An endowment policy document outlines terms of an investment plan for future financial benefits. When considering insurance options, understanding the endowment policy document is crucial.

It is a legal document that clearly defines the terms and conditions of the policy, including the maturity benefits and any additional clauses. By carefully reviewing and comprehending this document, policyholders can make informed decisions about their investments and ensure they meet their financial goals.

This document serves as a contract between the policyholder and the insurance company, providing a roadmap for the investment journey. It is essential to grasp the content of the endowment policy document to harness the full potential of the policy and secure financial stability.

What Is An Endowment Policy?

What is an Endowment Policy? An endowment policy is a type of life insurance contract that pays out a lump sum of money after a specific term or upon the death of the policyholder.

Definition And Purpose

Definition: An endowment policy is a financial product that combines savings and insurance, providing a lump sum payout at a predetermined maturity date or upon the insured individual’s death.

Purpose: The primary purpose of an endowment policy is to accumulate savings over time while offering a life insurance cover for the policyholder.

Key Features

- Long-Term Investment: Endowment policies are long-term investment vehicles that help individuals save for specific financial goals such as education, retirement, or buying a house.

- Maturity Benefit: Upon the policy’s maturity, the insured receives a lump sum amount, which can be used to meet financial needs or fulfill long-term aspirations.

- Life Cover: In the event of the policyholder’s death during the policy term, the nominated beneficiary receives the sum assured, providing financial security to the family.

- Guaranteed Returns: Endowment policies often offer guaranteed returns, ensuring a certain level of growth on the invested premiums.

- Tax Benefits: Policyholders can avail tax benefits on the premiums paid and the maturity amount received under specific sections of the Income Tax Act.

Understanding The Endowment Policy Document

When it comes to your endowment policy, understanding the policy document is crucial for making informed decisions.

Importance Of Reading The Document

Reading the endowment policy document thoroughly is crucial for a policyholder.

- Ensures you know your rights and obligations

- Helps in understanding the coverage and benefits provided

- Provides clarity on policy terms and conditions

What The Policy Document Contains

The policy document for an endowment policy typically contains important information:

- Policyholder details and policy number

- Coverage details and benefits

- Premium payment terms and frequency

- Exclusions and limitations

- Contact information for queries or claims

Deciphering The Terms And Conditions

Deciphering the Terms and Conditions of your Endowment Policy Document is a crucial step in understanding your policy details. By carefully reading and understanding the various sections and clauses, you can ensure that you make the most of your policy and avoid any surprises in the future. In this article, we will break down the key aspects of the policy document under the headings of Policy Duration, Premium Payments, Maturity Benefits, and Death Benefits.

Policy Duration

The Policy Duration section outlines the length of time your endowment policy will remain in force. It specifies the start and end dates of the policy term, giving you a clear understanding of the duration for which you will be covered. This information is essential for planning your financial goals and aligning them with the policy’s time frame.

Premium Payments

Under the Premium Payments section, you will find details about the schedule and frequency of premium payments. This includes information on the due dates, the acceptable modes of payment, and any penalties or charges for late payments. Understanding this section is important to ensure that you make timely payments and avoid any disruption in your policy coverage.

Maturity Benefits

The Maturity Benefits section outlines what you can expect to receive at the end of the policy term. It includes details about the maturity amount, which is the sum assured plus any accumulated bonuses or returns on investment. This section also provides information regarding the maturity date, the payout options available to you, and any additional benefits or bonuses you may be eligible for.

Death Benefits

The Death Benefits section explains what will happen in the event of your untimely demise during the policy term. It outlines the sum assured that will be paid to your nominee or beneficiary and any additional benefits or riders that may be applicable. Understanding this section is crucial to ensure financial security for your loved ones in case of any unfortunate events.

By carefully reading and understanding the Policy Duration, Premium Payments, Maturity Benefits, and Death Benefits sections of your Endowment Policy Document, you can fully comprehend the terms and conditions of your policy. This will equip you with the knowledge needed to make informed decisions regarding your financial future.

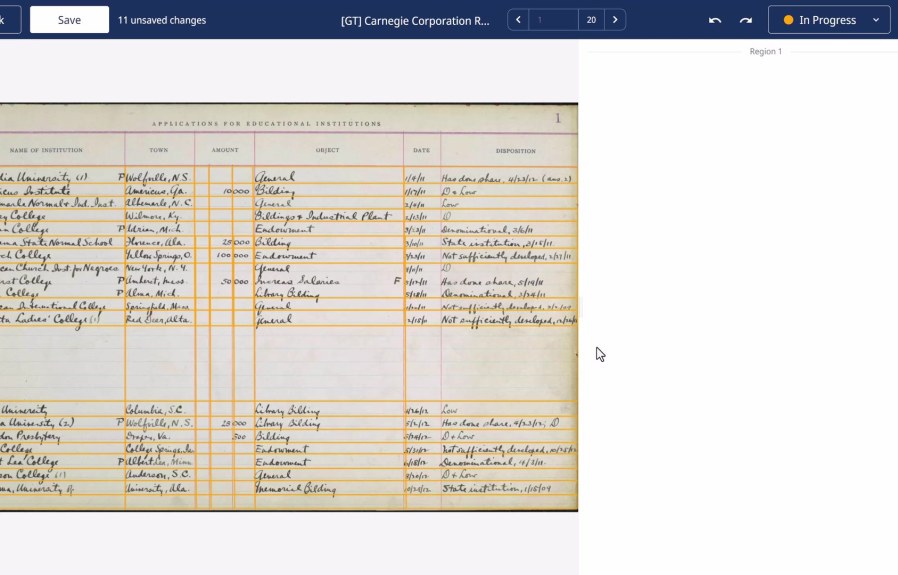

Credit: http://www.journalofaccountancy.com

Commonly Used Terminology

When it comes to understanding an endowment policy document, it’s important to familiarize yourself with commonly used terminology. This will help you navigate and comprehend the details of the policy effectively.

Sum Assured

The sum assured refers to the guaranteed amount that the policyholder’s beneficiaries will receive upon the death of the insured individual. It is the minimum amount assured by the policy.

Bonus Declarations

Bonus declarations refer to the additional amount that policyholders may receive based on the performance of the insurance company. These bonuses are typically declared annually and are added to the policy’s maturity value.

Surrender Value

The surrender value is the amount that the policyholder is entitled to receive if they choose to terminate the policy before its maturity. It is calculated based on the premiums paid and the duration for which the policy has been active.

Paid-up Value

The paid-up value is the reduced sum assured that a policy becomes eligible for if the premiums are discontinued after a certain period. While the policy remains active, it is no longer entitled to the full sum assured, but rather the reduced paid-up value.

Examining Exclusions And Limitations

An endowment policy document is a crucial legal and financial contract that outlines the terms and conditions of an endowment policy. By examining the exclusions and limitations within this document, policyholders can gain a comprehensive understanding of the scope and boundaries of their coverage.

Policy Exclusions

When evaluating your endowment policy document, it’s essential to pay close attention to the policy exclusions. These are specific scenarios or circumstances for which the insurance company will not provide coverage. While endowment policies typically offer comprehensive protection, they are not immune to certain limitations and exclusions.

Exceptions To Coverage

Understanding the exceptions to coverage is equally important. These exceptions delineate the situations in which the policy may offer coverage despite the policy exclusions. For policyholders, it’s essential to grasp these exceptions to ensure a clear understanding of the benefits and limitations of their endowment policy.

Comparing Endowment Policies

When it comes to securing your financial future, endowment policies can be a smart investment strategy. However, with so many options available in the market, it can be overwhelming to choose the right policy for your needs. In this article, we will explore the different types of endowment policies and compare their policy options, helping you make an informed decision.

Different Types Of Endowment Policies

If you’re considering an endowment policy, it’s essential to understand the different types available and their unique features. Let’s take a closer look:

Comparison Of Policy Options

Once you’ve familiarized yourself with the various types of endowment policies, it’s time to compare their policy options. This comparison can help you identify which policy aligns best with your financial goals and risk tolerance. Here are some factors to consider:

- Policy Term:

Policy term refers to the duration for which the policyholder pays premiums until the maturity date. Short-term policies may provide quicker returns, while long-term policies offer potential for higher growth over time.

- Premium Payment:

Different policies offer various premium payment options such as monthly, quarterly, annually, or a lump sum amount. Consider your financial capacity and choose a policy that allows you to comfortably meet the premium payments.

- Growth Potential:

Each endowment policy comes with its own growth potential, which is typically based on investment returns. Some policies invest a higher proportion in equities, while others focus on more conservative investments. Assess the growth potential of each policy to find one that suits your risk appetite.

- Maturity Benefit:

Check the maturity benefit offered by each policy. This benefit can consist of a lump sum payout, periodic payouts, or a combination of both. Understand the payout structure and evaluate whether it aligns with your financial goals.

- Bonus Options:

Many endowment policies provide bonus options that can enhance the value of your policy. These may include annual bonuses or terminal bonuses. Compare the bonus options of different policies to maximize your returns.

By considering these factors, you can make an informed decision when comparing endowment policies. Take your time, do thorough research, and choose a policy that fits your financial objectives and risk profile.

Tips For Understanding And Choosing The Right Policy

Understanding the nuances of endowment policy documents is essential for making informed decisions. Below are key tips to guide you in selecting the right policy.

seeking Professional Advice

- Consult with financial advisors to gain insights.

- Review recommendations from seasoned experts.

- Compare multiple options to diversify your knowledge.

evaluating Your Financial Goals

- Assess short and long-term financial objectives.

- Consider risk tolerance and investment preferences.

- Align policy features with your financial aspirations.

understanding Personal Circumstances

- Factor in life stage and family situation.

- Take health and retirement plans into account.

- Ensure policy terms complement personal needs.

Credit: http://www.westernsouthern.com

Credit: en.wikipedia.org

Frequently Asked Questions Of Who Endowment Policy Document

What Is An Endowment Policy Document?

An endowment policy document is a legal contract provided by the insurance company that outlines the terms and conditions of the endowment policy, including the coverage, premium payments, and maturity benefits. It serves as evidence of the policyholder’s agreement with the insurer.

Why Is The Endowment Policy Document Important?

The endowment policy document is crucial as it outlines the rights and obligations of the policyholder and the insurance company. It provides clarity on the policy’s terms, including maturity benefits, surrender value, and coverage details.

How Can I Obtain A Copy Of My Endowment Policy Document?

You can request a copy of your endowment policy document from the insurance company or agent who issued the policy. Typically, they will provide you with a physical or digital copy of the document for your reference and safekeeping. Always keep it in a secure place.

What Information Is Included In The Endowment Policy Document?

The endowment policy document contains essential details such as the policyholder’s name, policy number, coverage amount, premium payment schedule, maturity benefits, surrender value, and terms and conditions of the policy. Reviewing this document helps in understanding the policy terms comprehensively.

Conclusion

Understanding the significance of the endowment policy document is crucial for policyholders. It serves as a legal contract that outlines the terms and conditions of the policy, ensuring transparency and protecting the rights of both the insurer and the policyholder.

Regularly reviewing and comprehending the policy document empowers individuals to make informed decisions about their financial futures. By staying knowledgeable about the fine print, policyholders can maximize the benefits and peace of mind offered by their endowment policies.

Leave a comment