To know what motorcycle insurance you need, consider liability coverage, comprehensive and collision coverage, and optional coverage like uninsured/underinsured motorist coverage and medical payments coverage. If you own a motorcycle, it’s important to have the right motorcycle insurance coverage in place.

In the event of an accident or theft, having the appropriate coverage can help protect you financially. Motorcycle insurance typically includes liability coverage, which is required in most states and helps cover damages or injuries you may cause to others.

Additionally, comprehensive and collision coverage can help pay for damages to your motorcycle. Optional coverage, such as uninsured/underinsured motorist coverage and medical payments coverage, can provide further protection. Before purchasing a policy, assess your needs and consult with an insurance agent to make sure you have the right motorcycle insurance for your situation.

Importance Of Motorcycle Insurance

Motorcycle insurance is essential for protecting yourself and your bike in case of accidents, theft, or damage. It provides financial coverage for medical expenses, repairs, and liability claims. Ensure you have comprehensive and collision coverage, as well as uninsured/underinsured motorist protection to stay fully protected on the road.

Legal Requirements

Mandatory in most states to ensure compliance with regulations. Protects against legal penalties.

Financial Protection

Crucial for safeguarding against costly accidents and damages. Offers peace of mind.

Importance of Motorcycle Insurance:

Motorcycle insurance is essential for riders to stay protected on the road. It not only provides financial security but also ensures legal compliance. Understanding the type of coverage required is vital to maintain safety and financial stability.

Types Of Motorcycle Insurance

When it comes to motorcycle insurance, understanding the different types of coverage is crucial. Having the right insurance can protect you financially in case of accidents or damage to your motorcycle. There are three main types of motorcycle insurance that you need to consider: Liability Coverage, Collision Coverage, and Comprehensive Coverage.

Liability Coverage

Liability coverage is the most basic and essential motorcycle insurance you should have. It protects you financially in case you are at fault in an accident and cause injury to others or damage to their property. In simple terms, liability coverage pays for the damages you are legally responsible for.

Included in liability coverage are two types of coverage: bodily injury liability and property damage liability. Bodily injury liability covers the medical expenses, loss of income, and other costs associated with injuries suffered by the other party involved in the accident. Property damage liability, on the other hand, covers the repairs or replacement costs for the other party’s damaged property, such as their vehicle or belongings.

Liability coverage is required by law in most states, and the minimum coverage limits vary by jurisdiction. It’s important to understand the liability coverage requirements in your state and consider purchasing higher limits to provide additional protection.

Collision Coverage

If you want to protect your motorcycle from damage caused by collisions, collision coverage is the type of insurance you’ll need. This coverage pays for repairs or replacement of your motorcycle if it’s damaged in an accident, regardless of who is at fault. Whether you collide with another vehicle, a stationary object, or even if your motorcycle tips over, collision coverage will assist with the costs of repair or replacement.

It’s important to note that collision coverage is not required by law, but it may be required if you have financed your motorcycle. Even if it’s not required, collision coverage can provide you with peace of mind and protect your investment in your motorcycle.

Comprehensive Coverage

Comprehensive coverage is a type of insurance that protects your motorcycle from damage caused by factors other than collisions. This could include theft, vandalism, fire, severe weather, falling objects, and more. Essentially, comprehensive coverage covers virtually any non-collision-related damage to your motorcycle.

Just like collision coverage, comprehensive coverage is not usually required by law but may be necessary if you have financed your motorcycle. This type of coverage can be particularly valuable if you live in an area prone to theft, vandalism, or extreme weather conditions.

It’s important to note that both collision and comprehensive coverage often come with a deductible, which is the amount you’ll have to pay out of pocket before your insurance kicks in. It’s essential to choose a deductible that fits your budget and consider whether the cost savings of a higher deductible outweighs the potential increased out-of-pocket costs.

Factors Affecting Motorcycle Insurance

Choosing the right motorcycle insurance depends on various factors such as your driving experience, the type and value of your bike, your location, and the coverage you want. Factors like your age, driving record, and where you park your motorcycle also impact the insurance needed, whether it’s liability, collision, or comprehensive coverage.

Factors Affecting Motorcycle Insurance: Age and Riding Experience Age and riding experience significantly impact motorcycle insurance rates. Inexperienced riders or those under 25 usually face higher premiums due to their higher likelihood of accidents. Experienced riders, on the other hand, tend to get better rates due to their proven track record of safe riding. Type of Motorcycle The type of motorcycle you ride is a crucial factor in determining insurance costs. Sport bikes and high-performance motorcycles often come with higher insurance premiums due to their increased risk of accidents and theft. Cruisers and touring bikes generally have lower insurance rates as they are considered safer and less prone to accidents. Location Your location also plays a significant role in determining your motorcycle insurance rates. Urban areas with high traffic and increased crime rates commonly result in higher premiums. Rural areas, on the other hand, typically have lower insurance rates due to reduced traffic and lower instances of theft and accidents.

Credit: m.facebook.com

Essential Coverage To Consider

When considering motorcycle insurance, it’s crucial to have the right coverage to protect yourself and your bike. Understanding the essential coverage options is essential to ensure you are adequately protected in case of an accident or other unforeseen events. Here are some crucial coverage options every motorcycle rider should consider:

Uninsured/underinsured Motorist Coverage

Uninsured/Underinsured Motorist Coverage provides protection if you are involved in an accident with a driver who has insufficient or no insurance coverage. This coverage can help cover medical expenses, lost wages, and other costs associated with the accident if the at-fault party cannot pay for the damages.

Medical Payments Coverage

Medical Payments Coverage can help pay for medical expenses resulting from a motorcycle accident, regardless of who is at fault. It can cover hospital bills, surgery costs, x-rays, and other medical expenses for you and your passenger. This coverage can be beneficial, especially in states with no-fault insurance laws as it can help bridge the gap in medical coverage.

Optional Coverage Options

You should consider optional coverage options when determining the motorcycle insurance you need. These additional coverages provide added financial protection in case of accidents, theft, or damage to your bike. Including options like collision, comprehensive, and uninsured/underinsured motorist coverage can offer peace of mind on the road.

When it comes to motorcycle insurance, it’s important to understand that the basic coverage may not be enough to adequately protect you and your bike. That’s where optional coverage options come into play. These additional coverage options can provide you with extra protection and peace of mind in case of an accident or damage to your motorcycle.

Personal Injury Protection

Personal Injury Protection, or PIP, is an optional coverage that can help pay for medical expenses if you or your passengers are injured in an accident, regardless of who is at fault. This coverage can be crucial, especially if you don’t have health insurance or if your health insurance coverage is limited.

With PIP coverage, you can rest assured knowing that you won’t have to worry about expensive medical bills in the event of an accident. This coverage typically includes benefits such as medical expenses, lost wages, and even coverage for essential services like house cleaning or childcare.

Custom Parts And Equipment Coverage

If you’ve customized your motorcycle with aftermarket parts or added expensive upgrades, Custom Parts and Equipment Coverage is a must-have. This optional coverage provides protection for accessories, modifications, and enhancements that are not typically covered under the basic policy.

With Custom Parts and Equipment Coverage, you can be confident that your investment in your motorcycle’s customizations is protected. Whether you have a fancy paint job, aftermarket exhaust, or custom handlebars, this coverage ensures that you will be reimbursed for the full value of these enhancements in case of theft, damage, or loss.

It’s important to note that this coverage usually comes with a limit on the amount of coverage provided. Be sure to review your policy to understand the exact coverage limits and ensure they align with the value of your customizations.

In conclusion, when it comes to motorcycle insurance, considering optional coverage options such as Personal Injury Protection and Custom Parts and Equipment Coverage gives you the added protection and peace of mind you need. Assess your individual needs and the value of your motorcycle before deciding on the optional coverage options that are right for you.

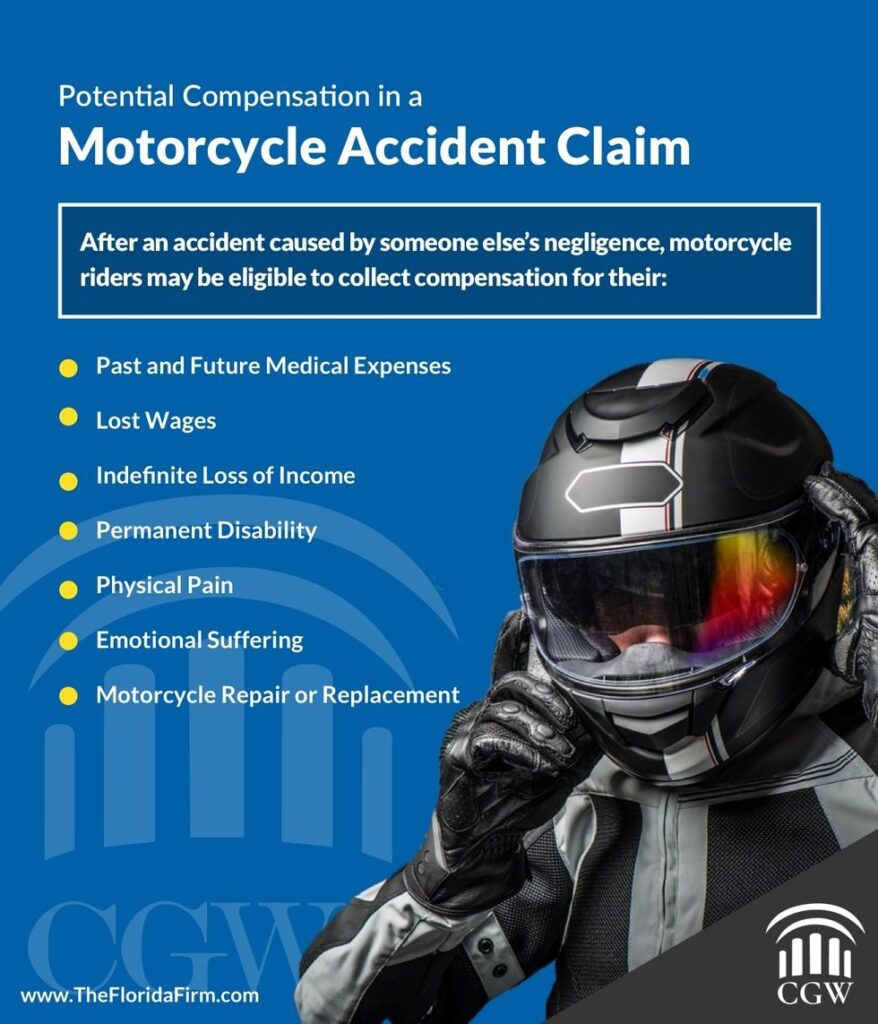

Credit: http://www.thefloridafirm.com

Tips For Getting The Right Coverage

When it comes to motorcycle insurance, having the right coverage is crucial for protecting yourself and your bike on the road. Here are some key tips to help you ensure you are adequately covered:

Assess Your Riding Habits

Start by assessing your riding habits to determine the level of coverage you need. Consider factors like how often you ride, where you ride, and whether you ride alone or with passengers.

Compare Multiple Quotes

Obtain quotes from multiple insurance providers to compare coverage options and pricing. This will help you find the best policy that fits your needs and budget.

Understand Policy Details

Before finalizing any insurance policy, take the time to thoroughly understand the policy details, including coverage limits, deductibles, and exclusions. Make sure you are clear on what is and isn’t covered.

Common Mistakes To Avoid

Avoiding common mistakes when it comes to motorcycle insurance is essential. Understand what coverage you need, compare quotes from different providers, and avoid underinsuring or overinsuring your bike. Keep your policy up to date and make sure you have sufficient coverage to protect yourself and your motorcycle on the road.

Common Mistakes to AvoidUnderinsuring Your Motorcycle

Failing to adequately insure your motorcycle can lead to financial difficulties if an accident occurs.

Neglecting Roadside Assistance Coverage

Overlooking roadside assistance coverage can leave you stranded in case of an emergency on the road.

Reviewing And Updating Your Policy

Regularly Review Coverage Needs

As a motorcyclist, it’s important to regularly review your insurance coverage needs. Life changes, and so do your insurance requirements. Whether you’ve acquired new assets, started a family, or changed jobs, these factors can affect the amount of coverage you need. By reviewing your policy annually, you can ensure that your coverage aligns with your current situation, providing peace of mind should you need to make a claim.

Update Policy After Modifications

After making modifications to your motorcycle, it’s crucial to update your policy accordingly. Whether you’ve added custom parts, upgraded the engine, or made significant cosmetic changes, these modifications should be reflected in your insurance policy. Failing to update your policy after such modifications could lead to potential coverage gaps in the event of an accident or loss.

Credit: http://www.maxpowerlaw.com

Frequently Asked Questions On What Motorcycle Insurance Do I Need

What Are The Different Types Of Motorcycle Insurance?

Motorcycle insurance can include liability, collision, and comprehensive coverage. Liability covers damages to others, while collision covers damages to your bike. Comprehensive insurance includes coverage for theft and non-accident-related damage.

How Much Motorcycle Insurance Coverage Do I Need?

The amount of coverage you need depends on factors such as the value of your bike, your assets, and your personal preferences. It’s essential to consider liability coverage, as well as coverage for your bike and potential medical expenses.

Should I Consider Uninsured Or Underinsured Motorist Coverage?

Yes, uninsured and underinsured motorist coverage can be essential. It protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have sufficient coverage to pay for your damages and medical expenses.

Does Motorcycle Insurance Cover Customization And Accessories?

Insurance can cover customized parts and accessories, but there may be limits to the coverage amount. It’s important to check your policy and consider additional coverage if your bike has extensive customizations.

Conclusion

Motorcycle insurance is a vital safeguard for riders, protecting against unforeseen accidents and financial liabilities. By understanding the various coverage options available, you can ensure you have the right insurance that suits your needs. Whether it’s liability coverage, comprehensive coverage, or personal injury protection, taking the time to research and select the most suitable policy can offer peace of mind on the open road.

Don’t overlook the importance of motorcycle insurance – it’s an investment in your safety and financial security.

Leave a comment