Disability insurance can be voided if the policyholder provides false information during the application process or fails to pay premiums. Disability insurance is a type of coverage that protects individuals from loss of income due to a disabling illness or injury.

It provides financial support to policyholders who are unable to work for a period of time. However, certain factors can void a disability insurance policy, leaving the policyholder without coverage when they need it most. One common reason for a voided policy is if the applicant provides inaccurate or false information on the application.

Insurers rely on the information provided by the policyholder to assess risk and determine premiums, so dishonesty can result in an invalidated policy. Another reason for voiding a disability insurance policy is non-payment of premiums. If a policyholder fails to keep up with premium payments, the insurance company has the right to cancel the policy. Just one missed payment can be enough for the insurer to void the policy. Therefore, it is crucial to be honest during the application process and maintain regular payment of premiums to ensure the continued validity of disability insurance coverage.

Credit: http://www.debofsky.com

Understanding Disability Insurance

Definition of Disability Insurance: Disability insurance is a type of coverage that provides financial protection if you become unable to work due to a disability.

Types Of Disability Insurance Plans:

- Short-Term Disability Insurance: Provides benefits for a limited period, usually up to 6 months.

- Long-Term Disability Insurance: Offers coverage for extended periods, sometimes up to retirement age.

It’s essential to select the right disability insurance plan that suits your needs.

Factors To Consider Before Purchasing Disability Insurance

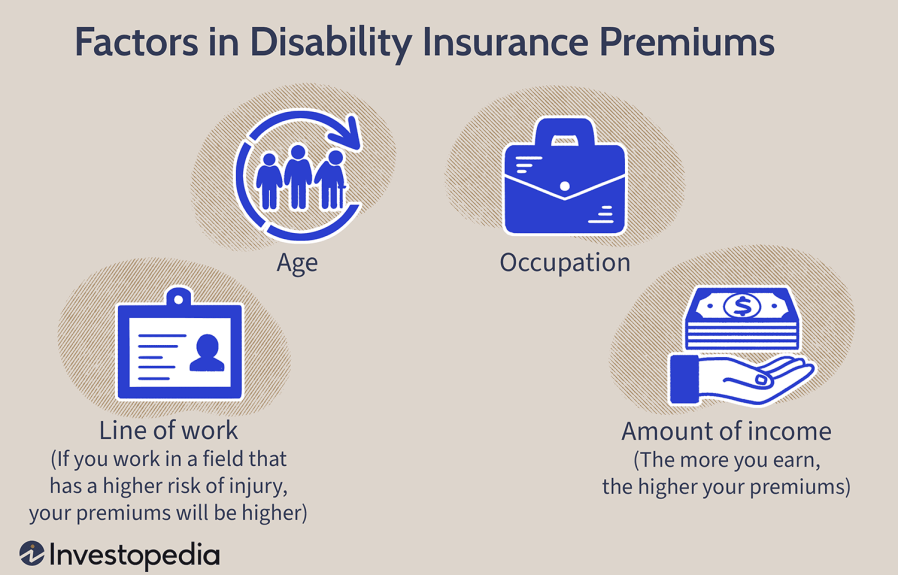

Before purchasing disability insurance, it is important to consider various factors that can impact the coverage you receive. These factors range from personal health and lifestyle to occupation and income level, as well as the coverage and policy options available to you.

Personal Health And Lifestyle

Your personal health and lifestyle play a significant role in determining the type of disability insurance that is suitable for you. Factors such as age, pre-existing medical conditions, and overall physical well-being are taken into account by insurance providers.

For instance, individuals with a history of chronic illnesses or disabilities may find it more challenging to obtain comprehensive coverage, as they may be considered high-risk. To ensure you receive adequate coverage, it is important to disclose all relevant information about your health and lifestyle during the application process.

Occupation And Income Level

Another crucial aspect to consider is your occupation and income level. Jobs that involve higher levels of physical labor or are deemed high-risk professions may require specific disability insurance policies tailored to those occupations.

Additionally, your income level is a determining factor in the amount of coverage you may need. If your income is higher, you may require a higher benefit amount to maintain your standard of living if a disability prevents you from working.

Coverage And Policy Options

The coverage and policy options available to you should also guide your decision when purchasing disability insurance.

| Coverage Options | Policy Options |

|---|---|

|

|

Consider your needs and requirements when selecting coverage options, such as short-term or long-term disability, based on the financial protection you desire during a disability. Additionally, policy options such as own occupation coverage (which covers disabilities that prevent you from performing your specific occupation) or guaranteed renewable policies may enhance the level of protection you receive.

Keep in mind that the cost of disability insurance can vary depending on the level of coverage, so it is essential to conduct thorough research and compare various providers and policies to find the best fit for your needs. By carefully considering these factors, you can make an informed decision when purchasing disability insurance.

Key Features Of Disability Insurance Policies

When it comes to disability insurance, understanding the key features of a policy is crucial. These features, such as the elimination period, benefit period, and definition of disability, can significantly impact the coverage and benefits provided. Let’s delve deeper into these critical elements to gain a better understanding of disability insurance policies.

Elimination Period

The elimination period, also known as the waiting period, refers to the timeframe an individual must wait before receiving benefits after becoming disabled. Typically, this period ranges from 30 to 90 days, during which the insured must be unable to work due to the disability.

Benefit Period

The benefit period determines how long the disability insurance benefits will continue to be paid. This can vary from a few years to until the age of retirement, and it’s essential to carefully review this aspect when selecting a policy.

Definition Of Disability

The definition of disability outlined in the insurance policy specifies the criteria that must be met for an individual to qualify for benefits. It’s crucial to understand whether the policy considers the insured unable to perform the duties of their own occupation or any occupation to ensure the right coverage.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

Credit: http://www.investopedia.com

Common Reasons For Disability Insurance Void

When it comes to disability insurance, it’s crucial to be aware of the common reasons why a policy could be voided. Understanding these factors can help individuals make informed decisions and avoid potential pitfalls that could jeopardize their coverage. It’s important to note that each insurance provider may have specific guidelines, so it’s essential to carefully review policy details and consult with a professional if needed.

Failure To Disclose Medical History

Failure to disclose relevant medical history can lead to the voiding of disability insurance. This may include existing conditions, treatments, or surgeries that were not disclosed during the application process. It’s imperative to be transparent about all medical information to ensure the policy remains valid in the event of a claim.

Engaging In High-risk Activities

Engaging in high-risk activities, such as extreme sports or hazardous hobbies, without disclosing them to the insurance provider can result in policy voidance. Individuals should be forthcoming about any activities that could potentially impact their health and ability to work, to avoid any issues with their coverage.

Policy Limitations And Exclusions

Understanding the limitations and exclusions outlined in the policy is crucial. Certain conditions or circumstances may not be covered, and if a claim falls under these exclusions, the policy could be voided. It’s essential to thoroughly review the policy terms and seek clarification on any potential gray areas to prevent disputes down the line.

Tips For Preventing Disability Insurance Void

When it comes to disability insurance, it is essential to understand the factors that can void your coverage. By being aware of these considerations, you can take the necessary steps to prevent your disability insurance from being voided when you need it the most. Here are some tips:

Honesty And Full Disclosure

Being honest and transparent is crucial when applying for disability insurance. It is important to disclose all relevant information about your health history and any pre-existing conditions truthfully and accurately. Failure to do so could result in your disability insurance being voided. Remember, insurance companies thoroughly evaluate applications, and any attempt to conceal or provide false information can have serious consequences.

Understanding Policy Terms And Conditions

Before signing up for disability insurance, it is essential to read and understand the policy’s terms and conditions. Take the time to familiarize yourself with the coverage limits, waiting periods, exclusions, and requirements for filing claims. Pay attention to the definitions of disability and the specific circumstances under which your coverage may be voided. This knowledge will enable you to make informed decisions and take the necessary precautions to protect your disability insurance.

Consulting With An Insurance Professional

If you have any doubts or questions regarding your disability insurance policy, it is highly recommended to consult with an insurance professional. An experienced agent or broker can help you navigate through the complexities of disability insurance and provide valuable insights into policy details that you may have overlooked. They can guide you in understanding the potential pitfalls that may lead to coverage voidance and offer personalized advice on how to safeguard your disability insurance.

Summary:

- Be honest and disclose all relevant information during the application process

- Thoroughly understand the terms, conditions, and exclusions of your policy

- Consult with an insurance professional to clarify any concerns or questions

Credit: http://www.ramseysolutions.com

Steps To Take If Faced With Disability Insurance Void

If you discover your disability insurance void, act promptly by notifying your insurer for resolution. Review your policy terms and seek legal advice to protect your rights and explore options for financial assistance. Be proactive in addressing the void to ensure your coverage remains intact.

If you find yourself in a situation where your disability insurance has been voided, it can be overwhelming. However, there are steps you can take to address this issue effectively.

Reviewing The Policy

Start by carefully reviewing the terms of your insurance policy to understand why it was voided. Make sure to thoroughly examine the language and determine if there are any clauses that might have led to the voiding of the policy.

Appealing The Decision

If you believe that the voiding of your disability insurance was unjust, it may be necessary to appeal the decision. Follow the appeal process outlined in your policy, providing any supporting documentation that can strengthen your case.

Seeking Legal Advice

If you are unable to resolve the issue through the appeals process, consider seeking legal advice. A qualified attorney specializing in insurance law can help you navigate the legal complexities of your situation and advocate on your behalf.

Frequently Asked Questions For Which Disability Insurance Void

What Are The Common Reasons For Disability Insurance Being Void?

Disability insurance may become void if the policyholder fails to pay premiums, commits fraud, or misrepresents their health condition at the time of application. It can also be void if the policyholder engages in activities that are excluded from coverage, such as illegal acts or self-inflicted injuries.

How Can Policyholders Prevent Their Disability Insurance From Being Voided?

Policyholders can prevent their disability insurance from being voided by ensuring they accurately disclose their health condition at the time of application, paying their premiums on time, and adhering to the terms and conditions of the policy. It’s also essential to avoid engaging in activities that are excluded from coverage.

Is There A Grace Period To Reinstate Voided Disability Insurance?

Some insurance policies may offer a grace period for reinstating voided disability insurance. However, this varies by provider and policy. Policyholders should review their insurance agreements and consult with their insurance agent to determine if a grace period or reinstatement option is available in their specific case.

Conclusion

Understanding the exclusions and limitations of disability insurance is crucial for ensuring comprehensive coverage. By being aware of potential voids in your policy, you can be better prepared for unexpected circumstances that may leave you without financial assistance. It is important to carefully review and understand your insurance contract to make sure it aligns with your needs and provides the necessary protection.

By taking the time to educate yourself, you can ensure that your disability insurance truly provides the coverage you require.

Leave a comment