Jaw surgery is typically covered by medical insurance if it is deemed necessary for oral health or functional reasons. Jaw surgery, also known as orthognathic surgery, is a procedure that corrects abnormalities or structural issues in the jawbones and teeth.

It can improve chewing, swallowing, speech, and overall aesthetics. Insurance coverage for jaw surgery depends on various factors, such as the insurer’s policies, the severity of the condition, and the necessity of the surgery. In most cases, medical insurance covers jaw surgery if it is considered medically necessary for oral health or functional reasons.

However, cosmetic or elective jaw surgery may not be covered by insurance. It is advisable to consult with your insurance provider and healthcare professional to determine if your specific case qualifies for coverage.

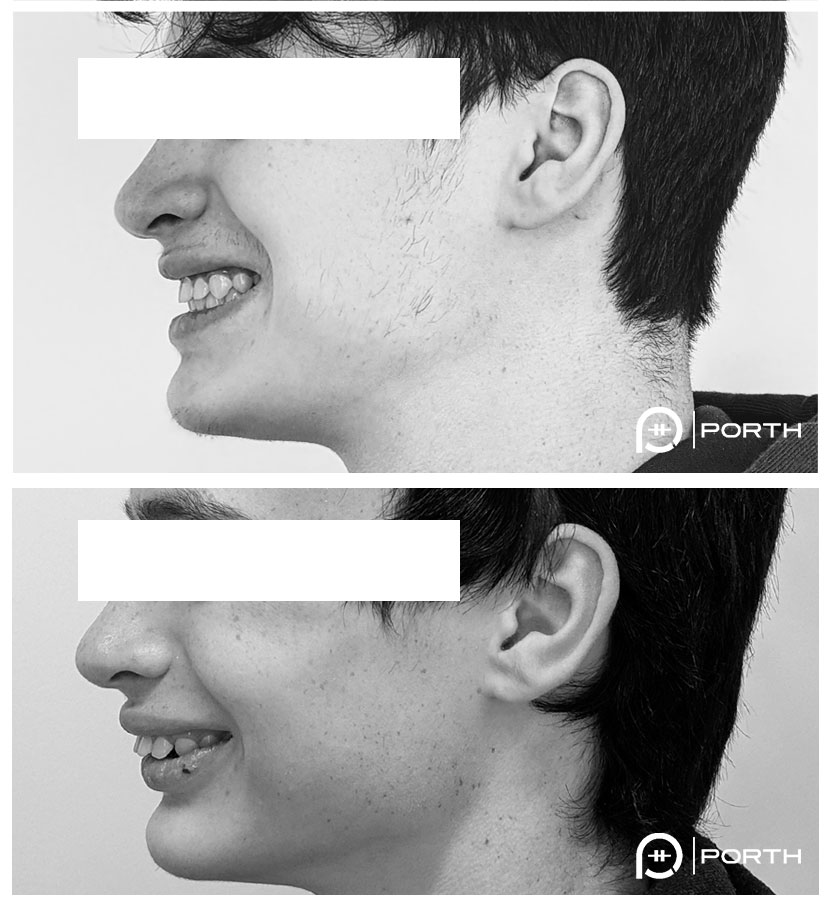

Credit: porth.io

Types Of Insurance Plans

Jaw surgery is a crucial procedure that may be necessary for various reasons. Understanding what insurance covers in relation to jaw surgery is essential to help manage the costs effectively. Different types of insurance plans can help offset the expenses associated with jaw surgery. Let’s explore the coverage offered by Health Insurance and Dental Insurance.

Health Insurance

Health insurance typically covers a portion of the cost of medically necessary jaw surgery. This can include procedures such as corrective jaw surgery to address conditions like misaligned jaws or obstructive sleep apnea.

Dental Insurance

Dental insurance may provide coverage for specific dental-related aspects of jaw surgery, such as the removal of impacted teeth or treatment of temporomandibular joint (TMJ) disorders.

Coverage For Jaw Surgery

When it comes to jaw surgery, understanding what insurance covers can provide much-needed peace of mind. Jaw surgery, also known as orthognathic surgery, is a procedure that corrects problems related to the jawbone, including misalignments, congenital defects, and traumas. It can improve both function and appearance, leading to a better quality of life. However, the cost of jaw surgery can be a concern for many individuals. That’s where insurance coverage comes into play.

Inclusions In Health Insurance

Health insurance often provides coverage for necessary medical procedures, and jaw surgery is no exception. While specific coverage can vary depending on your insurance provider and plan, there are common inclusions to be aware of:

- Diagnostic and pre-operative testing: Health insurance usually covers diagnostic tests, such as X-rays and CT scans, to determine the need for jaw surgery. Additionally, pre-operative tests like blood work and medical consultations are typically covered.

- Anesthesia and surgical fees: The cost of anesthesia and surgical fees associated with jaw surgery is often covered by health insurance. This ensures that you receive the necessary anesthesia during the procedure and that the surgical team is compensated.

- Hospital stay and post-operative care: Health insurance typically covers the cost of hospital stay after jaw surgery. This includes the expenses associated with the hospital room, nursing care, medications, and follow-up visits to your surgeon.

- Orthodontic treatment: In some cases, health insurance may cover a portion of the orthodontic treatment required before and after jaw surgery. This can help offset the costs of braces, aligners, or other orthodontic appliances.

Inclusions In Dental Insurance

While health insurance generally covers the medical aspects of jaw surgery, dental insurance may cover specific dental-related components of the procedure. Here are some common inclusions in dental insurance:

- Surgical extraction of impacted teeth: Dental insurance often covers the surgical extraction of impacted teeth, which is sometimes necessary before jaw surgery.

- Dental imaging: Dental insurance may cover dental imaging services, such as panoramic X-rays, to aid in the diagnosis and planning of jaw surgery.

- Oral examinations and consultations: Most dental insurance plans include coverage for oral examinations and consultations related to jaw surgery.

- Dental prosthetics: If jaw surgery requires the placement of dental prosthetics, such as dental implants or dentures, dental insurance may contribute to the cost.

Remember, the coverage for jaw surgery varies depending on your specific insurance plan. It is essential to review your policy documents, speak with your insurance provider, and consult with your healthcare team to understand your coverage and any out-of-pocket expenses you may incur.

Factors Affecting Coverage

Pre-existing Conditions

Pre-existing conditions, such as a history of jaw problems or related issues, can significantly impact insurance coverage for jaw surgery. Insurance providers often consider these conditions as high-risk factors, potentially affecting the approval of coverage or leading to higher premiums.

Policy Limitations

Policy limitations play a crucial role in determining the extent of coverage for jaw surgery. Many insurance policies have specific clauses that define the scope of coverage for surgical procedures, including jaw surgery. Familiarizing yourself with these limitations is essential to avoid any surprises and plan for potential out-of-pocket expenses.

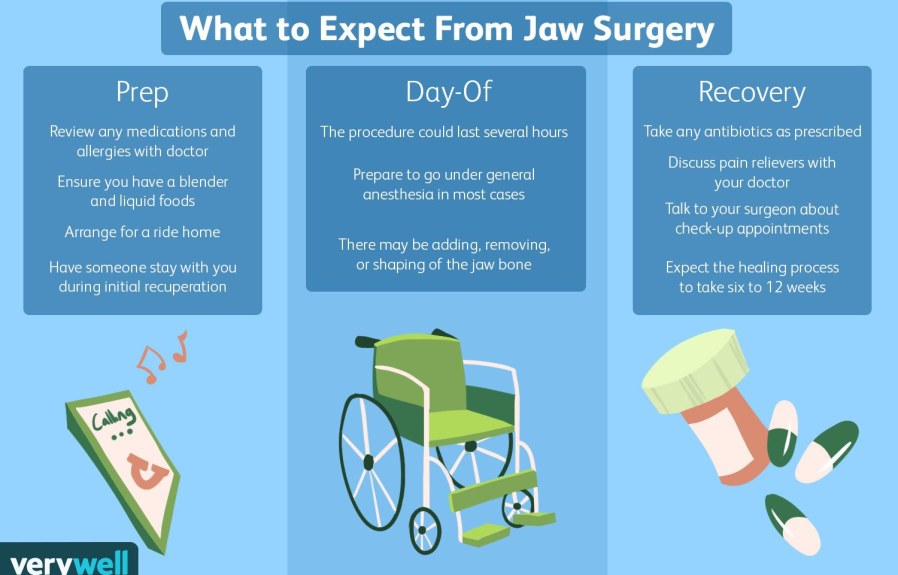

:max_bytes(150000):strip_icc()/location_TMJ-8c436a827bcd44c6ba1223b70e6c8d9e.jpg)

Credit: http://www.verywellhealth.com

How To Check Coverage

When it comes to jaw surgery, understanding what insurance covers can be crucial for managing the associated costs. Checking your coverage is essential to avoid unexpected financial burdens. Below, we will discuss how to check your insurance coverage for jaw surgery.

Reviewing Insurance Policy

Begin by reviewing your insurance policy to determine what is covered under your plan. Look for specific information related to surgical procedures, including jaw surgery. This may include details on coverage limits, deductibles, and any pre-authorization requirements. It’s important to understand the terms and conditions outlined in your policy to gain clarity on the extent of coverage for jaw surgery.

Contacting Insurance Provider

Next, contact your insurance provider to inquire about coverage for jaw surgery. Have your policy information readily available, and be prepared to ask detailed questions. Inquire about the specific codes or terminology related to jaw surgery to ensure accurate information. Be sure to document all interactions with your insurance provider, including dates, names, and details of the conversation.

Alternative Payment Options

Although jaw surgery is often a necessary procedure that can greatly improve quality of life, the costs can be a major concern for many patients. Thankfully, there are alternative payment options available to make this important treatment more accessible. These options include Flexible Spending Accounts (FSAs) and Payment Plans. In this article, we will explore how these options can help you cover the expenses of jaw surgery, allowing you to focus on your recovery without the burden of financial stress.

Flexible Spending Accounts (fsas)

Flexible Spending Accounts (FSAs) are a popular alternative payment option that many individuals rely on to cover the costs of medical procedures, including jaw surgery. An FSA is a tax-advantaged savings account offered by employers, allowing employees to set aside a portion of their pre-tax earnings to pay for qualified medical expenses.

Using an FSA to cover your jaw surgery costs can provide several advantages. First and foremost, the money set aside in an FSA is exempt from federal, state, and FICA taxes, which can result in significant savings. Additionally, FSAs often have higher contribution limits, allowing you to save more money specifically for medical expenses like jaw surgery. This means that you can allocate more funds toward your procedure without worrying about the tax consequences.

It’s worth noting that FSAs operate on a use-it-or-lose-it principle. This means that any funds not used by the end of the plan year may be forfeited, so it’s important to plan accordingly and estimate your jaw surgery costs accurately. Be sure to consult with your employer or benefits administrator to understand the specific rules and regulations regarding FSAs at your workplace.

Payment Plans

If you are unable to pay for jaw surgery upfront or do not have access to an FSA, payment plans can offer a practical solution. Many oral and maxillofacial surgeons understand the financial strain that jaw surgery can cause and are willing to work with patients to create a personalized payment plan.

A payment plan allows you to spread out the cost of your jaw surgery over a period of time, typically with monthly installments. The specific terms, such as the duration of the payment plan and the amount of each installment, will vary depending on the surgeon and facility. It’s essential to communicate with your surgeon’s office to discuss your financial situation and explore the available payment plan options.

When considering a payment plan, it’s crucial to understand the terms and conditions. Some surgeons may charge interest or additional fees for offering this service. Take the time to review and compare multiple options to ensure you find the best payment plan that suits your budget and needs.

Credit: porth.io

Steps To Maximize Coverage

Securing insurance coverage for jaw surgery can be complex. To ensure you get the best coverage, follow these crucial steps:

Getting Pre-authorization

Pre-authorization is vital for determining the extent of coverage for jaw surgery. Always obtain pre-authorization before proceeding with the procedure.

Choosing In-network Providers

Select providers within your insurance network to maximize coverage. In-network providers are more likely to be covered at a higher percentage.

Frequently Asked Questions For What Insurance Covers Jaw Surgery

What Are The Types Of Insurance That Cover Jaw Surgery?

Some types of insurance, such as health insurance, dental insurance, and medical savings accounts, may cover jaw surgery. However, coverage varies depending on the specific plan and individual circumstances.

How Can I Determine If My Insurance Covers Jaw Surgery?

To find out if jaw surgery is covered by your insurance, it’s important to contact your insurance provider directly. Ask for detailed information about your coverage, including any potential out-of-pocket expenses and required pre-authorizations.

What Factors Determine Insurance Coverage For Jaw Surgery?

Insurance coverage for jaw surgery often depends on factors such as medical necessity, the extent of the procedure, and whether it’s considered a fundamental part of your overall treatment plan. It’s crucial to consult with your insurance provider for specific details.

Conclusion

Jaw surgery can be a life-changing procedure that not only improves your oral health but also enhances your overall well-being. While insurance coverage for jaw surgery may vary, it is essential to understand what your policy entails and what expenses it covers.

By consulting with your insurance provider and understanding the specific details of your plan, you can ensure a smooth and hassle-free process. Remember, knowledge is power, and with the right insurance coverage, you can confidently embrace your journey towards a healthier smile.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What are the Types of Insurance That Cover Jaw Surgery?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Some types of insurance, such as health insurance, dental insurance, and medical savings accounts, may cover jaw surgery. However, coverage varies depending on the specific plan and individual circumstances.” } } , { “@type”: “Question”, “name”: “How Can I Determine if My Insurance Covers Jaw Surgery?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To find out if jaw surgery is covered by your insurance, it’s important to contact your insurance provider directly. Ask for detailed information about your coverage, including any potential out-of-pocket expenses and required pre-authorizations.” } } , { “@type”: “Question”, “name”: “What Factors Determine Insurance Coverage for Jaw Surgery?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Insurance coverage for jaw surgery often depends on factors such as medical necessity, the extent of the procedure, and whether it’s considered a fundamental part of your overall treatment plan. It’s crucial to consult with your insurance provider for specific details.” } } ] }

Leave a comment