National Insurance in the UK is a mandatory social security system for workers. It funds state benefits and services.

National Insurance, a critical element of the UK’s social welfare system, is pivotal in providing financial protection and support to individuals in times of need. Established as a means of contributing towards state benefits and services, National Insurance ensures a safety net for employees, helping fund healthcare, pensions, and other assistance programs.

Understanding the nuances of National Insurance is essential for both employees and employers to navigate the complex landscape of social security in the United Kingdom. In this comprehensive guide, we will delve into the intricacies of National Insurance, shedding light on its significance, categories, contributions, and benefits, to empower you with the knowledge needed to make informed decisions.

:max_bytes(150000):strip_icc()/welfare-state.asp-final-4128204523d845c89bf77d8805828fa6.png)

Credit: http://www.investopedia.com

What Is National Insurance?

National Insurance is a system of contributions paid by workers and employers in the UK to qualify for certain state benefits.

Definition And Purpose

National Insurance contributions are payments made to fund state benefits such as the State Pension and healthcare services.

Types Of National Insurance Contributions

- 1. Class 1: Paid by employees earning over a certain threshold.

- 2. Class 2: Voluntary contributions for self-employed individuals.

- 3. Class 3: Voluntary contributions for those not eligible for Class 1 or 2.

- 4. Class 4: Paid by self-employed individuals on profits above a specific amount.

Who Pays National Insurance?

People in the UK are responsible for paying national insurance, which helps fund various social security programs. National insurance contributions are made by employees, self-employed individuals, and employers.

Employed Individuals

Employed individuals working in the UK must pay National Insurance contributions.

- Contributions are automatically deducted from their salaries.

- Include employees, directors, and certain agency workers.

Self-employed Individuals

Self-employed individuals are responsible for paying their own National Insurance contributions.

- Must register with HM Revenue & Customs.

- Payments are made through self-assessment.

Exemptions And Special Cases

Some individuals may be exempt from paying National Insurance or have special conditions.

| Category | Details |

|---|---|

| Low earners | May be exempt from contributions. |

| Over State Pension age | No longer required to pay. |

| Special cases | Individuals with specific circumstances. |

How Is National Insurance Calculated?

Calculating National Insurance in the UK depends on your earnings. It’s deducted from your salary if you’re employed. The amount is based on your income level and class of National Insurance contribution.

Class 1 Contributions

Class 1 National Insurance contributions are calculated based on an individual’s salary and are paid by both employees and employers. The contribution is a percentage of your earnings that fall within certain thresholds. There are different thresholds depending on whether you’re an employee, an employer, or self-employed.

As an employee, the Class 1 National Insurance contribution rate for the 2021/2022 tax year is 12% of your earnings between £184 and £967 per week (the “primary threshold” and the “upper earnings limit” respectively).

For example, if your weekly earnings are £500, you will pay 12% on the £316 (£500 – £184) that falls between the primary threshold and your earnings. This means your National Insurance contribution would be £37.92 (£316 x 12%).

Employers also contribute towards Class 1 National Insurance at a rate of 13.8% on earnings above £170 per week (the “secondary threshold”). For example, if your weekly earnings are £500 as an employee, your employer would contribute 13.8% on £330 (£500 – £170), resulting in a contribution of £45.54 (£330 x 13.8%).

Class 2 Contributions

Class 2 National Insurance contributions are paid by self-employed individuals who earn over a certain threshold. For the 2021/2022 tax year, the Class 2 contribution is a flat rate of £3.05 per week if your self-employed profits reach £6,515 or more.

If your self-employed profits are below the threshold, you do not have to pay Class 2 contributions. However, you may choose to make voluntary payments to protect your entitlement to certain benefits.

Class 3 Contributions

Class 3 National Insurance contributions are voluntary contributions that can be paid by individuals to fill any gaps in their National Insurance record. These contributions can help ensure eligibility for certain state benefits, such as the State Pension.

The rate for Class 3 contributions for the 2021/2022 tax year is £15.40 per week. It’s important to note that Class 3 contributions only count towards your National Insurance record and do not increase the amount of benefits you may receive.

Class 4 Contributions

Class 4 National Insurance contributions are paid by self-employed individuals on their annual profits. The contributions are calculated based on a set percentage and different thresholds. For the 2021/2022 tax year, the Class 4 contribution rates are as follows:

| Profits | Rate |

|---|---|

| Up to £9,568 | 0% |

| £9,569 to £50,270 | 9% |

| Above £50,270 | 2% |

For example, if your annual self-employed profits are £30,000, you would pay 9% on the profits between £9,569 and £30,000, which is £1,673.61 (£30,000 – £9,569) x 9%.

It’s important to note that Class 4 contributions are not payable if your annual profits are below the lower profits limit, which is currently set at £6,515 for the 2021/2022 tax year.

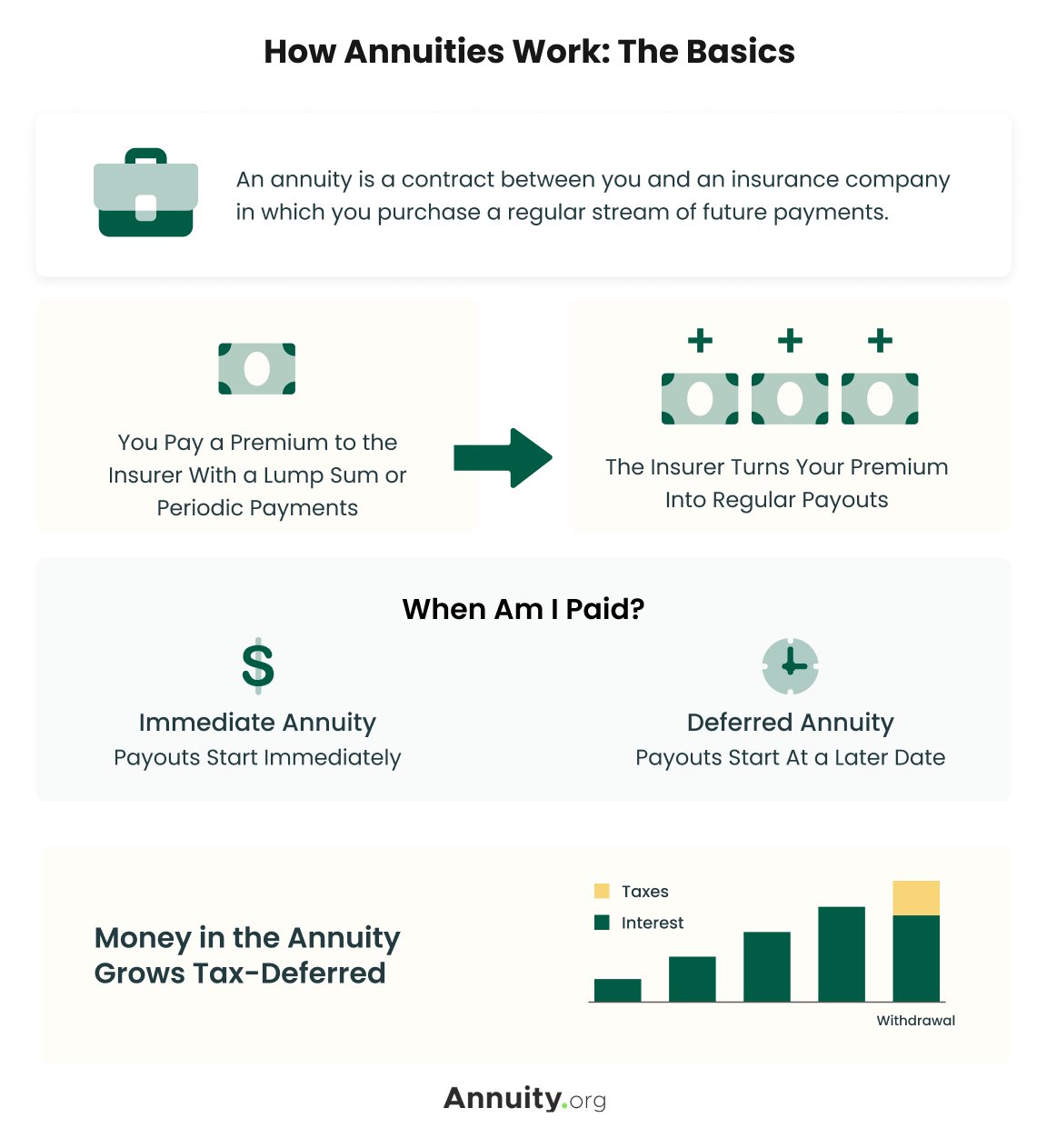

Credit: http://www.annuity.org

Benefits Of National Insurance

National Insurance in the UK provides various benefits to individuals contributing to the system. These benefits are vital for ensuring financial security in different stages of life. Below are some of the key benefits that National Insurance offers:

State Pension

The National Insurance contributions you make during your working life go towards qualifying you for the State Pension. When you reach State Pension age, you can receive a regular payment to support your living expenses in retirement.

Jobseeker’s Allowance

For individuals who have lost their job and are actively seeking employment, Jobseeker’s Allowance provides financial support to help cover the basic living expenses during the job hunting period.

Maternity Allowance

Maternity Allowance offers financial assistance to expecting mothers who do not qualify for Statutory Maternity Pay from their employers, ensuring they have financial support during their maternity leave.

Sickness And Disability Benefits

National Insurance contributions also entitle individuals to receive Sickness and Disability Benefits in case of health issues or disabilities that impact their ability to work, providing crucial financial support during such challenging times.

How To Apply For National Insurance?

When it comes to working in the UK, having a National Insurance number is crucial. This unique code is used to track your contributions to the country’s social security system, and is necessary for accessing state benefits and services. If you’re wondering how to apply for National Insurance, here’s what you need to know.

Obtaining A National Insurance Number

To obtain a National Insurance number, you can apply by calling the National Insurance number application line. After providing some initial details, you may be asked to attend an interview to confirm your identity and provide relevant documents. It’s a straightforward process that ensures you’re properly registered for tax and benefit purposes.

Registering For Self-employment

If you’re considering self-employment in the UK, registering for National Insurance is a necessary step. Once you’ve obtained your National Insurance number, you must also register as self-employed with HM Revenue and Customs (HMRC) within three months of starting your self-employment. This ensures you’re contributing to the National Insurance system correctly and meeting your tax obligations. Remember, failure to do so can result in penalties and legal consequences.

:max_bytes(150000):strip_icc()/payrolltax.asp_final-f09aa1c3011c44ba925ae501bd4785ad.jpg)

Credit: http://www.investopedia.com

Frequently Asked Questions On What National Insurance In Uk

What Is National Insurance In The Uk?

National Insurance in the UK is a system through which individuals make contributions to receive certain state benefits, including the state pension, unemployment benefits, and maternity allowance. It also helps fund the National Health Service (NHS).

Why Do I Need To Pay National Insurance?

Paying National Insurance contributions ensures that you are entitled to various state benefits, including the state pension, statutory sick pay, and maternity allowance. It also contributes to the funding of public services like the NHS.

How Is National Insurance Calculated?

National Insurance is calculated based on your earnings and employment status. The amount you pay may vary depending on whether you are employed, self-employed, or earning above a certain threshold. It’s important to understand your specific circumstances to determine your National Insurance contributions.

Conclusion

To sum it up, understanding National Insurance in the UK is essential for anyone working or residing in the country. From its purpose of funding state benefits to the different categories and rates, this blog post aimed to shed light on this significant aspect of the UK’s tax and social security system.

By grasping the ins and outs of National Insurance, individuals can ensure compliance and make informed decisions regarding their financial planning. Stay informed and up-to-date on this topic to navigate the UK’s tax landscape confidently.

Leave a comment