Endowment policies in Bangladesh offer a combination of insurance coverage and investment. These policies provide financial security to the insured and potential returns in the future.

In Bangladesh, endowment policies are popular among individuals looking for a way to protect their loved ones and save for the future. With various options available in the market, it is essential to understand the features and benefits of each policy to make an informed decision.

Endowment policies can serve as a tool for financial planning and goal setting, ensuring a secure future for oneself and one’s family. By choosing the right policy that aligns with one’s financial goals, individuals in Bangladesh can secure their future and achieve peace of mind.

Benefits Of Endowment Policies

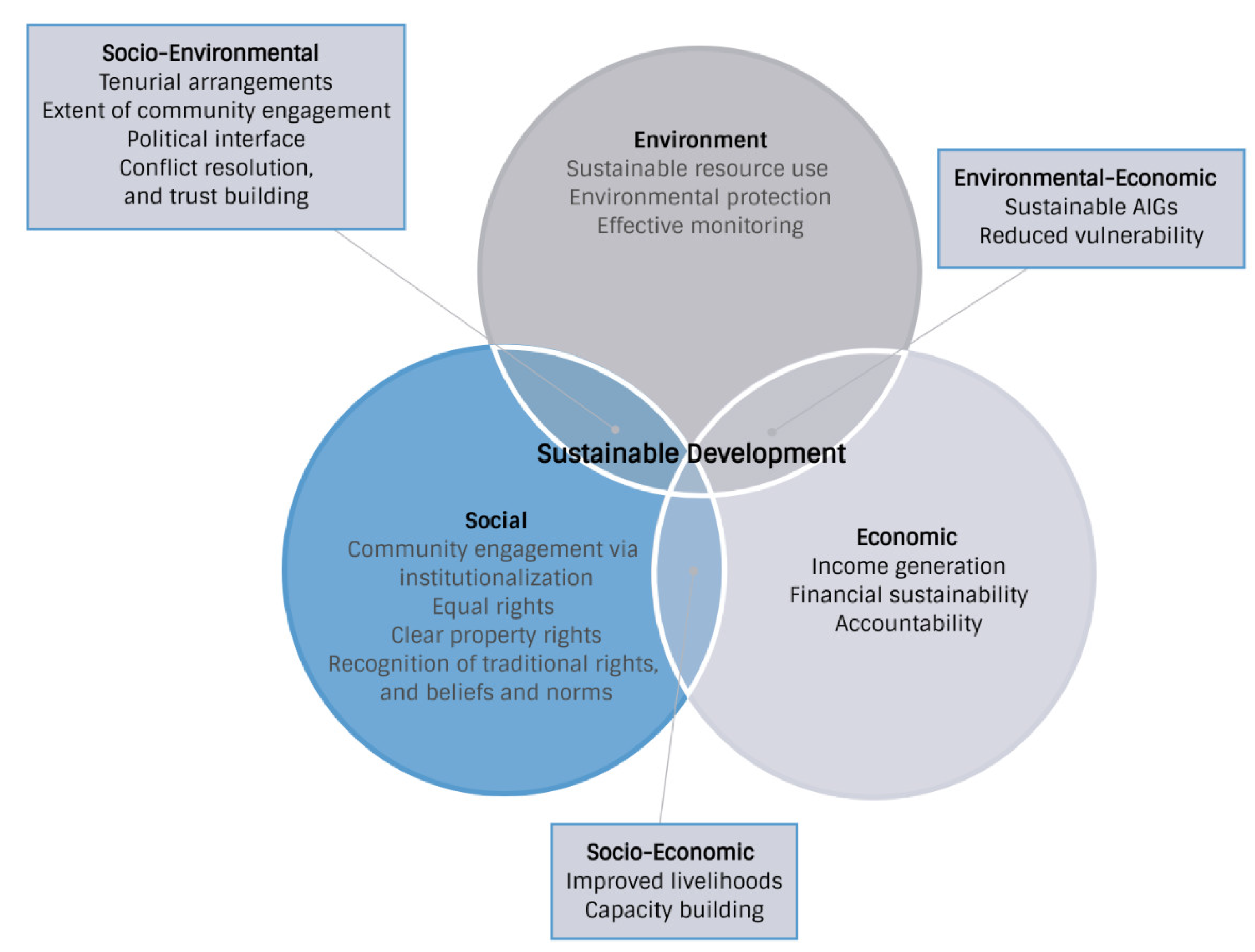

Endowment policies in Bangladesh offer a range of benefits that provide individuals with Guaranteed Financial Security, substantial Savings and Investment Opportunities.

Guaranteed Financial Security

Endowment policies ensure a secure financial future by providing recipients with a guaranteed lump sum payout at the policy’s maturity.

Savings And Investment Opportunities

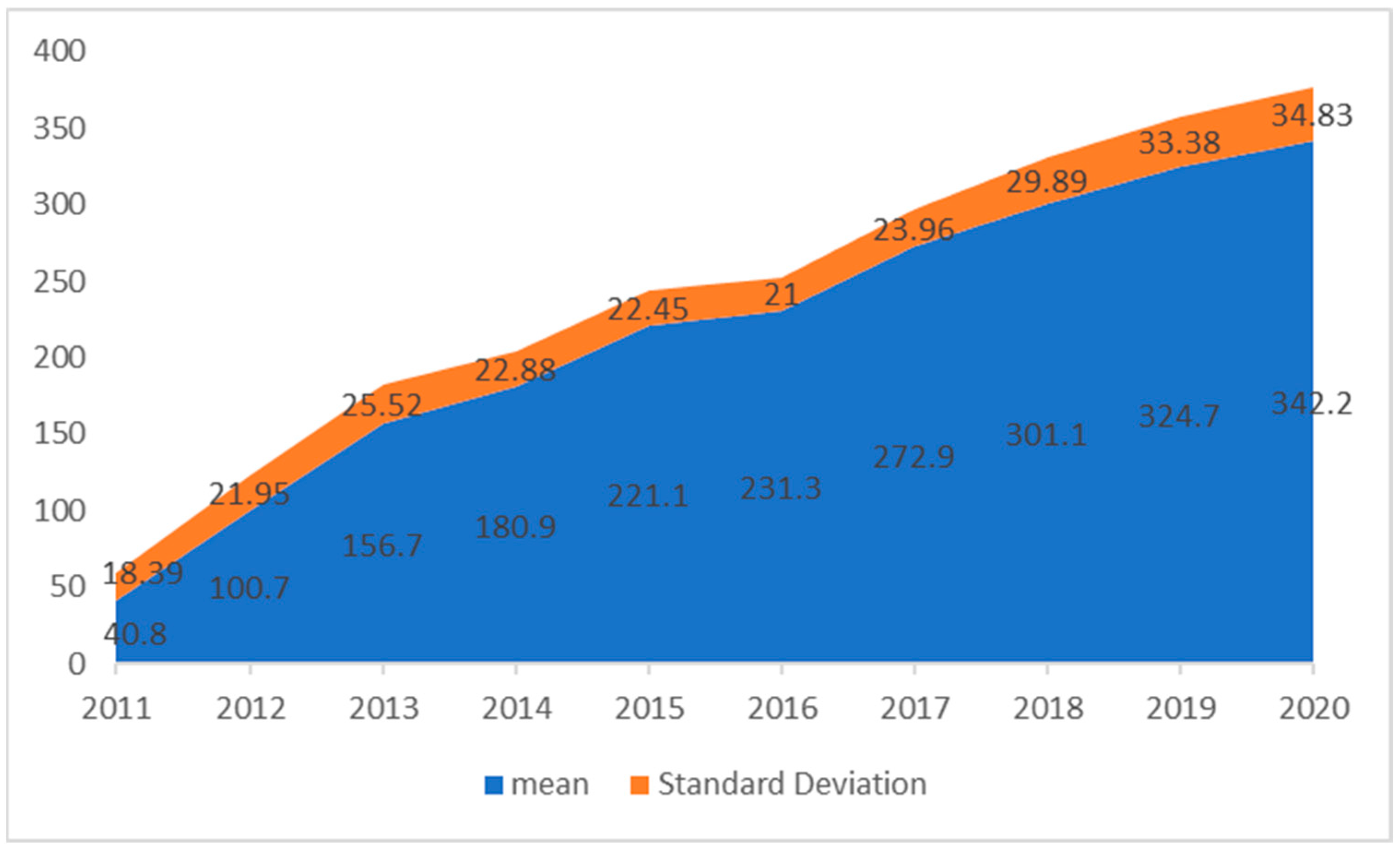

Endowment policies serve as both a savings tool and an investment vehicle, allowing individuals to accumulate funds over time while enjoying the benefits of financial growth.

Credit: http://www.mdpi.com

Types Of Endowment Policies

Endowment policies in Bangladesh offer a range of options for individuals seeking financial security with long-term investment opportunities. These policies include traditional endowment plans, unit-linked endowment policies, and savings-oriented endowment policies, ensuring flexibility and tailored coverage to meet individual needs.

Choose the right endowment policy to secure your future financial goals.

Types of Endowment PoliciesTraditional Endowment Policies

Traditional policies offer fixed benefits upon maturity, suitable for risk-averse individuals.Unit-linked Endowment Policies

Unit-linked policies combine insurance with investment, offering potential higher returns for investors. Endowment policies in Bangladesh cater to diverse financial needs. Traditional policies guarantee fixed benefits upon maturity, appealing to those seeking stability. On the other hand, unit-linked policies provide a mix of insurance and investment, attracting individuals desiring growth potential.Factors To Consider

Choosing the right endowment policy in Bangladesh is an important decision that requires careful consideration of various factors. These factors will determine the suitability and effectiveness of the policy in meeting your financial goals. Here are three key factors you should take into account:

Policy Term

The duration of the policy, known as the policy term, is an essential consideration when selecting an endowment policy. It typically ranges from 5 to 30 years, and the length of the term will depend on your financial objectives and circumstances. Longer-term policies may provide a greater scope for accumulating funds and earning returns over time, while shorter-term policies offer a quicker payout. Determine the policy term that aligns with your financial goals, ensuring it provides the necessary time to achieve your objectives.

Premium Flexibility

Another crucial factor to consider is the flexibility of premium payments. Endowment policies in Bangladesh offer various payment options, including monthly, quarterly, half-yearly, or annual premiums. Assess your financial capabilities and choose a premium payment frequency that is convenient and suits your cash flow. Flexibility in premium payments allows you to manage your policy more effectively, ensuring you can sustain the payments throughout the policy term without facing financial strain.

Death Benefit

The death benefit is an essential feature of an endowment policy as it provides financial security to your loved ones in case of your untimely demise. When selecting a policy, carefully review and compare the death benefit options offered by different insurers. Ensure the policy offers sufficient coverage to protect your family’s financial well-being and consider additional riders or benefits that can be added to enhance the death benefit. It is crucial to understand the terms and conditions of the death benefit, including any exclusions or limitations, to make an informed decision.

How To Choose The Right Endowment Policy

When it comes to securing your future financial goals, choosing the right endowment policy is an important decision to make. The right policy can provide you with financial security and help you achieve your long-term objectives. Here’s how you can choose the right endowment policy for your needs:

Assessing Financial Goals

Before selecting an endowment policy, it’s essential to assess your financial goals. Determine the amount of coverage you need and the duration of the policy. Consider your long-term financial milestones such as buying a house, funding your children’s education, or retirement planning.

Comparing Policy Features

Compare the features of different endowment policies available in Bangladesh. Look at the premium amount, policy term, maturity benefits, and additional bonuses offered by various providers. Consider policies from reputable insurers with a strong track record for delivering on their promises.

Seeking Professional Advice

Don’t hesitate to seek professional advice when choosing an endowment policy. A financial advisor can help you understand the complexities of the policies, assess your specific needs, and recommend the most suitable options for you. They can also provide valuable insights into the current market trends and help you make an informed decision.

Faqs About Endowment Policies

Endowment policies are a popular choice for individuals in Bangladesh who want to plan for their future financial needs. These policies offer a combination of insurance coverage and savings, providing a lump sum amount at the end of the policy term. Here are the answers to some frequently asked questions about endowment policies:

What Is The Surrender Value Of An Endowment Policy?

The surrender value of an endowment policy is the amount that the policyholder is entitled to receive if they decide to terminate the policy before its maturity. It is usually a percentage of the sum assured and the accumulated bonuses, subject to certain terms and conditions outlined in the policy document.

Can I Borrow Against My Endowment Policy?

Yes, most endowment policies allow the policyholder to take a loan against the policy’s cash value. The loan amount is typically a percentage of the policy’s surrender value and is subject to the terms and conditions specified by the insurance company. The outstanding loan amount accrues interest and may affect the final payout of the policy.

What Happens If I Stop Paying Premiums?

If you stop paying premiums, the endowment policy may lapse or be converted into a reduced paid-up policy. In the case of a lapsed policy, the insurance coverage ceases, and the policy’s benefits are lost. However, if the policy has acquired a surrender value, the policyholder may opt to convert it into a reduced paid-up policy, which offers a reduced sum assured and maturity benefits.

Credit: carnegieendowment.org

Credit: http://www.mdpi.com

Frequently Asked Questions On What Endowment Policy For Bangladesh

What Is An Endowment Policy In Bangladesh?

An endowment policy in Bangladesh is a life insurance plan that offers a combination of savings and protection. It provides a lump sum amount on maturity or in the event of the policyholder’s demise. This policy serves as a financial safeguard for the insured and their beneficiaries.

How Does An Endowment Policy Benefit Individuals In Bangladesh?

An endowment policy in Bangladesh serves as a long-term savings tool with a life insurance component. It offers financial security, acts as a source of regular income, and helps in achieving future financial goals. The policy also provides a lump sum amount on maturity or in case of an unfortunate event.

What Are The Key Features Of An Endowment Policy For Individuals In Bangladesh?

Key features of an endowment policy in Bangladesh include a savings component with a specific maturity date, life coverage, and the option to avail loans against the policy’s value. The policy enables individuals to build a corpus for the future while ensuring protection for their loved ones.

Conclusion

In a rapidly developing country like Bangladesh, an endowment policy can provide financial security and stability to individuals and their families. With its unique features and benefits, an endowment policy offers a combination of insurance coverage and savings opportunities. By choosing the right endowment policy, individuals can ensure a solid financial foundation for the future.

So, explore the options available and make an informed decision to secure your financial well-being.

Leave a comment