Umbrella insurance notice is typically provided by insurance companies to policyholders to inform them of changes or updates to their umbrella insurance coverage. It is important to review these notices carefully to ensure that you are aware of any modifications to your policy and understand the implications they may have on your coverage.

These notices are usually sent by mail or email and should be read and retained for future reference. Taking the time to read and understand these notices can help you make informed decisions about your insurance coverage.

What Is Umbrella Insurance?

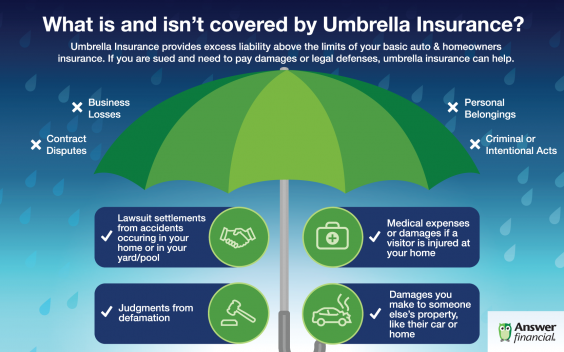

Umbrella insurance provides additional liability coverage beyond what your standard policies offer. It acts as a safety net in case of unexpected events where your basic policy limits may not be enough.

Definition Of Umbrella Insurance

An umbrella insurance policy is designed to protect you from major claims and lawsuits by providing additional liability coverage above the limits of your homeowners or auto insurance policies.

Coverage Details

Umbrella insurance covers a wide range of scenarios, including personal injury, property damage, and defamation claims. It offers financial protection and peace of mind in case of unforeseen accidents or lawsuits.

Importance Of Umbrella Insurance

Protect yourself from unforeseen circumstances with umbrella insurance, covering liability claims that exceed your existing policies. It offers the extra cushion you need, providing peace of mind and financial security. ‘gcqC

When it comes to protecting your assets, having umbrella insurance is of utmost importance. This additional layer of coverage provides you with extra protection beyond the limits of your existing insurance policies. Whether you own a home, car, or other valuable assets, umbrella insurance can offer you financial security and peace of mind in case of unexpected events.

Additional Protection

One of the primary reasons why umbrella insurance is important is because it provides additional protection. While your homeowner’s or auto insurance policies come with coverage limits, these limits may not be sufficient to cover a major lawsuit or accident. Umbrella insurance fills in the gaps and provides you with extended liability coverage, ensuring that you are adequately protected.

With umbrella insurance, you can safeguard your assets and prevent potential financial setbacks. It serves as a safety net, protecting you from substantial losses that could otherwise jeopardize your financial well-being.

Financial Security

Another key aspect of umbrella insurance is the financial security it offers. In today’s litigious society, lawsuits are increasingly common. Without the right protection, an unforeseen accident or legal dispute can quickly drain your savings and put you in a precarious financial situation.

| Umbrella Insurance | No Umbrella Insurance |

|

|

|

|

|

|

By opting for umbrella insurance, you can secure your future and protect your hard-earned assets. Instead of worrying about the potential financial implications of an accident or lawsuit, you can feel confident knowing that you have a reliable safety net.

In conclusion, umbrella insurance is not just an added expense, but a valuable investment. It provides you with additional protection, ensuring that you are adequately covered in case of unexpected events. With umbrella insurance, you can enjoy financial security and peace of mind, safeguarding your assets and securing your future.

Who Needs Umbrella Insurance?

When it comes to protecting your assets and financial well-being, umbrella insurance serves as an essential safety net, providing additional liability coverage above and beyond your standard policies. Let’s explore who specifically benefits from having umbrella insurance and why it’s crucial.

Homeowners

For homeowners, umbrella insurance offers added protection against potential lawsuits stemming from accidents or incidents that occur on their property. It’s particularly beneficial for those who have swimming pools, trampolines, or dogs, as these factors can increase the likelihood of liability claims.

High Net Worth Individuals

If you are among the bracket of high net worth individuals, umbrella insurance is crucial for safeguarding your substantial assets and wealth. It provides an extra layer of liability coverage, shielding you from potentially devastating financial losses in the event of a lawsuit or liability claim.

Benefits Of Umbrella Insurance

Umbrella insurance provides added protection beyond your existing policies and covers liabilities that may not be fully covered. It offers peace of mind knowing that you have additional coverage to safeguard your assets and future financial stability.

Benefits of Umbrella Insurance Umbrella insurance provides additional coverage beyond the limits of your homeowners, auto, and boat insurance policies. It offers an extra layer of protection in the event of a catastrophic liability claim or lawsuit. Let’s explore the key benefits of obtaining umbrella insurance. H3 headings must be in HTML syntax.Liability Coverage

Umbrella insurance extends your liability coverage, protecting your assets from lawsuits that exceed the limits of your primary insurance policies. It safeguards you from financial devastation in the event of a catastrophic accident for which you are held responsible.Legal Expenses Coverage

In the unfortunate event of a lawsuit, umbrella insurance covers legal expenses such as lawyer fees, court costs, and related expenses. This gives you peace of mind, knowing that you have financial protection against mounting legal charges. Protecting your assets with umbrella insurance is a smart financial decision. It ensures that you are adequately safeguarded against unexpected and costly liability claims.How Umbrella Insurance Works

Umbrella insurance is an additional form of liability coverage that protects you beyond the limits of your other insurance policies. It acts as an extra layer of protection in case you face a lawsuit or a claim that exceeds the coverage limits of your primary policies, such as your auto or homeowners insurance. Having umbrella insurance can provide you with peace of mind, knowing that you have added protection against unforeseen incidents that may result in significant financial loss.

Policy Limits

Umbrella insurance policies typically have much higher coverage limits than standard personal insurance policies. While the specific limits may vary depending on the insurance provider, umbrella policies generally offer coverage ranging from $1 million to $5 million or even more. It’s important to consider your personal needs and assets when deciding on the appropriate coverage limit for your umbrella policy.

Claims Process

Making a claim under an umbrella insurance policy is a relatively straightforward process. As with any insurance claim, it’s essential to act promptly and follow the necessary steps to ensure a smooth and efficient claims process. When you encounter a situation that may lead to a claim, such as an accident involving your vehicle or a liability incident on your property, notify your insurance provider immediately. They will guide you through the process and provide the necessary paperwork to submit along with your claim. It’s crucial to provide accurate and detailed information about the incident to expedite the claims process and receive a fair settlement.

Keep in mind that umbrella insurance coverage generally applies once the underlying policies, such as your auto or homeowners insurance, have been exhausted. This means that you must first file a claim with those policies and reach their respective limits before your umbrella insurance comes into play. Having comprehensive documentation and communicating openly with your insurance provider can help ensure a smooth transition between policies and a satisfactory resolution to your claim.

Credit: http://www.answerfinancial.com

Cost Of Umbrella Insurance

Umbrella insurance provides an extra layer of financial protection beyond your standard policies.

Factors Influencing Cost

- Coverage Limits

- Location

- Personal Factors

It’s important to consider these factors for accurate pricing of your umbrella policy.

Comparing Costs

| Insurance Company | Estimated Cost |

|---|---|

| ABC Insurance | $200 per year |

| XYZ Insurance | $250 per year |

Obtain quotes from different providers to find the best value for your umbrella coverage. Compare coverage details along with costs before making a decision.

Calculate your risk exposure and assess the potential financial impact of unforeseen events to determine the right amount of coverage for your needs.

Choosing The Right Umbrella Policy

Start of the blog post contentWhen it comes to choosing the right umbrella policy, there are key considerations that should guide your decision-making process.

Assessing Coverage Needs

Before purchasing an umbrella insurance policy, evaluate your current coverage to determine gaps that need additional protection.

Evaluating Insurers

Research different insurers to compare their rates, reputation, and customer reviews to ensure you select a reputable provider.

:max_bytes(150000):strip_icc()/Accidental-Death-and-Dismemberment-ADD-Insurance-v3-745262583fd74ebf9964311fd9bcaf29.png)

Credit: http://www.investopedia.com

Credit: http://www.businesswire.com

Frequently Asked Questions On Where Umbrella Insurance Notice

What Is Umbrella Insurance?

Umbrella insurance provides extra liability coverage that goes beyond the limits of a standard policy, offering protection against lawsuits and claims.

When Should I Consider Umbrella Insurance?

Consider umbrella insurance if you have significant assets or face a higher risk of being sued due to your profession or activities.

How Does Umbrella Insurance Benefit Me?

Umbrella insurance offers additional coverage for instances where your standard insurance falls short, providing financial protection and peace of mind.

Conclusion

Umbrella insurance is an essential coverage that can protect you from unexpected liabilities. So, don’t wait until it’s too late – take action now to secure your financial future. By understanding the benefits and how it works, you can make an informed decision to safeguard yourself and your assets.

Remember, being prepared is always better than regretting what could have been. Trust in the protection umbrella insurance can provide and enjoy peace of mind knowing you’re covered.

Leave a comment