An endowment policy is considered is a form of life insurance that pays out a lump sum upon maturity. It is a long-term savings option with a guaranteed payout.

Investing in an endowment policy can provide financial security and peace of mind. Endowment policies are designed to offer protection and savings benefits, making them a popular choice for individuals looking to secure their financial future. With fixed premiums and a predetermined payout, endowment policies provide a disciplined approach to financial planning.

The lump sum received at maturity can be used for various purposes such as funding education, retirement, or other financial goals. Understanding the nuances of endowment policies is essential for making informed decisions about your financial well-being.

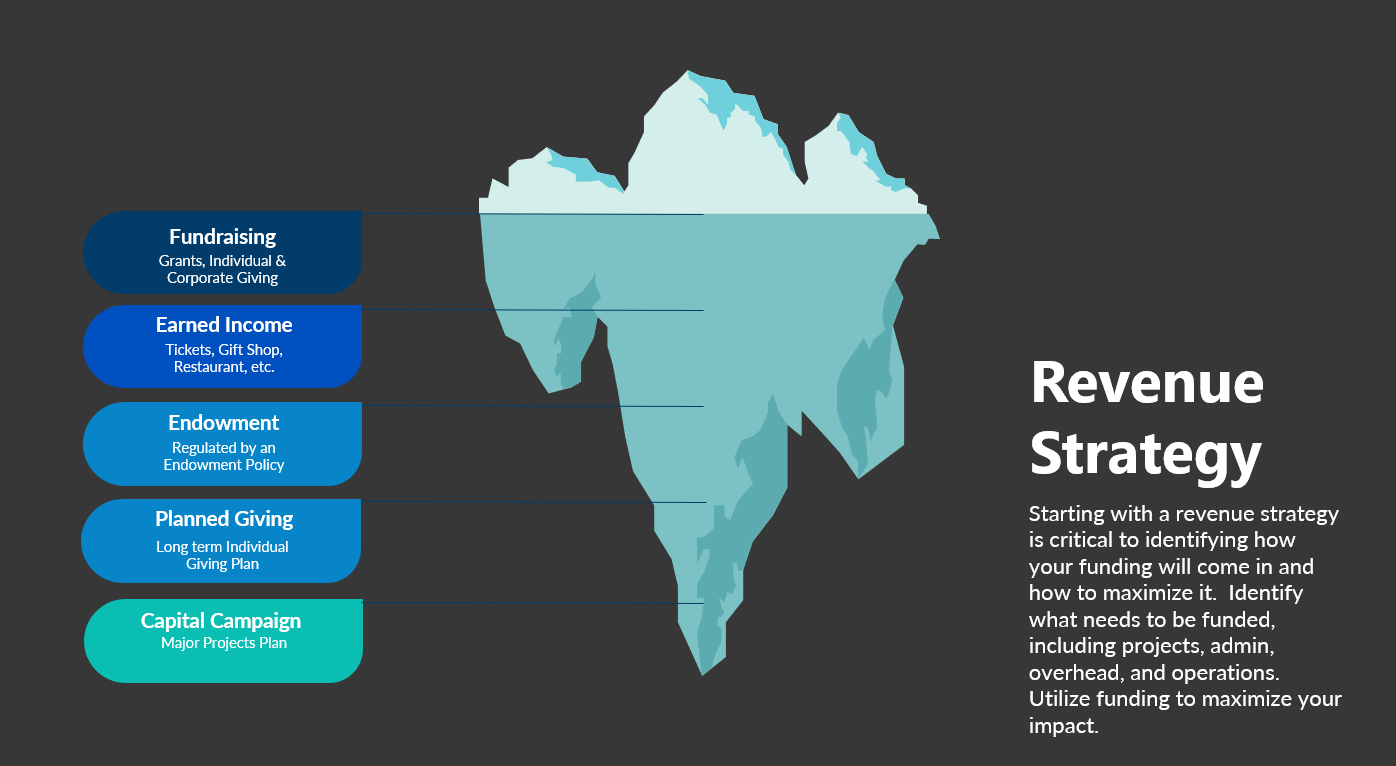

Credit: http://www.nmblstrategies.com

Understanding Endowment Policies

An endowment policy is an insurance contract that combines elements of insurance coverage and savings, providing both protection and potential investment growth.

What Is An Endowment Policy?

An endowment policy is a financial product offered by insurance companies that provides a lump-sum payout to the policyholder after a specified period or upon the policyholder’s death, whichever occurs first.

How Do Endowment Policies Work?

- Policyholder pays regular premiums over a set term

- Part of the premium goes towards life coverage, and the rest is invested

- At the end of the policy term or upon death, a lump sum is paid out

Credit: http://www.state.gov

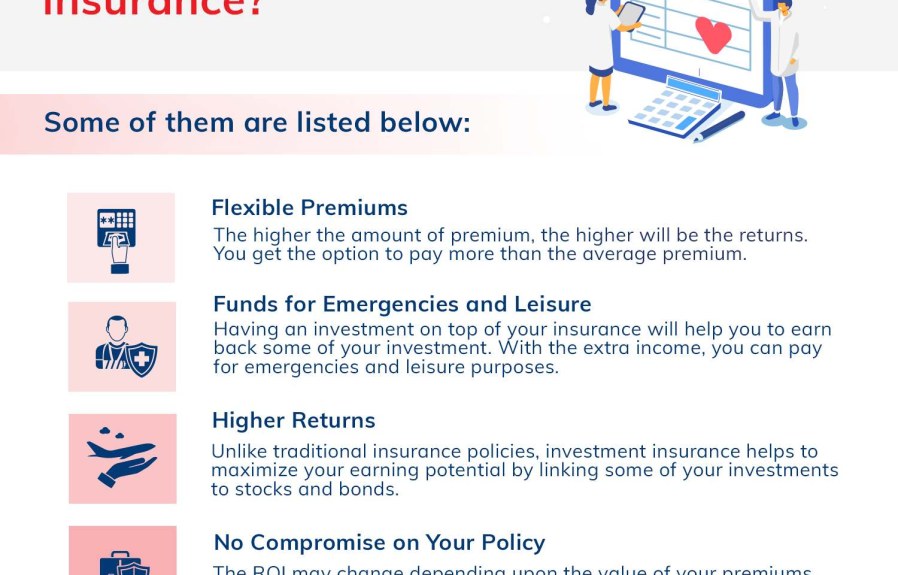

Benefits Of Investing In Endowment Policies

Endowment policies offer numerous advantages for individuals looking to secure their financial future. From steady and guaranteed returns to tax benefits and flexible investment options, investing in endowment policies can provide a range of benefits tailored to meet your long-term financial goals.

Steady And Guaranteed Returns

Endowment policies ensure a consistent stream of returns over a predefined period, offering financial stability and security for investors.

Tax Benefits

Investing in endowment policies can provide tax advantages by allowing individuals to benefit from tax deductions on their premiums or tax-free proceeds upon maturity.

Flexibility In Investment Options

Endowment policies offer versatile investment options, enabling investors to choose from various policy terms and premium payment frequencies to suit their specific financial needs.

Choosing The Right Endowment Policy

When it comes to selecting the right endowment policy, there are several factors that need to be taken into consideration. This crucial decision requires careful analysis and evaluation of various aspects to ensure that your investment goals are met. In this section, we will discuss the key factors that you should consider when choosing an endowment policy.

Determining Your Investment Goals

Before selecting an endowment policy, it is important to determine your investment goals. This involves considering factors such as the desired returns, risk tolerance level, and investment horizon. By clearly defining your objectives, you can align them with the specific features offered by different endowment policies and find the one that best suits your needs.

Considering The Policy Term

The policy term plays a significant role in endowment policy selection. The term refers to the duration of the policy, which can range from a few years to several decades. It is essential to align the policy term with your financial goals and obligations. For short-term goals, a policy with a shorter term may be more suitable, while long-term goals may require a policy with a longer term to maximize potential returns.

Evaluating The Track Record Of Insurance Providers

Choosing a reliable insurance provider is crucial for the success of your endowment policy. Evaluating the track record of insurance providers helps ensure that your investment is in safe hands. Look for insurance companies with a strong financial standing, a proven track record of fulfilling claims, and a history of generating consistent returns for policyholders. This information can be obtained through research, customer reviews, and consulting with financial advisors.

In summary, when selecting an endowment policy, it is important to determine your investment goals, consider the policy term, and evaluate the track record of insurance providers. By carefully analyzing these factors, you can make an informed decision that aligns with your financial objectives and maximizes the potential of your investment.

Maximizing Returns With Endowment Policies

Endowment policies offer a smart way to secure your financial future by providing a combination of savings and investment. When it comes to maximizing returns with endowment policies, it’s essential to consider various strategies to make the most of your investment. Regularly reviewing your policy, exploring additional investment options, and considering partial withdrawals can all contribute to optimizing the returns on your endowment policy.

Regularly Review Your Policy

When it comes to maximizing the returns on your endowment policy, it’s crucial to regularly review your policy to ensure it aligns with your financial goals and market conditions. Regular reviews enable you to assess the performance of your investment, evaluate the policy’s flexibility, and make necessary adjustments to maximize returns. Keep track of any changes in your financial situation and adjust your policy accordingly to optimize your returns.

Explore Additional Investment Options

To maximize returns with endowment policies, consider exploring additional investment options that can complement your policy. Diversifying your investment portfolio by exploring alternative investment vehicles such as stocks, bonds, or mutual funds can enhance the overall returns on your endowment policy. Evaluate the potential risks and returns of these additional options and consider consulting a financial advisor to make informed investment decisions.

Consider Partial Withdrawals

Another important strategy for maximizing returns with endowment policies is to consider making partial withdrawals when necessary. Carefully evaluating the timing and amount of partial withdrawals can provide you with the flexibility to access funds when needed without compromising the overall returns on your policy. Be mindful of any potential penalties or tax implications associated with partial withdrawals and make informed decisions to optimize your returns.

Risks Associated With Endowment Policies

Endowment policies offer a mix of savings and insurance benefits, but they are not without risks. It’s important to understand the potential pitfalls before investing in an endowment policy.

Inflation Risk

Inflation can erode the value of endowment policy returns over time, especially with policies that offer fixed returns. As the cost of living increases, the purchasing power of the returns may diminish, resulting in lower real returns for the policyholder.

Market Volatility

Endowment policies often invest in the financial markets, and as a result, they are susceptible to market fluctuations. This means that the returns on the policy may vary based on the performance of the underlying investments, potentially leading to lower-than-expected returns or even losses.

Policy Surrender Charges

When policies are surrendered prematurely, surrender charges may apply, which could significantly reduce the returns for the policyholder, affecting the overall financial benefits of the policy.

Credit: m.facebook.com

Using Endowment Policies As A Wealth Accumulation Tool

Endowment policies can serve as a valuable tool for accumulating wealth efficiently, providing a structured way to save for the future and enjoy guaranteed returns. These policies offer a disciplined approach to wealth building, combining insurance coverage with long-term investment growth potential.

Creating A Long-term Savings Plan

When it comes to building wealth and securing one’s financial future, it’s important to have a long-term savings plan in place. Endowment policies offer an excellent means to achieve this goal. By committing to regular premium payments over a set period, individuals can accumulate a substantial amount of savings that grows over time.

With an endowment policy, you have the advantage of being able to customize your savings plan to meet your specific financial needs and objectives. Whether you’re saving for your child’s education, buying a home, or planning for retirement, an endowment policy provides a disciplined approach to wealth accumulation.

Planning For Future Financial Goals

Planning for future financial goals is essential to achieving long-term financial success. One of the key benefits of using endowment policies as a wealth accumulation tool is the ability to align your savings with your specific goals.

The process begins by determining what your financial objectives are. Perhaps you want to buy a new car in five years or go on a dream vacation. Once you have identified your goals, you can choose the appropriate endowment policy term and premium amount that will allow you to reach these milestones.

By having a clear financial plan and utilizing an endowment policy, you are taking proactive steps towards ensuring your future goals are met.

Ensuring Financial Security For Your Loved Ones

Your loved ones’ financial well-being is undoubtedly a top priority. Endowment policies not only serve as a means to accumulate wealth but also offer valuable life insurance protection to safeguard your family’s future.

By including a life insurance component in your endowment policy, you can ensure that your loved ones are financially protected in the unfortunate event of your passing. This added benefit provides peace of mind, knowing that your family’s financial needs will be taken care of.

Endowment policies offer a comprehensive solution by combining wealth accumulation and life insurance, providing both security and growth for your loved ones.

Frequently Asked Questions Of When Endowment Policy New

What Is An Endowment Policy?

An endowment policy is a life insurance plan that combines life cover with a savings component. It provides a lump sum payout at the end of the policy term or upon the policyholder’s death.

How Does An Endowment Policy Work?

Endowment policies work by requiring the policyholder to pay regular premiums over a specified period. The policy accumulates cash value over time, providing a lump-sum payout at the end of the term. It offers financial protection and savings benefits.

What Are The Benefits Of An Endowment Policy?

Endowment policies offer a combination of life insurance and savings, providing financial security for the policyholder’s family in case of death and a lump-sum payout at maturity. They also offer tax benefits and disciplined savings that can be used for various financial purposes.

When Should I Consider An Endowment Policy?

You should consider an endowment policy if you want a disciplined way to save money for future needs while ensuring financial protection for your family. It’s suitable for individuals looking for a combination of insurance and savings benefits.

Conclusion

When considering an endowment policy, it is vital to weigh the long-term benefits and risks. By understanding how this type of policy works and aligning it with your financial goals, you can secure a reliable financial cushion for the future.

Make sure to thoroughly research and seek professional advice to make an informed decision. Empower yourself with knowledge and take charge of your financial security.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is an endowment policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “An endowment policy is a life insurance plan that combines life cover with a savings component. It provides a lump sum payout at the end of the policy term or upon the policyholder’s death.” } } , { “@type”: “Question”, “name”: “How does an endowment policy work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Endowment policies work by requiring the policyholder to pay regular premiums over a specified period. The policy accumulates cash value over time, providing a lump-sum payout at the end of the term. It offers financial protection and savings benefits.” } } , { “@type”: “Question”, “name”: “What are the benefits of an endowment policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Endowment policies offer a combination of life insurance and savings, providing financial security for the policyholder’s family in case of death and a lump-sum payout at maturity. They also offer tax benefits and disciplined savings that can be used for various financial purposes.” } } , { “@type”: “Question”, “name”: “When should I consider an endowment policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “You should consider an endowment policy if you want a disciplined way to save money for future needs while ensuring financial protection for your family. It’s suitable for individuals looking for a combination of insurance and savings benefits.” } } ] }

Leave a comment