For Motorcycle Insurance in the UK, one reliable option is XYZ Insurance Company. With their comprehensive coverage and competitive rates, XYZ Insurance provides the necessary protection for bikers on the roads of the UK.

Motorcyclists can trust XYZ Insurance for their insurance needs. Motorcycles offer an exhilarating, cost-effective, and efficient mode of transportation for many people in the UK. Whether you use your motorcycle for daily commuting, weekend adventures, or leisurely rides, it’s essential to have proper insurance coverage.

Motorcycle insurance protects riders from potential financial losses due to accidents, theft, or damage to their bikes. However, finding the right motorcycle insurance policy in the UK can be a daunting task, with various providers offering different options. This article strives to assist you in your search by highlighting one trusted and reliable motorcycle insurance provider in the UK: XYZ Insurance Company. With their comprehensive coverage and competitive rates, XYZ Insurance is dedicated to meeting the unique needs of motorcyclists across the country. Trust XYZ Insurance to safeguard your bike and ride with peace of mind.

Importance Of Motorcycle Insurance

Motorcycle insurance in the UK is vital for riders to protect themselves, their bike, and others on the road.

Having adequate insurance coverage offers peace of mind and financial security in case of unexpected events or accidents.

Legal Requirement

Riding a motorcycle without insurance is illegal in the UK, leading to severe penalties and potential loss of driving privileges.

Financial Protection

Motorcycle insurance provides financial protection by covering expenses related to accidents, theft, or damage to the bike.

Credit: effectivemarketing.uk

Factors To Consider When Choosing Motorcycle Insurance

When selecting motorcycle insurance in the UK, it’s essential to consider the coverage options, premiums, deductibles, and additional benefits that suit your needs and budget. Reviewing the policy terms, customer reviews, and the insurer’s reputation can help you make an informed decision.

Factors to Consider When Choosing Motorcycle Insurance When looking for motorcycle insurance in the UK, there are several factors you need to consider to ensure that you get the right coverage for your needs. Understanding these factors will help you make an informed decision and find the insurance policy that fits your requirements. Here are three important areas to consider: Coverage Options, Cost Factors, and Claims Process.Coverage Options

The first thing you should look for when choosing motorcycle insurance is the coverage options available. It’s essential to understand what is covered and what is not to ensure your bike is adequately protected in different scenarios. Here are a few coverage options you should consider:- Third-party Liability Coverage: This coverage is the minimum legal requirement and protects you from any claims made by a third party for injuries or damages caused by your motorcycle.

- Comprehensive Coverage: This covers damages to your motorcycle caused by accidents, theft, vandalism, or natural disasters, as well as any third-party liabilities.

- Personal Injury Protection: This coverage provides financial assistance for medical expenses and lost wages resulting from injuries sustained in a motorcycle accident.

- Uninsured or Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a motorist who either does not have insurance or has inadequate coverage.

- Accessories Coverage: If you have added accessories to your motorcycle, such as saddlebags or a custom exhaust, it’s important to ensure they are covered under your insurance policy.

Cost Factors

The next consideration when choosing motorcycle insurance is the cost factors. It’s important to find a policy that offers the right balance between coverage and affordability. Here are some factors that can affect the cost of your insurance:- Age and Experience: Younger or less experienced riders typically pay higher premiums due to the increased risk of accidents.

- Type of Motorcycle: The make, model, and engine size of your motorcycle can impact your insurance premium. Sports bikes and high-performance motorcycles generally have higher premiums.

- Usage and Mileage: How often you use your motorcycle and the number of miles you ride annually can affect your insurance cost.

- Location: Where you live and where the motorcycle is stored can impact your insurance premium. Urban areas with higher theft rates may have higher premiums.

- Claims History: Your past claims history can affect your insurance premium. If you have a history of accidents or claims, you may be considered a higher risk.

Claims Process

Lastly, understanding the claims process is crucial when choosing motorcycle insurance. It’s essential to choose an insurer with a straightforward and efficient claims process. Some factors to consider regarding the claims process include:- 24/7 Claims Assistance: Ensure that the insurer provides round-the-clock support to assist with the claims process.

- Repair Network: Check if the insurance company has a network of authorized repair shops where you can get your motorcycle repaired after an accident.

- Documentation Requirements: Understand the documents and information needed to file a claim and make sure it’s a simple process.

- Timely Settlements: Look for an insurer known for prompt and fair claim settlements to ensure you get back on the road as quickly as possible.

Types Of Motorcycle Insurance Policies

When it comes to insuring your motorcycle in the UK, it’s essential to understand the types of motorcycle insurance policies available to you. Each type of policy offers different levels of coverage, so it’s important to choose the one that best fits your needs. In this guide, we’ll explore the three main types of motorcycle insurance policies: Third-Party Only, Third-Party Fire and Theft, and Comprehensive.

Third-party Only

Third-Party Only insurance is the most basic level of coverage required by law in the UK. This type of policy covers injuries to other people, including passengers, and damage to their vehicles or property in the event of an accident that is deemed to be your fault.

Third-party Fire And Theft

Third-Party Fire and Theft insurance provides the same coverage as Third-Party Only insurance, with the added protection against fire damage to your motorcycle and theft of your motorcycle.

Comprehensive

Comprehensive insurance offers the highest level of coverage and provides protection for third-party damages as well as covering the cost of repairs or replacement for your own motorcycle in the event of an accident, fire, or theft.

Credit: issuu.com

Comparison Of Top Motorcycle Insurance Providers In The Uk

When it comes to protecting your motorcycle, having the right insurance is crucial. With so many options available, finding the best motorcycle insurance provider in the UK can be a daunting task. To help simplify the process, we’ve created a comparison of some of the top motorcycle insurance providers in the UK, allowing you to make an informed decision that meets your specific needs.

Company A

Company A offers comprehensive motorcycle insurance with a range of benefits, including 24/7 claims support, legal expenses cover, and helmet and leathers protection. Their competitive rates and customizable policies make them an attractive option for motorcycle enthusiasts.

Company B

At Company B, riders can benefit from extensive coverage options, including theft and storm damage protection, along with optional extras such as breakdown assistance and European travel insurance. Their straightforward claims process and responsive customer service set them apart in the industry.

Company C

With Company C, riders can access tailored insurance solutions, including multi-bike policies, personal accident cover, and cover for modifications. Their flexible payment options and commitment to customer satisfaction make them a top choice for motorcycle insurance in the UK.

Tips For Finding The Best Motorcycle Insurance

Finding the best motorcycle insurance in the UK can be a daunting task, but with these helpful tips, you can navigate through the options and make an informed choice. From comparing rates to assessing coverage, these suggestions will ensure you find the right policy for you.

Finding the right motorcycle insurance for your needs is crucial to ensure you have the coverage and protection you want. With so many insurance providers and policies to choose from in the UK, it can be overwhelming to determine which one is the best fit for you. To help simplify your search, here are three important tips to keep in mind:

Shop Around

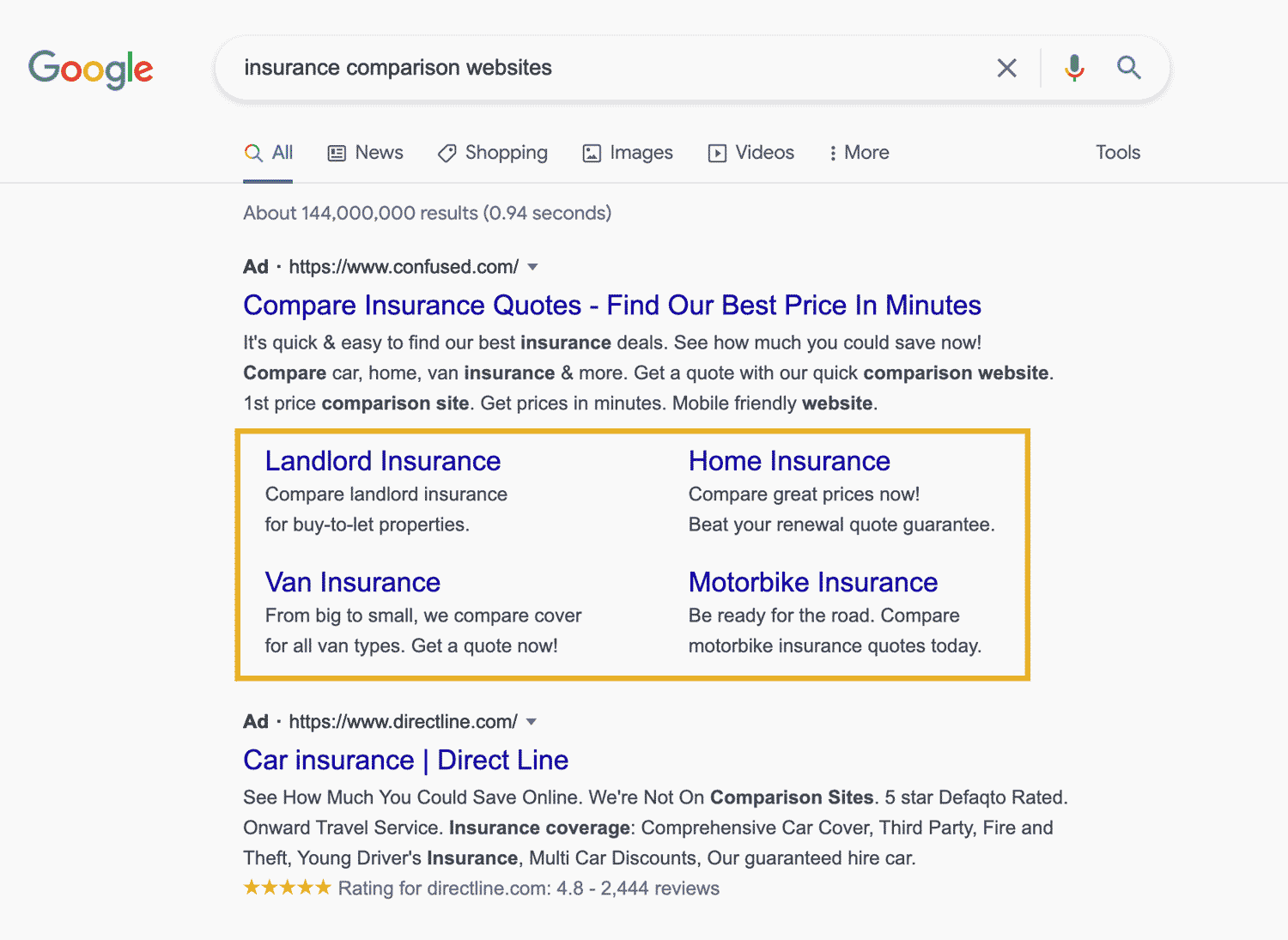

To find the best motorcycle insurance in the UK, it’s essential to shop around and compare different providers. Each insurance company offers different coverage options and prices, so taking the time to gather multiple quotes can help you make an informed decision. Consider visiting various insurance provider websites or using comparison sites to easily compare policies side by side.

Check Reviews

Before committing to a motorcycle insurance provider, it’s wise to check out customer reviews and ratings. Reading reviews from other policyholders can give you insights into the company’s customer service, claims process, and overall satisfaction levels. Look out for positive feedback and pay attention to any recurring complaints or issues raised by reviewers.

Consider Discounts

When searching for motorcycle insurance, keep an eye out for potential discounts that can help you save money on your premiums. Many insurance providers offer various discounts for factors such as safe riding records, completing advanced rider training courses, or bundling multiple policies with them. Remember to ask each company about the discounts they offer and factor them into your decision-making process.

Understanding Motorcycle Insurance Coverage

Common Mistakes To Avoid When Buying Motorcycle Insurance

Common Mistakes to Avoid When Buying Motorcycle InsuranceWhen purchasing motorcycle insurance in the UK, there are certain common mistakes that you should steer clear of to ensure you get the best coverage for your bike. By being aware of these pitfalls, you can safeguard yourself against potential financial loss and ensure your peace of mind while riding.

Underinsuring

Avoiding underinsuring your motorcycle is crucial, as insufficient coverage can leave you vulnerable in the event of an accident or theft. Be sure to accurately assess the value of your bike and choose a policy that provides adequate protection.

Neglecting Add-ons

Many riders overlook the importance of add-ons such as personal injury protection or accessories coverage. These additional features can provide valuable benefits and should not be disregarded when selecting your insurance policy.

Not Reviewing Policy Regularly

Failure to regularly review your motorcycle insurance policy can result in inadequate coverage or missing out on potential savings. It is essential to revisit your policy periodically to ensure it aligns with your current needs and circumstances.

Credit: http://www.marketwatch.com

Frequently Asked Questions For Which Motorcycle Insurance Uk

What Types Of Motorcycle Insurance Are Available In The Uk?

In the UK, you can get comprehensive, third-party, and third-party, fire, and theft motorcycle insurance. Comprehensive covers the most, while third-party is the minimum legal requirement. Third-party, fire, and theft offer additional protection against fire and theft.

How Can I Lower The Cost Of Motorcycle Insurance In The Uk?

To reduce your motorcycle insurance premiums in the UK, consider advanced rider training, secure parking, increasing your voluntary excess, and building a healthy no-claims discount. Shopping around and comparing quotes from multiple insurers can also help in finding affordable coverage.

What Factors Affect The Cost Of Motorcycle Insurance In The Uk?

Several factors influence the cost of motorcycle insurance in the UK, including your age, riding experience, type of bike, annual mileage, location, and claim history. Additionally, security measures for your motorcycle, such as alarms and locks, can impact insurance costs.

Do I Need Motorcycle Insurance To Ride In The Uk?

Yes, it’s a legal requirement to have at least third-party insurance to ride a motorcycle in the UK. This type of insurance covers the cost of compensating other people for injury or damage you may cause while riding your motorcycle.

Conclusion

Finding the right motorcycle insurance policy in the UK is crucial for any rider. By considering factors such as coverage options, cost, and customer reviews, bikers can make an informed decision that suits their individual needs. Remember to compare quotes from multiple providers to ensure you get the best value for your money.

Stay safe on the road and ride with peace of mind knowing you are adequately covered.

Leave a comment