Renters insurance can be obtained from insurance companies, banks, and online insurance providers, such as Lemonade, State Farm, and Allstate.

:max_bytes(150000):strip_icc()/whats-difference-between-renters-insurance-and-homeowners-insurance-v2-2694bc76e944405aa55fe2784c373999.png)

Credit: http://www.investopedia.com

Importance Of Renters Insurance

Renters insurance is crucial for protecting your belongings and providing liability coverage. Let’s delve into the key aspects of why having renters insurance is essential.

Protecting Personal Belongings

Renters insurance safeguards your personal possessions from theft or damage, providing peace of mind.

Liability Coverage

In the event of accidents on your rental property, liability coverage in renters insurance can protect you.

Understanding Renters Insurance

When renting a home or apartment, having renters insurance should be a top priority. Understanding what this type of insurance covers and doesn’t cover is essential for ensuring you have the proper protection in place. In this article, we’ll delve into the details of renters insurance, explaining what it covers and what it doesn’t cover, so you can make an informed decision about your insurance needs.

What It Covers

Renters insurance provides coverage for your personal belongings, liability protection, and additional living expenses in case your rented property becomes uninhabitable due to a covered peril. Here’s a breakdown of what renters insurance typically covers:

- Personal Belongings: Your renters insurance policy typically covers your personal belongings, including furniture, electronics, clothing, and appliances, against perils such as fire, theft, vandalism, and water damage caused by burst pipes or leaking appliances.

- Liability Protection: Renters insurance includes liability coverage, which protects you financially if someone gets injured while on your rented property or if you accidentally damage someone else’s property. It can help cover medical expenses, legal fees, and any damages awarded in a lawsuit against you.

- Additional Living Expenses: If your rented home becomes uninhabitable due to a covered peril, renters insurance can help cover your additional living expenses. This can include hotel bills, restaurant meals, and other necessary expenses while your home is being repaired or rebuilt.

Understanding what your renters insurance policy covers is crucial for safeguarding your personal belongings and protecting yourself financially in case of unexpected events.

What It Doesn’t Cover

While renters insurance provides valuable coverage, it’s important to be aware of what it doesn’t cover. Here are some common exclusions:

- Damage from Natural Disasters: Renters insurance typically doesn’t cover damage caused by earthquakes, floods, hurricanes, or other natural disasters. If you live in an area prone to these types of perils, you may need to consider purchasing additional coverage or a separate policy.

- Intentional Damage: Renters insurance won’t cover intentional damage caused by you or anyone residing with you. This includes damage resulting from illegal activities or alterations to the rented property without permission.

- High-Value Items: Most renters insurance policies have limits on coverage for high-value items such as jewelry, fine art, or collectibles. If you have expensive items, you may need to purchase additional coverage, also known as a rider, to ensure adequate protection.

Keep in mind that these are general exclusions, and it’s essential to review your policy and consult with your insurance provider to understand the specifics of your coverage.

Getting Renters Insurance

Renters insurance is a crucial financial safety net for tenants, providing protection for personal belongings and liability coverage. Getting renters insurance involves a few essential steps to ensure you choose the right policy for your needs.

Researching Insurance Companies

Before diving into the process of obtaining renters insurance, it’s essential to research various insurance companies. Comparing different providers allows you to evaluate their reputation, customer reviews, financial stability, and claim handling process. Look for insurers with a strong track record of reliability and positive customer feedback to ensure a smooth experience in the event of a claim.

Evaluating Coverage Options

Once you have narrowed down your list of potential insurance companies, it’s time to focus on evaluating the coverage options they offer. Consider the types of coverage available, such as personal property, liability, and additional living expenses. When reviewing policies, make sure the coverage limits align with the value of your belongings and potential risks in your rental property. Understanding the details of each policy ensures that you select the most appropriate coverage for your specific needs.

Factors To Consider

Location

Consider the location when choosing renters insurance. Different areas have varying levels of risk for certain perils, such as theft, fire, or natural disasters. It’s important to assess the crime rate and the likelihood of environmental hazards in your area.

Value Of Belongings

Another vital factor to consider is the total value of your belongings. Assess the total worth of your possessions, including furniture, electronics, clothing, and other items. This evaluation will guide you in determining the appropriate coverage amount for your renters insurance policy.

Cost Of Renters Insurance

When renting a property, one important aspect that tenants often overlook is the cost of renters insurance. Renters insurance provides valuable coverage for your personal belongings and liability protection in the event of unexpected incidents. Understanding the cost factors of renters insurance can help you make an informed decision and choose the right policy that suits your needs.

Premiums

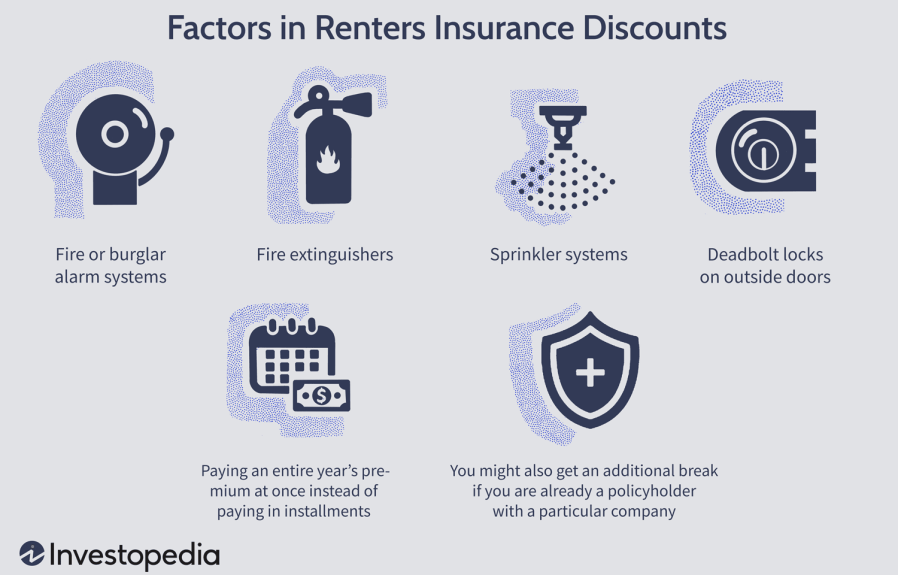

The premiums for renters insurance typically depend on various factors, such as the type and amount of coverage you choose to have. Insurance companies consider the risk associated with your location, the value of your personal belongings, and your desired coverage limits. Additionally, premium amounts can also be influenced by your deductible level, the security measures in your rental property, and your claims history.

It’s important to note that while the premium amount is a significant consideration, wise renters consider the overall value and coverage offered by the policy. Evaluating policies based solely on premiums might result in compromising on coverage when an unforeseen event occurs.

Deductibles

Deductibles are the amount you are responsible for paying out of pocket before your renters insurance coverage kicks in. Depending on the policy, you may have the option to choose a deductible amount that suits your budget. However, keep in mind that selecting a higher deductible typically means lower premiums. While this might initially save you money, it also means you’ll be responsible for a larger portion of the cost in the event of a claim.

Conversely, choosing a lower deductible might result in higher premiums. It’s essential to strike a balance between your budget and how much you can afford to pay out of pocket in the event of a covered loss. Analyzing your risk tolerance and financial situation can help you determine the appropriate deductible level that provides you with peace of mind and protection.

| Factors Affecting Cost of Renters Insurance | Examples |

|---|---|

| Location | High-crime neighborhoods may result in higher premiums. |

| Coverage Amount | Higher value of personal belongings leads to higher premiums. |

| Deductible Level | Higher deductibles might result in lower premiums. |

| Claims History | Frequent claims could lead to higher premiums. |

Ultimately, the cost of renters insurance is influenced by various factors that vary from person to person. It’s important to evaluate your needs, including the value of your possessions, your budget, and your risk tolerance, when determining the appropriate coverage and deductible levels. Remember, while finding an affordable policy is essential, prioritizing adequate coverage ensures peace of mind and financial protection in the face of unexpected events.

Credit: http://www.cashmanequipment.com

Making A Claim

From documenting losses to contacting the insurance company, the process of making a claim for your renters’ insurance can seem daunting at first. However, with the right guidance, this process can be straightforward and help you receive the coverage you deserve.

Documenting Losses

To effectively file a claim, ensure you document all losses with photos and written descriptions in detail. It’s vital to provide as much evidence as possible to expedite the claim process.

Contacting The Insurance Company

Notify your insurance company immediately after a loss occurs. Provide all necessary documentation to support your claim. Be responsive to their requests to ensure a swift resolution.

Common Mistakes To Avoid

Renters often make the mistake of thinking their belongings are not valuable enough to warrant adequate coverage.

Ensure you account for all your possessions to avoid undervaluing your policy.

Many renters neglect the importance of regularly reviewing their insurance policy.

Set a reminder to regularly reassess your coverage to prevent any gaps or outdated information.

Credit: time.com

Frequently Asked Questions For Where Renters Insurance Taken

Where Can I Get Renters Insurance?

You can get renters insurance from insurance companies, banks, or online insurance providers. It’s important to compare quotes and coverage options to find the best policy for your needs.

What Does Renters Insurance Cover?

Renters insurance typically covers personal belongings, liability protection, additional living expenses, and medical payments. It’s important to review the policy details to understand the specific coverage offered.

How Much Does Renters Insurance Cost?

The cost of renters insurance varies based on factors such as location, coverage limits, and deductible. On average, renters insurance can cost between $15 to $30 per month. It’s recommended to request quotes from different providers for accurate pricing.

Conclusion

Ultimately, renters insurance provides vital protection and peace of mind for tenants. From safeguarding personal belongings against theft or damage to covering liability in case of accidents, renters insurance is a small investment with potentially significant benefits. By understanding the coverage options, comparing quotes, and choosing the right policy, renters can ensure they are adequately protected and prepared for any unexpected events.

So, make the smart choice and secure your valuable possessions with renters insurance.

Leave a comment