The insurance company group number is a unique identifier assigned to a specific group of people who are all insured under the same insurance policy. Insurance company group numbers are essential for insurance providers to efficiently manage and track different groups of policyholders.

This number helps to differentiate between the various insurance plans, coverage options, and policies offered by the insurance company. Additionally, it facilitates the easy processing of claims and enables accurate tracking of premium payments and policy information. Understanding the insurance company group number is crucial for policyholders as it helps them navigate their coverage details and access the appropriate resources provided by their insurance company.

Credit: http://www.jrcinsurancegroup.com

History

The Insurance Company Group Number is a unique identifier assigned to a specific group of policyholders within an insurance company. This number helps the company manage and organize its client base efficiently, allowing for easier tracking of policies and claims.

Understanding the group number is important for policyholders to ensure accurate communication and compliance with their insurance provider.

`origins Of Insurance Company Group Numbers`

Insurance Company Group Numbers were first introduced in the early 1950s as a way to identify different insurance plans offered by a particular insurer.

`evolution Of Insurance Group Number Systems`

This system has evolved over time to include more complex alphanumeric codes that help determine the specific details of a policy at a glance.

Structure

An insurance company group number is a unique identifier assigned to a specific group of individuals who receive insurance coverage from the same employer or organization. This number helps insurance companies manage their policies and track the members of a particular group.

Components Of An Insurance Company Group Number

An insurance company group number is an essential element in insurance policies. It plays a crucial role in identifying a specific group or company within an insurance network. Understanding its structure can help both individuals and organizations grasp the meaning behind this alphanumeric code. A typical insurance company group number consists of several components, each serving a distinct purpose. Let’s break down these components to better understand how they contribute to the overall structure: 1. Prefix or Identifier: The group number usually begins with a prefix or identifier that designates the insurance company or organization. This helps differentiate the group from others within the same network. 2. Group Size: The next part of the group number indicates the size of the group or the number of individuals covered under the policy. It is often represented by numerical digits. 3. Plan Type: Following the group size, the group number may include a code or abbreviation representing the specific insurance plan or coverage type. This helps determine the benefits and services provided by the policy. 4. Other Identifying Information: In some cases, additional identifiers may be included in the group number to provide more specific information. This could include factors such as location, industry, or special requirements that apply to the group.How Group Numbers Are Assigned

The assignment of insurance company group numbers follows a systematic process to ensure accurate identification and classification. Here’s an overview of how these numbers are assigned: 1. Insurance Provider: First, the insurance provider assigns a unique identifier or prefix to represent their company. This ensures that their group numbers are distinguishable from other insurance providers within the same network. 2. Group Size and Plan: Once the insurance provider is identified, the group number is then structured to reflect the group size and plan type. Numerical digits are used to represent the number of individuals covered and the specific coverage offered. 3. Organizational Factors: Additional information may be incorporated into the group number based on specific organizational factors. This could involve factors such as the location of the group, the industry it belongs to, or any special requirements unique to that particular group. Understanding the structure and assignment process of insurance company group numbers can assist policyholders in comprehending their coverage. It enables them to identify their group within the insurance network and ensures proper recognition when interacting with insurance providers or healthcare facilities.Purpose

The purpose of an insurance company group number is to identify the specific group or plan under which an individual is covered by an insurance policy. This number is essential for insurance companies to manage and administer their policies effectively.

Benefits Of Having A Group Number

Having a group number provides several benefits for both the insurance company and the insured individual. For instance, it allows for efficient organization and management of policyholders within a specific group, enabling the insurance company to streamline its administrative processes. Additionally, it facilitates accurate identification and tracking of individuals and their associated benefits, making it easier to handle claims and other policy-related matters.

Role Of Group Numbers In Insurance Administration

Group numbers play a crucial role in insurance administration as they serve as unique identifiers for different groups or plans offered by an insurance company. These numbers help in categorizing and classifying policyholders based on their specific coverage, ensuring that administrative tasks such as premium payments, claims processing, and policy renewals are carried out smoothly and accurately.

Interpretation

Insurance Company Group Number is a vital identifier that helps insurers organize policyholders into specific groups for efficient management. This unique number allows insurance companies to streamline operations and provide tailored services to each group. Understanding the group number system is crucial for policyholders to access accurate information and benefits.

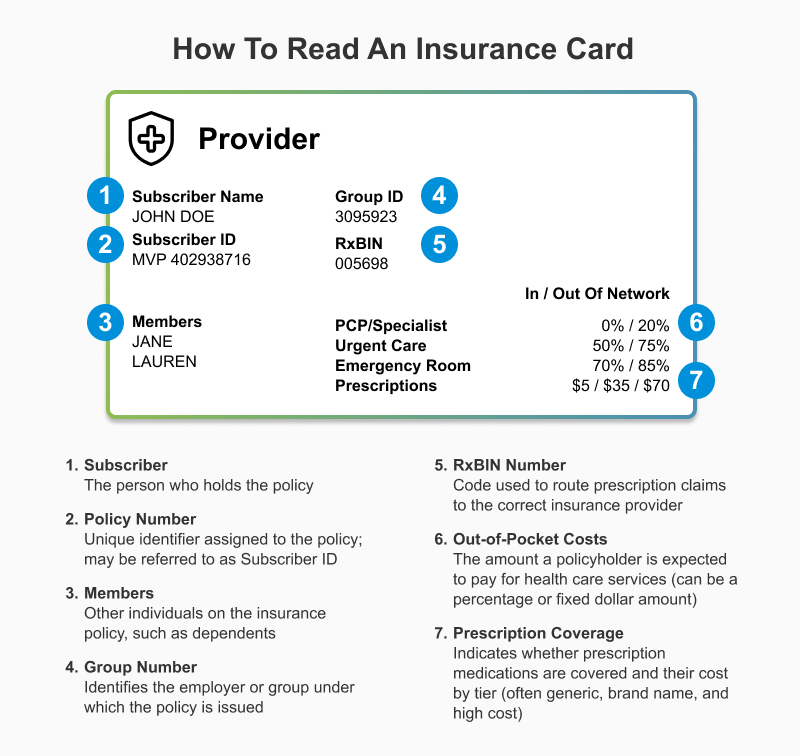

Understanding Group Numbers On Insurance Cards

An insurance company group number is a unique identifier assigned to a specific group insurance policy. This number is typically found on an individual’s insurance card and is used to identify the type of coverage, benefits, and services provided under the group plan. Understanding the group number on your insurance card can provide valuable insight into your insurance coverage and help you navigate the intricacies of your policy.

Deciphering Group Number Codes

Insurance group numbers are not random and often contain valuable information about the policy. Deciphering group number codes can help individuals and healthcare providers understand the specifics of the plan, including the network of providers, type of coverage, and deductible information. By understanding the structure and meaning of group number codes, individuals can make more informed decisions about their healthcare and optimize the benefits provided by their insurance policy.

Variations

When it comes to insurance, the concept of a Group Number is crucial for insurance companies to organize and manage their policies efficiently. The Group Number serves as a unique identifier for a specific group of individuals or entities who are covered under the same insurance plan. However, it is important to note that there are several variations and different types of group number systems used by insurance companies worldwide. Understanding these variations is key to comprehending how insurance policies are structured and administered.

Different Types Of Group Number Systems

Insurance companies utilize different types of group number systems to categorize their policyholders and maintain accurate records. These systems are designed to meet the specific needs and requirements of the insurance company and its customer base. The following are some common types of group number systems:

- Sequential Numbering System: This type of system assigns a unique group number to each policyholder in a sequential manner. It enables insurance companies to easily identify and track individual policyholders within a group.

- Geographical Numbering System: Insurance companies may assign group numbers based on the geographic location of a policyholder. This system helps in regional categorization and administration of policies.

- Product-based Numbering System: In this system, group numbers are assigned based on the specific insurance product or plan chosen by the policyholders. It allows insurance companies to differentiate between various policies they offer.

Global Perspectives On Group Number Formats

The format of group numbers can vary across different countries and regions, reflecting local regulations and industry practices. Here are some examples of global perspectives on group number formats:

| Country/Region | Group Number Format |

|---|---|

| United States | Usually a combination of letters, numbers, and symbols |

| United Kingdom | Numerical digits based on specific coding systems |

| Canada | Alpha-numeric codes varying by province |

These variations in group number formats reflect the diverse methodologies adopted by insurance companies globally. It is essential for insurance professionals and policyholders to understand the specific group number format applicable to their respective regions to ensure accurate record-keeping and seamless administration of insurance policies.

Security

An insurance company group number is a unique identifier that connects an individual to a specific group insurance plan. This number is crucial for accessing benefits and services provided by the insurance company. It is essential to understand the importance of security when it comes to your insurance company group number.

Protecting Your Insurance Company Group Number

Keeping your insurance company group number confidential is vital to ensure the security of your personal information. Avoid sharing this number with unauthorized individuals to prevent misuse.

Potential Risks Associated With Group Number Disclosure

- Identity theft

- Fraudulent claims

- Unauthorized access to benefits

Revealing your insurance company group number can expose you to various risks, including identity theft, fraudulent claims, and unauthorized access to benefits. Take proactive measures to safeguard your group number.

Future Outlook

With the rapid advancements in technology, insurance companies are leveraging innovative solutions to streamline group number management. Automation and digital tools are revolutionizing the way group numbers are assigned and tracked.

Predictions for the Future of Insurance Group Numbers

The future of insurance group numbers is set to witness enhanced customization and personalization. Companies are predicted to utilize data analytics to tailor group numbers based on specific demographics and risk factors.

Credit: http://www.metlife.com

Credit: http://www.plancover.com

Frequently Asked Questions On What Is Insurance Company Group Number

What Is An Insurance Company Group Number?

An insurance company group number is an identifier used to distinguish different groups under a single insurance company. It helps the insurance company manage and track the policies and benefits associated with specific groups, such as employers or organizations.

How Do I Find My Insurance Company Group Number?

To find your insurance company group number, check your insurance card or policy documents. The group number is usually listed along with your personal details. You can also contact your insurance company or employer’s HR department for assistance in locating your group number.

Why Is The Insurance Company Group Number Important?

The insurance company group number is important because it helps the insurance company and healthcare providers accurately identify and administer your benefits. It ensures that your claims are processed correctly and that you receive the appropriate coverage and services based on your specific group’s plan.

Can I Have Multiple Insurance Company Group Numbers?

Yes, it is possible to have multiple insurance company group numbers if you are covered under multiple plans through different employers or organizations. Each group number will correspond to a specific insurance policy and benefits package.

Conclusion

Understanding the insurance company group number is crucial in navigating the complexities of insurance policies. It serves as a unique identifier that categorizes individuals into specific groups, ensuring accurate billing and easy administration. By knowing your group number, you can ensure smooth communication with your insurance provider and maximize the benefits offered by your policy.

Stay informed and empowered by familiarizing yourself with this essential detail.

Leave a comment