When a landlord receives an insurance letter, it typically contains important policy details and coverage information. This documentation is essential for landlords to understand their insurance protection and responsibilities.

It outlines coverage limits, deductibles, policy duration, and contact information for the insurance provider. Landlords should carefully review this letter to ensure they have the right coverage for their rental property. In the event of a claim or an issue, having this information easily accessible can help streamline the process and protect their investment.

Understanding the contents of the landlord insurance letter is crucial for maintaining proper insurance coverage and protecting the property from potential risks.

Why Landlord Insurance Is Important

Protecting Your Investment Property

Owning a rental property comes with risks, but having landlord insurance can protect your valuable investment.

Safeguarding Against Losses

In the event of unforeseen circumstances such as damage or losses, landlord insurance provides financial protection.

Credit: http://www.incharge.org

Understanding Landlord Insurance Policies

Landlord insurance policies provide essential protection for property owners, safeguarding against potential risks and liabilities. Understanding these policies is crucial to ensuring adequate coverage in case of unforeseen events. It’s important to carefully review and comprehend the details laid out in the landlord insurance letter to make informed decisions about your property investment.

Coverage Options

A Landlord Insurance policy provides coverage for rental properties against risks such as damage, theft, liability, and loss of rental income.

It covers costs related to property damage, legal fees, and temporary relocation for tenants due to covered incidents.

Key Insurance Terms

When understanding Landlord Insurance, key terms to know include premium, deductible, liability coverage, property damage coverage, and loss of income protection.

Premium refers to the amount paid for the insurance policy, deductible is the out-of-pocket amount before coverage kicks in, and liability coverage protects against claims of injury or property damage.

Factors To Consider When Choosing A Policy

When it comes to protecting your investment as a landlord, having the right insurance policy is crucial. But with so many options available, how do you choose the right one? Consider these important factors before making a decision:

Types Of Properties Covered

One of the most important factors to consider when choosing a landlord insurance policy is the types of properties it covers. Different policies may have different eligibility requirements, so it’s important to find one that aligns with your specific needs. Whether you own residential rental properties, commercial buildings, or a mix of both, make sure the policy you choose provides coverage for the types of properties in your portfolio.

Extent Of Coverage

The extent of coverage offered by a landlord insurance policy is another crucial factor to consider. You want to ensure that the policy provides comprehensive protection for your investment. This includes coverage for property damage, liability claims, loss of rental income, and even legal expenses. Carefully review the policy’s terms and conditions to understand exactly what is covered and what is excluded.

Cost And Affordability

Of course, cost and affordability are important considerations when choosing a landlord insurance policy. While it’s tempting to simply opt for the cheapest option, it’s vital to strike a balance between cost and coverage. Assess your budget and determine how much coverage you can afford without compromising on essential protections. Remember, a comprehensive policy may save you from significant financial burdens in the long run.

By carefully considering these factors – the types of properties covered, the extent of coverage, and the cost and affordability – you can make an informed decision when choosing a landlord insurance policy. Protecting your investment and ensuring peace of mind is well worth the effort.

Credit: http://www.azibo.com

Essential Tips For Property Owners

Reviewing And Updating Coverage Regularly

Regular reviews of your landlord insurance coverage is essential to ensure that you are adequately protected. As property values and rental income may change over time, it is crucial to keep your coverage up-to-date. Regular updates can ensure that you are not underinsured or overpaying for coverage that no longer reflects the current value of your property and rental income.

Choosing The Right Insurer

When it comes to selecting an insurer, it’s crucial to conduct thorough research. Look for insurers with a strong reputation for serving property owners. Seek references from other landlords and ensure that customizable policies are offered to suit the unique needs of your property.

Understanding Policy Exclusions

Before purchasing landlord insurance, make sure you understand the exclusions in the policy. It’s important to know what is not covered, such as wear and tear, gradual damage, and certain types of liabilities. Being aware of these exclusions will help you choose additional coverage options if necessary.

Managing Tenant Risks

As a property owner, it’s essential to mitigate risks associated with tenants. Conduct thorough tenant checks and ensure that you have clear guidelines for tenant responsibilities and obligations. This proactive approach can help minimize the potential for tenant-related issues that could impact your property or your insurance claims.

Common Misconceptions About Landlord Insurance

Common misconceptions about landlord insurance can lead to costly mistakes for property owners and managers. Understanding the nuances of landlord insurance can help to dispel these misconceptions and make informed decisions regarding coverage for rental properties. Below are some key areas prone to misunderstanding.

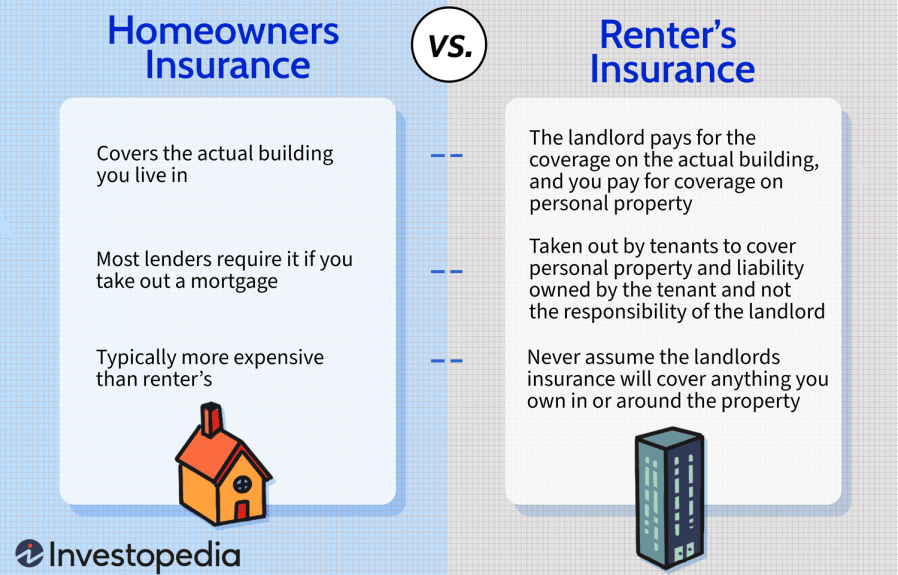

Coverage For Tenant Belongings

Many landlords mistakenly assume that their insurance policy will protect their tenants’ personal belongings in the event of damage or loss. However, landlord insurance typically only covers the physical structure of the property and any included appliances. Tenants are generally responsible for obtaining their own renter’s insurance to protect their personal possessions.

Replacement Cost Vs Actual Cash Value

Another common misconception relates to the difference between replacement cost and actual cash value coverage. Replacement cost coverage will reimburse landlords for the full amount needed to repair or replace damaged items at current market prices. On the other hand, actual cash value takes depreciation into account, resulting in a lower payout. Understanding the type of coverage included in the policy is crucial for accurately assessing potential losses.

Credit: http://www.rentecdirect.com

Steps To Follow When Filing A Claim

Filing a claim for your landlord insurance can be a crucial step in protecting your property investment. However, the process can often be overwhelming if you are unsure of what steps to take. In this section, we will guide you through the important steps to follow when filing a claim for your landlord insurance, ensuring that you document damages, contact your insurance provider, and coordinate with your tenants effectively.

Documenting Damages

When it comes to filing a claim, documenting damages is crucial to ensure you receive adequate compensation from your insurance provider. Here are the steps you should follow to effectively document the damages:

- Inspect the property thoroughly to identify all damages caused by the incident.

- Take clear and high-quality photographs of the affected areas, ensuring to capture the extent of the damage.

- Create a detailed inventory of damaged items, including their description, value, and any supporting documents.

- Keep all receipts, invoices, and repair estimates related to the damage, as these documents will be necessary for your claim.

Contacting The Insurance Provider

Once you have documented the damages, the next step is to promptly contact your insurance provider. Follow these steps to ensure a smooth communication process:

- Locate your insurance policy and gather all relevant information, such as policy number and contact details of your insurance provider.

- Notify your insurance provider about the incident as soon as possible, explaining the details and providing any necessary documentation.

- Follow any instructions given by your insurance provider, such as filling out claim forms or providing additional information.

- Keep a record of all the conversations and correspondence with your insurance provider for future reference.

Coordinating With Tenants

When filing a claim for your rental property, it is important to coordinate with your tenants to ensure a smooth process. Here’s how you can effectively involve your tenants:

- Notify your tenants about the incident and let them know that you will be filing a claim.

- Request their cooperation in documenting any damages to their personal belongings and provide them with guidelines on how to do so.

- Inform your tenants about any temporary repairs or relocation arrangements that may be necessary.

- Keep them updated on the progress of the claim and any potential changes or repairs that may affect their stay.

Additional Coverages To Consider

Looking to enhance your landlord insurance? Consider additional coverages to protect your investment. Whether it’s rental income loss or liability coverage, these options offer added peace of mind.

Loss Of Rental Income

If your property becomes uninhabitable due to covered losses, landlord insurance can help cover the income lost during repairs.

Legal Liability

Legal liability coverage protects you if a tenant or guest sues you for injury or property damage on your rental property.

Final Thoughts

Investing In Peace Of Mind

Protecting your rental property with landlord insurance is essential for securing your financial future.

It is a proactive measure that ensures your investment stays safe from unforeseen events.

Taking Steps To Protect Your Property

Implementing safety measures and acquiring comprehensive insurance can shield your property from risks.

Regular maintenance and prompt reporting of issues help you maintain the property’s value.

Frequently Asked Questions For When Landlord Insurance Letter

What Does Landlord Insurance Cover?

Landlord insurance typically covers property damage, liability protection, and loss of rental income due to property damage.

Do I Need Landlord Insurance If I Have Homeowners Insurance?

Yes, homeowners insurance only covers owner-occupied properties, while landlord insurance is tailored for rental properties.

How Can Landlord Insurance Letter Protect My Property?

A landlord insurance letter serves as official documentation of your property’s insurance coverage, providing evidence in case of disputes or incidents.

Can I Customize My Landlord Insurance Policy?

Yes, you can customize your policy to include specific coverages, such as natural disaster protection or rental default insurance.

Conclusion

Landlord insurance is an essential investment that provides protection and peace of mind for property owners. By understanding the coverage options and assessing the specific needs of the property, landlords can find the right policy to safeguard their investment. With the potential risks and liabilities that come with renting out a property, having landlord insurance is a smart and responsible choice.

So don’t delay, get the right insurance coverage today!

Leave a comment