone seeking additional liability coverage beyond standard policies. It provides extra protection and peace of mind in case of lawsuits or claims exceeding the regular coverage limits.

What Does Umbrella Insurance Cover?

Umbrella insurance offers an extra layer of protection, covering costs that surpass the limits of your regular policies. It can safeguard assets, such as savings, home, or future earnings, in the event of a large liability claim or lawsuit.

How Much Umbrella Insurance Coverage Do I Need?

The coverage amount for umbrella insurance depends on various factors, including assets, potential risks, and financial situation. It’s advisable to assess your net worth and consult with an insurance expert to determine the appropriate coverage level.

Conclusion

To conclude, umbrella insurance is an essential safeguard that provides an added layer of protection against unexpected liabilities. As accidents and lawsuits can arise at any time, having this coverage can offer peace of mind and financial stability. By expanding the limits of your existing policies, umbrella insurance ensures that you are adequately covered in case of a catastrophic event.

So, don’t overlook the importance of umbrella insurance when it comes to protecting your assets and future financial security.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Is umbrella insurance necessary for everyone?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Umbrella insurance is essential for anyone seeking additional liability coverage beyond standard policies. It provides extra protection and peace of mind in case of lawsuits or claims exceeding the regular coverage limits.” } } , { “@type”: “Question”, “name”: “What does umbrella insurance cover?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Umbrella insurance offers an extra layer of protection, covering costs that surpass the limits of your regular policies. It can safeguard assets, such as savings, home, or future earnings, in the event of a large liability claim or lawsuit.” } } , { “@type”: “Question”, “name”: “How much umbrella insurance coverage do I need?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The coverage amount for umbrella insurance depends on various factors, including assets, potential risks, and financial situation. It’s advisable to assess your net worth and consult with an insurance expert to determine the appropriate coverage level.” } } ] }

Leave a comment