Liability insurance was introduced in the late 19th century to protect individuals and businesses from potential financial losses resulting from lawsuits. This form of insurance provides coverage for various types of liability claims, such as bodily injury, property damage, and personal injury.

As society became more litigious and individuals sought compensation for damages, the need for liability insurance grew. Today, it is an essential component of risk management for businesses and individuals alike, providing peace of mind and financial protection against potential legal liabilities.

Whether it is a small business or a large corporation, liability insurance plays a critical role in safeguarding assets and mitigating potential legal costs.

Evolution Of Liability Insurance

Historical Context

Liability insurance originated in the 19th century to protect individuals and businesses from legal claims.

Initially, liability coverage was limited and mainly applied to maritime risks.

Key Developments

- 1900s: General liability insurance for businesses emerged.

- 1930s: Auto liability insurance became mandatory in the U.S.

- 1950s: Malpractice insurance gained prominence in the healthcare sector.

Impact On Society

When liability insurance was introduced, it had a significant impact on society. Let’s explore the economic effects and legal implications that this type of insurance brought about.

Economic Effects

The introduction of liability insurance had several economic effects. Businesses and individuals could now protect themselves financially against potential legal claims and damages. This led to increased confidence in conducting business transactions and reduced fears of bankruptcy or financial ruin.

Furthermore, liability insurance provided a safeguard against the rising costs of litigation. With the coverage in place, individuals and businesses could avoid substantial legal expenses, such as attorney fees and court costs. This aspect of liability insurance played a crucial role in fostering economic growth and stability.

Legal Implications

The legal implications of liability insurance cannot be understated. Prior to its introduction, without proper insurance coverage, individuals and businesses were directly responsible for any damages or injuries caused, often resulting in costly legal battles.

However, liability insurance shifted the burden of financial responsibility from the individual or business to the insurer. This allowed for a more efficient and fair legal system by ensuring that adequate compensation could be provided to those who suffered harm.

Moreover, liability insurance also had implications for the legal profession itself. As the demand for legal services increased due to a rise in insurance claims, lawyers specializing in liability cases became more prominent. This specialization allowed for a more streamlined and effective legal process, benefiting both plaintiffs and defendants.

In conclusion, the introduction of liability insurance had a profound impact on society. From its economic effects, such as increased confidence and protection from financial ruin, to its legal implications, empowering individuals and businesses to navigate legal battles more efficiently. Liability insurance has undoubtedly shaped modern society by providing a safety net for potential risks and promoting stability in both the economic and legal realms.

Role Of Insurance Companies

Insurance companies play a vital role in the management and distribution of liability insurance. Their main objective is to provide financial protection and mitigate risks for individuals and businesses. Let’s explore how insurance companies handle underwriting standards and the claims process.

Underwriting Standards

Insurance companies follow strict underwriting standards to assess the potential risks associated with providing liability insurance coverage. This involves evaluating the applicant’s risk factors, such as previous claims history, industry type, and current operational practices. The underwriting process helps insurers determine the appropriate coverage and premiums for the insured parties.

Claims Process

When a liability claim arises, insurance companies facilitate the claims process to ensure a fair and timely resolution. This involves gathering relevant information, evaluating the claim’s validity, and determining the compensation amount. The goal is to provide support to the insured parties and mitigate the impact of potential liabilities.

Technological Advancements

Technological advancements have played a pivotal role in reshaping the landscape of liability insurance. With the introduction of innovative risk assessment tools and the utilization of big data analytics, the insurance industry has been able to adapt and evolve to meet the changing needs of businesses and individuals.

Risk Assessment Tools

The integration of advanced risk assessment tools has significantly enhanced the accuracy and efficiency of liability insurance. These tools employ sophisticated algorithms to analyze various risk factors and provide insurers with valuable insights into potential liabilities. As a result, insurance policies can be tailored more precisely to mitigate specific risks and safeguard against unforeseen circumstances.

Big Data Analytics

Big data analytics has revolutionized the way liability insurance is underwritten and managed. By leveraging vast quantities of data, insurers can identify patterns, trends, and correlations that were previously undetectable. This enables more informed decision-making and empowers insurance providers to offer proactive risk mitigation strategies to their clients. In turn, policyholders benefit from comprehensive coverage that is tailored to their unique needs, ultimately minimizing their exposure to liability.

Global Adoption

The introduction of liability insurance revolutionized the way individuals, businesses, and organizations protected themselves against unforeseen risks and potential lawsuits. Initially introduced in the late 19th century, liability insurance quickly gained popularity around the world, with countries adopting this invaluable safeguard to protect both individuals and businesses.

Cross-cultural Perspectives

The adoption of liability insurance varied across different cultures and societies. While some countries embraced this concept wholeheartedly, others took time to recognize its significance. However, as awareness of liability insurance grew, governments worldwide began acknowledging its importance in safeguarding various industries and ensuring financial stability for individuals and businesses alike.

Regulatory Frameworks

As liability insurance gained traction globally, governments started developing regulatory frameworks to govern its implementation and ensure adherence to industry-specific rules and standards. These frameworks aimed to protect both policyholders and insurance providers, promoting transparency and fairness in the insurance market.

In several countries, regulatory bodies were established to oversee the functioning of liability insurance, monitor industry practices and enforce compliance. This not only facilitated the smooth operation of insurance providers but also enhanced consumer trust in this essential form of coverage.

Moreover, regulatory frameworks imposed stringent requirements on insurance companies, guaranteeing their financial stability, solvency, and ability to fulfill their contractual obligations. These regulations helped in mitigating potential risks for policyholders and maintaining a healthy insurance market.

Credit: http://www.facebook.com

Challenges And Controversies

Challenges and controversies surrounding the introduction of liability insurance have been a key focus in the insurance industry.

Claims Fraud

Claims fraud is a significant issue that liability insurance has grappled with since its inception.

Scamming insurance companies through false claims remains a prevalent challenge.

Coverage Disputes

Coverage disputes are common in the realm of liability insurance policies.

Controversies often arise when policyholders feel their claims should be covered but are denied.

Future Trends

Future Trends in the field of liability insurance are shaping the way businesses and individuals manage risks.

Innovations In Liability Insurance

New technological advancements are revolutionizing the way liability insurance policies are created and managed.

- Digital platforms streamline policy issuance processes.

- Machine learning enhances risk assessment accuracy.

- Blockchain technology ensures secure data storage.

Sustainability Practices

Companies are increasingly incorporating eco-conscious initiatives into their liability insurance strategies.

- Encouraging green business practices to mitigate risks.

- Offering incentives for environmentally friendly operations.

- Developing policies that address climate change implications.

Credit: http://www.amazon.com

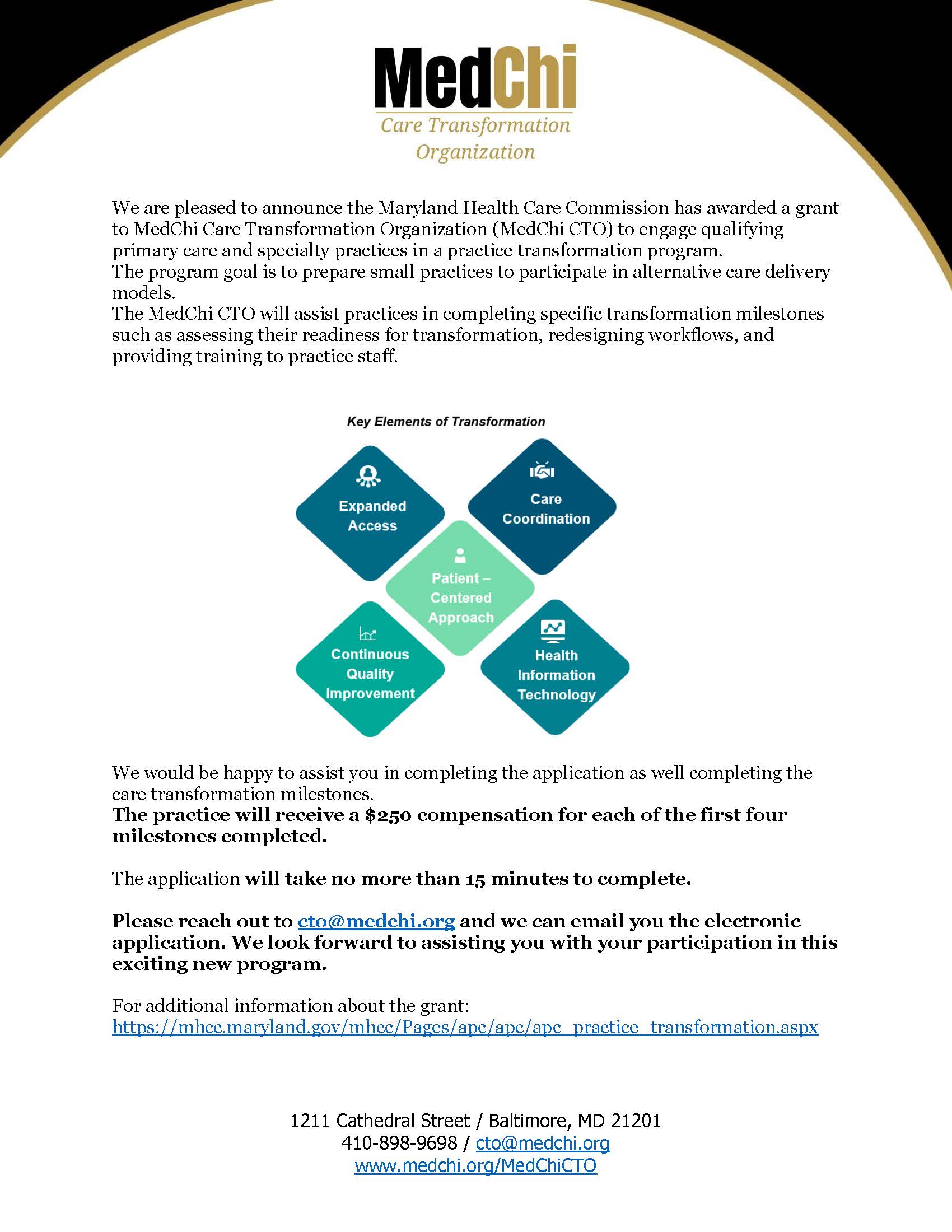

Credit: http://www.medchi.org

Frequently Asked Questions For When Liability Insurance Was Introduced

When Was Liability Insurance First Introduced?

Liability insurance was first introduced in the 19th century to protect individuals and businesses from financial loss due to legal claims.

What Does Liability Insurance Cover?

Liability insurance covers legal costs and payouts for claims related to bodily injury, property damage, and personal or advertising injury.

Why Is Liability Insurance Important For Businesses?

Liability insurance is crucial for businesses as it provides financial protection against legal claims and helps maintain business continuity. It also enhances credibility and trust among stakeholders.

Conclusion

The introduction of liability insurance marked a significant shift in the way individuals and businesses protected themselves from potential lawsuits and financial risks. By providing coverage for legal expenses and damages, liability insurance has become a crucial safeguard in today’s fast-paced and litigious society.

This essential form of insurance continues to evolve and adapt to meet the ever-changing needs of individuals and businesses alike. So, whether you’re a small business owner or an individual seeking personal protection, liability insurance is an indispensable tool to secure your financial and legal interests.

Leave a comment