Endowment policies are insurance contracts that provide both life insurance coverage and a savings component, which work by the policyholder paying regular premiums over a specific term for a lump sum payout at maturity. These policies are popular among those who wish to protect their loved ones financially in the event of their death while simultaneously building savings for future goals such as buying a house or paying for education expenses.

:max_bytes(150000):strip_icc()/prospecttheory.asp-FINAL-55296758049c4501808f54b52747cb35.png)

Credit: http://www.investopedia.com

Understanding Endowment Policies

Endowment policies work by combining insurance coverage with savings, offering a lump sum payout after a specified period or upon the policyholder’s death. These policies provide a disciplined way to save for long-term financial goals while ensuring financial protection for loved ones.

Definition Of Endowment Policies

An endowment policy is a financial product that combines elements of life insurance and savings investment.

How Endowment Policies Work

Endowment policies work by the policyholder making regular premium payments to the insurance company.

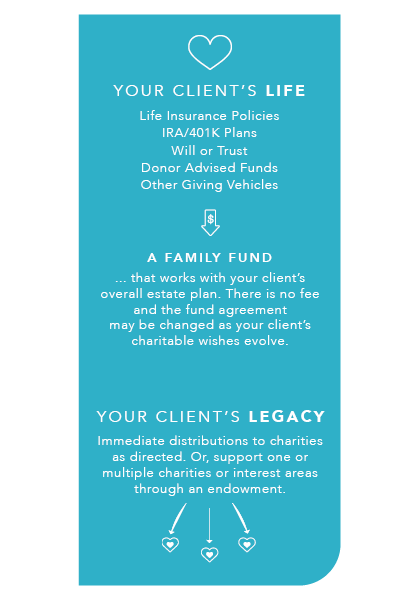

Credit: http://www.sfacf.org

Benefits Of Endowment Policies

Endowment policies provide a long-term, tax-free investment that can offer financial security and a lump sum payout at the end of the policy term. These policies work well for those looking for a disciplined savings approach with the added benefit of life insurance coverage.

Savings And Investment Combined

Endowment policies offer a unique combination of savings and investment benefits. With these policies, you can accumulate savings over a specified period, while also investing in various financial instruments. This dual approach ensures that your money grows steadily over time. Rather than keeping your savings stagnant in a regular savings account, an endowment policy allows you to build your wealth through investments.Tax Benefits

One of the key advantages of endowment policies is the tax benefits they offer. In many countries, the premiums you pay towards the policy are eligible for tax deductions. This means that you can reduce your taxable income and potentially pay less tax. Additionally, the growth of your investment within the policy is often tax-free. This can significantly enhance your overall returns and help you create a more financially stable future. By taking advantage of the tax benefits inherent in endowment policies, you can effectively maximize your savings and investment efforts.Choosing The Right Endowment Policy

When it comes to securing your financial future, choosing the right endowment policy is crucial. With various options available in the market, it’s essential to assess your financial goals and compare different policies to make an informed decision.

Assessing Your Financial Goals

Before diving into the world of endowment policies, take a step back to evaluate your financial goals. Consider factors such as your long-term financial commitments, risk tolerance, and desired savings component. Understanding your specific needs and objectives will help in determining the type of endowment policy that aligns with your financial aspirations.

Comparing Different Policies

With numerous endowment policies offered by different providers, it’s crucial to compare the terms, benefits, and performance of each policy. Compare factors such as the policy term, maturity benefits, bonus rates, and flexibility of premiums. By evaluating these aspects, you can make an informed choice that suits your financial goals and preferences.

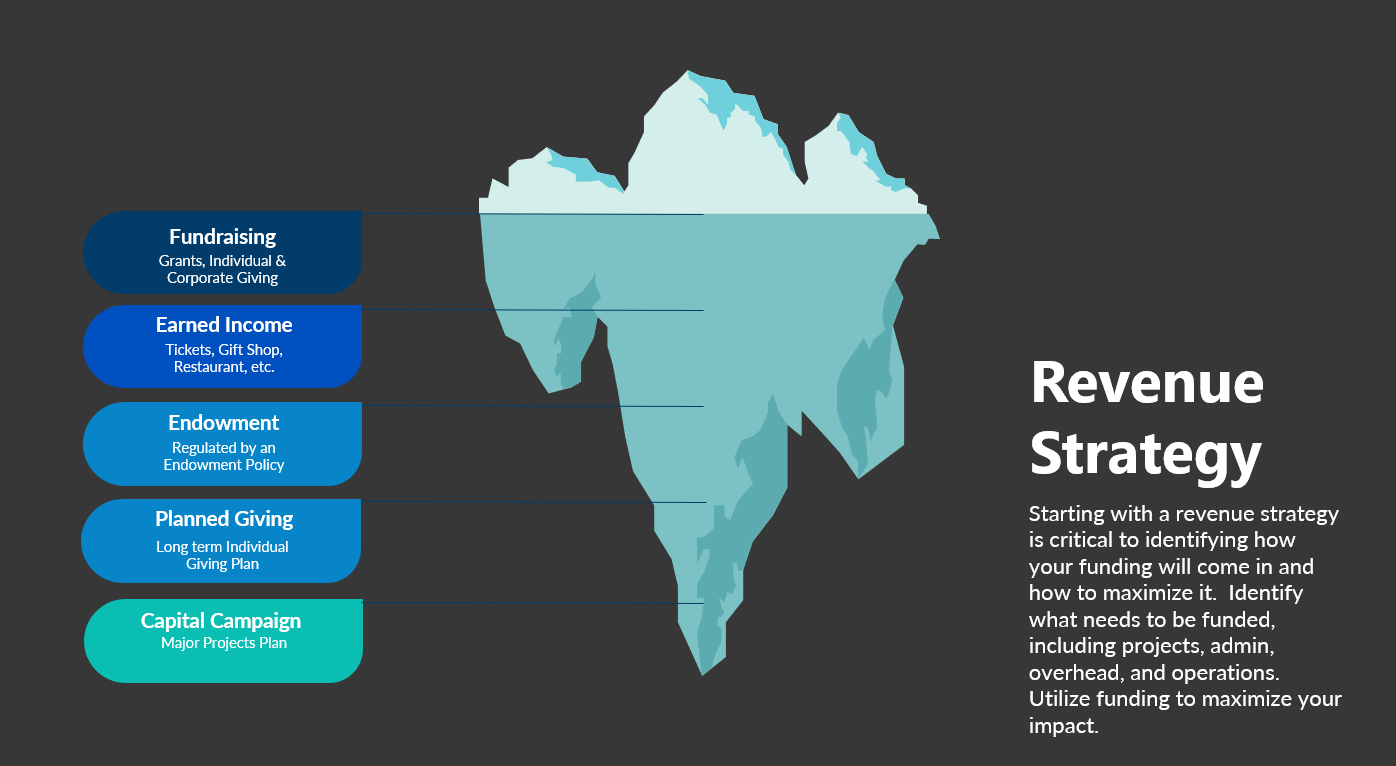

Credit: http://www.nmblstrategies.com

Maximizing Returns On Endowment Policies

When it comes to maximizing returns on endowment policies, understanding the different types of premiums and how to optimize the maturity value is key. Endowment policies offer a unique opportunity to grow your money over time while providing a guaranteed sum of money at the policy’s maturity. By making informed decisions about regular premiums vs. single premiums and optimizing the maturity value, you can significantly increase your returns.

Regular Premium Vs. Single Premium

Endowment policies can be structured in two ways: regular premium and single premium. Regular premium policies involve making periodic payments over the policy term, while single premium policies require a one-time lump-sum payment. Each option has its own advantages and drawbacks, and the choice between them should align with your financial goals and risk tolerance. Regular premiums offer the benefit of spreading the cost over time, while single premiums may provide potential for higher growth with an upfront investment.

Optimizing Maturity Value

There are several strategies for maximizing the maturity value of an endowment policy. Firstly, understanding the policy’s features and benefits can help you make informed decisions. Consider adjusting the policy term and contribution amount to align with your financial goals and expectations. Diversifying investments within the policy can help spread risk and potentially enhance returns. Furthermore, reviewing the policy regularly and making adjustments as necessary can ensure that you are on track to achieve the desired maturity value.

Risks Associated With Endowment Policies

When considering investing in endowment policies, it is important to evaluate the risks involved. Like any financial product, endowment policies come with their fair share of risks that potential policyholders should be aware of. In this section, we will discuss two key risks associated with endowment policies: inflation risk and market risks.

Inflation Risk

Inflation risk is a significant concern when it comes to endowment policies. In simple terms, inflation risk refers to the potential loss of purchasing power over time due to the steady rise in the prices of goods and services. As an endowment policyholder, you need to consider the impact of inflation on the future value of your policy’s payouts.

| Key Points: |

|---|

| Inflation risk can erode the real value of the payouts received from an endowment policy. |

| Policyholders must carefully assess whether the potential returns from the policy will outpace inflation. |

| Diversifying investments and selecting policies with built-in inflation protection can mitigate inflation risk. |

Market Risks

Endowment policies are subject to market risks, which can have a direct impact on the returns generated. Market risks arise from fluctuations in the financial markets, including stock markets, bond markets, and property markets. Understanding these risks is crucial, as they can affect the value of your policy’s underlying investments.

Whether it’s a sudden stock market crash or a downturn in the property market, market risks can result in a decline in the value of the investments supporting your endowment policy. It’s essential to take into account the potential impact of market volatility on your policy’s performance.

- Market risks can adversely affect the returns and final payouts of endowment policies.

- Policyholders should be prepared for the possibility of market downturns and plan accordingly.

- Diversification and regular review of investment strategies can help mitigate market risks.

By being aware of these risks – inflation risk and market risks – associated with endowment policies, you can make informed decisions and take appropriate measures to protect your investments. Remember to conduct thorough research, seek professional advice, and assess your risk tolerance when considering the purchase of an endowment policy.

Case Studies

Endowment policies prove to be effective investment tools, as evidenced by multiple case studies. These studies demonstrate how endowment policies work, providing valuable insights into their benefits and potential returns.

Case Studies Endowment policies can play a crucial role in building long-term financial stability. Let’s explore some Successful Endowment Policy Investments as well as Lessons Learned from them. Successful Endowment Policy Investments 1. John invested in an endowment policy that matured after 15 years, providing him with substantial returns. 2. Sarah’s endowment policy helped fund her child’s college education, showcasing the benefits of long-term planning. Lessons Learned – Start early to maximize the benefits of compound interest. – Regularly review and adjust your endowment policy to align with changing financial goals. Endowment policies can be a powerful tool for achieving financial goals over the long term.Frequently Asked Questions On Where Endowment Policy Work

What Is An Endowment Policy?

An endowment policy is a life insurance contract that pays out a lump sum after a specific term or on the death of the policyholder. It combines savings and protection, offering financial security to the insured and their beneficiaries.

How Does An Endowment Policy Work?

Endowment policies work by providing a guaranteed payout at the end of the policy term, or upon the death of the policyholder. They also accumulate a cash value over time, which can be cashed in or borrowed against, offering both protection and a savings component to the policyholder.

What Are The Benefits Of An Endowment Policy?

Endowment policies offer long-term savings and investment opportunities, along with life insurance protection. They can also provide tax advantages and disciplined savings, promoting financial planning and security for the policyholder and their beneficiaries.

Are Endowment Policies Suitable For Everyone?

Endowment policies may not be suitable for everyone, as they are long-term commitments and may have associated surrender charges. It’s essential to carefully assess your financial situation, investment goals, and risk tolerance before considering an endowment policy as an option.

Conclusion

To conclude, endowment policies offer a unique and effective way to secure financial stability and protect one’s future. With their long-term investment approach and built-in life insurance, these policies provide a comprehensive solution for individuals seeking both growth and protection.

By carefully considering individual needs and goals, endowment policies can offer a reliable avenue for financial growth and peace of mind. Choose wisely and take advantage of this powerful financial tool.

Leave a comment