Qualifying health care coverage includes plans that meet the minimum essential coverage requirements mandated by the Affordable Care Act (ACA) and are provided through an employer, government program, or purchased individually. In addition to meeting the minimum essential coverage requirements, qualifying health care coverage must also be affordable and provide a minimum level of benefits as defined by the ACA.

It is important for individuals and families to have qualifying health care coverage to avoid penalties and to ensure access to necessary medical services. By having coverage that meets these criteria, individuals can protect their health and well-being while also complying with the ACA regulations.

Importance Of Qualifying Health Care Coverage

Definition And Significance

Achieving Qualifying Health Care Coverage ensures access to essential medical services.

Impact On Individuals

Qualifying Health Care Coverage directly impacts individual well-being and financial security.

Types Of Qualifying Health Care Coverage

Having a qualifying health care coverage is crucial to ensure that you meet the requirements of the Affordable Care Act (ACA) and avoid penalties when filing your taxes. Here are the different types of qualifying health care coverage:

Employer-sponsored Plans

If you are employed, it is likely that your employer offers a health insurance plan as part of your benefits package. These plans, often referred to as employer-sponsored plans, provide coverage for employees and their families. To qualify as a qualifying health care coverage, the plan must meet the minimum requirements set by the ACA. This includes offering essential health benefits and providing coverage for preventive care services without cost-sharing.

Government-sponsored Programs

Government-sponsored health insurance programs, such as Medicaid and Medicare, also qualify as qualifying health care coverage. Medicaid is a program that provides health coverage to low-income individuals and families. On the other hand, Medicare is a health insurance program for people aged 65 and older, as well as certain individuals with disabilities. These programs are designed to ensure that vulnerable populations have access to affordable and comprehensive health care.

Individual Health Insurance Plans

If you do not have access to an employer-sponsored plan or qualify for a government-sponsored program, you can obtain qualifying health care coverage through an individual health insurance plan. These plans are typically purchased directly from an insurance company or through the Health Insurance Marketplace. To qualify as a qualifying health care coverage, individual plans must meet the ACA’s standards and provide essential health benefits.

Understanding the types of qualifying health care coverage can help you make informed decisions when it comes to choosing the right plan for you and your family. Whether you have an employer-sponsored plan, receive coverage through a government program, or purchase an individual health insurance plan, having qualifying health care coverage ensures that you have the necessary protection and access to essential health services.

Requirements For Qualifying Health Care Coverage

When it comes to determining qualifying health care coverage, it’s essential to understand the specific requirements that define what constitutes adequate coverage. Meeting these requirements is crucial for individuals to avoid penalties and ensure they have access to essential healthcare services. This article will delve into the requirements for qualifying health care coverage and outline the criteria, duration, exceptions, and exemptions.

Minimum Essential Coverage Criteria

The criteria for minimum essential coverage encompass a range of healthcare services that individuals must have access to in order to fulfill the requirements. These include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehab services, laboratory services, preventive and wellness services, and pediatric services.

Duration Of Coverage

Qualifying health care coverage should provide continuous access to essential health services for the entire year. It’s essential for individuals to maintain coverage without any significant gaps to ensure they meet the duration requirement. A lapse in coverage could lead to penalties, so it’s crucial for individuals to maintain consistent coverage throughout the year.

Exceptions And Exemptions

There are certain exceptions and exemptions that may apply to individuals regarding qualifying health care coverage. These could include certain life events such as marriage, birth, adoption, or placement for adoption, which may allow for a special enrollment period. Additionally, individuals may be eligible for exemptions based on financial hardship, religious beliefs, membership in a healthcare sharing ministry, incarceration, or being a non-U.S. resident.

Credit: http://www.federalregister.gov

Challenges In Obtaining Qualifying Health Care Coverage

Acquiring qualifying health care coverage poses several challenges that individuals and families may encounter. From concerns regarding affordability to understanding plan options and access to care, navigating the complex landscape of health insurance can be daunting. Let’s delve into the specific challenges and considerations that individuals face when seeking qualifying health care coverage.

Affordability Concerns

Affordability remains a significant barrier for many individuals when it comes to obtaining qualifying health care coverage. The cost of premiums, deductibles, and copayments can far exceed what some individuals can comfortably afford. In such cases, the perceived financial burden often leads to a lack of health insurance coverage, leaving individuals vulnerable to unforeseen medical expenses and limited access to essential care.

Access To Care

Securing qualifying health care coverage does not guarantee seamless access to necessary medical services. Even when individuals are enrolled in a health plan, limitations in provider networks, long wait times for appointments, and geographical barriers can hinder timely access to essential medical care. Understanding coverage limitations and navigating the intricacies of in-network providers is essential for ensuring adequate access to care when needed.

Understanding Plan Options

Understanding the various health plan options and their respective benefits, limitations, and cost-sharing structures can be overwhelming and complex. From deciphering the nuances of different coverage tiers to evaluating prescription drug formularies and coverage gaps, individuals often face challenges in comprehending the intricacies of health insurance. Making informed decisions about plan selection and coverage options demands clarity and accessibility from insurers and healthcare providers.

Penalties For Not Having Qualifying Health Care Coverage

Failure to have qualifying health care coverage can result in certain penalties and impacts on your tax returns. It’s important to understand the repercussions of not having the appropriate coverage to avoid any issues with the Internal Revenue Service (IRS).

Individual Mandate Tax Penalty

One of the penalties for not having qualifying health care coverage is the Individual Mandate Tax Penalty. This penalty was introduced as part of the Affordable Care Act and has been in effect for several years. If you fail to have the required coverage for yourself and any dependents, you may be subject to this tax penalty.

The amount of the penalty varies depending on factors such as your income, the number of uninsured months, and whether you qualify for any exemptions. For a given tax year, the penalty is calculated as either a percentage of your income or a flat fee, whichever is higher.

It’s important to note that this penalty is no longer in effect starting from the tax year 2019. However, it was in place for the tax years 2014 through 2018, so if you were uninsured during that period, you may still be liable for the penalty.

Impact On Tax Returns

The failure to have qualifying health care coverage can also impact your tax returns. When filing your taxes, it is required to indicate whether you and your dependents had the necessary coverage for each month of the tax year. If you were uninsured for any period during the year and are not eligible for an exemption, you may have to pay the Individual Mandate Tax Penalty.

It’s important to provide accurate information on your tax returns regarding your health care coverage. Failing to do so can result in audits or other inquiries from the IRS, potentially leading to further penalties or consequences.

To avoid any issues with your tax returns, ensure that you have qualifying health care coverage for yourself and your dependents throughout the tax year. This will help you comply with the requirements and avoid unnecessary penalties or complications.

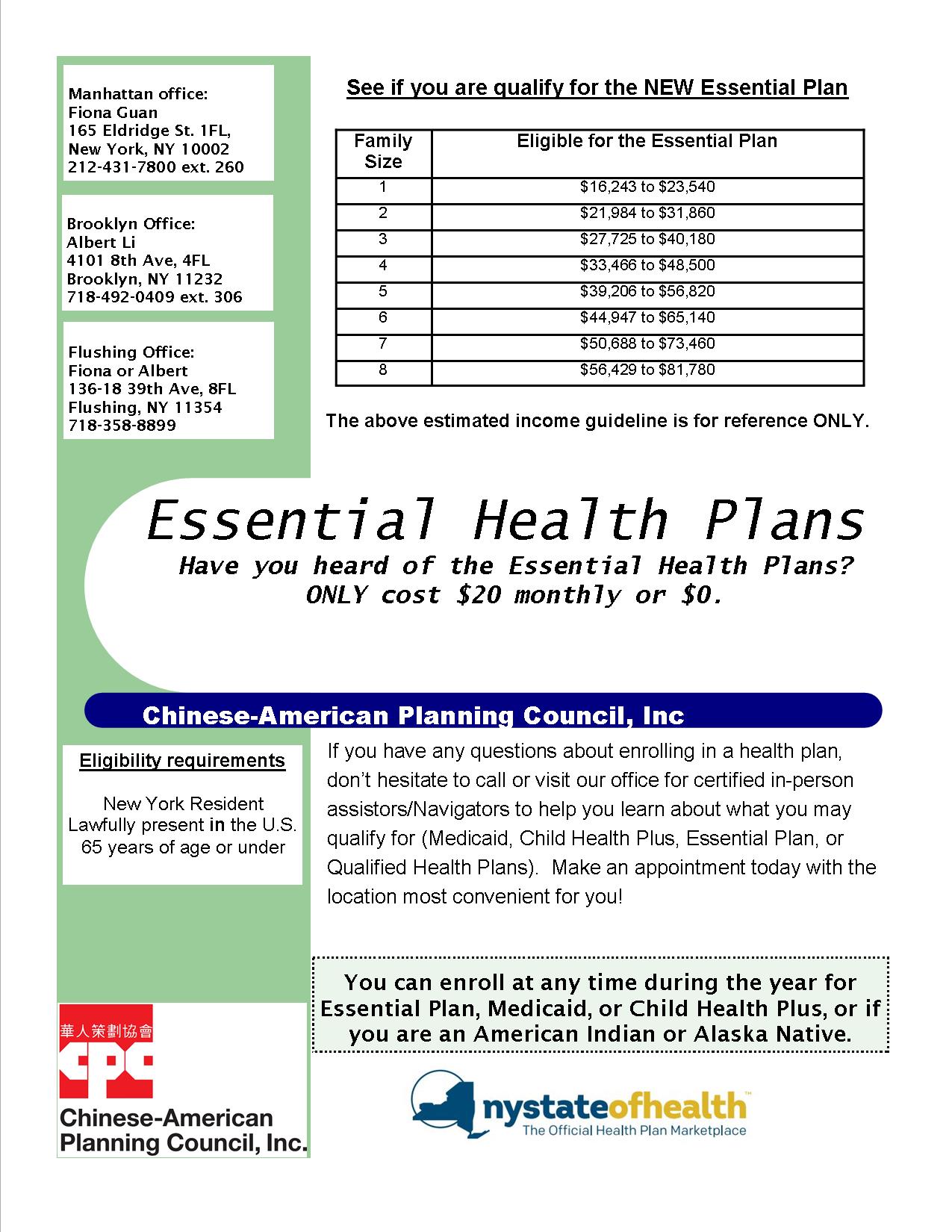

Credit: http://www.cpc-nyc.org

Enrollment Periods For Qualifying Health Care Coverage

Enrollment Periods for Qualifying Health Care Coverage play a crucial role in ensuring individuals have access to necessary healthcare services. It’s essential to understand the different enrollment periods to make informed decisions about obtaining and maintaining coverage.

Open Enrollment Period

The Open Enrollment Period is a designated time frame during which individuals can enroll in or make changes to their health coverage. This period usually occurs once a year and allows people to select or adjust their health insurance plans for the upcoming year.

Special Enrollment Periods

A Special Enrollment Period is a time outside the regular Open Enrollment Period when individuals can sign up for health insurance due to specific qualifying circumstances. These events trigger a special enrollment opportunity, enabling individuals to get coverage outside the standard enrollment periods.

Qualifying Life Events

Qualifying Life Events are significant life changes that may make individuals eligible to enroll in health insurance outside the typical enrollment periods. Examples include getting married, having a baby, losing other health coverage, moving to a new state, or experiencing other qualifying life events as determined by the insurance marketplace.

Resources For Obtaining Qualifying Health Care Coverage

Health Insurance Marketplaces

Health Insurance Marketplaces assist in finding and comparing various health insurance plans.

Medicaid And Chip Programs

Medicaid and CHIP Programs provide low-cost or free health coverage to eligible individuals.

Insurance Brokers And Agents

Insurance Brokers and Agents can help navigate through different health insurance options.

Future Trends In Qualifying Health Care Coverage

The future trends in qualifying health care coverage are rapidly evolving as technology advances and policy changes impact the industry. It is essential to stay informed about the innovations and policy shifts that are shaping the landscape of health insurance. Understanding these trends can help individuals make informed decisions about their health care coverage.

Innovations In Health Insurance

Recent innovations in health insurance have transformed the way people access and receive care. The rise of telemedicine, wearable health devices, and personalized medicine are reshaping the health care experience. These advancements aim to improve convenience, enhance patient outcomes, and reduce overall healthcare costs.

Policy Changes Impacting Coverage

Policy changes play a crucial role in defining what qualifies as health care coverage. Legislative reforms, such as the expansion of Medicaid, changes in essential health benefits, and modifications to the Affordable Care Act, significantly impact the scope and accessibility of health insurance. It’s important to remain aware of these changes to ensure compliance with qualifying health care coverage requirements.

Credit: http://www.amazon.com

Frequently Asked Questions Of What Is Considered Qualifying Health Care Coverage

What Is Qualifying Health Care Coverage?

Qualifying health care coverage refers to insurance that meets the minimum essential coverage requirements set by the Affordable Care Act. This can include employer-sponsored plans, individual plans, Medicare, Medicaid, and certain other government programs.

Why Is Qualifying Health Care Coverage Important?

Qualifying health care coverage is crucial for avoiding penalties and ensuring access to essential medical services. It helps individuals and families manage healthcare costs, maintain good health, and comply with legal requirements under the Affordable Care Act.

How To Determine If My Health Care Coverage Qualifies?

You can confirm if your health care coverage qualifies by checking if it meets the minimum essential coverage criteria outlined by the IRS. This includes assessing whether your plan provides essential benefits, such as preventive care, emergency services, and prescription drugs.

Conclusion

Understanding what qualifies as health care coverage is crucial for individuals seeking the right insurance options. By meeting the necessary criteria, such as having employer coverage or enrolling in a government program like Medicaid or Medicare, individuals can ensure they have proper access to medical services.

It is important to stay informed about the evolving landscape of qualifying health care coverage to make informed decisions about one’s health insurance needs.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is qualifying health care coverage?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Qualifying health care coverage refers to insurance that meets the minimum essential coverage requirements set by the Affordable Care Act. This can include employer-sponsored plans, individual plans, Medicare, Medicaid, and certain other government programs.” } } , { “@type”: “Question”, “name”: “Why is qualifying health care coverage important?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Qualifying health care coverage is crucial for avoiding penalties and ensuring access to essential medical services. It helps individuals and families manage healthcare costs, maintain good health, and comply with legal requirements under the Affordable Care Act.” } } , { “@type”: “Question”, “name”: “How to determine if my health care coverage qualifies?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “You can confirm if your health care coverage qualifies by checking if it meets the minimum essential coverage criteria outlined by the IRS. This includes assessing whether your plan provides essential benefits, such as preventive care, emergency services, and prescription drugs.” } } ] }

Leave a comment