Endowment life policy is more popular because it combines life insurance coverage with an investment component, providing both protection and potential cash value growth. With its dual benefits, individuals are attracted to this insurance product.

Introduced in the early 19th century, endowment life policies have gained popularity due to the potential for financial security and wealth accumulation they offer. Combining both insurance and investment features, these policies provide a safety net for beneficiaries in the event of the policyholder’s death while also building cash value over time.

The allure of endowment life policies lies in their ability to provide the best of both worlds: the security of life insurance coverage and the potential for financial growth. We will explore the reasons behind the popularity of endowment policies and how they can benefit policyholders.

Historical Context

Endowment policies have a long history dating back to the early insurance practices in the 18th century.

These policies were originally designed to provide financial security to individuals and families in case of untimely death.

Endowment policies gained popularity as a way to save for the future while ensuring protection for loved ones.

This concept of combining insurance and investment played a crucial role in the development and widespread acceptance of endowment policies.

Endowment policies underwent significant evolution over the years, adapting to changing economic conditions and customer needs.

The traditional endowment policy evolved into more flexible and customizable options, catering to diverse financial goals.

Advancements in technology and finance paved the way for innovative features and benefits within endowment policies.

The evolution of endowment policies reflects a continual effort to meet the evolving demands of consumers in the insurance sector.

Features Of Endowment Life Policy

An Endowment Life Policy is a type of life insurance policy that combines life coverage with a savings component. It offers a guaranteed payout and includes an investment component. Let’s explore the features of an Endowment Life Policy in more detail:

Guaranteed Payout

A key feature of an Endowment Life Policy is the guaranteed payout it offers to the policyholder. This means that upon the maturity of the policy or in the event of the insured individual’s death, a predetermined amount is paid out. This provides financial security and peace of mind for both the policyholder and their loved ones.

Investment Component

Another important feature of an Endowment Life Policy is the investment component it includes. A portion of the premiums paid by the policyholder is allocated towards investments, allowing the policy to accumulate cash value over time. This cash value can be accessed by the policyholder during the policy term or upon maturity, providing additional flexibility and potential for growth.

The investment component of an Endowment Life Policy offers the opportunity to build savings over the policy term. The policyholder can choose from various investment options, such as stocks, bonds, or mutual funds. The returns generated from these investments contribute to the growth of the policy’s cash value, potentially resulting in a higher payout at maturity.

The investment component of an Endowment Life Policy also allows the policyholder to participate in the financial markets’ potential upside. However, it’s important to note that there may be risks involved in investing, and the policy’s cash value could fluctuate based on market conditions.

Comparison With Other Insurance Policies

An endowment life policy is a popular insurance option, offering a combination of savings and protection. Understanding how it compares with other insurance policies can help you make an informed decision.

Term Life Insurance Vs Endowment Policies

Term life insurance provides coverage for a specific period, offering protection to the policyholder’s beneficiaries in case of death. On the other hand, an endowment policy provides a lump sum amount upon maturity or in the event of the policyholder’s death. The primary difference lies in the payout structure, with endowment policies also serving as a savings instrument.

Whole Life Insurance Vs Endowment Policies

Whole life insurance provides lifelong coverage with a cash value component, often earning dividends. Similarly, endowment policies offer a guaranteed sum at maturity, providing a savings element alongside protection. However, whole life insurance focuses on lifelong coverage, while endowment policies have a specific maturity period.

Popularity Factors

Endowment life policies are gaining popularity due to their long-term investment benefits, tax advantages, and financial protection for beneficiaries. The policy’s popularity is attributed to its versatility, offering both insurance coverage and a savings component, making it a popular choice for individuals looking for comprehensive financial security.

Tax Benefits

An endowment life policy is gaining popularity due to the tax benefits it offers. Policyholders receive tax deductions on the premium paid and the maturity amount is also tax-free, making it an attractive investment choice.

Savings And Investment Combined

Another factor contributing to the popularity of endowment life policies is the combination of savings and investment it provides. Policyholders can allocate a portion of their premium towards investment, allowing them to build a financial cushion while ensuring adequate life cover.

Market Trends

Understanding the market trends is crucial when it comes to making informed decisions about financial products. The popularity of endowment life policies is not exempt from these trends. Let’s explore two key factors that contribute to the growing popularity of endowment life policies in the market today.

Shift In Consumer Preferences

Consumer preferences are constantly evolving and shaping the financial market. In recent years, there has been a noticeable shift towards more long-term, secure investment options. This shift can be attributed to a greater desire for financial stability and a growing awareness of the importance of future planning.

Endowment life policies, with their combination of life insurance coverage and an investment component, align well with these changing consumer preferences. These policies provide individuals with a way to protect their loved ones financially while also allowing them to accumulate savings over time. The appeal of endowment life policies lies in their ability to offer both peace of mind and long-term financial growth, making them increasingly sought after by consumers seeking a comprehensive solution.

Additionally, endowment life policies often come with flexible payment options, allowing policyholders to tailor their premiums to suit their financial circumstances. This flexibility makes them an attractive choice for individuals from a range of income brackets, further contributing to their growing popularity.

Influence Of Economic Conditions

Economic conditions play a crucial role in shaping consumer behavior and preferences. During periods of economic uncertainty or low-interest rates, individuals are often drawn towards investment options that provide more stability and predictable returns.

Endowment life policies offer a certain level of stability as the savings component is predominantly invested in low-risk instruments, such as government bonds or fixed-income securities. This characteristic becomes especially appealing when other investment options may be subject to market volatility.

Moreover, endowment life policies also provide individuals with tax benefits in many countries, further adding to their attractiveness as a long-term investment vehicle. These advantages contribute to the rising popularity of endowment life policies, as individuals seek ways to grow their wealth while minimizing risk in uncertain economic times.

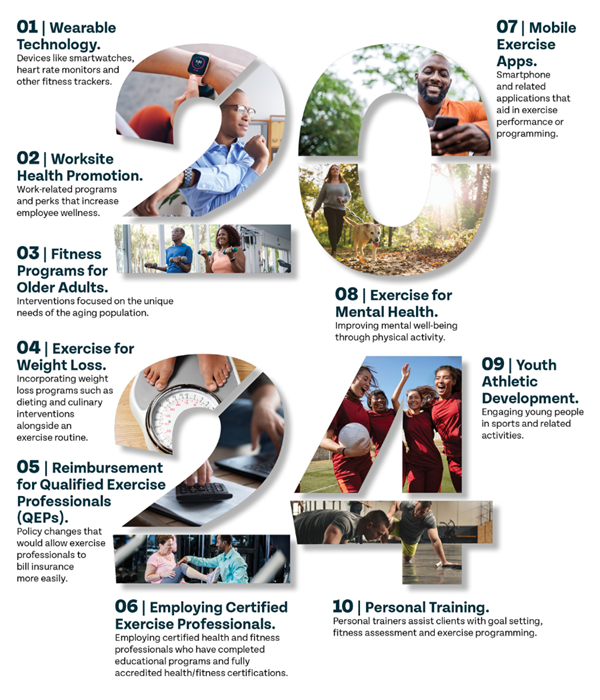

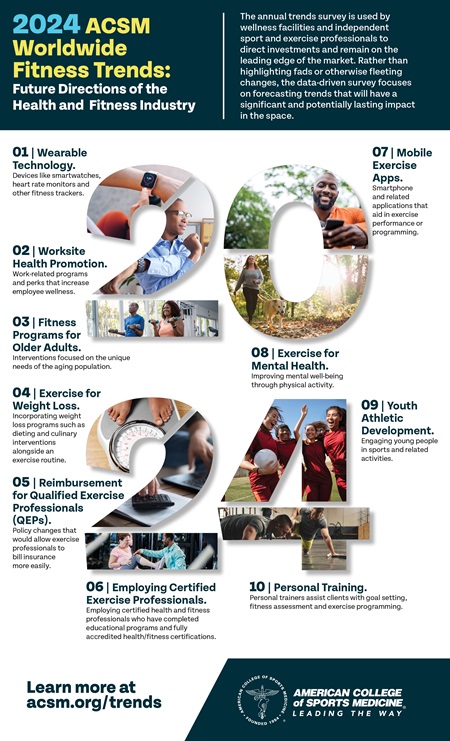

Credit: http://www.acsm.org

Pros And Cons

Endowment policies are a popular choice for many individuals seeking a combination of insurance coverage and investment benefits. Let’s dive into the advantages and disadvantages of these policies below.

Advantages Of Endowment Policies

- Long-term Savings: Endowment policies offer a disciplined way to save for the future.

- Insurance Coverage: They provide financial protection in case of unforeseen circumstances.

- Guaranteed Returns: Policyholders can expect a fixed sum assured at maturity.

- Tax Benefits: Endowment policies often come with tax advantages, helping policyholders save more.

Disadvantages Of Endowment Policies

- Low Liquidity: Endowment policies usually have a lock-in period, limiting access to funds.

- Lower Returns: The returns from endowment policies might be lower compared to other investment options.

- Complexity: Understanding the terms and conditions of endowment policies can be challenging.

- Penalties: Policyholders may face penalties for early withdrawals or policy surrender.

Future Outlook

Predictions For Endowment Life Policy Industry

The endowment life policy industry is poised for significant growth in the upcoming years.

- Increased market demand for long-term financial planning.

- Rising interest in guaranteed returns and savings options.

- Expansion of target demographics to younger generations.

Potential Innovations And Changes

Innovations within the endowment life policy sector are expected to revolutionize the industry.

- Integration of digital technology for streamlined processes.

- Development of customizable policy options for diverse needs.

Credit: http://www.princeton.edu

Credit: http://www.acsm.org

Frequently Asked Questions Of What Is Endowment Life Policy More Popular

What Are The Benefits Of An Endowment Life Policy?

An endowment life policy offers both death benefits and savings to the policyholder. It provides financial protection for loved ones, acts as a forced savings plan, and ensures a lump sum payout at the policy’s maturity.

How Does An Endowment Life Policy Differ From Term Life Insurance?

Unlike term life insurance, an endowment policy provides a savings and investment component, in addition to death benefits. It also offers fixed premiums and a guaranteed payout at the end of the policy term, making it a more comprehensive financial tool.

Can I Access The Cash Value Of An Endowment Life Policy?

Yes, policyholders can borrow or withdraw the cash value of an endowment policy during the policy term, providing a source of liquidity in times of financial need. However, accessing the cash value may affect the death benefits and the overall policy performance.

Conclusion

Endowment life policies have gained popularity due to their unique benefits. With a combination of life insurance and investment, these policies provide financial security and potential growth for the policyholder. The flexibility to withdraw funds or borrow against the policy makes it a versatile option.

With careful consideration and professional advice, an endowment life policy can be a valuable asset in an individual’s financial planning journey.

Leave a comment