Landlord insurance typically expires at the end of the policy term or when it is canceled by either the landlord or the insurance company. As a landlord, protecting your investment is crucial, and one way to do that is by having the right insurance coverage.

Landlord insurance provides financial safeguards against potential risks such as property damage, liability claims, and lost rental income. However, it’s important to note that landlord insurance is not a lifelong policy. Instead, it typically expires at the end of the policy term or when it is canceled by either the landlord or the insurance company.

Understanding when your landlord insurance expires is vital so that you can ensure continuous coverage and make informed decisions to protect your rental property and investment.

Importance Of Landlord Insurance Renewal

Why Landlord Insurance Renewal Is Essential

Regular renewal of landlord insurance protects your investment.

Failure to renew may expose you to financial risks and lawsuits.

Consequences Of Letting Landlord Insurance Expire

Expired insurance leaves you vulnerable to property damage costs.

Tenants could also file legal claims against you.

%5B1%5D.webp)

Credit: http://www.azibo.com

Understanding Landlord Insurance Coverage

Landlord insurance coverage typically expires after a set period, depending on the policy. It’s essential for landlords to understand the expiration date of their insurance to avoid any gaps in coverage and potential financial risks. Staying informed about when landlord insurance expires is crucial for maintaining protection against potential property-related liabilities.

As a landlord, protecting your investment property is crucial. Landlord insurance provides coverage specifically designed to safeguard rental properties from a range of risks. Understanding the coverage options and key features of landlord insurance is essential for ensuring you have the right protection in place. Let’s dive deeper into the types of coverage offered and the key features that make landlord insurance a wise investment.Types Of Coverage Offered

Landlord insurance typically offers several types of coverage to address different risks associated with rental properties. These coverage options may include:- Property Damage: This covers the cost of repairs or replacement for damages resulting from covered perils such as fire, vandalism, or severe weather events. It can also include coverage for attached structures, like garages or sheds.

- Liability Insurance: Liability coverage provides financial protection in case someone is injured on your rental property and decides to sue you. This coverage can help pay for legal fees, medical expenses, or settlement costs if you’re held responsible.

- Loss of Rental Income: If your rental property becomes uninhabitable due to a covered event, this coverage can reimburse you for the lost rental income during the repair or rebuilding process.

- Personal Property Coverage: This covers the landlord’s personal belongings that are stored at the rental property, such as appliances or furniture, in case they are damaged or stolen.

- Additional Living Expenses: In the event that your rental property becomes temporarily uninhabitable, this coverage can help cover the cost of alternative accommodations and additional expenses.

Key Features Of Landlord Insurance

Landlord insurance offers several key features that distinguish it from standard homeowner’s insurance. These features cater specifically to the unique needs and risks faced by landlords:- Tenant Default Insurance: This optional coverage protects landlords against financial losses in case tenants default on their rent payments.

- Eviction Coverage: Some landlord insurance policies may offer coverage for legal expenses involved in evicting a tenant for reasons such as non-payment or property damage.

- Replacement Cost Coverage: Landlord insurance often provides replacement cost coverage, which ensures that damages are reimbursed based on the property’s current value rather than the initially insured amount.

- Landlord Contents Coverage: This coverage protects the landlord’s personal belongings that are left for tenants to use, such as appliances, furniture, or gardening equipment.

- Comprehensive Liability Protection: Landlord insurance typically includes comprehensive liability protection, shielding landlords from potential lawsuits resulting from injuries or accidents that occur on the rental property.

Factors Affecting Renewal Premiums

Property Location And Risk Factors

Insurance companies consider the property’s location and its associated risk factors to determine the renewal premiums for landlord insurance. Properties situated in high-crime areas or prone to natural disasters may incur higher premiums due to the elevated risk of theft, vandalism, or property damage. Additionally, proximity to fire stations and the quality of local emergency services can also impact the renewal premiums.

Claim History And Insurance Companies’ Policies

The claim history of a property plays a pivotal role in shaping the renewal premiums. Frequent claims or a history of extensive damage may lead to increased premiums as it signifies a higher likelihood of future claims. Additionally, insurance companies’ policies and underwriting guidelines can vary, impacting the renewal premiums for landlord insurance.

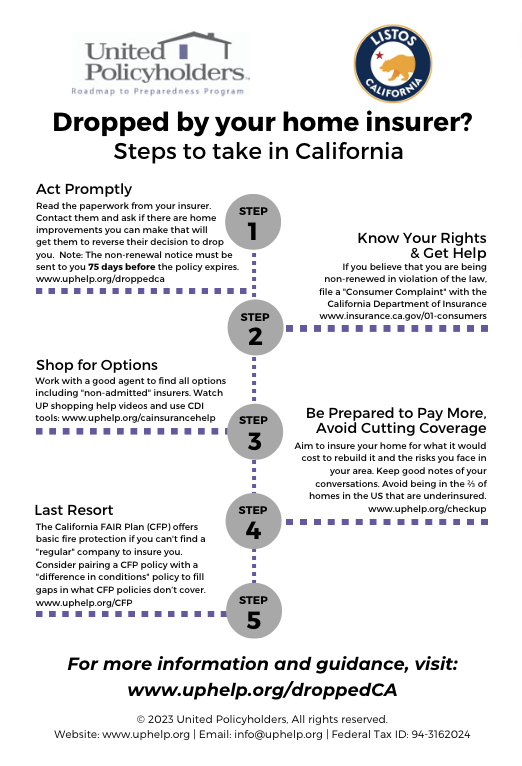

Credit: uphelp.org

Steps To Take Before Renewing

Before renewing your landlord insurance, it’s crucial to assess your current coverage and compare insurance quotes to ensure you have adequate protection and are getting the best value for your money.

Assessing Current Coverage

- Review your policy documents carefully to understand the extent of your current coverage.

- Assess the types of risks and liabilities that are included in your existing policy.

- Identify any gaps or limitations in your coverage that may leave you vulnerable to potential losses.

- Consider any changes in your property or tenancy that may require adjustments to your insurance coverage.

Comparing Insurance Quotes

- Research multiple insurance providers to compare the range of coverage options and prices available.

- Request quotes from different insurers and carefully review the terms, conditions, and inclusions provided.

- Consider any additional benefits or features that may be offered by alternative insurance providers.

- Ensure that the quotes you receive align with your specific needs and offer comprehensive protection for your rental property.

Renewal Process Explained

Understanding the renewal process for landlord insurance is crucial to ensuring continuous coverage for your rental property. Let’s delve into the key steps involved in renewing your policy to maintain protection for your investment:

Notifying Your Insurance Provider

Notify your insurance provider of your intent to renew the policy before the expiration date.

Provide any updated information about the property that may impact the coverage.

Understanding Renewal Terms And Conditions

Review the terms and conditions of the renewal to ensure you are aware of any changes.

Understand the coverage limits, deductibles, and any new endorsements added to the policy.

Credit: http://www.steadily.com

Reviewing And Updating Coverage

Ensure you regularly review and update your landlord insurance coverage to avoid any gaps or expiration. Stay on top of policy details to maintain comprehensive protection for your rental property and assets. Keeping coverage current is essential for peace of mind and financial security.

Update Coverage Based On Property Changes

Assess any modifications to your property to update and align your coverage accordingly.

- Inspect structural changes to the property.

- Review any renovations or additions.

Inform your insurer promptly to avoid gaps in coverage for increased property value or new risks.

Additional Coverage Options To Consider

Explore these optional coverages to enhance your landlord insurance policy:

- Loss of rental income coverage for tenant displacement.

- Flood insurance for properties in high-risk areas.

- Umbrella liability insurance for additional liability protection.

Keep your coverage up-to-date and tailored to your property’s needs for comprehensive protection.

Common Mistakes To Avoid

Avoid the common mistake of letting your landlord insurance expire. Stay protected and secure by being proactive and renewing it before it lapses. Be a responsible landlord and ensure that you have continuous coverage for your property.

The expiration of landlord insurance can often go unnoticed, leaving property owners exposed to potential risks. To ensure the continued protection of your property, it is crucial to be aware of when your landlord insurance expires and take the necessary steps to renew it on time. In this section of our blog post, we will highlight common mistakes to avoid, including waiting until the last minute to renew and not reviewing policy details thoroughly.

Waiting Until Last Minute To Renew

One of the most common mistakes landlords make is waiting until the last minute to renew their insurance policy. Procrastinating in this regard can lead to potential gaps in coverage and leave you vulnerable to unexpected damages or liability claims. To avoid this, it is essential to set a reminder well in advance of your policy’s expiration date. This will give you enough time to evaluate your coverage, make any necessary adjustments, and secure a renewed policy without any disruptions.

Not Reviewing Policy Details Thoroughly

Another critical mistake many landlords make is not thoroughly reviewing the details of their insurance policy. Insurance policies can often contain complex language and terms that may be confusing to understand. However, it is vital to carefully read through the policy documents to ensure you have a clear understanding of the coverage, limitations, and exclusions. Failure to do so may result in unexpected surprises when filing a claim and could potentially lead to disputes with your insurer. Take the time to review your policy thoroughly, and if you have any questions or concerns, don’t hesitate to reach out to your insurance provider for clarification.

Benefits Of Timely Renewal

When it comes to landlord insurance, timely renewal is crucial to ensure continuous coverage and avoid any gaps in protection. By renewing your landlord insurance on time, you can enjoy a range of benefits that safeguard your investment and provide peace of mind. In this article, we will explore two key benefits of timely renewal: ensuring continuous coverage and avoiding a gap in protection.

Ensuring Continuous Coverage

Renewing your landlord insurance on time ensures continuous coverage, meaning that there will be no lapse in the protection provided by your policy. This is especially important in the ever-changing landscape of the rental property market, where unforeseen events can occur at any time.

By renewing on time, you won’t have to worry about any gaps in your coverage that could leave you financially vulnerable. Whether it’s a tenant causing damage to your property or a natural disaster affecting the area, having uninterrupted coverage gives you the confidence that you’re protected.

Furthermore, with continuous coverage, you can avoid potential issues when filing a claim. Insurance providers may deny claims that occur during a lapse in coverage, leaving you responsible for all associated costs. Avoid the headache and financial burden by renewing your landlord insurance on time.

Avoiding A Gap In Protection

When your landlord insurance expires, a gap in protection can occur. Without active insurance, you leave yourself exposed to various risks and liabilities that could have serious financial consequences. It’s crucial to avoid this gap in protection by renewing your policy on time.

By renewing promptly, you ensure that your investment property remains protected against risks such as fire, theft, vandalism, and liability claims. In the unfortunate event that an incident occurs during the gap period, you may be left responsible for any damages or legal costs incurred.

Renewing your landlord insurance on time not only mitigates financial risks but also demonstrates your commitment to being a responsible and proactive landlord. Tenants will appreciate knowing that their rental property has consistent coverage, and your reputation as a reliable landlord will be enhanced.

In conclusion, the benefits of timely renewal for landlord insurance are significant. By ensuring continuous coverage and avoiding a gap in protection, you safeguard your investment and minimize your financial risks. Don’t overlook the importance of renewing your policy on time – it’s a small investment that can provide substantial benefits in the long run.

Frequently Asked Questions For Where Landlord Insurance Expires

What Does Landlord Insurance Cover?

Landlord insurance typically covers property damage, liability, and loss of rental income. It may also offer protection for legal fees and expenses.

When Does Landlord Insurance Expire?

Landlord insurance expires at the end of the policy period, usually one year after the effective date. Renewal options are typically available.

Does Landlord Insurance Include Tenant Damage?

Yes, landlord insurance can include coverage for tenant damage, such as accidental damage to the property or contents. It’s important to review policy details.

Why Is Landlord Insurance Important?

Landlord insurance is important as it protects property owners from financial losses due to damage, liability, or loss of rental income. It provides peace of mind and security.

Conclusion

It is crucial for landlords to fully understand the limitations and expiration dates of their insurance policies. By ensuring that they have the appropriate coverage and regularly reviewing their policies, landlords can protect their investments and mitigate potential risks. Remember to consult with insurance professionals to assess your specific needs and find the most suitable insurance solution.

In this ever-changing landscape, staying informed and proactive is key to safeguarding your rental properties.

Leave a comment