Unit-Linked Insurance Plan Xyz is a type of insurance scheme that combines insurance coverage with investments. It offers customers the opportunity to grow their wealth while being protected.

Unit-Linked Insurance Plan Xyz provides individuals with the dual benefit of insurance coverage and investment opportunities. This unique plan allows policyholders to secure their future financially through insurance and investment in one product. With Unit-Linked Insurance Plan Xyz, customers can enjoy potentially higher returns compared to traditional insurance policies.

The flexibility and control over investment options make it an attractive choice for those looking to build wealth while ensuring financial security for themselves and their loved ones.

Understanding The Benefits Of Unit-linked Insurance Plan Xyz

When considering Unit-Linked Insurance Plan XYZ, it is crucial to understand the benefits it offers. Let’s delve into the advantages this unique insurance product brings to the table.

Investment Potential

With Unit-Linked Insurance Plan XYZ, investment potential is a key feature. Your premiums are invested in market-linked funds, offering the opportunity for potentially higher returns compared to traditional insurance plans.

Insurance Coverage

This plan provides comprehensive insurance coverage alongside investment benefits. In the unfortunate event of unforeseen circumstances, your loved ones are financially protected with the insurance component of Unit-Linked Insurance Plan XYZ.

Flexibility And Customization

Unit-Linked Insurance Plan XYZ stands out for its flexibility and customization. You have the freedom to choose where your premiums are invested, adjust coverage levels according to your changing needs, and even switch between funds to optimize returns.

Credit: http://www.schwab.com

How Does Unit-linked Insurance Plan Xyz Work?

How Does Unit-Linked Insurance Plan XYZ Work?

Combining Insurance And Investment

Unit-Linked Insurance Plan XYZ combines insurance coverage with investment opportunities.

Allocation Of Premiums

When you pay premiums for Unit-Linked Insurance Plan XYZ, a portion goes towards insurance coverage and the rest is invested.

Choosing Investment Options

- Evaluate various investment options provided by the plan.

- Select investments based on your risk tolerance and financial goals.

Tracking The Performance Of Investments

To ensure your investments are growing, regularly monitor the performance of the investment funds.

Key Features Of Unit-linked Insurance Plan Xyz

When planning for the future, it’s important to ensure financial security and protection for yourself and your loved ones. Unit-Linked Insurance Plan XYZ offers a comprehensive solution that combines the benefits of insurance coverage with investment opportunities. This insurance plan not only safeguards your future but also provides various features to optimize your returns and cater to your financial needs. Let’s explore the key features of Unit-Linked Insurance Plan XYZ.

Liquidity

In times of unforeseen circumstances or financial emergencies, liquidity is crucial. Unit-Linked Insurance Plan XYZ provides you the flexibility to access your funds when needed. With this plan, you have the option to make partial withdrawals without compromising the overall coverage and investment value.

Tax Benefits

One of the attractive aspects of Unit-Linked Insurance Plan XYZ is the tax benefits it offers. By investing in this plan, you can enjoy tax deductions under section XYZ of the Income Tax Act. This not only helps reduce your tax liability but also enables you to maximize your savings while ensuring financial protection for your loved ones.

Switching And Top-up Options

Unit-Linked Insurance Plan XYZ understands that your investment goals may change over time. To align with your evolving financial requirements, this plan allows you to switch between different funds seamlessly. You can reallocate your investments based on market conditions or personal preferences, ensuring optimum returns. Additionally, the top-up option allows you to increase your investment amount, empowering you to maximize wealth creation efficiently.

Multiple Fund Options

Unit-Linked Insurance Plan XYZ offers a diverse range of fund options to suit your risk appetite and investment goals. Whether you prefer a conservative approach or seek higher returns with increased risk, there are different funds available for you to choose from. Each fund has a unique investment strategy, allowing you to customize your portfolio and optimize returns based on your financial objectives.

Credit: http://www.slideteam.net

Maximizing Wealth With Unit-linked Insurance Plan Xyz

Understanding Investment Risks

Unit-Linked Insurance Plan XYZ offers the potential to maximize your wealth through a combination of insurance and investment. Understanding investment risks is crucial to make informed decisions. With ULIP XYZ, you are exposed to market fluctuations, so it’s important to evaluate the risks associated with different investment options.

Choosing The Right Mix Of Funds

Choosing the right mix of funds is essential to achieve your wealth maximization goals with ULIP XYZ. Balancing equity, debt, and balanced funds can help manage risk and enhance returns. Whether you seek long-term growth or stability, selecting the right mix is pivotal for wealth maximization.

Regular Monitoring And Adjustment

Regular monitoring and adjustment are vital aspects of maximizing wealth through ULIP XYZ. Periodically reviewing fund performance and adjusting your investment strategy can help you stay on track with your financial objectives. It’s essential to stay proactive and responsive to market movements.

Utilizing Top-up And Switching Options

ULIP XYZ provides additional features like top-up and switching options that can further boost your wealth accumulation. Making use of these facilities allows you to increase your investment when you have additional funds, and also pivot between funds to optimize your portfolio based on market conditions.

Considerations In Selecting Unit-linked Insurance Plan Xyz

When selecting a Unit-Linked Insurance Plan XYZ, it’s important to consider various aspects to ensure it aligns with your financial goals and risk tolerance. This approach can help you make a well-informed decision and maximize the benefits of the plan. Here are some key considerations to keep in mind when evaluating Unit-Linked Insurance Plan XYZ options:

Assessing Your Risk Appetite

Understanding your risk tolerance is crucial in choosing a Unit-Linked Insurance Plan XYZ. Assessing how comfortable you are with market fluctuations can guide you in selecting the right investment strategy within the plan. It’s essential to align the risk level with your financial objectives to achieve a balanced portfolio.

Evaluating Past Performance

Reviewing the historical performance of Unit-Linked Insurance Plan XYZ is imperative. Analyzing the track record of the underlying funds and their consistency in delivering returns can provide insights into potential growth opportunities and risks associated with the plan.

Understanding Charges And Fees

Gaining clarity on the charges and fees associated with the plan is vital. It’s essential to comprehend the allocation and administration charges, fund management fees, and any other expenses. Understanding these costs can help in comparing the overall value proposition of different Unit-Linked Insurance Plan XYZ options.

Comparing Plans From Different Providers

Comparing Unit-Linked Insurance Plan XYZ from various providers is essential to ensure you have a comprehensive understanding of the available options. Examining the flexibility, fund options, customer service, and additional features offered by different providers can aid in making an informed decision that suits your financial requirements.

Credit: trailhead.salesforce.com

Tips For Getting The Most Out Of Unit-linked Insurance Plan Xyz

When it comes to maximizing the benefits of your Unit-Linked Insurance Plan XYZ, there are several important tips to keep in mind. From setting clear financial goals to staying informed about market trends, taking proactive steps can help you make the most of your investment. In this article, we will discuss key strategies to help you get the most out of your Unit-Linked Insurance Plan XYZ.

Setting Clear Financial Goals

Setting clear financial goals is crucial when it comes to getting the most out of your Unit-Linked Insurance Plan XYZ. By identifying your financial objectives, you can align your investments with them and work towards achieving them efficiently. Whether you aim to save for retirement, your child’s education, or buying your dream home, having well-defined goals allows you to allocate your financial resources wisely.

Diversifying Investments

Diversifying your investments is one of the key strategies to mitigate risk and enhance your returns. By spreading your investments across various asset classes, such as stocks, bonds, and commodities, you can reduce the impact of market fluctuations on your portfolio. Additionally, consider diversifying within each asset class by investing in different sectors or geographic regions. This approach helps you optimize your returns while minimizing potential losses.

Reviewing And Adjusting As Needed

Regularly reviewing your investment portfolio and making necessary adjustments is essential for maximizing the benefits of your Unit-Linked Insurance Plan XYZ. Market conditions and your financial goals may change over time, so it’s important to adapt your investments accordingly. Keep a close eye on your portfolio’s performance and consult with a financial advisor if needed to ensure your investments are aligned with your evolving needs and risk tolerance.

Staying Informed About Market Trends

To make informed investment decisions, it is crucial to stay updated with the latest market trends. Stay informed about economic developments, industry news, and political events that may impact the performance of your investments. Utilize financial news platforms, subscribe to newsletters, and follow reliable financial experts to enhance your knowledge and understanding of the market. By keeping yourself well-informed, you can make better investment choices and capitalize on favorable opportunities.

Frequently Asked Questions Of Where Unit-linked Insurance Plan Xyz

What Is A Unit-linked Insurance Plan?

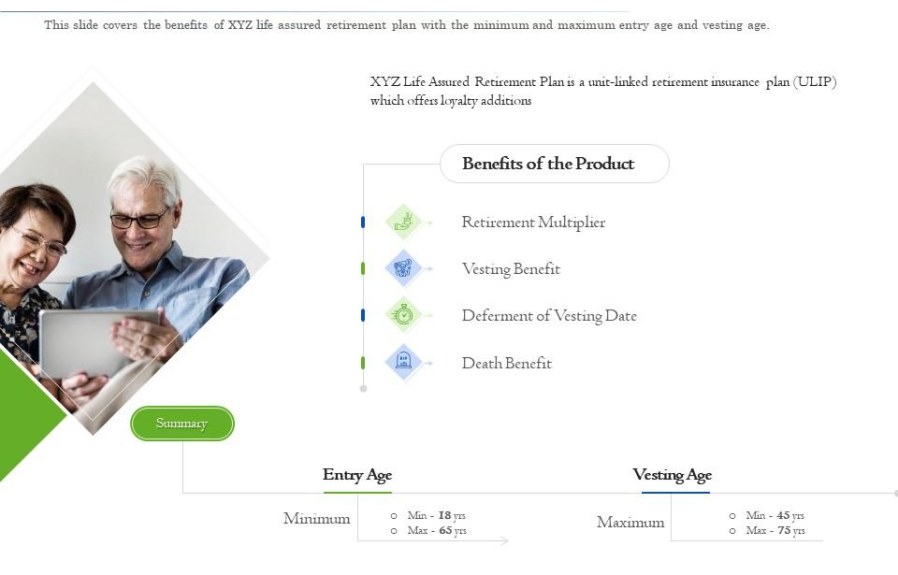

A Unit-Linked Insurance Plan (ULIP) is an insurance product that offers both insurance and investment. It allows you to invest in funds while providing life cover.

How Does Unit-linked Insurance Plan Work?

ULIP works by allowing you to choose from different investment options like equity, debt, or balanced funds. A part of your premium is allocated towards life cover, while the rest is invested in your chosen funds.

What Are The Benefits Of Unit-linked Insurance Plan?

ULIP offers the dual benefit of insurance and investment growth. It provides flexibility to switch between funds, tax benefits, and maturity or death benefits.

Is It Possible To Customize Unit-linked Insurance Plan?

Yes, ULIPs offer flexibility to customize your investment portfolio based on your risk appetite and financial goals. You can choose the proportion of funds you want to invest in.

Conclusion

Unit-Linked Insurance Plan XYZ provides a unique combination of insurance and investment options. With customizable investment strategies and potential for higher returns, it is a suitable choice for individuals seeking to grow their wealth while protecting their loved ones. By understanding the features and benefits offered by XYZ, you can make an informed decision that aligns with your financial goals.

Remember to consult with a financial advisor to ensure it is the right fit for your specific needs.

Leave a comment