Liability insurance covers damages to others in an accident, while collision insurance covers damage to your vehicle. Both types of insurance are important for full coverage and protection in case of an accident.

Liability insurance is essential for covering the costs of injuries and damages to others, while collision insurance is crucial for repairing or replacing your own vehicle in case of a collision. Understanding the difference between these two types of insurance can help you make informed decisions when choosing your coverage options.

By having both liability and collision insurance, you can ensure comprehensive protection for yourself and others on the road.

Credit: http://www.marketwatch.com

Introduction To Liability Insurance And Collision Coverage

Understanding the differences between Liability Insurance and Collision Coverage is essential for maintaining adequate financial protection while driving on the road.

Definition Of Liability Insurance

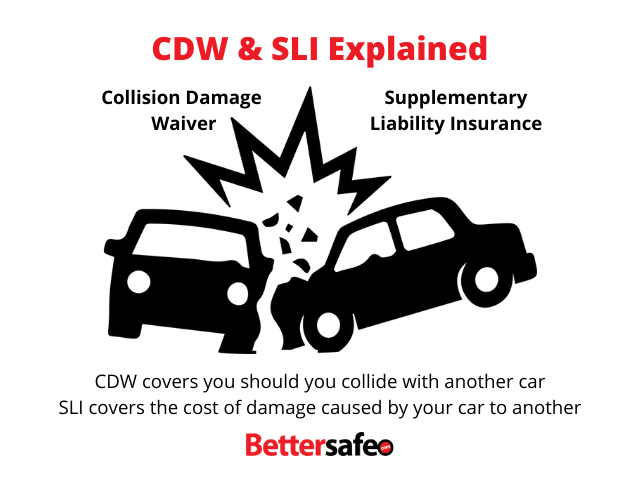

Liability Insurance provides coverage in case you’re at fault in an accident, covering expenses related to damage to third-party property and medical bills.

Definition Of Collision Coverage

Collision Coverage helps pay for repairs to your own vehicle in the event of an accident, regardless of who is at fault.

:max_bytes(150000):strip_icc()/comprehensive-insurance.asp-final-3fc81e079d04428e8c1c6456b311c3a1.png)

Credit: http://www.investopedia.com

Key Differences Between Liability Insurance And Collision Coverage

Understanding the key differences between liability insurance and collision coverage is crucial for ensuring you have the right protection for your vehicle. Below, we delve into the distinct aspects of both types of auto insurance to help you make an informed decision when selecting coverage.

Coverage Provided

Liability Insurance: Covers costs if you’re at fault in an accident resulting in damage to others’ property or injuries.

Collision Coverage: Pays for repairs or replacement of your vehicle in case of an accident, regardless of fault.

Nature Of Claims

Liability Insurance: Involves claims made against you for damages caused to others due to your fault in an accident.

Collision Coverage: Deals with claims for damages to your own vehicle, including repair or replacement costs.

Costs And Premiums

Liability Insurance: Generally cheaper as it covers damages to others’ property or injuries, not your vehicle.

Collision Coverage: Costs more due to covering repairs or replacement for your vehicle, regardless of fault.

Understanding Liability Insurance

Liability insurance is an essential coverage for individuals and businesses alike. It protects you financially if you are found liable for causing damage or injury to someone else or their property. Let’s delve deeper into the scope of coverage and explore some examples of liability insurance claims.

Scope Of Coverage

Liability insurance provides coverage for situations where you are held responsible for causing harm to others. This includes bodily injury to someone or damage to their property. The coverage typically extends to various aspects of your life, including:

- Your personal life

- Your professional life/business

- Your automobile

Whether you’re at fault in a car accident, a visitor gets injured on your property, or a defective product causes harm to someone, liability insurance can help cover the costs and potential legal ramifications.

Examples Of Liability Insurance Claims

Liability insurance claims can arise in various scenarios, and it’s crucial to understand how this coverage protects you. Here are some common examples:

| Situation | Example Claim |

|---|---|

| Car accident | Another driver sustains injuries and requires medical treatment due to your negligence on the road. |

| Slip and fall | A guest slips and falls on your property, resulting in injuries and potential medical expenses. |

| Professional negligence | A client suffers financial losses due to your erroneous advice or services, leading to a legal claim against you. |

| Product liability | A defective product causes harm to a consumer, requiring medical treatment or resulting in property damage. |

These are just a few illustrations of how liability insurance can safeguard you from unexpected financial burdens when you are held liable for damages. It’s essential to have the right coverage in place to protect your assets and ensure peace of mind.

Explaining Collision Coverage

Scope Of Coverage

Collision coverage is a component of an auto insurance policy that covers the cost of repairing or replacing your vehicle after a collision with another vehicle or object, regardless of fault. This coverage is different from liability insurance, which covers damage to another person’s vehicle or property but does not cover your own vehicle.

Examples Of Collision Coverage Claims

- Colliding with another vehicle on the road

- Hitting a tree or other object

- Damage caused by a single-vehicle accident, such as flipping over

When And Why Liability Insurance Is Necessary

Understanding the differences between liability insurance and collision coverage is crucial for any responsible vehicle owner. Liability insurance serves as an essential safeguard, protecting you in a variety of situations. It’s important to know when and why liability insurance is necessary and how it can provide peace of mind on the road.

Legal Requirements

Liability insurance is essential as it is often legally required. In most states, drivers are mandated to carry a minimum amount of liability coverage. Failure to comply with these legal requirements can lead to fines, license suspension, and even vehicle impoundment. Therefore, having adequate liability insurance is not only a smart decision but also a legal obligation.

Protecting Against Lawsuits

Liability insurance provides crucial protection against potential lawsuits resulting from an accident. If you are found at fault in a collision, liability coverage can assist in covering the costs of injuries and property damage sustained by others involved. Without this coverage, you may be personally responsible for these expenses, which can be financially devastating.

Credit: http://www.bettersafe.com

When And Why Collision Coverage Is Necessary

Collision coverage is essential when it comes to protecting your vehicle from damage caused by accidents or collisions with objects. This type of insurance is different from liability insurance, which covers damages to other people’s property or injuries. Collision coverage ensures that your own vehicle is protected in the event of a collision, providing peace of mind on the road.

1. Vehicle Ownership

Collision coverage becomes necessary based on your vehicle ownership status. If you own your vehicle outright, collision coverage may be optional. However, if you lease your vehicle or have an outstanding loan, collision coverage is typically required by the leasing company or lender. This is because they want to protect their financial interest in the vehicle in case of an accident.

2. Coverage For Vehicle Damage

Collision coverage provides financial protection for the damage caused to your own vehicle in a collision, regardless of who is at fault. Whether it’s a fender-bender or a major accident, collision coverage can help cover the costs of repairs or even the replacement of your vehicle.

- Repairs: Collision coverage can cover the expenses for repairing your vehicle after an accident, including labor costs and replacement parts.

- Total Loss: In the unfortunate event that your vehicle is deemed a total loss, collision coverage can provide you with the value of your vehicle before the accident occurred.

Without collision coverage, you would be responsible for paying for these expenses out of pocket, which can be financially burdensome.

It’s important to note that collision coverage only applies to damage caused by collisions with other vehicles or objects, such as trees or fences. Damage resulting from other incidents, like theft or vandalism, would usually be covered by comprehensive insurance.

Ensuring you have the appropriate coverage for your vehicle is crucial in protecting your financial well-being. By understanding when and why collision coverage becomes necessary, you can make informed decisions about your insurance needs.

Factors To Consider When Choosing Liability Insurance

When selecting liability insurance, there are several crucial aspects to keep in mind that can directly impact your coverage and financial security.

Minimum Coverage Limits

The minimum coverage limits denote the least amount of liability insurance you are required to carry as per state laws, ensuring you meet legal mandates.

- Review state minimums to comply with legal requirements

- Evaluate your financial assets to determine ideal coverage

Additional Protection Options

Additional protection options can provide extra coverage beyond basic liability insurance, offering enhanced security against unforeseen accidents.

- Consider umbrella insurance for added liability protection

- Include medical payments coverage for medical expenses

Factors To Consider When Choosing Collision Coverage

When choosing collision coverage, there are several factors to consider that can significantly impact the protection you receive in the event of an accident. Understanding these factors can help you make an informed decision that suits your needs and budget.

Deductibles

Deductibles are the amount you must pay out of pocket before your insurance kicks in. Higher deductibles typically mean lower premiums but result in more upfront costs in the event of a claim.

Coverage Limits

Coverage limits determine the maximum amount your insurance will pay for damages. Consider how much protection you need based on the value of your vehicle and potential repair costs.

Frequently Asked Questions On What Is Liability Insurance Vs Collision

What Is Liability Insurance?

Liability insurance provides coverage for damages or injuries caused by the policyholder to others. It helps cover legal costs, medical expenses, and property damage resulting from the policyholder’s actions.

How Does Liability Insurance Differ From Collision Insurance?

Liability insurance covers damages and injuries caused to others, while collision insurance covers damage to the policyholder’s vehicle in the event of a collision with another vehicle or object.

Why Is Liability Insurance Important For Drivers?

Liability insurance is crucial for drivers as it helps protect them from financial burden in case they are responsible for causing harm or damage to others. It also helps ensure compliance with legal requirements for vehicle insurance.

When Should One Consider Getting Liability Insurance?

It is advisable to consider getting liability insurance as soon as one starts driving. Driving without liability insurance can lead to legal and financial consequences in case of accidents or incidents.

Conclusion

Understanding the difference between liability insurance and collision insurance is crucial for any driver. While liability insurance covers damages to others in an accident, collision insurance is designed to protect your own vehicle. This knowledge can help you make informed decisions when it comes to choosing the right insurance coverage for your needs.

So, whether you are a new driver or a seasoned one, be sure to consider these factors and select the insurance option that best suits your circumstances. Your peace of mind on the road depends on it.

Leave a comment