Landlord insurance operates when protecting property owners from financial losses due to damages or liabilities. This specialized insurance safeguards landlords from risks associated with renting out properties, such as property damage, legal disputes, and loss of rental income.

Landlord insurance typically covers various perils, including fire, theft, vandalism, and certain natural disasters. It provides liability coverage in case a tenant or visitor sustains an injury on the property. Additionally, landlord insurance may offer coverage for legal fees in the event of a lawsuit related to the property.

This insurance is an essential tool for landlords to mitigate risks and protect their investments in the rental property market.

Understanding Landlord Insurance

As a property owner, it is crucial to protect your investment. One way to do this is by obtaining landlord insurance. But what exactly is landlord insurance, and why is it important? In this blog post, we will delve into the ins and outs of landlord insurance, covering what it is, its importance for property owners, and how it operates.

What Is Landlord Insurance?

Landlord insurance is a specialized insurance policy designed specifically for property owners who rent out their properties. It provides coverage for the risks and liabilities associated with renting out properties, offering protection from potential financial losses.

Unlike standard homeowners insurance, which typically doesn’t cover rental properties, landlord insurance offers tailored protection that takes into account the unique situations faced by property owners who rent out their homes, apartments, or commercial spaces.

The specific coverage of landlord insurance can vary depending on the policy and insurance provider, but generally, it protects against common risks such as property damage caused by fire, storms, or vandalism, loss of rental income due to tenant default or property damage, and liability claims for injuries suffered by tenants or guests on the property.

Importance For Property Owners

Landlord insurance holds immense importance for property owners who rent out their properties. By investing in this type of insurance, property owners gain peace of mind knowing that they are financially protected against unforeseen circumstances that may arise during the rental period.

One of the primary reasons why landlord insurance is crucial is that it safeguards property owners from financial losses caused by property damage. Whether it’s damage resulting from natural disasters or tenant negligence, the insurance coverage ensures that repair costs are covered, helping property owners avoid significant financial burdens.

In addition to property damage, landlord insurance also provides coverage for loss of rental income. If tenants default on their rent payments, or if the property becomes uninhabitable due to covered perils, the insurance policy can compensate property owners for the lost rental income during the repair or vacancy period.

Furthermore, landlord insurance protects property owners from potential liability claims. In the event a tenant or guest is injured on the property and holds the property owner responsible, the insurance policy can cover legal expenses and settlement costs, saving property owners from potentially devastating financial consequences.

In conclusion, landlord insurance provides invaluable protection for property owners, covering them against property damage, loss of rental income, and liability claims. By investing in this insurance, property owners can minimize financial risks associated with renting out their properties, ensuring their investment remains secure.

:max_bytes(150000):strip_icc()/whats-difference-between-renters-insurance-and-homeowners-insurance-v2-2694bc76e944405aa55fe2784c373999.png)

Credit: http://www.investopedia.com

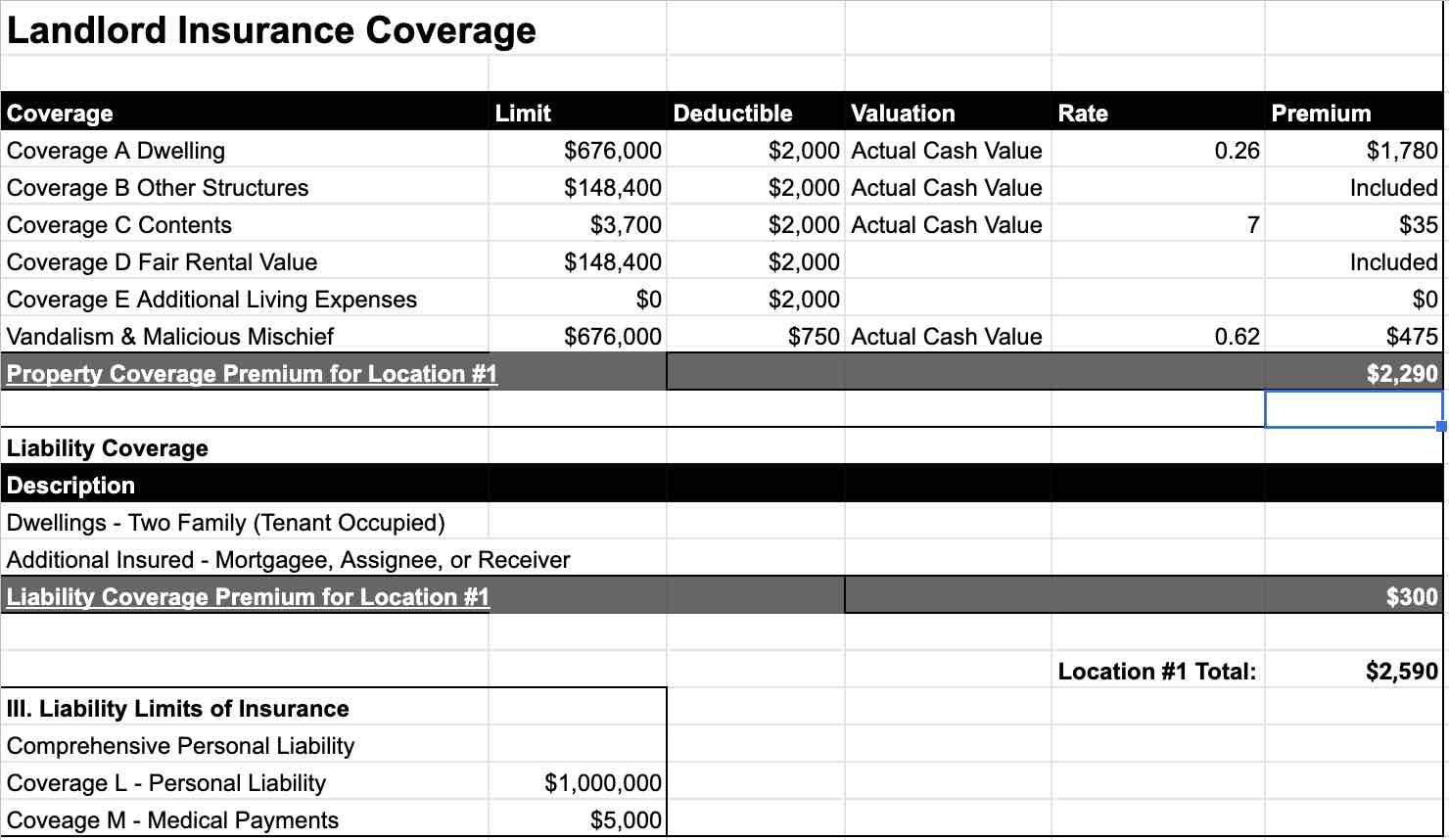

Coverage Offered

When it comes to landlord insurance, it’s important to understand the coverage offered to protect your investment. Landlord insurance operates to safeguard property owners from various risks that come with renting out properties.

Property Damage Coverage

Property damage coverage ensures protection against any damages to the structure of the property itself. This includes coverage for accidents, natural disasters, and vandalism.

Liability Coverage

Liability coverage is crucial for landlords as it protects them from legal liabilities in case a tenant or visitor suffers an injury on the property. This coverage includes medical expenses and legal fees.

Legal Responsibilities

Landlord insurance operates to protect landlords from legal responsibilities like property damage or tenant injuries. It provides coverage in case of unforeseen events that may lead to financial losses. Investing in landlord insurance is crucial to safeguard assets and mitigate risks effectively.

Legal ResponsibilitiesTenant Injuries

Landlords are liable for tenant injuries on the property.

Property Damage By Tenants

Insurance covers property damage caused by tenants.

Rental Income Protection

One key aspect of landlord insurance is rental income protection, which provides coverage for landlords in case their rental property becomes uninhabitable or if tenants fail to pay rent. This coverage ensures that landlords can continue to receive a steady source of income even in challenging situations.

Coverage For Lost Rent

In the event that your rental property suffers damage from situations like fire, storms, or vandalism, resulting in it being uninhabitable, landlord insurance can help cover the lost rental income during the repair or rebuilding period. This coverage acts as a financial safeguard, allowing you to continue meeting your financial obligations even when your property is temporarily out of commission.

Temporary Relocation Expenses

During the repair or rebuilding process, your tenants may need to temporarily relocate to another property. In such cases, landlord insurance can also assist with the expenses associated with their temporary relocation, such as hotel stays or short-term rentals. By providing this support, you can maintain a positive relationship with your tenants and ensure their needs are met during an already stressful time.

Overall, rental income protection is a crucial feature of landlord insurance that safeguards the financial well-being of property owners. By providing coverage for lost rent and temporary relocation expenses, landlord insurance helps landlords mitigate the financial risks associated with property damage or tenant defaults.

Additional Benefits

When considering landlord insurance, it’s essential to understand the additional benefits it offers beyond standard coverage. These extra advantages can provide invaluable protection and peace of mind for landlords, safeguarding their investments and rental properties in various situations.

Legal Expenses Coverage

Legal expenses coverage included in landlord insurance can assist in covering legal fees associated with disputes, evictions, or pursuing claims against tenants. This can be a crucial safeguard for landlords facing legal challenges, minimizing the financial burden of legal proceedings.

Malicious Damage By Tenants

Another valuable aspect of landlord insurance is protection against malicious damage caused by tenants. In the unfortunate event of intentional destruction or vandalism by a tenant, this coverage can mitigate the financial impact by providing assistance in covering the repair or replacement costs.

Credit: hcmpm.com

Choosing The Right Policy

When it comes to choosing the right landlord insurance policy, it’s vital to consider various factors. Understanding how landlord insurance operates and the options available will help you make an informed decision. Below are essential aspects to consider when selecting the right policy.

Evaluating Property Type

One crucial step in choosing the right landlord insurance policy is evaluating your property type. Different properties carry diverse levels of risk. For instance, a standalone home might require different coverage compared to a multi-unit building. Consider the size, age, and location of the property, as these factors play a significant role in determining the type of coverage needed.

Comparing Insurance Providers

Another critical aspect of choosing the right policy is comparing insurance providers. Research different insurers to find one that offers the specific coverage you need. Compare premiums, coverage limits, deductibles, and additional services offered. Ensure you select a reputable provider known for their reliability and willingness to provide support when needed.

Claims Process

When making claims through landlord insurance, the process involves submitting necessary documentation for assessment. Landlord insurance operates by providing coverage for various property-related expenses, helping landlords safeguard their investments.

Notifying The Insurance Company

Documenting Damages

When it comes to the claims process for landlord insurance, there are a few key steps to keep in mind. Failure to follow these steps accurately and promptly can lead to delays or even denials of your claim. Here, we will outline the importance of notifying the insurance company and documenting damages.Notifying The Insurance Company:

If you experience any damages or losses that fall under the coverage of your landlord insurance policy, it is crucial to notify your insurance company as soon as possible. Most insurance policies require you to report the incident within a specific time frame, typically within 24 to 48 hours. Failure to notify them promptly can potentially result in your claim being denied. To notify the insurance company, you will need to gather important details about the incident, such as the date it occurred, the cause of the damage, and any relevant police or incident report numbers. Be prepared to provide detailed information about the extent of the damage, including photographs or videos if possible.Documenting Damages:

Once you have notified the insurance company, the next step in the claims process is to document the damages. This documentation is crucial for providing evidence and supporting your claim. It is advisable to create a comprehensive inventory of all damaged items, including their value and age, if applicable. Here are some tips for effectively documenting damages:- Take clear and detailed photographs or videos of the affected areas or items. These visual records can be essential evidence during the claims process.

- Make a written list of all damaged items, including a description, quantity, and estimated value.

- Keep all receipts, invoices, and repair estimates related to the damages. These documents will help prove the financial impact of the incident.

- Include any relevant documentation, such as police reports, witness statements, or expert assessments.

Credit: eastinsurancegroup.com

Frequently Asked Questions Of When Landlord Insurance Operates

What Does Landlord Insurance Cover?

Landlord insurance typically covers property damage, liability protection, and loss of rental income due to unforeseen events such as fire, vandalism, or natural disasters.

Is Landlord Insurance Mandatory?

Landlord insurance is not legally required, but it’s highly recommended to protect your investment and mitigate financial risks associated with rental properties.

How Is Landlord Insurance Different From Homeowners Insurance?

Landlord insurance is specifically designed to cover rental properties, whereas homeowners insurance is meant for owner-occupied properties, offering different types of coverage and protections.

Can Landlord Insurance Protect Against Tenant Damages?

Yes, landlord insurance can provide coverage for damages caused by tenants, such as vandalism, intentional destruction, or failure to pay rent, depending on the policy terms and conditions.

Conclusion

To summarize, landlord insurance plays a crucial role in protecting property owners from potential financial losses. With its comprehensive coverage, landlords can have peace of mind knowing that they are safeguarded against various risks, such as property damage, liability claims, and loss of rental income.

By understanding the coverage options and finding the right policy, landlords can effectively manage their risks and ensure the longevity of their rental business. So, don’t underestimate the importance of landlord insurance for your investment property.

Leave a comment