Home insurance is a financial protection that covers homeowners against losses and damages to their property. It provides coverage for the structure of the home, personal belongings, and liability protection.

Home insurance is essential for homeowners to safeguard their investment and provide peace of mind in case of unexpected events like natural disasters or theft. Owning a home is a significant investment, and protecting it with home insurance is crucial.

By having the right coverage, homeowners can ensure that they are financially secure in case of any unforeseen circumstances. Home insurance not only protects the physical structure of the property but also provides coverage for personal belongings and liability in case someone is injured on the property. It is a wise decision for homeowners to invest in home insurance to safeguard their assets and provide financial security for their families.

1. Importance Of Home Insurance

When it comes to protecting your home, home insurance plays a crucial role in safeguarding your most valuable asset. Home insurance provides a safety net in times of unexpected events such as natural disasters, theft, or accidents.

1.1 Peace of MindWith home insurance, you can have peace of mind knowing that your home is protected against unforeseen circumstances. Sleep soundly knowing that your insurance policy has your back in case of any damages or losses.

1.2 Financial ProtectionHome insurance offers financial protection, ensuring that you are not left with a significant financial burden in the event of property damage or loss. Your insurance policy can cover repair costs or even provide temporary housing if needed.

Credit: m.facebook.com

2. Types Of Home Insurance Policies

Achieving the right type of home insurance policy is crucial in safeguarding your property against unexpected events. There are three main types of home insurance policies that cater to varying levels of coverage and protection.

2.1 Basic Form Policy

Basic form policy offers limited coverage for specific perils like fire, theft, and vandalism.

2.2 Broad Form Policy

Broad form policy provides expanded coverage compared to basic form policy, including protection for additional risks.

2.3 Special Form Policy

Special form policy is the most comprehensive option, offering coverage for a wide range of perils unless explicitly excluded in the policy.

3. Factors To Consider When Choosing Home Insurance

When it comes to protecting your most valuable asset, home insurance is an essential investment. However, with so many options available, it can be overwhelming to choose the right policy for your specific needs. To ensure you make an informed decision, consider these important factors before purchasing home insurance:

3.1 Location And Risk Factors

Where your home is located plays a significant role in determining your insurance premiums. Certain areas may be prone to natural disasters such as earthquakes, floods, or hurricanes, while others may have higher rates of property crime. Assessing the risk factors associated with your location enables you to select a policy with adequate coverage.

3.2 Coverage Limits

Understanding the coverage limits offered by different insurance providers is crucial. These limits determine the maximum amount an insurer will pay in the event of a claim. Assess your property’s value, including its contents, and choose a policy that provides enough coverage to replace or repair your home should the unexpected happen.

3.3 Deductibles

Deductibles are the out-of-pocket expenses you must pay before your insurance coverage kicks in. Higher deductibles usually result in lower insurance premiums. Consider your financial situation and risk tolerance when deciding on a deductible amount that suits your needs. Keep in mind that opting for a higher deductible means you will bear a larger portion of the costs in case of a claim.

3.4 Additional Coverage Options

In addition to standard coverage, many insurance providers offer additional options that can enhance your policy’s protection. These may include coverage for valuable items such as jewelry or artwork, liability coverage for accidents that occur on your property, or coverage for alternative living arrangements in case your home becomes uninhabitable. Evaluate these additional coverage options to ensure your policy meets all your specific requirements.

By considering these factors when choosing home insurance, you can make an informed decision that provides you with the financial protection and peace of mind you deserve.

4. Understanding Coverage Options

When it comes to home insurance, understanding the coverage options is crucial for homeowners looking to protect their investment. With a variety of options available, it’s essential to comprehend the different types of coverage to ensure you have the right protection for your home and belongings.

4.1 Dwelling Coverage

Dwelling coverage helps protect the structure of your home in the event of damage caused by covered perils such as fire, windstorm, or vandalism. This coverage typically includes the main structure of the house, as well as attached structures such as a garage or deck.

4.2 Personal Property Coverage

Personal property coverage provides financial protection for your belongings inside your home, such as furniture, clothing, and electronics. In the event of theft, damage, or destruction, this coverage can help you replace or repair your personal items.

4.3 Liability Coverage

Liability coverage offers protection if someone is injured on your property or if you accidentally damage someone else’s property. This coverage can help cover legal expenses and medical bills for the injured party, providing you with essential financial protection.

4.4 Additional Living Expenses Coverage

Additional living expenses coverage, also known as loss of use coverage, can help cover the costs of living elsewhere if your home becomes uninhabitable due to a covered event. This coverage can include expenses such as hotel bills, meals, and other living costs while your home is being repaired.

5. Ways To Lower Home Insurance Premiums

Lowering your home insurance premiums is a smart way to save money without sacrificing coverage. By implementing a few simple strategies, you can effectively reduce your insurance costs while safeguarding your home and belongings. Here are five effective ways to lower your home insurance premiums:

5.1 Increase Deductibles

Consider increasing your deductibles to reduce your insurance premiums. Higher deductibles can significantly lower your monthly or annual premiums, but be sure you have the means to cover the deductible amount in case of a claim.

5.2 Install Safety Features

Enhance your home’s safety and security by installing safety features such as smoke alarms, burglar alarms, deadbolt locks, and fire extinguishers. Many insurance providers offer discounts for homes equipped with these protective measures.

5.3 Bundle Coverage

Combine your home insurance with other policies, such as auto or life insurance, to bundle coverage. Bundling can lead to significant discounts and cost savings while simplifying your insurance management.

5.4 Seek Discounts

Explore various discounts offered by insurance companies, such as loyalty discounts, new home discounts, claims-free discounts, and senior citizen discounts. These discounts can add up to substantial savings on your home insurance premiums.

:max_bytes(150000):strip_icc()/does-homeowners-insurance-cover-roof-replacement-v2-e0e8219dfb9c4dceabe765b0a03768a6.jpg)

Credit: http://www.investopedia.com

6. Steps To Take After An Insurance Claim

Once you’ve filed an insurance claim for your home, it’s important to take a few immediate steps to ensure a smooth and efficient process. By following these steps, you’ll be able to document damages accurately, contact your insurance provider promptly, and navigate the claims process effectively. Let’s dive into each step:

6.1 Document Damages

Documenting the damages to your home is crucial for a successful insurance claim. Take the following steps to ensure you have comprehensive documentation:

- Take clear, detailed photographs of the affected areas.

- Make a list of damaged items and describe their condition.

- Keep all receipts and documentation for repairs.

- If needed, hire a professional inspector to assess the damages.

By gathering thorough evidence of the damages, you’ll strengthen your claim and increase the likelihood of a favorable outcome.

6.2 Contact Insurance Provider

Once you’ve documented the damages, it’s crucial to promptly contact your insurance provider. Follow these steps to initiate the claim process:

- Retrieve your insurance policy details and keep them handy.

- Call your insurance provider’s claims hotline or customer service number.

- Provide the necessary information, including your policy number and a detailed account of the damages incurred.

- Listen carefully to the instructions provided by the representative and inquire about any additional documentation required.

Acting swiftly and efficiently will ensure that your claim is registered and that the necessary measures are taken promptly.

6.3 Follow Claims Process

Once you’ve reported the claim, it’s important to follow the specific guidelines provided by your insurance provider. Each provider may have a slightly different claims process, but the following steps are common:

- Obtain a claim number from your insurance provider and keep it in a safe place.

- Submit any additional documentation or evidence as requested by your insurance company.

- Cooperate with any inspections or assessments conducted by the insurance adjuster.

- Communicate promptly with your insurance carrier if you have any questions or concerns.

- Keep track of all communication and correspondence related to your claim.

- Stay patient, but don’t hesitate to follow up with your insurance provider if the claim is taking longer than anticipated.

- Review and discuss the settlement offer provided by your insurance provider before accepting it.

By following these steps and being proactive throughout the claims process, you’ll have a greater chance of receiving a fair and timely settlement for your home damages.

7. Common Myths About Home Insurance

When it comes to home insurance, there are several common myths that can mislead homeowners and renters. Let’s debunk these myths to ensure you have the right coverage.

7.1 Home Insurance Covers Everything

Home insurance does not cover every possible scenario. Certain events such as natural disasters or floods may require additional coverage. Review your policy to ensure you have the right protections in place.

7.2 Renters Don’t Need Home Insurance

Even as a renter, having renters insurance is crucial. This type of insurance can protect your personal belongings and provide liability coverage in case of accidents. Don’t assume you are fully protected without it.

7.3 Home Maintenance Isn’t Important

Regular home maintenance is essential for the longevity of your property. Neglecting maintenance could lead to issues that may not be covered by insurance. Stay proactive in maintaining your home to avoid costly repairs.

Credit: twitter.com

8. Additional Tips For Comprehensive Home Insurance Coverage

Ensuring comprehensive coverage for your home is essential to protect your investment and belongings. In addition to the basic coverage, there are several additional tips you can follow to enhance your home insurance policy:

8.1 Regularly Review And Update Policy

Review your home insurance policy regularly to make sure it aligns with your current needs and circumstances. Update your policy as needed to reflect any changes in your home or possessions.

8.2 Understand Exclusions And Limitations

Be aware of any exclusions and limitations in your home insurance coverage. Understand what is not covered by your policy to avoid any surprises when filing a claim.

8.3 Maintain Home Security Measures

Maintain adequate security measures in your home to reduce the risk of theft or damage. Install security systems, deadbolts, and smoke detectors to enhance your home insurance coverage.

Frequently Asked Questions On Where Home Insurance Xi

What Does Home Insurance Cover?

Home insurance typically covers damage to the property from fire, theft, and certain natural disasters, as well as liability for injuries that occur on the property.

How Much Home Insurance Do I Need?

The amount of home insurance needed depends on the value of the property and belongings. It’s important to calculate replacement costs accurately.

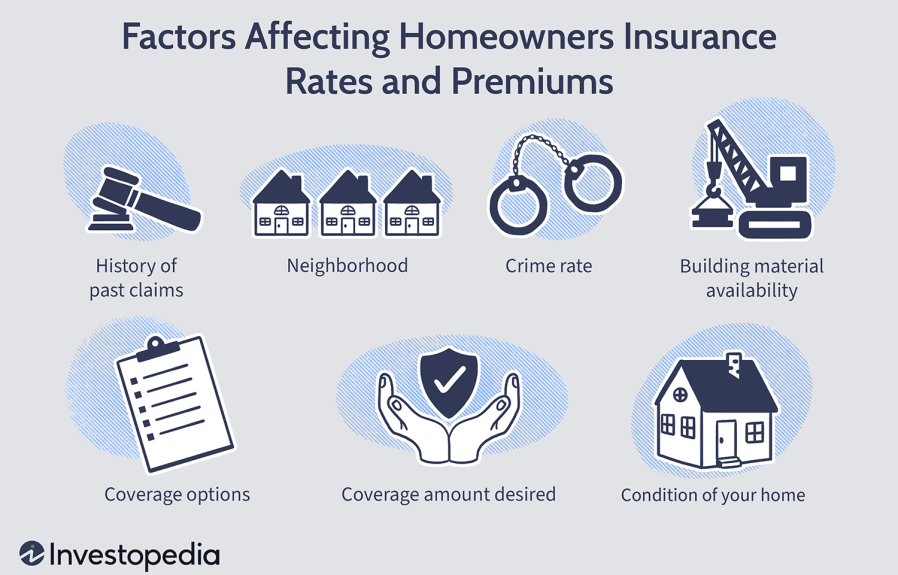

What Factors Affect Home Insurance Premiums?

Factors such as the property’s location, age, and construction, the homeowner’s claim history, and the chosen coverage amounts can affect premiums.

Is Flood Insurance Included In Home Insurance?

No, flood insurance is usually a separate policy. Home insurance typically does not cover damage from floods, so it’s crucial to consider this additional coverage.

Conclusion

Having home insurance is crucial to protect your property and possessions from unforeseen events like fires, theft, or natural disasters. It provides financial security and peace of mind, allowing you to rebuild and recover without facing significant financial burdens. Remember to carefully review and compare different insurance policies to find the one that suits your needs and budget.

Don’t wait for the unexpected to happen, get the right home insurance today.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What does home insurance cover?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Home insurance typically covers damage to the property from fire, theft, and certain natural disasters, as well as liability for injuries that occur on the property.” } } , { “@type”: “Question”, “name”: “How much home insurance do I need?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The amount of home insurance needed depends on the value of the property and belongings. It’s important to calculate replacement costs accurately.” } } , { “@type”: “Question”, “name”: “What factors affect home insurance premiums?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Factors such as the property’s location, age, and construction, the homeowner’s claim history, and the chosen coverage amounts can affect premiums.” } } , { “@type”: “Question”, “name”: “Is flood insurance included in home insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “No, flood insurance is usually a separate policy. Home insurance typically does not cover damage from floods, so it’s crucial to consider this additional coverage.” } } ] }

Leave a comment