A unit-linked non-participating insurance plan combines insurance coverage with investment options. This plan offers policyholders the opportunity to invest in funds and earn returns based on market performance.

An introduction to unit-linked non-participating insurance plans: Unit-linked non-participating insurance plans have gained popularity in recent years as they offer a unique combination of insurance coverage and investment opportunities. These plans are designed to provide policyholders with the flexibility to choose how their premiums are invested, allowing them to potentially benefit from market growth.

With a unit-linked non-participating insurance plan, policyholders can direct their premiums into various investment funds such as equities, bonds, or money market instruments. The returns on these investments are linked to the performance of the chosen funds. This means that policyholders can enjoy potential growth on their investment, depending on the market conditions. At the same time, these plans also provide life insurance coverage, offering financial protection to the policyholder and their beneficiaries. This introduction provides a brief overview of what unit-linked non-participating insurance plans are and highlights the key features that make them an appealing choice for individuals looking to secure their financial future.

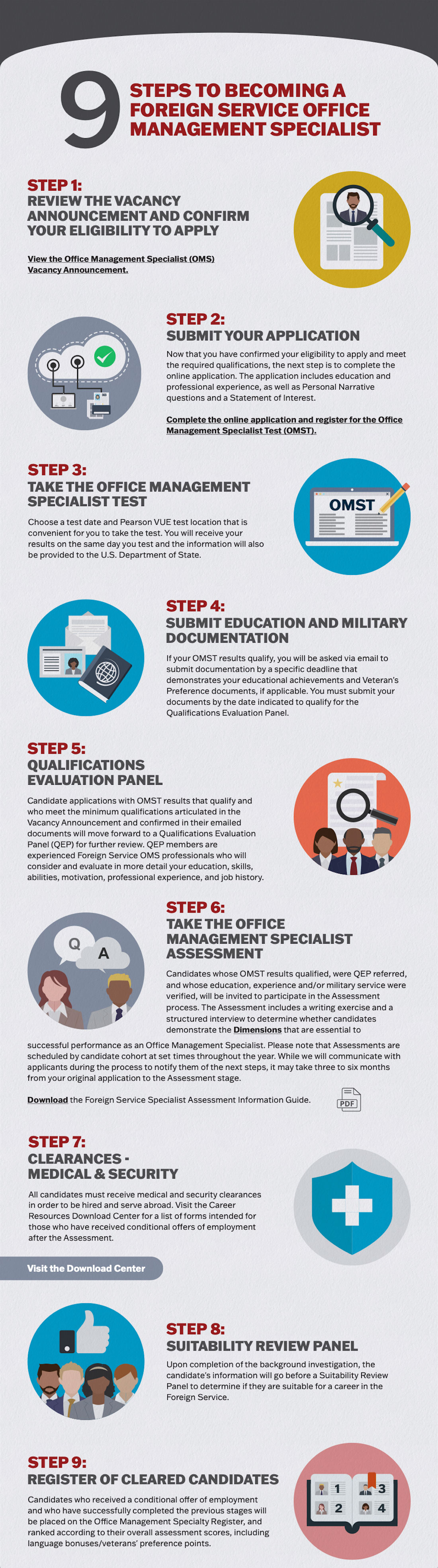

Credit: careers.state.gov

Understanding Ulnp Insurance

Unit Linked Non Participating Insurance Plans (ULNP) offer a unique investment and insurance blend. These plans offer flexibility in investment choices and potential for higher returns based on market performance. ULNP insurance provides a platform for individuals to grow their wealth while securing financial protection simultaneously.

What Are Unit Linked Non Participating Insurance Plans?

Unit Linked Non Participating Insurance Plans (ULNP) are financial products that combine insurance coverage with investment opportunities.

ULNP offers policyholders the flexibility to invest in various asset classes while also providing a life cover.

Key Features Of Ulnp Insurance

- Combines Insurance and Investment

- Allows Flexibility in Investment Choices

- Transparency in Investment Performance

- Partial Withdrawal Options

- Option to Switch between Funds

Credit: blog.hootsuite.com

Benefits Of Ulnp Insurance

Unit Linked Non Participating (ULNP) Insurance is a unique insurance plan that offers a combination of investment and insurance benefits. It provides policyholders with the opportunity to grow their wealth while safeguarding their loved ones against any unforeseen circumstances. ULNP insurance offers various benefits that make it an attractive choice for individuals looking to secure their financial future.

Investment And Insurance Combination

ULNP Insurance provides policyholders with the dual benefit of investment and insurance. It allows individuals to invest a portion of their premium towards different investment funds of their choice, while also providing a life coverage component. This means that not only will your money grow, but you will also have the peace of mind knowing that your loved ones will be financially protected in case of any unfortunate event.

Flexibility In Investment Choices

One of the key advantages of ULNP Insurance is the flexibility it offers in investment choices. Policyholders have the freedom to choose from a wide range of investment funds, including equity funds, debt funds, and balanced funds. This allows individuals to align their investment strategy with their risk appetite and financial goals. Whether you are a conservative investor or have a higher risk tolerance, ULNP Insurance gives you the freedom to tailor your investment portfolio according to your preferences.

Furthermore, ULNP Insurance also provides the option to switch between investment funds based on market conditions, thus enabling policyholders to optimize their investment returns. This flexibility ensures that you have the opportunity to make the most of market opportunities and maximize your wealth accumulation potential.

Ulnp Vs. Traditional Insurance

In the realm of insurance, the choice between a Unit Linked Non Participating (ULNP) plan and traditional insurance can be a pivotal decision. Each option has its own merits and demerits, making it imperative to weigh the nuances before arriving at a decision. Let’s delve deeper into the distinctions between ULNP and Traditional Insurance.

Differences In Structure

- Traditional Insurance primarily offers a guaranteed sum assured, while ULNP blends insurance with investment, allowing policyholders to invest in equity, debt, or a combination of both.

- ULNP policies provide flexibility in terms of allocating funds among various investment options, whereas traditional insurance offers limited or no choice in investment allocation.

- The maturity benefit in traditional insurance is predetermined, often guaranteeing a fixed amount, whereas ULNP policies provide maturity benefits based on the performance of the chosen investment fund.

Risk And Return Comparison

When it comes to risk and return, ULNPs provide a potential for higher returns due to the investment component, but with added risk as the returns are market-linked. On the other hand, traditional insurance offers lower risk with modest returns, as the investment is not directly linked to the market.

Choosing The Right Ulnp Plan

When it comes to securing your financial future, choosing the right Unit Linked Non-Participating (ULNP) insurance plan is crucial. These plans offer a unique combination of insurance and investment, providing both protection and potential for wealth accumulation. However, selecting the right ULNP plan requires careful consideration of various factors. Here, we will discuss the key aspects to keep in mind when choosing a ULNP plan and provide valuable tips for making an informed decision.

Factors To Consider

- Risk Tolerance: Assess your risk appetite and choose a ULNP plan that aligns with your comfort level.

- Investment Objectives: Identify your financial goals and select a plan that offers the right investment options to meet those objectives.

- Fund Performance: Research the historical performance of the funds offered by different ULNP plans to gauge potential returns.

- Charges and Fees: Evaluate the various charges associated with the plan, including management fees and administrative costs.

Tips For Selection

When selecting a ULNP plan, consider the diverse investment options available, such as equity funds, debt funds, or balanced funds. Additionally, seek transparency in the plan’s terms and conditions, and make sure to thoroughly understand the associated costs. It’s also advisable to review the track record of the insurance provider in terms of claim settlement and customer service. Lastly, don’t hesitate to seek professional advice to ensure that you are making an informed decision.

Ulnp Insurance Charges

Unit Linked Non Participating Insurance Plan (ULNP) charges are associated with the investment component, impacting the growth of the policy. These charges include fund management, policy administration, and mortality charges, which affect the returns on the investment. Understanding these charges is crucial for evaluating the benefits and drawbacks of ULNP plans.

Understanding Cost Structure

When it comes to Unit Linked Non Participating (ULNP) Insurance Plans, one of the most important aspects to consider is the cost structure. ULNP Insurance Charges refer to the various fees and expenses associated with these insurance plans. Understanding the cost structure is crucial as it directly impacts the returns you can expect from your policy.Impact On Returns

The cost structure of ULNP Insurance Plans has a significant impact on the returns you can expect to receive. These plans typically have various charges that are deducted from your premium before the remaining amount is invested in the chosen fund(s). Some common charges include:- Premium Allocation Charge: This charge is deducted upfront as a percentage of the premium paid. It covers expenses related to underwriting, policy issuance, and distribution.

- Fund Management Charge: This charge is levied as a percentage of the value of assets under management. It covers the cost of managing the investment portfolio.

- Mortality Charge: This charge is calculated based on your age, gender, and sum assured. It covers the risk of life coverage provided by the policy.

- Policy Administration Charge: This charge is deducted periodically to cover the administrative expenses incurred in servicing the policy.

- Discontinuance Charge: If you choose to surrender or discontinue your policy prematurely, this charge may be applicable. It helps cover the costs incurred by the insurance company.

Ulnp Insurance: Case Studies

ULNP insurance offers tangible benefits to individuals facing diverse financial situations.

Success Stories

Explore how ULNP insurance transformed lives in these remarkable instances.

:max_bytes(150000):strip_icc()/Unit-linked-insurance-plan-resized-d9ca6fd160504191b77aee8d2c1b9fec.jpg)

Credit: http://www.investopedia.com

Frequently Asked Questions For What Is Unit Linked Non Participating Insurance Plan

What Is A Unit Linked Non Participating Insurance Plan?

A Unit Linked Non Participating Insurance Plan is a type of insurance policy that combines a life insurance cover with investment options. The policyholder can choose to invest in different funds, such as equity, debt, or balanced funds, based on their risk appetite and financial goals.

This type of plan provides flexibility and potential for higher returns compared to traditional insurance plans.

Conclusion

Unit Linked Non Participating Insurance Plans offer a seamless combination of investment and insurance, providing individuals with an opportunity to grow their wealth while securing their family’s future. With the flexibility to choose between various investment options, policyholders can tailor their plans according to their financial goals.

The transparency and tax benefits make it a preferred choice for many. So, if you are looking to invest in a plan that offers both growth and protection, Unit Linked Non Participating Insurance Plans can be a wise decision.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is a Unit Linked Non Participating Insurance Plan?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A Unit Linked Non Participating Insurance Plan is a type of insurance policy that combines a life insurance cover with investment options. The policyholder can choose to invest in different funds, such as equity, debt, or balanced funds, based on their risk appetite and financial goals. This type of plan provides flexibility and potential for higher returns compared to traditional insurance plans.” } } ] }

Leave a comment