Group Health Plans are employer-provided insurance policies that cover a group of individuals, typically employees and their dependents. These plans offer medical coverage for members within the group.

Group Health Plans offer a cost-effective solution for employers to provide health insurance benefits to their employees. By pooling a large group of individuals together, these plans have the advantage of spreading the risk and cost across the group. This type of insurance often provides comprehensive coverage at lower premiums compared to individual health plans.

Group Health Plans vary in coverage and features, allowing employers to tailor benefits to meet the needs of their workforce. With rising healthcare costs, having a Group Health Plan can be a valuable asset for both employers and employees.

What Is A Group Health Plan

In the realm of health insurance, a Group Health Plan is a coverage plan that is offered by an employer or organization to provide healthcare benefits to its employees or members.

Definition

A Group Health Plan is a type of health insurance plan that covers a group of people, typically employees of a company or members of an organization.

Coverage Types

Group Health Plans often include various types of coverage such as:

- Medical Coverage: Covers doctor visits, hospital stays, and medical procedures.

- Prescription Drug Coverage: Helps to pay for the cost of prescription medications.

- Dental Coverage: Includes dental procedures like cleanings, fillings, and extractions.

- Vision Coverage: Covers eye exams, glasses, and contact lenses.

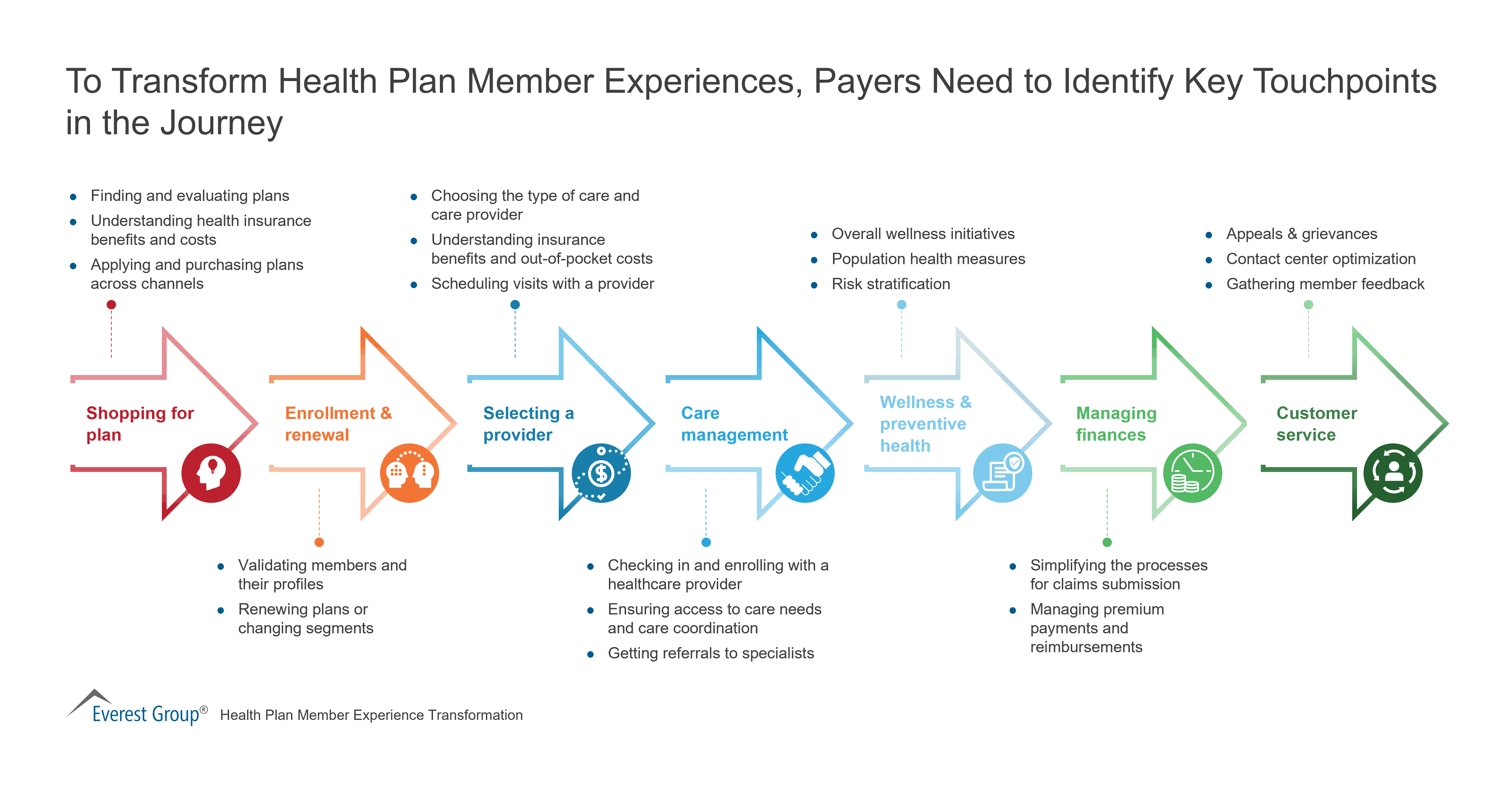

Credit: http://www.everestgrp.com

Advantages Of Group Health Plans

`Group Health Plans offer various benefits to both employers and employees. Let’s explore the key advantages of these plans:`

Cost Savings |

`By pooling resources, companies can negotiate better rates, resulting in lower overall costs for health care services.` |

|---|---|

Broader Coverage |

`Group plans often provide a wider range of coverage options, including preventive care, dental, and vision benefits.` |

Employee Retention |

`Offering comprehensive health plans can boost loyalty among employees, reducing turnover rates.` |

Key Features Of Group Health Plans

Group Health Plans, also known as employer-sponsored health insurance, are a popular choice for organizations to provide coverage for their employees. These plans offer a range of benefits, ensuring that employees have access to comprehensive healthcare services. Let’s explore three key features of Group Health Plans:

Employer Contribution

One of the major advantages of Group Health Plans is that employers typically contribute towards the cost of the premiums. This means that employees can enjoy the benefits of healthcare coverage at a more affordable rate. The employer’s contribution can vary, but it is usually a significant portion of the total premium cost.

Employee Eligibility

In order to be eligible for Group Health Plans, employees must meet certain criteria. These eligibility requirements may include factors such as the number of hours worked, length of employment, or full-time status. Employers have the flexibility to define the eligibility criteria based on their specific needs.

Network Providers

Group Health Plans often have a network of preferred providers that employees can choose from. These providers have agreed to offer services at lower rates to plan members. With access to a network of healthcare professionals, employees can receive quality care at reduced costs. It is important for employees to review the network of providers to ensure that their preferred healthcare providers are included.

Credit: http://www.linkedin.com

Types Of Group Health Plans

Types of Group Health Plans refers to the different options available for businesses to provide health coverage to their employees. These plans vary in terms of cost, coverage, and administration. Understanding the types of group health plans can help businesses make informed decisions about the best options for their employees.

Fully Insured Plans

Fully Insured Plans involve a contract between the employer and an insurance company. The employer pays a premium to the insurance company, and in return, the insurance company assumes the risk for paying employees’ claims. These plans are regulated by state laws and typically provide a range of coverage options, including medical, dental, and vision.

Self-funded Plans

Self-Funded Plans, also known as self-insured plans, involve the employer assuming the financial risk for providing healthcare benefits to employees. Rather than paying premiums to an insurance company, the employer pays the claims directly. While self-funded plans offer more flexibility and potential cost savings, they also carry the risk of higher expenses if employees require extensive medical care.

How Group Health Plans Benefit Employers

Group health plans are one of the most valuable benefits an employer can offer to employees. They provide a way for employers to ensure the health and well-being of their workforce, which in turn has numerous benefits for the employer. From attracting top talent to enjoying tax advantages, group health plans offer a range of perks for employers.

Attracting Talent

Group health plans can give employers a competitive edge in attracting and retaining top talent. In today’s job market, employees often prioritize comprehensive health benefits when considering potential employers. By offering a group health plan, employers can demonstrate their commitment to the well-being of their employees, making them an attractive choice for job seekers.

Tax Advantages

Employers can enjoy tax advantages by offering group health plans. Contributions made to the plan are often tax-deductible for the employer, providing a financial incentive for offering these benefits. Additionally, in some cases, employees’ contributions to the plan may be made on a pre-tax basis, reducing their taxable income and providing further savings for both the employee and the employer.

Reduced Administrative Burden

Group health plans can help reduce the administrative burden on employers. By offering a single plan that covers multiple employees, employers can streamline the management of benefits, eliminating the need to negotiate and manage individual policies for each employee. This can save time and resources, allowing employers to focus on other important aspects of running their business.

How Group Health Plans Benefit Employees

A group health plan is an excellent option for employees to enjoy comprehensive healthcare coverage while ensuring affordable costs. These plans offer several advantages that promote the well-being of employees and their families. In this section, we will explore the key benefits of group health plans for employees.

Affordability

Group health plans are designed to be affordable, allowing employees to access quality healthcare without straining their budgets. By spreading the costs among a large group, these plans have lower premiums compared to individual health insurance policies. Additionally, employers often contribute a portion of the premium, further reducing the financial burden on employees. This affordability ensures that employees can receive necessary medical care without worrying about exorbitant expenses.

Comprehensive Coverage

Group health plans provide comprehensive coverage that goes beyond basic healthcare needs. These plans typically include essential medical services such as doctor visits, hospital stays, emergency care, and prescription drugs. Moreover, they may cover additional services like mental health treatments, physical therapy, and chiropractic care. This comprehensive coverage ensures that employees have access to a wide range of medical services, promoting overall health and well-being.

Preventive Care

Prevention is crucial in maintaining good health and diagnosing potential health issues early on. Group health plans prioritize preventive care by covering routine check-ups, vaccinations, screenings, and preventive tests. This proactive approach helps detect any underlying conditions at an early stage, which can lead to more effective treatment and better health outcomes. By promoting preventive care, group health plans empower employees to take charge of their well-being and reduce the risk of serious health complications.

Considerations For Choosing Group Health Plans

Start of section: Considerations for Choosing Group Health PlansWhen selecting a group health plan for your employees, it is vital to consider various factors. Below are key aspects to focus on:

H3: Cost vs CoverageCost Vs Coverage

Cost: The expense of the group health plan should align with the budget while ensuring adequate coverage.

H3: Employee NeedsEmployee Needs

Individual Needs: Assess the diverse medical requirements and preferences of your employees.

H3: Provider NetworksProvider Networks

Network Coverage: Evaluate the accessibility of healthcare providers within the plan for seamless care.

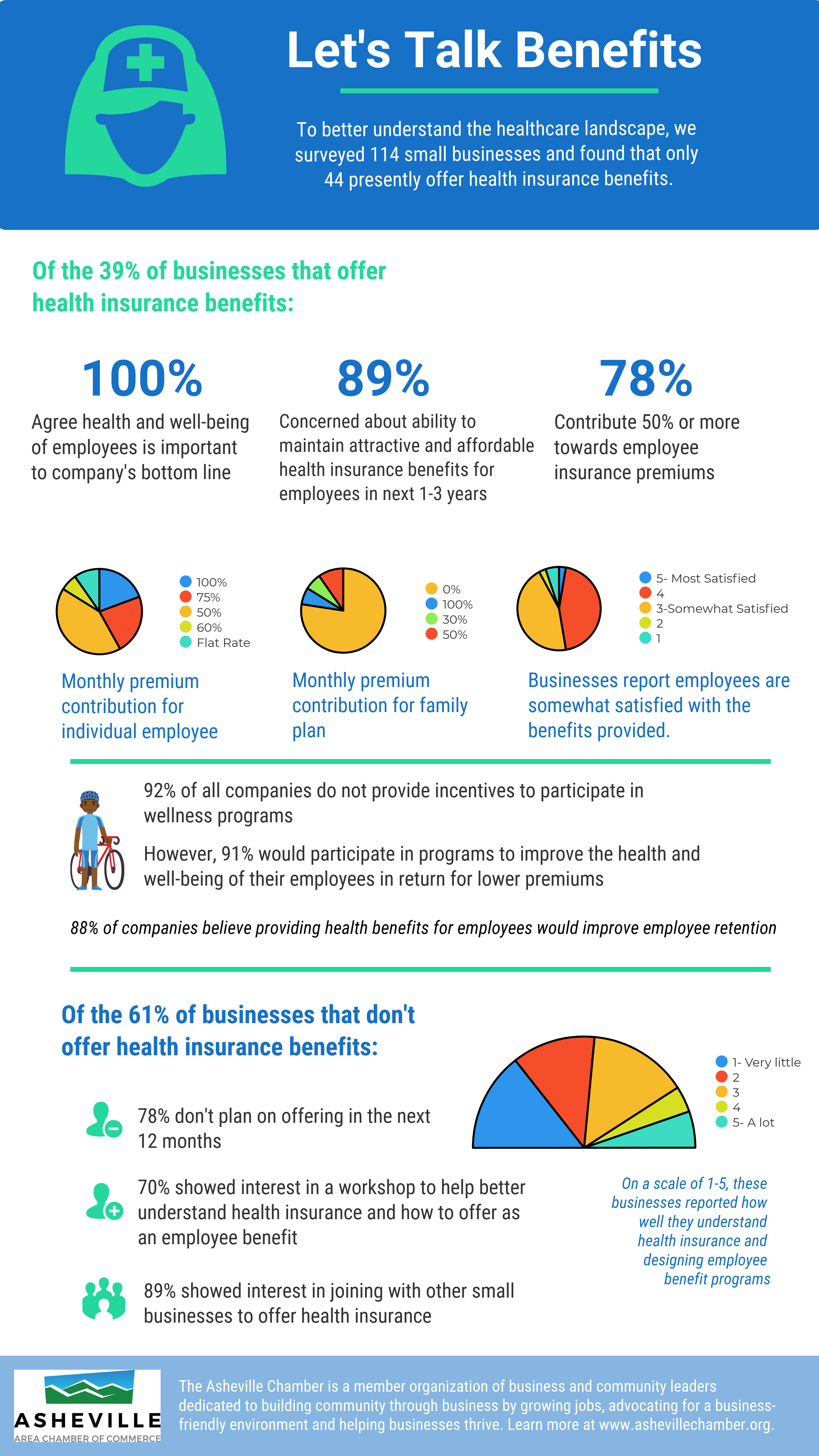

Credit: http://www.ashevillechamber.org

Regulatory Requirements For Group Health Plans

Group health plans are insurance plans that provide healthcare coverage to a group of people, typically employees in a company. These plans are subject to stringent regulatory requirements to ensure compliance with laws such as the Affordable Care Act and ERISA.

Compliance includes providing essential health benefits and prohibiting discrimination based on health status.

Erisa Compliance

Employers offering group health plans must comply with the Employee Retirement Income Security Act.

ERISA safeguards employees’ rights to vested benefits and outlines fiduciary responsibilities.

Group health plans must provide participants with a Summary Plan Description.

Employers must adhere to ERISA reporting and disclosure requirements.

Aca Regulations

The Affordable Care Act imposes rules on group health plans to ensure adequate coverage.

Employers must offer affordable coverage meeting minimum value requirements.

ACA prohibits annual and lifetime benefit limits on essential health benefits.

Employers with 50 or more full-time employees must offer health insurance or face penalties.

Frequently Asked Questions On What Are Group Health Plans

What Are Group Health Plans?

Group health plans are insurance plans offered by employers to cover medical expenses for employees. These plans often provide better coverage and lower costs than individual insurance plans, making them a valuable benefit for employees. They can include medical, dental, vision, and other health-related benefits.

How Do Group Health Plans Work?

Group health plans work by pooling together the resources of a group of people, usually employees of a company, to provide insurance coverage for medical expenses. Employers typically share the cost of premiums with employees, and the plans often offer a wider range of benefits at a lower cost than individual plans.

What Are The Benefits Of Group Health Plans?

Group health plans offer several benefits, including access to affordable healthcare, comprehensive coverage for medical expenses, and potential tax advantages for both employers and employees. These plans also promote a healthier workforce, improve employee retention, and can be tailored to meet the specific needs of the group.

What Is The Enrollment Process For Group Health Plans?

The enrollment process for group health plans typically involves employees signing up for coverage during a specified enrollment period. Employers provide information about plan options, costs, and coverage details, and employees can choose the plan that best meets their needs.

Enrollment may also occur during initial hiring or qualifying life events.

Conclusion

Group health plans provide valuable benefits to both employers and employees. By offering comprehensive healthcare coverage, these plans promote the well-being and productivity of employees. With access to a wide range of medical services and preventive care, individuals can better manage their health and reduce healthcare costs in the long run.

Moreover, group health plans encourage a culture of health and wellness within organizations, fostering a supportive and engaged workforce. Implementing a group health plan is a strategic decision that can positively impact the overall success of a business.

Leave a comment