The insurance business model involves providing financial protection against potential risks or losses to individuals and organizations. It operates by collecting premiums from policyholders and paying out claims when necessary.

Insurance companies play a critical role in managing and mitigating risks for their clients. By offering various policies such as life, health, property, and liability insurance, they provide a sense of security and peace of mind to policyholders. The business model typically encompasses underwriting, pricing, and claims processing to ensure effective risk management.

Additionally, insurance companies invest premiums to generate returns, contributing to their revenue streams. Overall, the insurance business model is designed to safeguard individuals and businesses from unforeseen circumstances while maintaining financial sustainability.

Components Of Insurance Business Model

Components of Insurance Business Model are crucial elements that define the operational framework of insurance companies. Understanding these components is key to grasping how insurance companies operate efficiently and serve their customers effectively.

Insurance Products

Insurance Products are the core offerings that insurance companies provide to their customers. These products can include various types of insurance coverages, such as life insurance, health insurance, property insurance, and more.

Underwriting

Underwriting is the process through which insurance companies assess the risk associated with insuring a particular individual or entity. It involves evaluating various factors, including the person’s health, age, occupation, and lifestyle, to determine the premium rates and coverage options.

Risk Assessment

Risk Assessment is a critical component of the insurance business model, as it helps insurers evaluate the likelihood of a claim being made and the potential costs associated with it. Insurers use sophisticated algorithms and historical data to assess risks accurately.

Premiums And Claims

Premiums are the payments that policyholders make to insurance companies in exchange for coverage. Claims refer to the requests made by policyholders to receive benefits or compensation under their insurance policies in case of covered events.

Credit: http://www.researchgate.net

Types Of Insurance Business Models

When examining the landscape of the insurance industry, understanding the different types of insurance business models is crucial. These models determine how insurance companies operate and serve their customers. In this post, we will dive into three main types of insurance business models: Traditional Insurance Model, Digital Insurance Model, and Peer-to-Peer Insurance Model.

Traditional Insurance Model

The Traditional Insurance Model follows the conventional approach where insurance products are sold through agents, brokers, or direct channels. These companies typically have physical offices and offer a wide range of insurance products tailored to meet specific needs.

Digital Insurance Model

The Digital Insurance Model leverages technology to provide insurance services online. This model offers a convenient way for customers to purchase and manage their policies through websites or mobile apps. Digital insurers often focus on streamlining processes and enhancing user experience.

Peer-to-peer Insurance Model

In the Peer-to-Peer Insurance Model, individuals come together to form a community that pools their resources to provide coverage for each other. This model promotes transparency, trust, and shared risk among members, leading to potentially lower premiums and better customer engagement.

“` When it comes to insurance business models, understanding the different types can help you make informed decisions. Traditional insurers follow conventional methods, while digital insurers leverage technology for online services. Peer-to-peer insurance encourages community involvement and shared risk among members. Each insurance business model caters to different customer needs and preferences.Challenges Faced By Insurance Business Models

Insurance business models have always been subject to various challenges that require constant adaptation and innovation. In today’s rapidly changing landscape, three key factors stand out as the main challenges faced by insurance companies: technological advancements, regulatory changes, and consumer behavior.

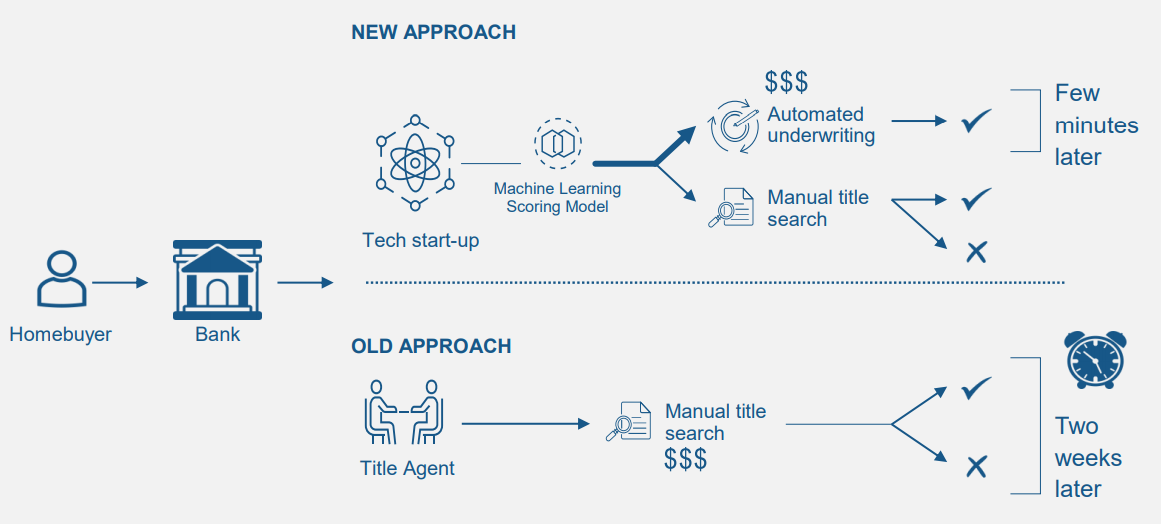

Technological Advancements

The rapid advancements in technology have revolutionized the insurance industry, presenting both opportunities and obstacles for insurance business models. In the digital age, insurance companies must keep pace with emerging technologies to remain competitive.

Technological advancements, such as artificial intelligence and machine learning, have the potential to streamline operations, enhance underwriting accuracy, and improve customer experience. However, integrating these technologies into the existing business model can be complex.

Insurance companies must invest in robust IT infrastructure and systems to handle big data and ensure data security. Furthermore, they need to adapt their business processes to exploit the full potential of technology, leveraging automation and data analytics to drive operational efficiency and provide personalized services to policyholders.

Regulatory Changes

Regulatory changes play a vital role in shaping insurance business models. As governments introduce new regulations to protect consumers and ensure fair competition, insurance companies must navigate a complex landscape of compliance requirements.

Compliance with changing regulations often demands significant investment in research and development, as well as in staff training. Insurance business models must adapt their processes and workflows to align with new guidelines, which may lead to additional costs and temporary disruptions.

Regulatory changes also impact product pricing, distribution channels, and customer disclosure requirements. Insurance companies must anticipate and respond to these changes promptly to remain compliant and avoid penalties or reputational damage.

Consumer Behavior

Consumer behavior has transformed in the digital era, with customers expecting instant access to information, personalized experiences, and simplified processes. Insurance companies must keep up with evolving consumer expectations to stay relevant.

The rise of digital platforms and online comparison tools has empowered customers, enabling them to compare policies, prices, and coverage options effortlessly. Insurance companies must understand these shifting patterns and adapt their business models accordingly.

This underscores the need for insurance businesses to invest in user-friendly websites, mobile apps, and customer relationship management systems. By embracing digital channels and providing self-service options, insurance companies can enhance customer experience, retain existing policyholders, and attract new ones.

To conclude, insurance business models face significant challenges in today’s dynamic environment. Technological advancements, regulatory changes, and evolving consumer behavior require insurance companies to be agile and adaptable. By leveraging new technologies, complying with regulations, and catering to changing customer expectations, insurance business models can thrive in the modern era.

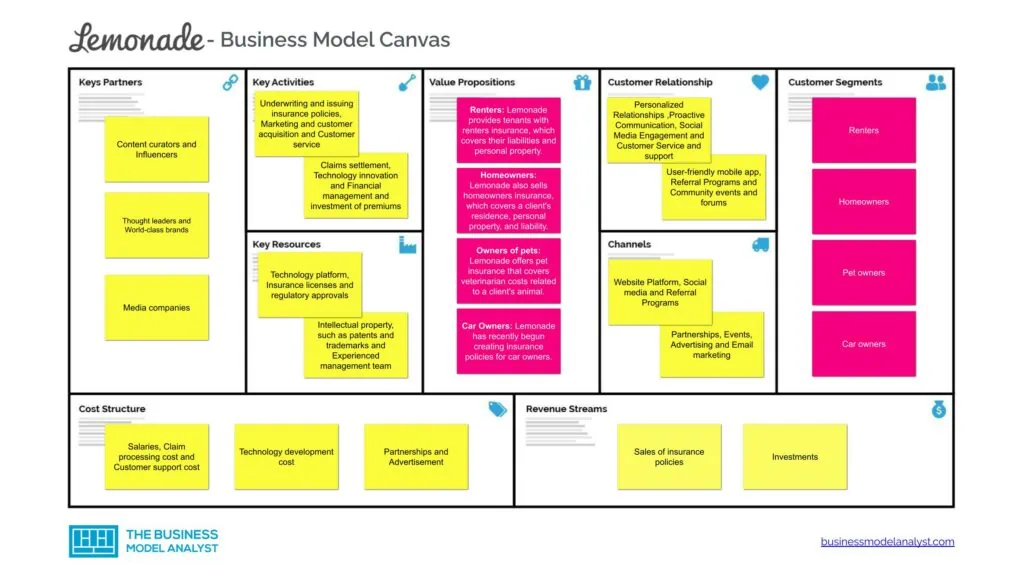

Credit: businessmodelanalyst.com

Opportunities For Insurance Business Models

Data Analytics And Artificial Intelligence

One of the significant opportunities for insurance business models lies in leveraging data analytics and artificial intelligence (AI) technologies. With the ever-increasing amount of data available, insurance companies can use advanced analytics to gain valuable insights into customer behaviors, preferences, and risks. By utilizing AI, insurers can streamline underwriting processes, reduce fraud, and enhance risk management.

Mobile Technology And Digital Payments

The advent of mobile technology and digital payments presents another promising avenue for insurance business models. Mobile apps and digital platforms enable insurers to connect with customers directly, offer seamless services, and provide real-time assistance. Furthermore, digital payment options facilitate easy and convenient premium payments, enhancing customer experience and reducing operational costs.

Customized Insurance Products

Customized insurance products represent another opportunity for insurers to differentiate themselves in the market. Tailoring insurance coverage to meet the specific needs of customers, such as personalized health insurance plans or usage-based car insurance, allows companies to address niche markets and attract a more diverse customer base.

Future Trends In Insurance Business Models

The insurance industry is changing rapidly with the advancements in technology and the changing needs of consumers. To stay competitive and meet evolving customer requirements, insurance companies are adapting their business models to incorporate emerging trends. Some of the key future trends in insurance business models include the adoption of blockchain technology, utilization of the Internet of Things (IoT), and collaboration with insurtech startups.

Blockchain Technology

Blockchain technology is poised to revolutionize the insurance industry by enhancing security, transparency, and efficiency in various processes such as claims management, underwriting, and policy administration. The decentralized nature of blockchain allows for secure and immutable record-keeping, reducing the likelihood of fraud and errors. Smart contracts powered by blockchain enable automated claims processing, leading to faster settlements and reduced administrative costs.

Internet Of Things (iot)

Internet of Things (IoT) is driving a fundamental shift in the insurance business model by enabling insurers to gather real-time data from connected devices such as wearables, home sensors, and telematics devices. This data can be leveraged to provide personalized and usage-based insurance offerings, allowing insurers to assess risk more accurately and offer tailored pricing and coverage options. IoT also facilitates proactive risk prevention and predictive maintenance, leading to improved loss control and better customer engagement.

Collaboration With Insurtech Startups

Embracing collaboration with insurtech startups allows traditional insurance companies to harness innovative technologies and business models. By partnering with insurtech firms, insurers can access cutting-edge solutions in areas such as artificial intelligence, machine learning, and customer experience enhancement. This collaboration fosters agility and innovation, enabling insurers to swiftly adapt to evolving consumer demands and industry disruptions.

Credit: http://www.strimgroup.com

Frequently Asked Questions On What Is Insurance Business Model

What Is The Insurance Business Model?

The insurance business model involves insurers providing financial protection to policyholders in exchange for premiums. They assess risks and use statistical data to determine appropriate premiums, ensuring they can cover potential claims while making a profit. Insurers also invest premiums to generate additional revenue.

How Do Insurance Companies Make Money?

Insurance companies make money by collecting premiums from policyholders and investing those funds to generate additional income. They then use these funds to pay out claims and operating expenses, with any remaining amount representing their profits.

What Are The Different Types Of Insurance Business Models?

There are several types of insurance business models, including traditional insurers, captive insurers, and direct sellers. Traditional insurers operate through agents, while captive insurers are owned by the insured entities. Direct sellers, on the other hand, market policies directly to consumers without intermediaries.

Why Is The Insurance Business Model Important?

The insurance business model is crucial as it enables individuals and businesses to mitigate financial risks by transferring them to an insurance company. It ensures that policyholders are protected from unforeseen events, making it an essential component of financial planning and risk management.

Conclusion

To sum up, understanding the insurance business model is crucial for both insurance providers and policyholders. It involves a detailed analysis of risks, premiums, claim settlements, and customer satisfaction. By comprehending the underlying principles of the insurance industry, individuals and organizations can make informed decisions when it comes to protecting their assets and mitigating financial risks.

Remember, a comprehensive insurance plan is essential in today’s uncertain world.

Leave a comment