Long Term Care Insurance in Virginia offers financial protection for the costs of long-term care services. It helps cover expenses for daily activities and provides support for individuals who may need assistance due to aging, illness, or disability.

When considering Long Term Care Insurance in Virginia, it’s essential to understand the benefits it offers. Virginia residents can secure their future by investing in this insurance, which can help ease the financial burden of long-term care. With the rising costs of healthcare services, having Long Term Care Insurance in Virginia can provide peace of mind and security for individuals and their families.

This insurance ensures that individuals receive the necessary care without depleting their savings or assets. By exploring the options available, Virginia residents can make informed decisions about their long-term care needs and safeguard their financial well-being.

Credit: promiselaw.com

What Is Long Term Care Insurance?

Long Term Care Insurance offers coverage for services that are not typically covered by traditional health insurance or Medicare.

It is specifically designed to provide support and assistance to individuals who may need long-term care due to chronic illness, disability, or advanced age.

This type of insurance helps cover expenses related to daily living activities, such as bathing, eating, and dressing, that may not be covered by other health insurance plans.

Long Term Care Insurance in Virginia typically covers costs associated with care in various settings, including at home, in an assisted living facility, or in a nursing home.

- Offers financial protection against the high costs of long-term care services

- Allows individuals to receive care in the setting that best fits their needs

- Helps preserve assets and savings by covering long-term care expenses

- Provides peace of mind for individuals and their families

With Long Term Care Insurance, individuals can access the care they need without depleting their savings or burdening their loved ones financially.

Importance Of Long Term Care Insurance

Protecting Your Finances

Unexpected long-term care costs can quickly deplete savings and investments.

Maintaining Independence And Quality Of Life

Long term care insurance provides flexibility and choice in care options.

Types Of Long Term Care Insurance Policies

The need for long term care is a reality that many individuals and families in Virginia have to face. Planning for this care can be overwhelming, but long term care insurance can provide peace of mind by offering financial protection for the expenses associated with long term care. There are different types of long term care insurance policies available to cater to the diverse needs of individuals. In this article, we will discuss the three main types of long term care insurance policies: Traditional Long Term Care Insurance, Hybrid Long Term Care Insurance, and Long Term Care Insurance Riders.

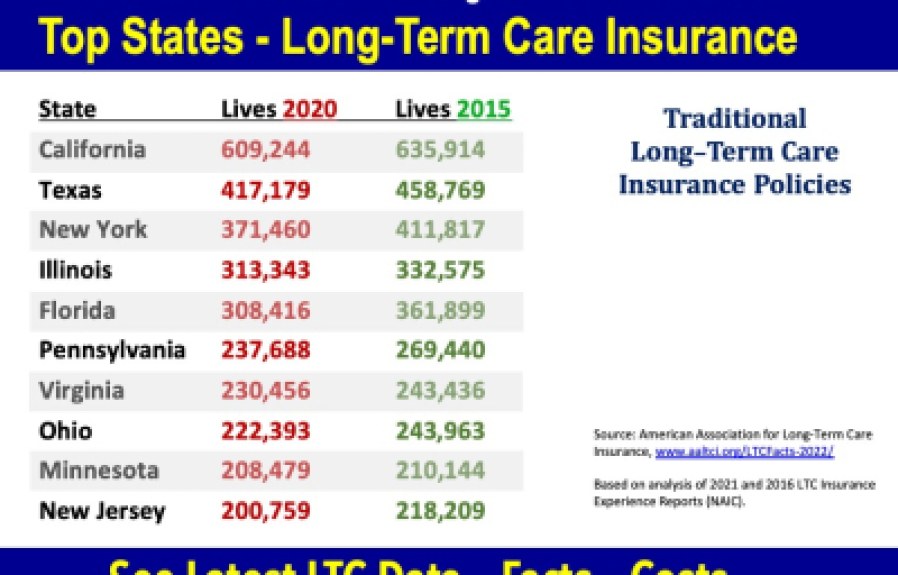

Traditional Long Term Care Insurance

Traditional Long Term Care Insurance is the most common type of coverage that individuals opt for. It is a standalone policy specifically designed to cover long term care expenses. With this policy, you pay premiums to the insurance company, and in return, they provide coverage for the cost of care services if you meet the policy’s eligibility requirements.

Here are some key features of Traditional Long Term Care Insurance:

- Covers a wide range of long term care services including home care, assisted living, and nursing home care.

- Allows you to choose the amount of coverage as well as the waiting period before benefits begin.

- Offers flexibility in selecting the benefit period which determines how long the policy will pay for your care.

- Generally, premiums increase over time but can be tax-deductible.

Hybrid Long Term Care Insurance

Hybrid Long Term Care Insurance is a combination of long term care insurance and life insurance or an annuity. This type of policy provides long term care benefits but also has a death benefit or annuity component. Hybrid policies are becoming increasingly popular as they offer more options and flexibility compared to traditional policies.

Here are some key features of Hybrid Long Term Care Insurance:

- Combines the advantages of long term care coverage with life insurance or an annuity.

- Provides a death benefit to beneficiaries if long term care benefits are not used.

- Offers a return of premium option, allowing you to receive a refund if you decide to cancel the policy.

- Premiums can be paid in a lump sum or over a specific period.

Long Term Care Insurance Riders

Long Term Care Insurance Riders are optional add-ons to a life insurance or annuity policy that provide long term care benefits. These riders allow you to add long term care coverage to your existing policy instead of purchasing a separate long term care insurance policy.

Here are some common types of Long Term Care Insurance Riders:

- Accelerated Death Benefit Rider: This rider allows you to receive a portion of the policy’s face value to cover long term care expenses if you have a qualifying medical condition.

- Long Term Care Extension Rider: This rider extends the life insurance coverage to also cover long term care expenses.

- Chronic Illness Accelerated Benefit Rider: This rider provides benefits if you are diagnosed with a chronic illness that requires long term care.

Credit: promiselaw.com

Determining Your Long Term Care Insurance Needs

When considering long term care insurance in Virginia, it’s essential to assess your current situation, anticipate future healthcare costs, and evaluate your family history. By addressing these key factors, you can determine the long term care insurance coverage that best suits your needs.

Assessing Your Current Situation

Evaluate your current physical and mental health, as well as any existing medical conditions. Consider your ability to perform daily activities independently and assess if you have a support system in place if your health were to decline. Take into account your current income and assets and how they would be impacted by long-term care costs.

Considering Future Healthcare Costs

Anticipate potential healthcare expenses related to long-term care. Research the costs of assisted living facilities, nursing homes, and in-home care services in Virginia. Take into account the potential expenses for specialized care or medical equipment that may be required in the future.

Evaluating Your Family History

Consider your family’s health history and longevity. Determine if there are common health conditions or genetic factors that may increase the likelihood of needing long-term care in the future. Understanding your family’s health history can provide insight into your potential long term care needs.

How Does Long Term Care Insurance Work?

Long term care insurance provides coverage for the costs associated with prolonged care, offering financial security and assistance for those in need of ongoing care services. Understanding how long term care insurance works is essential in making informed decisions about your coverage. Below, we’ll delve into the key aspects of long term care insurance to help you better comprehend its workings.

Qualifying For Benefits

To qualify for benefits under long term care insurance, individuals typically need to demonstrate that they require assistance with activities of daily living or suffer from cognitive impairments. These activities may include bathing, dressing, eating, toileting, transferring, and continence. It’s vital to review the specific qualification criteria outlined in your policy.

Choosing Benefit Amount And Duration

When selecting a long term care insurance policy, individuals have the flexibility to choose their benefit amount and duration. The benefit amount refers to the maximum daily or monthly payment the policy will cover for care services, while the duration indicates the maximum period during which benefits will be paid. It’s crucial to evaluate your individual needs and consult with a qualified insurance advisor to determine the optimal benefit amount and duration for your situation.

Understanding The Elimination Period

The elimination period, also known as the waiting or deductible period, is the duration an individual must wait before receiving benefits after meeting the qualifying conditions. This period can range from 0 to 365 days, and the length of the elimination period selected can impact the premium costs. Carefully consider the elimination period when structuring your long term care insurance plan.

Premium Payments And Options

Long term care insurance premiums can vary based on factors such as age, health status, coverage amount, and policy provisions. Premium payment options may include a single lump sum, annual, semi-annual, or monthly payments. Understanding the available premium payment options and their implications is essential for ensuring your coverage remains manageable and sustainable over time.

Finding The Right Long Term Care Insurance Policy

In Virginia, finding the right long-term care insurance policy is crucial for financial security. Careful evaluation of different policies and understanding the coverage options can help individuals select the most suitable long-term care insurance for their needs. Consulting with an insurance advisor can provide valuable insights and guidance in making this important decision.

Researching Insurance Providers

When it comes to finding the right long term care insurance policy in Virginia, it’s important to do your research. Researching different insurance providers can help you find the best options for your needs. Look for insurance companies that specialize in long term care coverage and have a good reputation in the industry. Spend some time browsing their websites, reading customer reviews, and checking their ratings with independent rating agencies.Comparing Policy Features And Costs

Once you have a list of potential insurance providers, it’s time to start comparing policy features and costs. Look for policies that offer comprehensive coverage, including in-home care, assisted living, and nursing home care. Pay attention to the specific benefits provided, such as the daily benefit amount, elimination period, and inflation protection options.| Policy Features | Costs |

|---|---|

| Comprehensive coverage | Reasonable premium |

| Daily benefit amount | Affordable premiums |

| Elimination period | Competitive rates |

| Inflation protection | Flexible payment options |

Working With An Insurance Agent

To make the process of finding the right long term care insurance policy easier, consider working with an experienced insurance agent in Virginia. An insurance agent can help you navigate through the options available, understand the fine print, and answer any questions you may have. They can also provide personalized recommendations based on your specific needs and budget. Unordered List: – Research different insurance providers – Compare policy features and costs – Work with an insurance agent Ordered List: 1. Research insurance providers 2. Compare policy features and costs 3. Work with an insurance agent Remember, finding the right long term care insurance policy is an important decision that requires thoughtful consideration. By investing time in researching insurance providers, comparing policy features and costs, and working with an insurance agent, you can make an informed choice that provides the coverage and peace of mind you and your loved ones deserve.Factors Affecting Long Term Care Insurance Costs

When considering Long Term Care Insurance in Virginia, there are several crucial factors affecting the costs that individuals should take into account. Understanding these factors can help individuals make informed decisions about their long-term care coverage. Here are some key factors influencing the cost of Long Term Care Insurance in Virginia:

Age And Health Status

Age and health significantly impact Long Term Care Insurance costs as older individuals or those with pre-existing health conditions may face higher premiums.

Location

Location plays a role in determining Long Term Care Insurance costs, as the cost of care and regulations vary by state. In Virginia, factors such as the cost of living and availability of care facilities can influence insurance prices.

Coverage Options And Riders

Coverage options and riders selected by policyholders can affect the overall cost of Long Term Care Insurance. Additional coverage for specific conditions or services may increase premiums.

Credit: http://www.aaltci.org

Planning For Long Term Care In Virginia

Planning for long term care in Virginia can be made easier with long term care insurance. Protect your financial stability and ensure the best possible care for yourself or your loved ones in the future. Our expert team can guide you through the process of selecting the right insurance plan that meets your needs.

Planning for Long Term Care in Virginia Long term care insurance is a vital consideration for Virginia residents as they plan for potential future care needs.Understanding Medicaid Eligibility

Medicaid eligibility criteria in Virginia affect access to long term care services.Exploring Other Long Term Care Options

Various long term care options beyond insurance can provide comprehensive care support.Considerations For Aging Population

Virginia’s aging population highlights the importance of proactive long term care planning.Frequently Asked Questions For Long Term Care Insurance Virginia

What Is Long Term Care Insurance?

Long term care insurance is a policy that covers the cost of long-term care services, including assistance with activities of daily living such as bathing, dressing, and eating.

Who Needs Long Term Care Insurance?

People who want to protect their savings and assets from the high costs of long-term care services, and ensure they have access to quality care when they need it.

What Does Long Term Care Insurance In Virginia Cover?

Long term care insurance in Virginia typically covers nursing home care, assisted living facility care, in-home care, and adult day care services.

How Do I Choose The Right Long Term Care Insurance Policy?

When choosing a long term care insurance policy, consider your budget, the level of coverage you need, the insurance company’s reputation, and the policy’s flexibility and benefits.

Conclusion

Long term care insurance in Virginia provides vital financial protection for families and individuals, offering peace of mind and security for the future. By planning ahead and investing in this important coverage, Virginians can ensure that they are prepared for the potential costs of long-term care services.

With various options available, it’s crucial to carefully review and select a policy that meets your specific needs. Don’t delay in exploring the benefits of long-term care insurance and safeguarding your financial well-being.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is long term care insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Long term care insurance is a policy that covers the cost of long-term care services, including assistance with activities of daily living such as bathing, dressing, and eating.” } } , { “@type”: “Question”, “name”: “Who needs long term care insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “People who want to protect their savings and assets from the high costs of long-term care services, and ensure they have access to quality care when they need it.” } } , { “@type”: “Question”, “name”: “What does long term care insurance in Virginia cover?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Long term care insurance in Virginia typically covers nursing home care, assisted living facility care, in-home care, and adult day care services.” } } , { “@type”: “Question”, “name”: “How do I choose the right long term care insurance policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “When choosing a long term care insurance policy, consider your budget, the level of coverage you need, the insurance company’s reputation, and the policy’s flexibility and benefits.” } } ] }

Leave a comment