A retirement plan distribution refers to the process of withdrawing funds from a retirement savings account for personal use. Retirement plan distributions enable individuals to access the money they have saved in retirement accounts, such as 401(k)s or individual retirement accounts (IRAs), when they are ready to retire.

These distributions can take various forms, including lump-sum payments, periodic payments, or annuities. The purpose of a retirement plan distribution is to provide individuals with income during their retirement years. It is crucial to plan these distributions strategically to ensure financial stability and meet long-term goals.

Understanding the rules, tax implications, and withdrawal options associated with retirement plan distributions is essential to make informed decisions and maximize retirement savings.

Credit: kiermanlaw.com

Types Of Retirement Plans

Types of Retirement Plans:

401(k) Plans

A 401(k) plan is a retirement savings account sponsored by an employer where employees can contribute a portion of their salary into the plan.

Ira (individual Retirement Account)

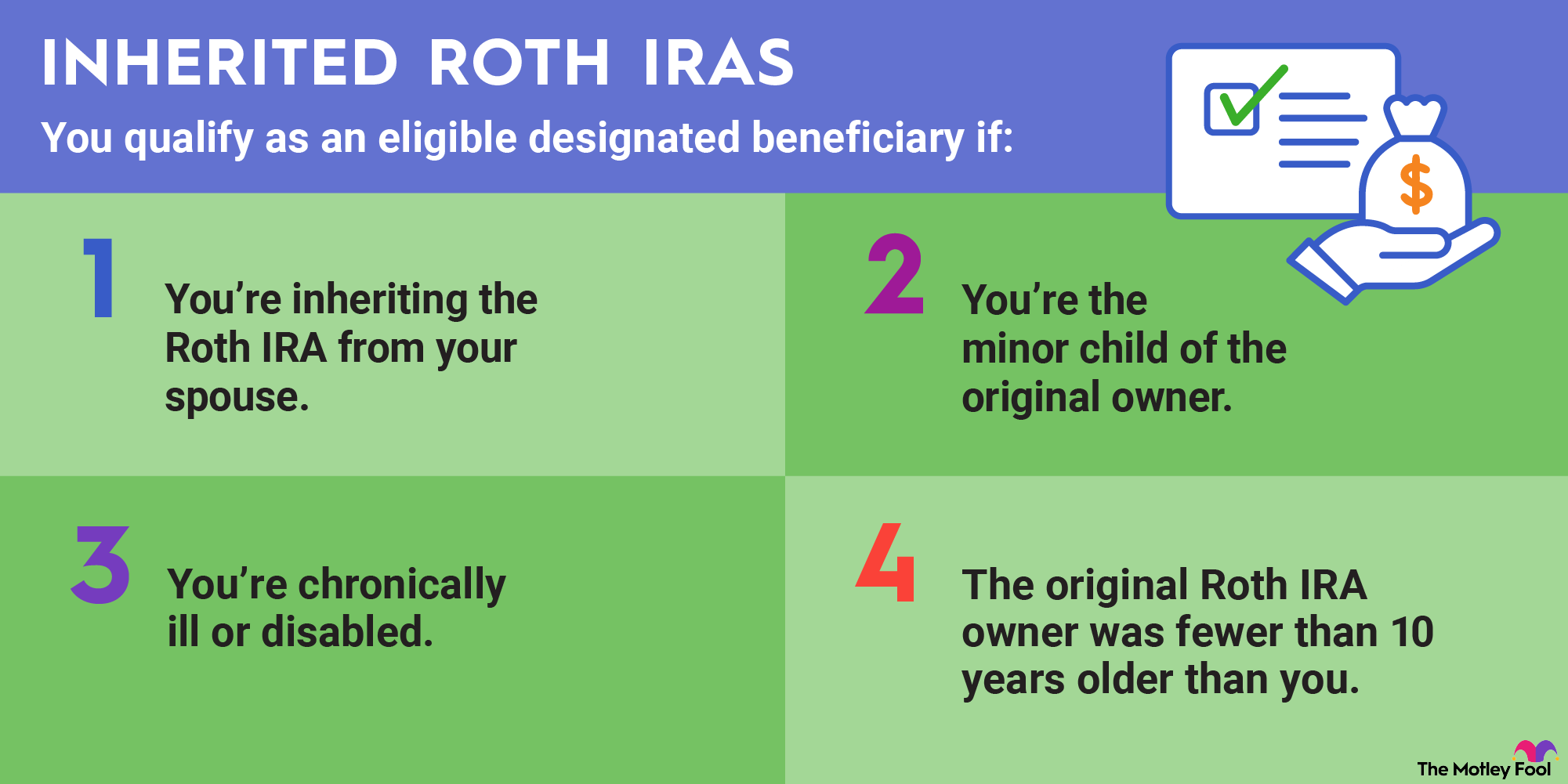

An Individual Retirement Account (IRA) provides individuals with a tax-advantaged way to save for retirement.

“` In HTML-formatted content for WordPress, the blog post section titled ‘Types of Retirement Plans’ discusses two common types of retirement accounts – 401(k) Plans and IRA (Individual Retirement Account). The section is concise and informative, utilizing clear headings for better readability.

Credit: http://www.fool.com

Distribution Options

A retirement plan distribution refers to the strategic options available for withdrawing funds from a retirement account. Individuals can choose from various distribution options based on their financial needs and circumstances, including lump sum withdrawals, systematic withdrawals, or annuitization. Understanding the different distribution choices can help retirees effectively manage their retirement savings.

When it comes to your retirement plan, one important factor to consider is how you want to receive your funds. This decision is known as a retirement plan distribution. There are several distribution options available to you, depending on your individual needs and financial goals. In this article, we will explore the two main types of distribution options: lump-sum distribution and periodic payments.

Lump-sum Distribution

A lump-sum distribution is a one-time payout of your entire retirement plan balance. This means that you will receive all the funds in your retirement account at once, in a single cash payment. Choosing a lump-sum distribution can offer immediate access to your funds, allowing you to use the entire amount as you see fit.

Many individuals choose a lump-sum distribution when they have a specific financial need or a large expense that they want to address. However, it’s important to carefully consider the tax implications of a lump-sum distribution. Depending on your age and the type of retirement plan, you may be subject to income tax and potentially even early withdrawal penalties.

Periodic Payments

Alternatively, you may choose to receive your retirement plan distribution in the form of periodic payments. This option allows you to receive a steady stream of income over a specified period of time, typically monthly or annually. Periodic payments can provide a reliable source of income during your retirement years.

There are different types of periodic payment options available, including fixed annuities, which provide a predictable payment amount, and variable annuities, which allow you to invest your funds and potentially earn more over time. The specific payment amount and duration will depend on factors such as your age, life expectancy, and the terms of your retirement plan.

Before deciding on a periodic payment option, it’s important to consider your current and future financial needs. You may want to consult with a financial advisor to determine the best approach for your individual circumstances. Keep in mind that periodic payments can offer a sense of financial security in retirement, but they may not provide the same level of flexibility as a lump-sum distribution.

Tax Implications

When it comes to planning for retirement, understanding the tax implications of a retirement plan distribution is crucial. Knowing the tax consequences can help individuals make informed decisions and take advantage of potential tax benefits.

Taxation Of Distributions

A retirement plan distribution is subject to taxation as ordinary income. Distributions from a traditional 401(k) or IRA are generally taxable in the year they are withdrawn. The amount withdrawn will be added to your annual income and taxed at your marginal tax rate.

Penalties For Early Withdrawal

Early withdrawals from a retirement plan may result in additional penalties. If you withdraw funds before reaching the age of 59½, you may be subject to a 10% early withdrawal penalty, in addition to the regular income tax on the distribution.

Factors To Consider

When considering a retirement plan distribution, it’s important to weigh various factors to ensure a secure financial future. Factors such as retirement age and financial needs play a crucial role in making informed decisions. Let’s delve into these factors and explore considerations for each.

Retirement Age

Retirement age significantly impacts the distribution of a retirement plan. It’s essential to factor in the age at which you plan to retire, as this will determine when you begin taking distributions from your retirement plan.

Financial Needs

Assessing your financial needs is vital in determining the amount and frequency of retirement plan distributions. Consider expenses such as housing, healthcare, and lifestyle choices to ensure that your retirement distributions adequately support your financial requirements.

Rolling Over Distributions

When it comes to managing your retirement plan, understanding how to distribute your funds is essential. One way to do this is through a process called rolling over distributions. Rolling over distributions allows you to transfer your retirement funds from one account to another, keeping them growing tax-free.

Direct Rollover

With a direct rollover, your retirement plan distribution is sent directly from your current retirement account to your new account. By doing this, you avoid any tax withholding and penalties that could be incurred with other methods of distribution. It’s a seamless process that ensures your retirement funds stay intact and continues to grow.

Indirect Rollover

Another option is an indirect rollover. This involves taking a distribution from your current retirement account and then depositing it into another qualified retirement account within 60 days. While this method gives you more flexibility, there are a few things to be aware of. First, if you fail to complete the rollover within the specified timeframe, you could face taxes and penalties. Additionally, if you choose this method, your current retirement account provider is required to withhold 20% of the distribution for taxes, which you will need to replace with other funds to complete the rollover.

Avoiding Common Mistakes

A retirement plan distribution refers to the withdrawal of funds from a retirement account, such as a 401(k) or IRA. It is important to understand the rules and potential tax implications before making a distribution to avoid mistakes that could impact your retirement savings.

Failure To Rollover Within Time Limit

Forgetting About Required Minimum Distributions

When considering a retirement plan distribution, it’s crucial to be aware of common mistakes to avoid.

Failure To Rollover Within Time Limit

Failing to transfer funds to another retirement account within 60 days can result in tax consequences.

- Set a reminder for the 60-day deadline.

- Consult a financial advisor for guidance.

Forgetting About Required Minimum Distributions

Ensure you take the mandatory yearly withdrawals from your retirement account to escape penalties.

- Calculate your Required Minimum Distribution (RMD) accurately.

- Schedule automatic withdrawals to meet RMD requirements.

Seeking Professional Advice

Seeking professional advice is crucial when navigating retirement plan distributions. Knowing how to manage your funds properly can make a significant difference in the long run.

Consulting A Financial Advisor

When considering a retirement plan distribution, it’s essential to consult a financial advisor. They can provide insightful guidance tailored to your individual financial goals.

Working With A Tax Professional

Working with a tax professional can help you maximize your retirement savings. They can offer expert advice on tax implications and strategies.

:max_bytes(150000):strip_icc()/rothira_final-9ddd537c67fd44ecb14dbdeba58a6ace.jpg)

Credit: http://www.investopedia.com

Frequently Asked Questions For What Is A Retirement Plan Distribution

What Is A Retirement Plan Distribution?

A retirement plan distribution is the disbursement of funds from a retirement account. It could be in the form of a lump sum or periodic payments. This typically occurs when an individual reaches retirement age or separates from their employer.

When Can I Take A Retirement Plan Distribution?

You can typically take a retirement plan distribution penalty-free after reaching age 59½. However, there are some exceptions, such as early retirement or financial hardship, where you may be eligible to take distributions without incurring penalties.

What Taxes Apply To Retirement Plan Distributions?

Retirement plan distributions are generally subject to income tax. The amount of tax depends on the type of retirement account and the age at which the distribution is taken. Additionally, early withdrawals may incur a 10% penalty tax.

Can I Roll Over A Retirement Plan Distribution?

Yes, you can roll over a retirement plan distribution into another qualified retirement account to defer the taxes and avoid penalties. This is commonly done when transitioning jobs or consolidating multiple retirement accounts into one. Note: rollover rules and eligibility criteria apply.

Conclusion

Understanding retirement plan distribution is crucial for managing your finances in your post-work years. By grasping the ins and outs of this concept, you can effectively strategize how to allocate your retirement savings, minimize taxes, and ensure a steady income stream throughout your golden years.

Taking the time to educate yourself on retirement plan distribution will ultimately empower you to make informed financial decisions and enjoy a secure retirement.

Leave a comment