Unit Linked Insurance Plan (ULIP) is a type of insurance policy that combines investment and insurance benefits. It offers investors the opportunity to get life insurance coverage while also investing in various market-linked investment options like stocks, bonds, and mutual funds, providing potential returns.

ULIPs allow policyholders to have control over their investments and customize their investment portfolio based on their risk appetite and financial goals. It’s a flexible and tax-efficient investment tool that not only protects individuals and their families but also helps in wealth creation over the long term.

Nowadays, many people are looking for insurance policies that not only provide life coverage but also offer a chance to grow their money. Unit Linked Insurance Plans (ULIPs) have gained significant popularity in recent years due to their unique combination of insurance and investment features. We will explore the concept of ULIPs in detail, highlighting their benefits, features, and considerations. Whether you are a new investor or someone looking to diversify your portfolio, understanding ULIPs can be crucial in making informed financial decisions. Let’s delve into the world of ULIPs, uncovering their potential advantages and evaluating whether they are the right investment option for you.

Understanding Unit Linked Insurance Plan (ulip)

Understanding ULIPs can be crucial for those interested in investing for their future. This article delves into the intricacies of Unit Linked Insurance Plans, providing valuable insights and helpful information.

What Is Ulip?

A Unit Linked Insurance Plan (ULIP) is an insurance product that combines investment and insurance.

Features Of Ulip

- Combines investment and insurance

- Flexibility to choose funds

- Transparency in charges

- Option to switch between funds

Benefits Of Investing In Ulip

Discover the advantages of investing in ULIP, combining insurance coverage with investment opportunities for potential growth and financial security. With flexible premium payment options and the potential for high returns, ULIP offers a comprehensive financial planning solution for individuals seeking long-term benefits.

Wealth Maximization

Insurance Coverage And Investment Growth

Investing in a Unit Linked Insurance Plan (ULIP) offers several benefits that make it a popular choice among investors. ULIPs provide a unique combination of insurance coverage and investment growth, making them an attractive option for individuals looking to maximize their wealth while ensuring financial protection for their loved ones. Let’s take a closer look at these benefits in detail.Wealth Maximization

ULIPs allow investors to efficiently grow their wealth over the long term. One of the key advantages of ULIPs is the flexibility to invest in a variety of asset classes, including equities, debt instruments, and money market instruments. This diversification helps in spreading the risk and potentially yields higher returns. Additionally, ULIPs offer the option to switch between funds based on the prevailing market conditions and the investor’s risk appetite. This feature enables investors to take advantage of market opportunities and maximize their investment gains.Insurance Coverage And Investment Growth

ULIPs provide the dual benefit of insurance coverage and investment growth. A portion of the premium paid towards a ULIP is allocated for life insurance coverage, ensuring financial protection for the policyholder’s family in case of any unfortunate events. This coverage provides peace of mind and acts as a safety net, safeguarding the family’s financial well-being even in the absence of the policyholder. At the same time, the remaining portion of the premium is invested in various funds, allowing for potential growth over time. ULIPs offer the option to choose between different investment funds based on an individual’s risk appetite and financial goals. With a wide range of options available, investors have the flexibility to select a fund that aligns with their investment preferences and maximizes their returns. In conclusion, investing in a ULIP offers the twin benefits of insurance coverage and investment growth, making it a valuable choice for individuals looking to build wealth while safeguarding their loved ones’ financial future. With the potential for higher returns and the flexibility to tailor the investment strategy, ULIPs provide a comprehensive solution for long-term financial planning.Factors To Consider Before Investing

Before investing in a Unit Linked Insurance Plan (ULIP), there are crucial factors that should be carefully evaluated. Assessing your risk tolerance and investment goals is imperative to make an informed decision. Understanding these factors will help you make a well-informed investment choice that aligns with your financial objectives and comfort level.

Risk Tolerance

Assessing your risk tolerance is essential when considering a ULIP investment. It involves evaluating how comfortable you are with the possibility of fluctuations in the market affecting the value of your investment. Factors such as age, financial obligations, and investment experience should be considered in determining risk tolerance.

Investment Goals

Understanding your investment goals is crucial before investing in a ULIP. Are you investing for short-term gains, long-term financial security, or a specific financial objective, such as education or retirement? Clearly defining your investment goals will help in selecting a ULIP plan that aligns with your objectives.

:max_bytes(150000):strip_icc()/Term-Definitions_aum-resized-dd226f8a432c4db79cbae22a79ae3571.jpg)

Credit: http://www.investopedia.com

Comparison With Other Investment Options

Explore how Unit Linked Insurance Plans stand out against traditional investment choices, offering a unique blend of protection and growth potential. With ULIPs, investors benefit from insurance coverage along with market-linked returns, making it a versatile investment option to consider.

Ulip Vs. Mutual Funds

ULIPs and Mutual funds are both investment options that offer opportunities for wealth creation. However, the key difference lies in the insurance component. While ULIPs offer the dual benefit of investment and insurance, mutual funds focus solely on investment opportunities without any insurance coverage.

Ulip Vs. Traditional Insurance Policies

When comparing ULIPs with traditional insurance policies, the primary variation is the investment aspect. ULIPs combine insurance and investment, allowing policyholders to reap the benefits of both, whereas traditional insurance policies focus primarily on providing life coverage with minimal investment opportunities.

Maximizing Wealth Through Ulip

Unit Linked Insurance Plans (ULIPs) provide individuals with a unique opportunity to not only secure their financial future but also maximize their wealth. ULIPs offer the dual benefits of insurance and investment, making them a popular choice among investors. In this blog post, we will explore two key strategies for maximizing wealth through ULIP – choosing the right fund options and regular review and rebalancing.

Choosing The Right Fund Options

When it comes to ULIPs, one of the most critical decisions you need to make is selecting the right fund options. ULIPs offer a range of fund choices, including equity funds, debt funds, and balanced funds. Equity funds provide higher potential returns but also come with higher risk. Debt funds, on the other hand, provide stability and lower risk but may offer lower returns. Balanced funds aim to strike a balance between risk and return, offering a combination of both equity and debt.

It is essential to consider your risk appetite, investment goals, and financial situation while choosing the right fund options in ULIPs. A risk-averse investor may opt for a higher allocation towards debt funds, while an investor with a higher risk appetite may consider equity funds. Additionally, it is important to periodically review and realign your investment strategy based on your changing requirements and market conditions.

Regular Review And Rebalancing

Regular review and rebalancing of your ULIP portfolio are crucial to maximize wealth. It is imperative to keep track of your investments and assess their performance periodically. This allows you to determine whether your investment strategy aligns with your financial goals and make any necessary adjustments.

Rebalancing involves adjusting the allocation of funds in your ULIP portfolio to maintain the desired asset mix and risk level. For example, if equity funds have performed exceptionally well, you may consider rebalancing by reducing the allocation towards equity and increasing the allocation towards debt funds. This not only helps you mitigate risks but also ensures that your investment portfolio remains aligned with your risk tolerance.

When it comes to maximizing wealth through ULIPs, choosing the right fund options and regular review and rebalancing are two key strategies you must employ. By making informed decisions and staying proactive, you can unlock the full potential of your ULIP investment and achieve your long-term financial goals.

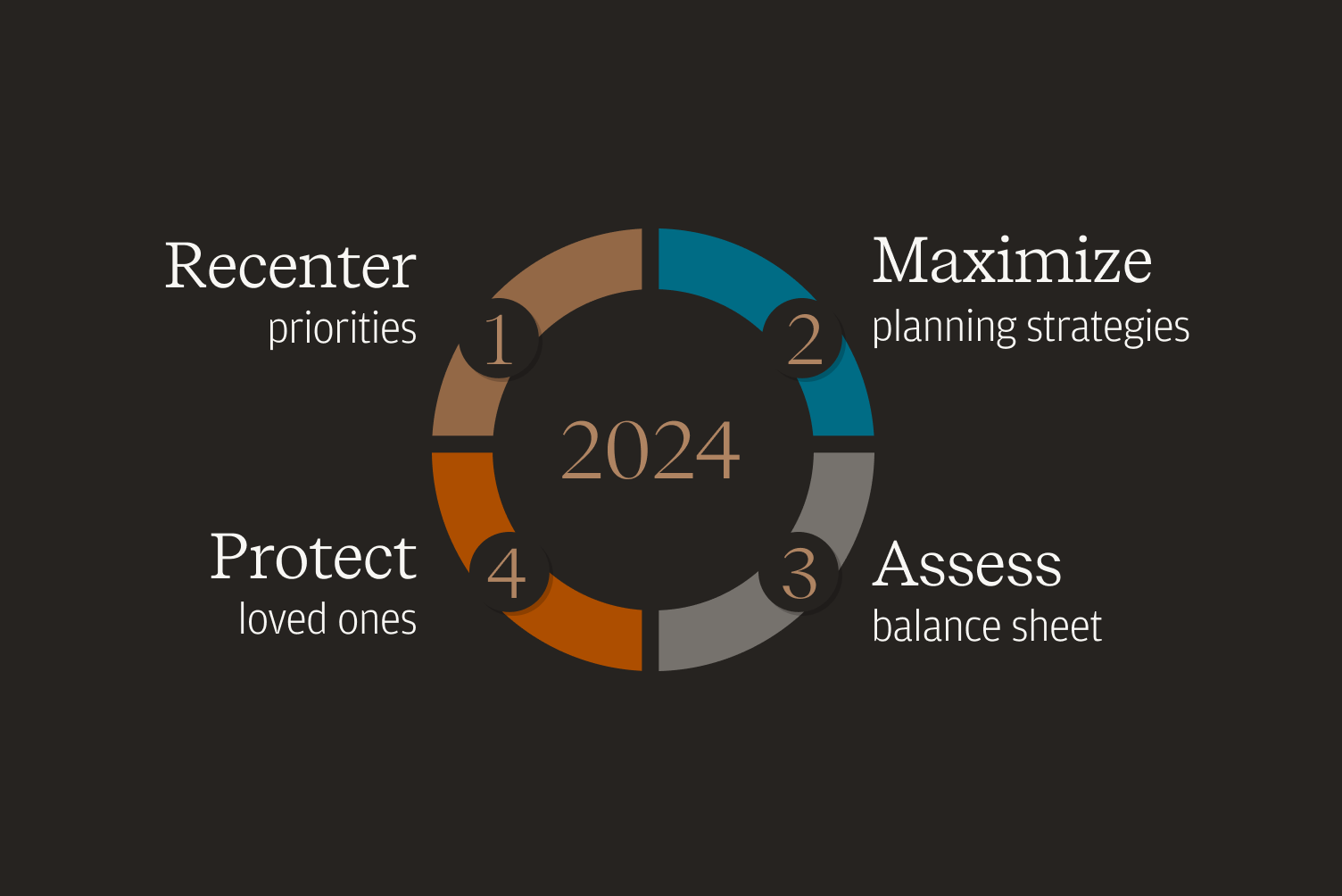

Credit: privatebank.jpmorgan.com

Tax Benefits Of Ulip

Tax Benefits of ULIP:

Section 80c Benefits

- Investment in ULIP qualifies for deduction under Section 80C of the Income Tax Act.

- Up to ₹1.5 lakh can be claimed as a deduction in a financial year.

- ULIP premiums contribute to reducing the taxable income of the policyholder.

Tax-free Withdrawals And Maturity Proceeds

- Withdrawals from ULIP after the lock-in period are tax-free.

- Maturity proceeds of ULIP are also tax-free under Section 10(10D) of the Income Tax Act.

- This tax exemption adds to the overall benefits of investing in ULIP for long-term goals.

Understanding Charges In Ulip

Unit Linked Insurance Plan (ULIP) is a unique financial product that combines insurance and investment. It offers policyholders the opportunity to invest in market-linked funds while also providing life insurance coverage. However, it’s essential to have a clear understanding of the charges associated with ULIP to ensure optimal financial planning.

Premium Allocation Charges

Premium allocation charges refer to the portion of the premium deducted by the insurance company to cover expenses like underwriting and distribution. These charges are deducted upfront before investing in the chosen fund, impacting the actual amount allocated to the investment component.

Fund Management Charges

Fund management charges are incurred for managing the investment funds within the ULIP. These charges are calculated as a percentage of the fund value and cover the costs associated with fund management, including research, monitoring, and trading expenses.

Choosing The Right Ulip Plan

When it comes to securing your financial future, choosing the right Unit Linked Insurance Plan (ULIP) is crucial. With a plethora of options available in the market, it’s essential to research different plans and customize them based on your financial goals.

Researching Different Plans

Before diving into any ULIP plan, it’s imperative to conduct thorough research to understand the offerings, charges, and benefits associated with each plan. Take time to compare various ULIPs offered by different insurance providers, and pay close attention to factors such as fund performance, NAVs, and associated costs.

Customizing Based On Financial Goals

Each individual’s financial goals are unique, and it’s important to customize a ULIP plan accordingly. Whether your aim is wealth creation, retirement planning, or securing your family’s future, choose a ULIP that aligns with your specific objectives. Consider factors such as policy term, premium payment frequency, and the flexibility to switch between funds to ensure your ULIP fits your financial aspirations.

Credit: http://www.coastalwealthmanagement24.com

Frequently Asked Questions On Unit Linked Insurance Plan Ppt

What Is A Unit Linked Insurance Plan (ulip)?

A Unit Linked Insurance Plan (ULIP) is a financial product that provides both life insurance coverage and an investment component. With ULIP, a portion of the premium is allocated to insurance coverage, while the remaining amount is invested in various funds according to the policyholder’s choice.

ULIPs offer the dual benefit of protection and wealth creation.

How Does A Unit Linked Insurance Plan Work?

A Unit Linked Insurance Plan works by combining the elements of insurance and investment. The premiums paid towards a ULIP are allocated into different funds such as equity, debt, or hybrid funds. Depending on the market performance and chosen funds, the ULIP’s value fluctuates.

Additionally, ULIPs offer the flexibility to switch between funds based on the policyholder’s risk appetite and financial goals.

What Are The Key Benefits Of Investing In A Unit Linked Insurance Plan?

Investing in a Unit Linked Insurance Plan offers several advantages. ULIPs provide life coverage along with the potential for wealth creation. They offer flexibility to choose between various funds based on market conditions and investment goals. Moreover, ULIPs also provide tax benefits and the option to customize the insurance coverage based on the policyholder’s needs.

How To Choose The Right Unit Linked Insurance Plan?

Choosing the right Unit Linked Insurance Plan involves assessing factors such as investment objectives, risk appetite, and policy features. It is essential to consider the charges associated with the ULIP, the fund performance, and the track record of the insurance provider.

Additionally, understanding the policy’s terms and conditions and aligning it with financial goals is crucial in selecting the most suitable ULIP.

Conclusion

To summarize, a Unit Linked Insurance Plan (ULIP) is a versatile financial product that offers the twin benefits of insurance and investment. With its unique features and flexibility, a ULIP can be an effective tool for long-term wealth creation and financial protection.

By understanding the workings of a ULIP and making informed investment decisions, individuals can secure their future and achieve their financial goals. Explore the possibilities of a ULIP and embark on your wealth-building journey today.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is a Unit Linked Insurance Plan (ULIP)?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A Unit Linked Insurance Plan (ULIP) is a financial product that provides both life insurance coverage and an investment component. With ULIP, a portion of the premium is allocated to insurance coverage, while the remaining amount is invested in various funds according to the policyholder’s choice. ULIPs offer the dual benefit of protection and wealth creation.” } } , { “@type”: “Question”, “name”: “How does a Unit Linked Insurance Plan work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A Unit Linked Insurance Plan works by combining the elements of insurance and investment. The premiums paid towards a ULIP are allocated into different funds such as equity, debt, or hybrid funds. Depending on the market performance and chosen funds, the ULIP’s value fluctuates. Additionally, ULIPs offer the flexibility to switch between funds based on the policyholder’s risk appetite and financial goals.” } } , { “@type”: “Question”, “name”: “What are the key benefits of investing in a Unit Linked Insurance Plan?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Investing in a Unit Linked Insurance Plan offers several advantages. ULIPs provide life coverage along with the potential for wealth creation. They offer flexibility to choose between various funds based on market conditions and investment goals. Moreover, ULIPs also provide tax benefits and the option to customize the insurance coverage based on the policyholder’s needs.” } } , { “@type”: “Question”, “name”: “How to choose the right Unit Linked Insurance Plan?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Choosing the right Unit Linked Insurance Plan involves assessing factors such as investment objectives, risk appetite, and policy features. It is essential to consider the charges associated with the ULIP, the fund performance, and the track record of the insurance provider. Additionally, understanding the policy’s terms and conditions and aligning it with financial goals is crucial in selecting the most suitable ULIP.” } } ] }

Leave a comment