Endowment Policy Limited is a financial services firm specializing in endowment policies. They offer investment options and financial planning services to clients seeking long-term financial security.

With a focus on strategic planning and customer-centric solutions, the company aims to help individuals build wealth and achieve their financial goals. Endowment Policy Limited stands out for their expertise in endowment policies and commitment to personalized financial advice tailored to each client’s needs.

By providing transparent and reliable financial solutions, the firm has earned a reputation as a trusted partner in long-term wealth management. With a track record of success and a dedication to excellence, Endowment Policy Limited is a top choice for individuals seeking to secure their financial future.

What Is An Endowment Policy

An Endowment Policy Limited is a type of financial product that combines elements of insurance and investment. It offers the policyholder both a life insurance coverage and a savings plan. In simple terms, an endowment policy is a contract between the insured and the insurer, where the insured pays a regular premium for a specified period, and in return, receives a lump sum amount at maturity or in case of an unfortunate event.

Definition

An endowment policy is a financial product that provides a combination of life insurance coverage and investment savings over a fixed term.

Features

- Insurance Protection: Provides a death benefit to the policyholder’s beneficiaries if the insured passes away during the policy term.

- Savings Component: Includes a savings or investment feature that builds cash value over time.

- Maturity Benefit: Offers a lump sum payment to the policyholder at the end of the policy term, irrespective of the insured’s survival.

- Fixed Premiums: Requires the policyholder to pay regular premiums for a specified period, ensuring financial discipline and long-term savings.

How An Endowment Policy Works

Endowment policies are long-term savings plans that consist of a mix of insurance and investment components. Let’s delve into the details of how these policies work.

Premiums And Contributions

Endowment policies require the policyholder to make regular premium payments over a specified period.

Investment Component

- The premium is divided into two parts: a portion that goes towards insurance coverage and a portion that is invested by the insurance company.

- The investment component allows the policy to accumulate cash value over time.

Maturity Payout

- When the policy matures, the policyholder receives a lump sum amount known as the maturity payout.

- The maturity payout typically includes the accumulated cash value and bonuses earned over the policy term.

Advantages Of An Endowment Policy

An endowment policy is a financial product that offers a range of benefits to policyholders. It combines elements of savings, insurance coverage, and investment opportunities. Let’s explore the advantages of an endowment policy in detail:

Guaranteed Returns

One of the most appealing advantages of an endowment policy is the guaranteed returns it offers. Unlike other investment options that may be subject to market volatility, an endowment policy provides a predictable return on investment. This assurance gives policyholders peace of mind, knowing that their money is secure and will grow over time.

With an endowment policy, you can plan for the future with confidence, as you know exactly how much money you will receive at the maturity of the policy. This stability is particularly valuable for those who want a reliable financial plan, whether it’s for a specific goal like your child’s education or simply to build wealth over time.

Life Insurance Coverage

Another significant advantage of an endowment policy is the life insurance coverage it provides. The policy offers a death benefit, which means that if the policyholder passes away during the policy term, the designated beneficiary will receive a lump-sum payment. This ensures that your loved ones are financially protected in the event of your untimely demise.

The life insurance coverage offered by an endowment policy provides an added layer of security for you and your family. It offers peace of mind, knowing that your loved ones will be financially supported even if you are no longer able to provide for them.

Long-term Savings

Aside from the guaranteed returns and life insurance coverage, an endowment policy also serves as a long-term savings vehicle. It encourages you to save money consistently over a predetermined period, typically five to twenty years. These regular contributions gradually build up a significant sum of money, which can be used to fulfill your financial goals.

Whether you’re saving for a down payment on a house, planning for retirement, or accumulating wealth for your dream vacation, an endowment policy helps you achieve these goals by providing a structured saving mechanism. The discipline of contributing to your policy regularly ensures that you stay on track and accumulate a substantial amount over time.

In conclusion, an endowment policy offers a host of advantages including guaranteed returns, life insurance coverage, and the opportunity for long-term savings. This financial product provides stability, security, and a path towards achieving your future financial goals. It’s a comprehensive solution that combines the benefits of savings, investment, and protection in one package.

Credit: m.facebook.com

Types Of Endowment Policies

Traditional Endowment

A traditional endowment policy is a long-term savings plan that provides a lump sum payout at the end of the policy term, or upon the death of the policyholder, whichever occurs first.

Unit-linked Endowment

A unit-linked endowment policy combines life insurance coverage with investment options. The premiums paid are invested in units of investment funds, offering potential for higher returns but also subject to market risks.

Factors To Consider Before Investing

Before investing in an endowment policy, it’s crucial to evaluate your financial goals and risk tolerance. Consider the policy’s terms, surrender charges, fees, and potential returns to make an informed decision. Conduct thorough research and seek advice from financial experts before committing.

Factors to Consider Before Investing When considering an endowment policy limited, it’s crucial to weigh various factors to ensure that it aligns with your financial objectives and risk tolerance. Risk profile, financial goals, and policy term are significant elements to evaluate before making an investment decision. Risk Profile Before investing in an endowment policy limited, evaluate your risk profile to determine the level of risk you are comfortable with. Consider factors such as your age, financial responsibilities, and overall risk tolerance. A thorough understanding of your risk profile will help you select an endowment policy that suits your comfort level with risk. Financial Goals Your financial goals play a crucial role in determining the suitability of an endowment policy limited. Assess your short-term and long-term financial goals, such as saving for retirement, purchasing a home, or funding a child’s education. Understanding your financial goals will guide you in selecting a policy that aligns with your specific objectives. Policy Term The policy term is a critical consideration when investing in an endowment policy limited. Take into account your long-term financial commitments and obligations when determining the appropriate policy term. Be mindful of the duration of the policy and how it aligns with your financial milestones and life events. By carefully assessing your risk profile, financial goals, and policy term, you can make informed decisions when considering an endowment policy limited. These factors will guide you in selecting a policy that is aligned with your financial aspirations and risk tolerance.

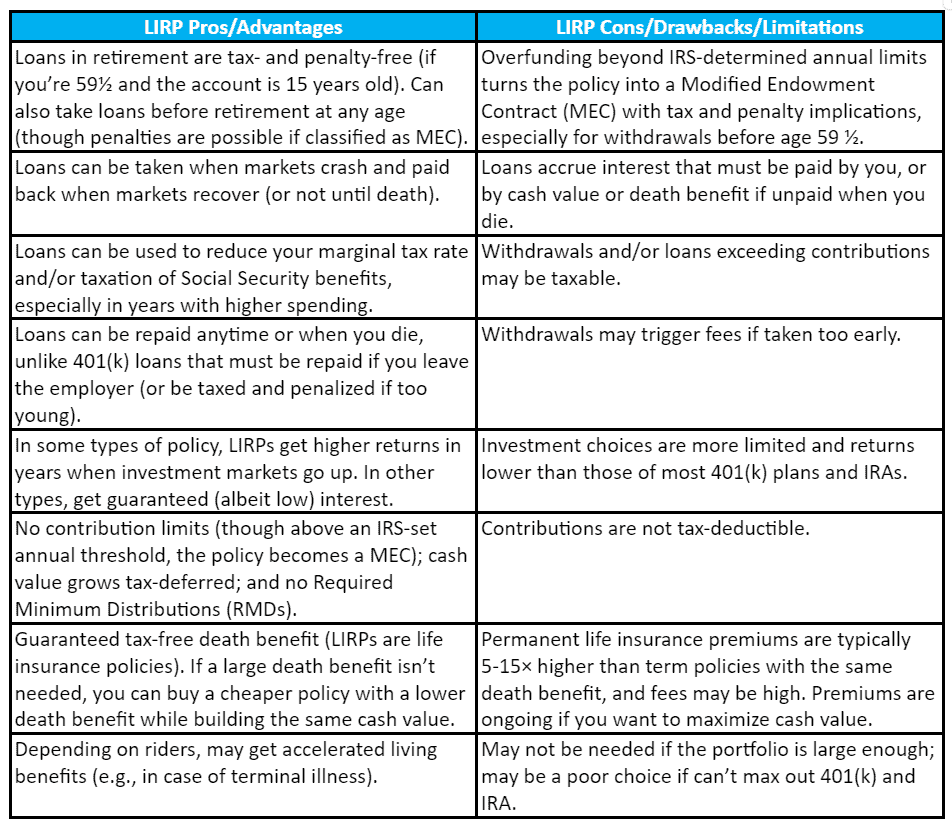

Credit: wealthtender.com

Comparison With Other Investment Options

When it comes to investing your hard-earned money, it’s important to consider the various options available and choose the one that suits your needs and goals. One such option is an endowment policy. In this section, we’ll compare an endowment policy with two other popular investment options: savings account and fixed deposit.

Endowment Vs Savings Account

An endowment policy offers a unique combination of protection and investment benefits. Unlike a savings account, which serves primarily as a safekeeping place for your money, an endowment policy provides both a guaranteed return and life insurance coverage. This means that in addition to growing your wealth, you also ensure financial security for your loved ones in the event of any unfortunate circumstances.

Moreover, with an endowment policy, your money grows at a higher interest rate compared to a typical savings account. While a savings account may offer an interest rate of around 1-2%, an endowment policy can provide returns of around 5-6%. This higher rate of return is achieved by investing your money in a mix of fixed income securities and equities, offering the potential for greater growth over the long term. Therefore, if you’re looking for a balance between savings and investment, an endowment policy could be the ideal choice.

Endowment Vs Fixed Deposit

When it comes to comparing an endowment policy with a fixed deposit, there are a few key factors to consider. Although both options provide a guaranteed return, an endowment policy offers a multitude of advantages over a fixed deposit.

Firstly, an endowment policy not only grows your money but also provides life insurance coverage, ensuring financial protection for your loved ones. On the other hand, a fixed deposit lacks this added benefit.

Secondly, an endowment policy offers flexibility in terms of the tenure. You can choose the duration of the policy based on your financial goals and needs. In contrast, a fixed deposit locks your funds for a specific period, limiting your accessibility to the money until maturity.

Lastly, an endowment policy has the potential for higher returns compared to a fixed deposit. While the interest accumulated in a fixed deposit may be subject to taxation, the returns from an endowment policy are often tax-exempt, allowing you to maximize your savings.

In conclusion, an endowment policy stands out when compared to other investment options like a savings account or fixed deposit. It offers not only growth of your wealth but also life insurance coverage, flexibility, and the potential for higher returns, making it a well-rounded choice for those seeking financial security and growth.

Tips For Maximizing Your Endowment Policy

Maximize the benefits of your endowment policy by following these key tips. From choosing the right policy to reviewing and adjusting it regularly, these strategies can help you make the most of your investment.

Choose The Right Policy

Before selecting an endowment policy, compare different options to find one that aligns with your financial goals. Consider factors like policy duration, premium amount, and expected returns to ensure it suits your needs.

Review And Adjust Regularly

Set a schedule to review your policy regularly to ensure it continues to meet your requirements. Consider adjustments based on changes in your financial situation or life circumstances to optimize the benefits.

Credit: http://www.dermotcole.com

Frequently Asked Questions On Who Endowment Policy Limited

What Is An Endowment Policy?

An endowment policy is a life insurance product that provides a lump sum payout at the end of a specified term or upon the policyholder’s death. It combines life insurance coverage with a savings plan, offering both protection and long-term savings.

How Does An Endowment Policy Work?

Endowment policies work by requiring the policyholder to make regular premium payments over a specific term. Upon maturity or the insured’s death, the policy pays out a lump sum amount, which can be used for various purposes such as retirement planning, education funds, or mortgage payoff.

What Are The Benefits Of An Endowment Policy?

Endowment policies offer a range of benefits, including life insurance protection, a guaranteed lump sum payout at the end of the policy term, tax advantages on the returns, and a disciplined savings plan that encourages long-term financial planning and security for the insured and their loved ones.

Conclusion

A carefully chosen endowment policy can provide an effective way to secure your financial future. With its combination of savings and protection, it offers a unique solution that meets your long-term goals. By understanding the benefits and limitations of an endowment policy, you can make an informed decision about whether it suits your needs.

So, take the time to review and compare different policies before making your choice. Your financial security is worth it.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is an endowment policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “An endowment policy is a life insurance product that provides a lump sum payout at the end of a specified term or upon the policyholder’s death. It combines life insurance coverage with a savings plan, offering both protection and long-term savings.” } } , { “@type”: “Question”, “name”: “How does an endowment policy work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Endowment policies work by requiring the policyholder to make regular premium payments over a specific term. Upon maturity or the insured’s death, the policy pays out a lump sum amount, which can be used for various purposes such as retirement planning, education funds, or mortgage payoff.” } } , { “@type”: “Question”, “name”: “What are the benefits of an endowment policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Endowment policies offer a range of benefits, including life insurance protection, a guaranteed lump sum payout at the end of the policy term, tax advantages on the returns, and a disciplined savings plan that encourages long-term financial planning and security for the insured and their loved ones.” } } ] }

Leave a comment