To insure your apartment, you need landlord insurance that covers property damage and liability protection. A comprehensive landlord insurance policy is necessary to safeguard your investment and protect against potential lawsuits or losses caused by your tenants.

Credit: http://www.azibo.com

Understanding Landlord Insurance

As a landlord of an apartment, it’s crucial to have the right insurance coverage in place. Landlord insurance for an apartment typically includes property damage, liability protection, and loss of rental income. It’s important to carefully assess the specific needs of your rental property to ensure that you have the appropriate coverage in place.

What Is Landlord Insurance?

Landlord Insurance is coverage designed specifically for those who rent out residential properties to tenants.

Importance Of Landlord Insurance

Having Landlord Insurance is crucial to protect your investment property and mitigate financial risks.

Your standard homeowners insurance policy does not provide adequate coverage for rental properties.

Insuring your apartment with the right Landlord Insurance policy can safeguard you against unforeseen events like natural disasters and tenant lawsuits.

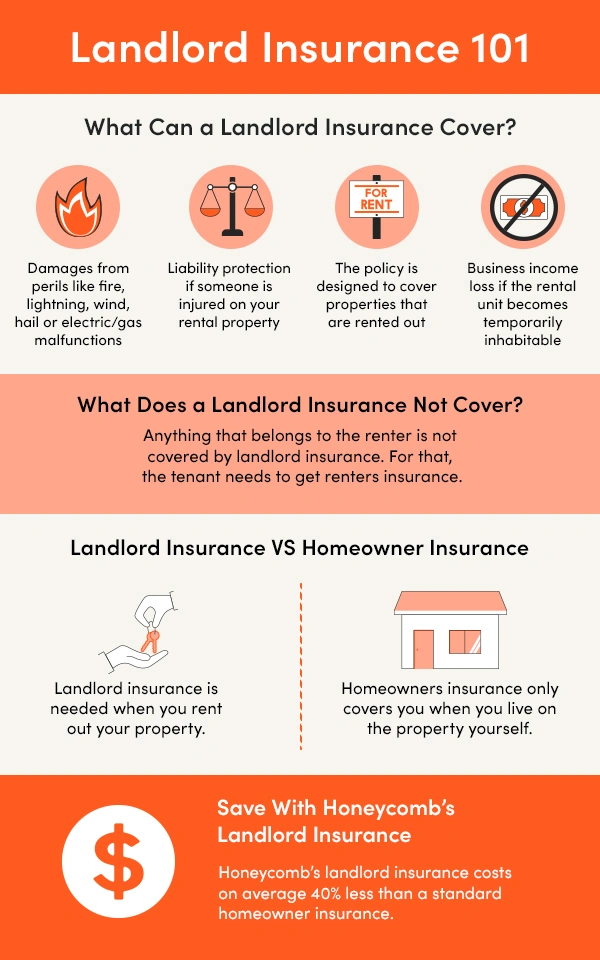

Credit: honeycombinsurance.com

Types Of Landlord Insurance

Landlord Insurance for apartments covers a range of risks including property damage, liability, and loss of rental income. It provides protection against unforeseen events, offering peace of mind to landlords.

When renting out an apartment, it is essential to have the right insurance coverage to protect your investment and liabilities. Landlord insurance is specifically designed to provide coverage for property damage, liability claims, and loss of rental income. Here are the three main types of landlord insurance that you should consider:

Property Coverage

Property coverage is a crucial aspect of landlord insurance. It helps protect your rental property and the structures on it. This coverage typically includes protection against perils such as fire, vandalism, and natural disasters. In case of any unfortunate events that lead to damage or destruction of your apartment, property coverage will provide financial support to repair or rebuild the property.

In addition to the physical buildings, property coverage may also extend to other structures on your premises, such as garages, sheds, and fences. It is important to carefully assess the value of your property and ensure that you have adequate coverage to protect your investment in the event of a major loss.

Liability Coverage

Liability coverage is another crucial component of landlord insurance. It helps protect you from financial losses if a tenant or third party suffers injuries or property damage due to your negligence. For example, if a tenant slips and falls in the common area of your apartment building and files a lawsuit, liability coverage will provide coverage for legal fees, medical expenses, and any potential settlements or judgments.

Liability coverage can also protect you against claims of defamation, wrongful eviction, or invasion of privacy. It is important to note that liability coverage typically has limits, so it’s important to carefully evaluate your risk exposure and select appropriate coverage limits.

Loss Of Rental Income Coverage

Loss of rental income coverage provides financial protection if your rental property becomes uninhabitable due to covered events such as fire or storm damage. It helps compensate for the lost rental income during the period of repairs or renovations. This coverage can be especially valuable if your rental property is your primary source of income or if you depend on the rental income to cover mortgage payments.

Loss of rental income coverage typically has a specified limit and a waiting period before the coverage kicks in. It is important to review the policy terms and conditions to understand the coverage limits and any exclusions that may apply.

Having the right types of landlord insurance coverage for your apartment is crucial to protect your investment and limit your liabilities. By understanding the different types of insurance available, you can make informed decisions and ensure that you have the necessary coverage to safeguard your rental property.

Key Coverage Essentials

When considering landlord insurance for your apartment, it’s important to understand the key coverage essentials that you need to protect your investment. Here are the essential areas to focus on:

Property Damage

Property damage coverage is crucial for protecting your apartment building and its contents from unforeseen events such as fires, storms, or vandalism. This insurance provides financial support to repair or replace the building structure and the landlord’s property, including fixtures and fittings.

Liability Protection

Liability protection is vital as it safeguards you in the event of accidents or injuries that occur on your property. This coverage helps you cover the legal costs and medical expenses related to the incident, offering protection from potential lawsuits.

Loss Of Rental Income

Loss of rental income coverage is essential for landlords as it provides financial support in the event that your property becomes uninhabitable due to a covered loss. It helps to compensate for the lost rental income during the repair or rebuilding process.

Legal Expenses Coverage

Legal expenses coverage is important as it provides financial protection against legal disputes with tenants, such as eviction or lease violation cases. This insurance helps cover your legal expenses, ensuring that you are protected from legal costs that can often arise in the landlord-tenant relationship.

Factors To Consider

When determining landlord insurance for an apartment, consider factors like location, property size, tenant type, and coverage options to ensure comprehensive protection. Assessing these aspects will help in selecting the right insurance for your specific rental property needs.

Factors to Consider There are several key factors to consider when determining the type of landlord insurance needed for an apartment. Understanding these factors can help ensure you have suitable coverage to protect your investment. When selecting landlord insurance, it’s essential to take into account the property’s location, size, value, the type of tenants, and conducting a thorough risk assessment. “`htmlProperty Location

“` The property’s location plays a crucial role in determining the type of landlord insurance required. Urban areas with higher crime rates may necessitate additional coverage for theft or vandalism. In contrast, properties located in regions prone to natural disasters, such as earthquakes or floods, may require specific insurance policies to safeguard against these risks. “`htmlProperty Size And Value

“` The size and value of the apartment are significant factors in ascertaining the appropriate landlord insurance coverage. Larger properties typically entail higher replacement costs in the event of damage or loss. Consequently, the insurance coverage should align with the property’s value to ensure comprehensive protection against potential risks and liabilities. “`htmlType Of Tenants

“` The type of tenants occupying the apartment is another crucial aspect to consider when selecting insurance coverage. Different tenant demographics may present varying levels of risk. For instance, a property with student tenants or young professionals might require different coverage than one housing families or retirees. It’s essential to assess the potential risks associated with the tenant demographic and select insurance accordingly. “`htmlRisk Assessment

“` Conducting a thorough risk assessment is imperative in determining the appropriate landlord insurance. This assessment involves evaluating potential hazards, liabilities, and vulnerabilities specific to the property. By identifying and analyzing these risks, landlords can tailor their insurance coverage to mitigate potential threats effectively. By carefully considering the property location, size and value, type of tenants, and conducting a comprehensive risk assessment, landlords can make informed decisions when selecting the most suitable insurance coverage for their apartment. Each of these factors plays a critical role in ensuring the protection of the property and mitigating potential risks and liabilities.Optional Coverages

In addition to the standard coverages provided by landlord insurance, there are several optional coverages that you might want to consider for your apartment. These coverages offer extra protection and can provide peace of mind in the face of unexpected events. Here are some of the optional coverages you may want to include in your landlord insurance policy:

Natural Disasters Coverage

Living in an area prone to natural disasters such as hurricanes, earthquakes, or floods can be risky for property owners. While standard landlord insurance policies usually cover damages caused by fire or certain weather events like hailstorms, they may not cover damage resulting from major natural disasters. That’s where natural disasters coverage comes in. This optional coverage can help protect your apartment from the destruction caused by these catastrophic events.

Whether it’s repairing structural damage or replacing personal belongings, having natural disasters coverage ensures that you won’t be shouldering the entire financial burden on your own. It’s important to carefully review the policy details to understand what specific natural disasters are covered and any exclusions that may exist. Investing in this optional coverage can give you the peace of mind knowing that your apartment is protected against the unpredictable forces of nature.

Vandalism Coverage

Vandalism can strike when you least expect it, causing significant damage to your apartment. Broken windows, graffiti, and intentional destruction of property can result in costly repairs and loss of rental income. While landlord insurance typically includes coverage for acts of vandalism, it’s often limited and may not fully cover the expenses to restore your apartment to its original condition.

Opting for vandalism coverage will ensure your insurance policy provides adequate protection against intentional damage caused by malicious individuals. With this optional coverage, you can have the peace of mind knowing that your insurance will financially support the repairs necessary to restore your apartment. Make sure to carefully review the policy provisions and any deductible that may apply to vandalism coverage.

Building Ordinance Coverage

Building ordinances are regulations and codes enforced by local authorities to ensure buildings meet certain safety standards. In the unfortunate event that your apartment building suffers extensive damage, you may be required to rebuild or repair it in compliance with updated building codes. This could result in additional expenses that may not be covered by your standard landlord insurance policy.

Building ordinance coverage is an optional coverage that provides financial protection for unforeseen expenses related to complying with building codes during repairs or rebuilding. It can cover costs such as bringing the building up to current code requirements, removing debris, and even the loss of rental income during the construction period. Adding this coverage to your policy helps safeguard your investment by ensuring that you won’t face unexpected financial setbacks due to compliance with building regulations.

When considering which optional coverages to include in your landlord insurance policy, it’s important to assess the unique needs and risks associated with your apartment. By carefully reviewing the policy provisions and seeking professional advice if needed, you can tailor your insurance coverage to provide the best protection for your property.

Credit: m.facebook.com

Cost Considerations

When insuring an apartment, consider the costs for essential coverage like property damage protection and liability insurance. Landlord insurance for apartments typically includes coverage for fire, theft, and tenant damage to safeguard your investment. Tailoring your policy to meet your needs ensures comprehensive protection.

Cost Considerations Premium Costs Apartment landlord insurance premiums typically range from $500-1,500 annually. Deductibles Deductibles for landlord insurance can vary from $500-2,000. Discount Options Explore discount options such as multi-policy discounts for reduced landlord insurance costs.Choosing The Right Policy

When it comes to ensuring your apartment is protected as a landlord, choosing the right insurance policy is paramount. By assessing your coverage needs, comparing quotes, and reviewing policy details, you can make an informed decision that safeguards your investment.

Assessing Coverage Needs

- Understand the specific risks associated with renting out an apartment.

- Determine the level of property and liability coverage required for your situation.

- Consider additional coverage options such as loss of rental income or legal expenses.

Comparing Quotes

- Obtain quotes from multiple insurance providers to compare premiums and coverage.

- Ensure each quote includes the same level of protection for accurate comparison.

- Look for any discounts or package deals that may be available to lower costs.

Reviewing Policy Details

- Thoroughly read through the terms and conditions of each policy to understand coverage limits and exclusions.

- Pay attention to the deductible amount and how claims are processed.

- Seek clarification on any ambiguous language or clauses in the policy document.

Frequently Asked Questions For What Landlord Insurance Do I Need For An Apartment

What Is Landlord Insurance For Apartments?

Landlord insurance for apartments provides protection for property owners against financial losses resulting from damages, liability claims, and rental income loss. It covers the structure, liability, and loss of rental income.

What Does Landlord Insurance Typically Cover?

Landlord insurance typically covers property damage, liability protection, loss of rental income, and legal expenses. It provides financial protection for property owners against unforeseen circumstances such as natural disasters and tenant damages.

Do I Need Landlord Insurance As A Property Owner?

Yes, it is essential for property owners to have landlord insurance. Standard homeowners insurance does not provide adequate coverage for rental properties. Landlord insurance offers protection specifically tailored to the unique risks associated with renting out a property.

Conclusion

To ensure comprehensive protection for your apartment as a landlord, you need the right landlord insurance. This type of insurance offers coverage for property damage, liability claims, and rental income loss. By understanding your specific needs and assessing potential risks, you can obtain a policy that suits you best.

It’s crucial to consult with insurance professionals who can guide you through the process and provide tailored solutions. Safeguarding your investment will bring peace of mind and financial security.

Leave a comment