Flood zone letters indicate the level of risk a property faces in terms of potential flooding. These letters provide information to property owners or prospective buyers about the flood zone designation of a particular area.

In the United States, flood zone letters refer to the classification assigned by the Federal Emergency Management Agency (FEMA) through their Flood Insurance Rate Map (FIRM) program. These designations categorize areas into different flood zones based on the likelihood and severity of flooding.

The letters, such as Zone A, Zone AE, Zone X, or Zone VE, indicate whether a property is in a high-risk flood zone, a moderate-risk zone, or in an area with minimal risk. These letters are crucial for property owners and buyers to assess the need for flood insurance and take appropriate measures to mitigate potential risks.

Credit: http://www.mdpi.com

Importance Of Flood Zone Letters

Flood zone letters denote the risk of flooding in a specific area. These letters are crucial for property owners and buyers to assess potential damage and secure appropriate insurance coverage. Understanding flood zone letters helps in making informed decisions about real estate investments and ensuring property protection.

START OF BLOG CONTENTDefinition And Purpose

Flood Zone Letters are official documents that determine a property’s flood risk status.

These letters are issued by FEMA and are crucial in assessing potential flooding hazards.

Impact On Property Value

Flood Zone Letters significantly influence a property’s overall value and potential insurance costs.

Properties in high-risk flood zones may experience lower resale value and higher insurance premiums.

Importance of Flood Zone Letters:

Understanding a property’s flood zone status is essential for mitigating potential risks.

__Homeowners__ can make informed decisions about insurance, renovations, and disaster preparedness.

Properties in low-risk zones may enjoy higher market value and insurance affordability.

Flood Zone Letters serve as a critical tool in ensuring property protection and financial security.

END OF BLOG CONTENT

Credit: http://www.nature.com

Types Of Flood Zones

Flood zone letters indicate different types of flood zones and their risk level for potential flooding. These letters help homeowners understand the flood risk and determine appropriate insurance coverage.

Flood zones are geographical areas that are categorized based on their risk of flooding. Understanding the different types of flood zones is crucial for homeowners, as it helps determine their insurance rates, building requirements, and overall flood risk.

Understanding Fema Designations

FEMA, the Federal Emergency Management Agency, designates flood zones across the United States. The agency uses an alphanumeric system to categorize different flood zones, with each designation representing a specific level of flood risk. These designations are crucial for homeowners and insurance companies to assess the potential for flooding in a particular area.

Commonly Used Flood Zone Letters

Let’s take a closer look at some of the most commonly used flood zone letters and what they mean:

| Flood Zone Letter | Description |

|---|---|

| A | Areas with a high risk of flooding, often located near bodies of water, such as rivers or lakes. |

| V | Coastal areas with a high risk of flooding due to storm surges and wave action. |

| X | Areas with minimal flood risk, typically located on higher ground or further away from bodies of water. |

| AE | High-risk areas susceptible to flooding from both river and storm-related sources. |

| AO | Areas with a high risk of shallow flooding, often caused by heavy rainfall or slow-draining sources. |

| X500 | Areas with moderate flood risk, typically located outside the 100-year floodplain. |

| C | Areas of moderate risk due to ponding or local drainage issues. |

It’s essential to note that flood zone letters can vary by location. Depending on your area, you may encounter additional flood zone designations or variations of the above letters. Consulting with your local authorities or insurance provider can provide more information about the flood zone designations specific to your region.

Deciphering Flood Zone Letters

Unravel the significance of flood zone letters to understand the specific flood risks associated with a property. These letters determine the level of flood insurance required and help property owners make informed decisions to safeguard their assets.

Deciphering Flood Zone Letters When it comes to understanding flood zones and the potential risks they pose, deciphering flood zone letters is crucial. These letters contain valuable information about the flood risk level of a specific property or area, helping homeowners, insurance providers, and government agencies make informed decisions. In this section, we will explore the key components of a flood zone letter and guide you through the process of interpreting flood risk levels.Key Components Of A Flood Zone Letter

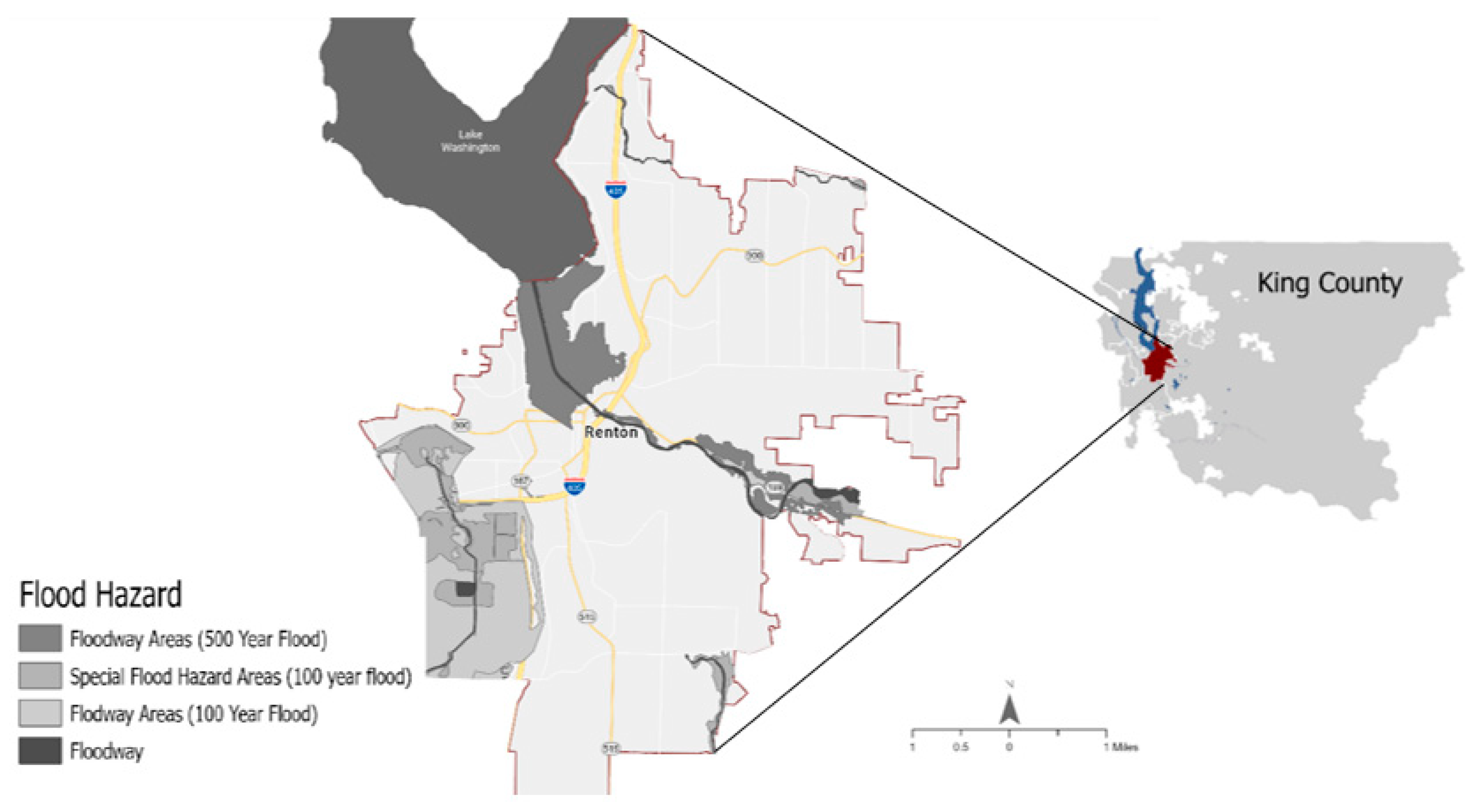

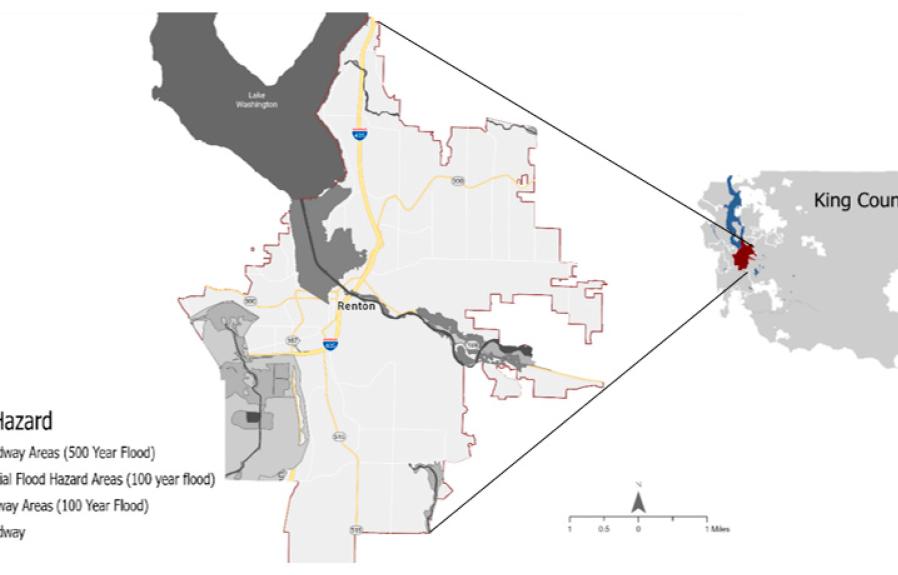

A flood zone letter typically consists of several key components that provide essential details about the flood risk associated with a property. By understanding these components, you can gain insights into the potential dangers of flooding in a specific area. Here are the key components to look for in a flood zone letter: – Property Information: The flood zone letter will contain specific details about the property, including its address, parcel number, and other identifying information. This section ensures that the letter pertains to the correct property and eliminates any potential confusion. – Flood Zone Designation: The flood zone designation is arguably the most critical component of the letter. It indicates the level of flood risk associated with the property, ranging from moderate to high risk. Each flood zone has a unique designation, such as Zone A, Zone B, or Zone X, assigned by the Federal Emergency Management Agency (FEMA). – Base Flood Elevation (BFE): The Base Flood Elevation (BFE) is the predicted height that floodwaters are expected to reach during a one percent annual chance flood event. This component provides vital information for determining the potential severity of flooding and evaluating the adequacy of flood insurance coverage. – Special Flood Hazard Areas (SFHAs): SFHAs are areas with a high risk of flooding where flood insurance is typically mandatory. These areas are designated based on factors like historical flood data, topography, and hydraulic modeling. The flood zone letter will identify whether the property falls within an SFHA or not. – Flood Insurance Rate Map (FIRM): The FIRM is a map provided by FEMA that depicts flood risks in a particular area. It shows the different flood zones, as well as the base flood elevation and other relevant information. The flood zone letter may reference the FIRM to further illustrate the flood risk associated with the property.Interpreting Flood Risk Levels

Understanding the flood risk levels mentioned in the flood zone letter is essential for making informed decisions regarding insurance coverage and property investments. Here’s a breakdown of how to interpret flood risk levels: – High-Risk Zones (e.g., Zones A, AE, and VE): Properties located in high-risk zones face a significant risk of flooding. These areas have a 26 percent or higher chance of flooding over the life of a 30-year mortgage. Flood insurance is typically mandatory in these zones, and property owners should take necessary precautions to mitigate potential damages. – Moderate-Risk Zones (e.g., Zone X): Moderate-risk zones have a relatively lower risk of flooding compared to high-risk zones, but there is still a moderate chance of flooding. Nevertheless, it is recommended that property owners in these zones consider obtaining flood insurance, as flooding can still occur due to the unpredictable nature of weather patterns. – Minimal-Risk Zones (e.g., Zone C): Properties located in minimal-risk zones are considered to have the lowest flood risk. However, it’s important to note that minimal risk does not mean zero risk. Floods can occur due to unforeseen circumstances, such as intense rainfall or changes in drainage patterns. Therefore, property owners may still want to consider obtaining optional flood insurance. By understanding the key components of a flood zone letter and interpreting the flood risk levels properly, you can make educated decisions to protect your property and assets from potential flood-related damages.| Zone Designation | Flood Risk Level | Description |

|---|---|---|

| Zone A, AE, VE | High | Significant risk of flooding; flood insurance usually mandatory |

| Zone X | Moderate | Relatively lower risk, but flood insurance is still recommended |

| Zone C | Minimal | Lowest risk, but optional flood insurance may still be worth considering |

Factors Influencing Flood Zone Determination

Flood zone designation is based on several crucial factors that impact the level of flood risk in a particular area. Understanding these factors can help property owners make informed decisions about flood insurance and mitigation measures.

Location And Topography

- Low-lying areas are more prone to flooding.

- Proximity to rivers, lakes, and oceans increases flood risk.

- Elevation plays a key role in determining flood zones.

Historical Flooding Data

- Past instances of flooding in the area are taken into consideration.

- Frequency and severity of previous floods influence flood zone determination.

- Records of flooding help assess the potential for future risks.

These factors are thoroughly evaluated by experts to accurately determine the flood zone of a specific location.

Mitigation Strategies For High-risk Zones

Mitigation strategies for high-risk flood zones are essential to reduce the potential impact of flooding on properties and communities. These strategies include elevating structures, complying with flood insurance requirements, and implementing measures to minimize the risk of flood damage. Understanding these mitigation strategies is crucial for individuals and communities living in high-risk flood zones to protect lives and property.

Elevating Structures

Elevating structures is a key mitigation strategy for properties located in high-risk flood zones. By raising the elevation of buildings, homes, and other structures, the risk of flood damage can be significantly reduced. Elevating structures helps to keep the living space and essential utilities above the potential floodwaters, mitigating the risk of damage and the need for costly repairs.

Flood Insurance Requirements

Compliance with flood insurance requirements is essential for properties located in high-risk flood zones. Flood insurance provides financial protection in the event of flood damage, helping property owners mitigate the financial impact. Understanding and adhering to flood insurance requirements ensures that property owners have the necessary coverage to recover from potential flood-related losses.

Credit: http://www.carpetcleaningforce.co.nz

Challenges And Controversies

Challenges and Controversies:

Accuracy And Updating Of Flood Maps

Flood zone designations are based on flood maps, which outline the areas prone to flooding. The accuracy and updating of these maps are crucial for determining property insurance rates and construction regulations.

The challenge lies in ensuring that these flood maps are regularly updated to reflect the evolving landscape, coastal erosion, and new development. Outdated maps can lead to misinformed zoning decisions, creating potential risks for property owners and communities.

Community Disagreements On Zoning

Community disagreements on zoning often stem from varying perspectives on the impact of flood zone designations. Some argue that strict zoning limits development and affects property values, while others emphasize the importance of enforcing zoning regulations to mitigate flood risks.

These disputes can spark controversies within communities, leading to debates on property rights, environmental protections, and economic considerations. Finding a balance between sustainable development and flood risk management remains a contentious issue among stakeholders.

Legal And Financial Ramifications

Understanding flood zone letters is crucial due to the legal and financial implications they carry.

Disclosure Laws For Home Sellers

Home sellers are required by law to disclose the flood zone status of their property to potential buyers.

Insurance Premiums

Flood zone letters impact insurance premiums with higher risk zones leading to increased costs.

Future Trends In Flood Risk Assessment

In recent years, the field of flood risk assessment has witnessed significant advancements. These advancements have been driven by various factors such as advancements in mapping technology and the increasing impacts of climate change. Let’s explore the future trends in flood risk assessment in more detail:

Advancements In Mapping Technology

The development of advanced mapping technology has revolutionized flood risk assessment. Geographic Information Systems (GIS) and remote sensing techniques enable experts to analyze and visualize flood-prone areas more accurately. These systems provide vital data on elevation, rainfall patterns, land use, and hydrological features, which aid in identifying vulnerable zones more precisely.

Moreover, the emergence of high-resolution satellite imagery has further enhanced flood mapping capabilities. These images provide detailed insights into the topography and vegetation cover that influence the flow of water during flooding events.

Modern mapping technology also allows for the integration of real-time data from weather stations and river gauges into flood risk assessment models. This integration ensures that flood risk assessments are more up-to-date and reflective of current conditions, improving their overall accuracy.

Furthermore, the utilization of LiDAR (Light Detection and Ranging) technology has proven instrumental in producing highly accurate elevation data. LiDAR uses laser pulses to measure the distance between the sensor and the Earth’s surface, enabling experts to create precise digital elevation models. These models are crucial for assessing flood risk as they establish the heights and slopes in flood-prone areas.

Climate Change Impacts

Climate change is undeniably one of the greatest challenges of our time, impacting numerous aspects of our environment, including flood risk. Rising global temperatures, shifting precipitation patterns, and intensifying storms are all contributing to increased flood risk in many regions.

As climate change continues to progress, flood risk assessments need to incorporate these evolving dynamics. By analyzing climate models and historical data, experts can better predict future flood scenarios. These predictions consider factors like sea-level rise, changes in rainfall patterns, and altering weather extremes, enabling stakeholders to adapt and plan accordingly.

Understanding the relationship between climate change and flood risk is crucial for developing effective flood mitigation strategies. By identifying vulnerable areas, stakeholders can implement robust measures such as flood-proofing infrastructure, land-use zoning, and enhanced drainage systems to minimize the impact of future floods.

In conclusion, future trends in flood risk assessment are poised to deliver more accurate and comprehensive information. Advancements in mapping technology, in conjunction with a deeper understanding of climate change impacts, will enable stakeholders to make informed decisions and take proactive measures in managing flood risks effectively.

Frequently Asked Questions On What Do Flood Zone Letters Mean

What Is A Flood Zone Letter?

A flood zone letter is a document that identifies the level of flood risk for a specific property. It is usually required by mortgage lenders to assess the potential for flood damage and determine the need for flood insurance.

How To Obtain A Flood Zone Letter?

To obtain a flood zone letter, you can contact the Federal Emergency Management Agency (FEMA) or a licensed land surveyor. You’ll need to provide the property’s address and possibly pay a fee for the service.

What Information Does A Flood Zone Letter Contain?

A flood zone letter typically includes the property’s location, flood zone designation, base flood elevation, and any available flood insurance rate maps. This information helps property owners and insurers determine the risk of flooding and the need for insurance coverage.

Why Is A Flood Zone Letter Important?

A flood zone letter is important because it provides essential information about the potential risk of flooding for a property. This information is crucial for property owners, insurance companies, lenders, and local authorities to make informed decisions about flood insurance, property development, and emergency planning.

Conclusion

To summarize, flood zone letters are crucial documents that provide valuable information about the level of flood risk associated with a property. By understanding the different flood zones and their implications, homeowners can make informed decisions regarding insurance coverage and property investments.

These letters serve as essential tools for property owners, real estate professionals, and insurance companies alike. By staying informed about the flood risk, individuals can take proactive measures to protect their investments and ensure their safety.

Leave a comment