Unit Linked Insurance Plan (ULIP) charges refer to the fees and expenses associated with investing in a ULIP policy. ULIP charges encompass various elements, including premium allocation charges, mortality charges, policy administration charges, fund management charges, and surrender charges, among others.

An Introduction to Unit Linked Insurance Plan Charges: ULIPs have gained popularity as a hybrid financial product that combines insurance and investment. They provide the dual benefit of life cover along with the opportunity to grow your wealth through investing in various market-linked funds.

However, before investing in a ULIP, it’s crucial to understand the charges involved. These charges can impact your investment returns and should be carefully evaluated to make informed decisions. We will delve deeper into the different types of charges associated with ULIPs, their purpose, and how they affect your investment. By understanding the ULIP charges, you can make well-informed choices and optimize your investment strategy. So, let’s get started!

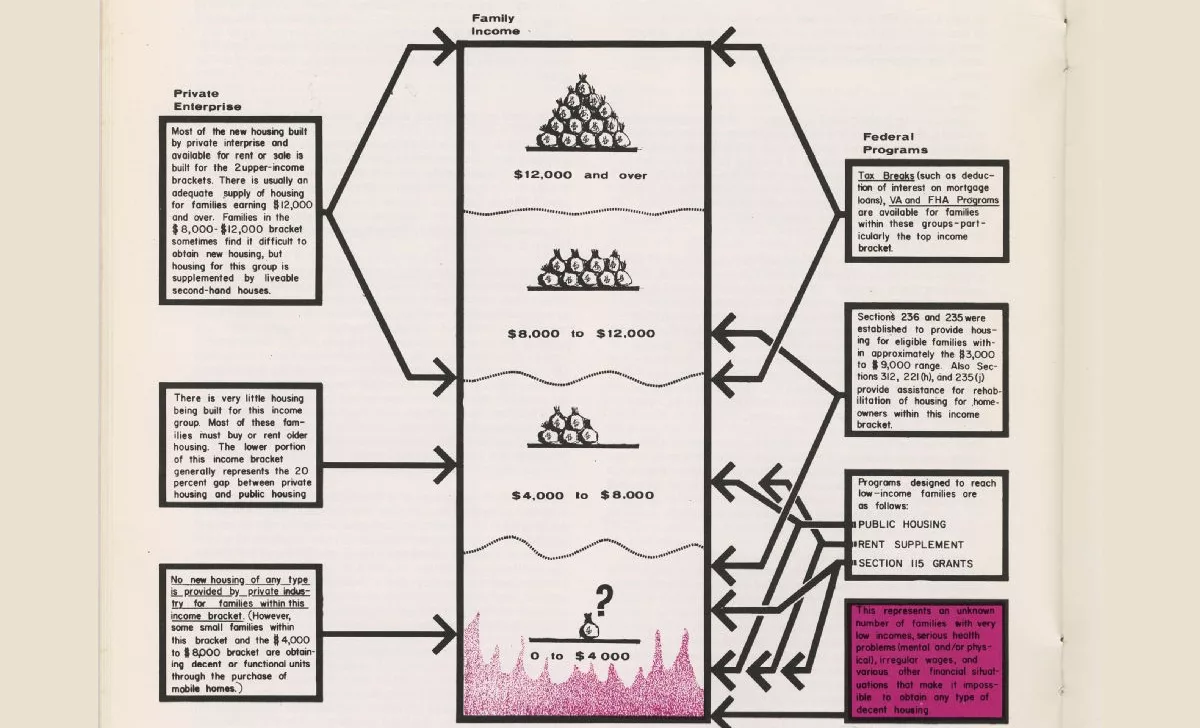

Credit: lexingtonky.news

Understanding Ulip Charges

Start of Understanding ULIP Charges SectionUnit Linked Insurance Plans (ULIPs) come with various charges that investors need to be aware of.

These charges impact the overall returns on investment and should be understood before investing.

Allocation Charges

- Initial fees deducted from the premium before the investment is made

- Usually shown as a percentage of the premium

Mortality Charges

- Charges for providing life insurance coverage in the ULIP

- Determined based on the age and health of the policyholder

Fund Management Charges

- Fees for managing the investment portfolio within the ULIP

- Charged as a percentage of the total assets under management

Understanding these charges is crucial to make informed investment decisions and maximize the benefits of a ULIP.

Credit: liquidity-provider.com

Revealing The Impact Of Charges

Uncovering the true impact of charges in Unit Linked Insurance Plans is crucial for understanding the overall investment performance. By delving into the detailed breakdown of charges, investors can gain insight into the potential impact on their returns, making informed decisions for their financial future.

Effect On Returns

When it comes to Unit Linked Insurance Plans (ULIPs), one of the crucial aspects that can significantly impact your investment returns are the charges associated with them. It’s essential to understand the impact of charges to make an informed decision when considering investing in ULIPs.- ULIP charges can include premium allocation charges, policy administration charges, fund management charges, mortality charges, and surrender charges.

- Premium allocation charges are deducted upfront from your premium, and the remaining amount is invested in your chosen funds. These charges can range from 2% to 6% of the premium paid, depending on the insurer and the tenure of the policy.

- Policy administration charges are levied for the maintenance of your policy and can be either a fixed amount or a percentage of the premium. It is important to note that these charges may vary from insurer to insurer.

- Fund management charges are deducted as a percentage of the fund’s value on an annual basis. These charges typically range from 1% to 1.5% of the fund’s value and are meant to cover the cost of managing the investment portfolio.

- Mortality charges are imposed to provide life cover and depend on the age, sum assured, and risk profile of the policyholder.

- Surrender charges are applicable if you decide to surrender your ULIP before the completion of the lock-in period, which is usually five years. The surrender charges can vary based on the time of surrender, and they gradually decrease over time.

Comparing Ulip Charges With Mutual Funds

While ULIPs provide a combination of investment and insurance, mutual funds solely focus on investment. By comparing ULIP charges with those of mutual funds, you can assess the impact of charges on your investment returns.| Charges | ULIPs | Mutual Funds |

|---|---|---|

| Premium Allocation Charges | Can range from 2% to 6% of the premium paid | N/A – No premium allocation charges in mutual funds |

| Policy Administration Charges | Varies from insurer to insurer – fixed amount or percentage of the premium | N/A – No policy administration charges in mutual funds |

| Fund Management Charges | Usually 1% to 1.5% of the fund’s value | 0.5% to 2.5% of the fund’s value, depending on the mutual fund scheme |

| Mortality Charges | Depends on the risk profile and age of the policyholder | N/A – No mortality charges in mutual funds |

| Surrender Charges | Applicable if surrendered before the lock-in period | N/A – No surrender charges in mutual funds |

Long-term Implications

It is crucial to consider the long-term implications of ULIP charges on your investment portfolio. While the charges may seem substantial initially, their impact diminishes over time due to the power of compounding. Opting for ULIPs with lower charges can significantly enhance your investment returns in the long run. Keep in mind that ULIPs offer the benefit of tax advantages under Section 80C of the Income Tax Act, making them an attractive investment option for individuals looking to mitigate their tax liability while aiming for significant returns. By being aware of the effect of charges on ULIP returns, comparing ULIP charges with mutual funds, and understanding the long-term implications, you can make an informed decision about whether ULIPs align with your investment goals and risk tolerance. Remember to carefully analyze and compare various ULIP products offered by different insurers to find the most suitable option for your financial objectives.Disclosure And Transparency

When considering a Unit Linked Insurance Plan (ULIP), it’s essential to comprehend the charges involved. One critical aspect of understanding ULIP charges is disclosure and transparency. This aspect ensures that policyholders have access to all the necessary information about the charges associated with their ULIP, enabling informed decision-making.

Regulatory Requirements

The Insurance Regulatory and Development Authority of India (IRDAI) mandates that insurance providers disclose all charges associated with ULIPs. This regulatory requirement ensures transparency and empowers policyholders to comprehend the cost structure of their ULIP policies.

Policy Documents Clarity

Insurers are obligated to present policy documents in a clear and concise manner, outlining all charges levied on the ULIP policy. By providing transparent and easily understandable policy documents, insurers enhance the overall disclosure of charges, simplifying the comprehension for policyholders.

Credit: http://www.linkedin.com

Strategies To Minimize Ulip Charges

When it comes to Unit Linked Insurance Plans (ULIPs), minimizing charges is essential to optimize returns. By strategically choosing the right policy, optimizing investment allocation, and regularly reviewing and adjusting, investors can ensure that their ULIP charges are kept to a minimum.

Choosing The Right Policy

When selecting a ULIP, it’s crucial to carefully evaluate the policy’s terms and conditions, including all associated charges. Look for policies with lower administration charges and fund management fees, as these can significantly impact the overall returns on your investment.

Optimizing Investment Allocation

Carefully consider the allocation of your funds within the ULIP to minimize charges. By diversifying your investments across various funds, you can potentially reduce the impact of charges on individual funds. Ensure that your investment strategy aligns with your risk appetite and financial goals to optimize returns while minimizing charges.

Regularly Reviewing And Adjusting

Continuously monitoring your ULIP and making adjustments as needed can help minimize charges. Regularly review the performance of your funds and the associated charges. If certain funds consistently underperform or carry high charges, consider reallocating your investment to more cost-effective options within the ULIP.

Understanding Surrender Charges

When it comes to Unit Linked Insurance Plans (ULIPs), it is important for policyholders to be aware of the various charges that apply. One such charge is the surrender charge, which can have a significant impact on policyholders. In this article, we will define surrender charges and explain how they are calculated. We will also highlight the impact these charges can have on policyholders.

Definition And Calculation

Surrender charges, also known as discontinuance charges, are levied by insurance companies in case policyholders decide to terminate their ULIP before the completion of the lock-in period. These charges are a percentage of the fund value or the premium paid, and act as a deterrent to early withdrawals.

The calculation of surrender charges varies from one insurance company to another. Generally, surrender charges are higher in the initial years of the policy and gradually decrease over time. The charges are calculated based on a predetermined formula specified in the policy terms and conditions.

For example, let’s say you have a ULIP with a 5-year lock-in period and surrender charges of 10% in the first year, 9% in the second year, and so on. If you decide to surrender your policy in the third year, the surrender charge will be 8% of the fund value.

Impact On Policyholders

The impact of surrender charges on policyholders can be significant. Here are a few key points to consider:

- Financial Loss: Surrendering a ULIP before the completion of the lock-in period can result in a financial loss for the policyholder. The surrender charges deducted from the fund value can reduce the overall returns on the investment.

- Long-term Commitment: ULIPs are designed as long-term investment-cum-insurance products. The surrender charges act as a deterrent to encourage policyholders to stay invested for the intended period, enabling them to reap the full benefits of the plan.

- Decision-making: Policyholders must carefully evaluate their financial needs and goals before surrendering a ULIP. If they anticipate needing the funds in the short term, it may be better to consider other investment options without stringent lock-in periods and surrender charges.

- Flexibility: Some ULIPs offer partial withdrawals after the completion of the lock-in period. This allows policyholders to meet their financial requirements without surrendering the entire policy, thereby avoiding surrender charges.

Understanding surrender charges is crucial for policyholders considering a ULIP investment. It is important to carefully review the policy terms and conditions, including the surrender charge structure, before making a commitment.

Comparing Ulips Across Companies

Comparing ULIPs across different companies is essential to make an informed decision about which plan suits your investment goals and risk appetite. One of the key aspects to consider while comparing ULIPs is the charges associated with the plan. These charges may vary across companies and can significantly impact the returns on your investment. Understanding the different fee structures and performance metrics to evaluate will help you make a well-informed choice.

Different Fee Structures

When comparing ULIPs across companies, it is crucial to analyze the fee structures to get a clear picture of the charges levied. Here are some key fee structures:

- Premium Allocation Charge: This fee is deducted upfront from the premium paid by the policyholder. It covers various administrative and distribution expenses.

- Mortality Charges: These charges are levied to cover the risk of life insurance provided under the ULIP. The amount may vary based on factors like age, the sum assured, and the policyholder’s health status.

- Fund Management Charges: These charges are deducted to manage the investment portfolio of the ULIP. They typically range from 0.75% to 1.35% of the fund value and cover the expenses incurred in managing the underlying funds.

- Policy Administration Charges: These charges are deducted for the administrative services provided by the insurance company. It includes activities related to policy maintenance, servicing, and record keeping.

- Surrender Charges: In case the policyholder decides to surrender the ULIP before the completion of the lock-in period, surrender charges are applicable. These charges discourage premature exits and may vary based on the policy term and the surrender year.

Performance Metrics To Evaluate

Assessing the performance metrics of ULIPs across different companies will help you gauge the potential return on your investment. Here are some essential performance metrics to consider:

- Fund Performance: Evaluate the historical performance of the funds offered by the ULIP. Look for consistent returns and compare them with benchmark indices or similar mutual funds to get an idea of how well the funds have performed.

- Asset Allocation: Examine the asset allocation strategy of the ULIP funds. Diversification across various asset classes like equity, debt, and cash can help mitigate risks and optimize returns.

- Expense Ratio: The expense ratio represents the percentage of the annual fund assets consumed by operating expenses. A lower expense ratio indicates a more cost-effective ULIP.

- Claim Settlement Ratio: Consider the claim settlement ratio of the insurance company offering the ULIP. This ratio indicates the company’s efficiency in settling claims, reflecting its credibility and trustworthiness.

Case Studies: Real-life Examples

Case Study 1: High-charge Ulip Vs. Low-charge Ulip

Comparing two similar ULIPs with different charges to highlight the impact on returns.

- High-Charge ULIP

- Low-Charge ULIP

| High-Charge ULIP | Low-Charge ULIP |

|---|---|

| High admin & fund management charges | Low admin & fund management charges |

| Lower returns due to higher fees | Higher potential returns due to lower fees |

Case Study 2: Surrender Charges Consequences

Understanding how surrender charges affect your investment in a ULIP.

- Early exit penalties

- Impact on final payout

Consider these real-life scenarios to make informed decisions about your ULIP investments.

The Future Of Ulip Charges

Trends In Fee Reduction

As technology advances, ULIP providers are reducing charges to attract more investors.

Impact Of Technology And Competition

Due to technological advancements, ULIP charges are decreasing to stay competitive in the market.

Frequently Asked Questions Of Unit Linked Insurance Plan Charges

What Are The Different Charges Associated With A Unit Linked Insurance Plan (ulip)?

ULIPs come with charges like premium allocation, policy admin, fund management, mortality, and surrender charges. It’s crucial to understand these charges and their impact on your investment returns.

How Do Ulip Charges Impact The Returns On Investment?

ULIP charges can reduce the overall investment returns by eating into the invested amount. Understanding the impact of charges can help in making informed decisions while choosing a ULIP.

Why Is It Important To Compare The Charges Of Different Ulip Plans?

Comparing ULIP charges is crucial as it helps in identifying the plan that offers better returns by minimizing the impact of charges. Comparing charges can aid in making well-informed investment decisions.

Conclusion

Considering the various charges associated with Unit Linked Insurance Plans, it is crucial for policyholders to understand and evaluate them before making a decision. From fund management charges to premium allocation charges, these fees can significantly impact the overall returns.

By being aware of these charges and their potential impact on investment growth, individuals can make informed choices and optimize their ULIP investments. Make sure to carefully read the policy documents and consult with financial advisors to make the most of your investment.

Leave a comment