A health insurance policy is a contract between an individual and an insurance company that provides financial coverage for medical expenses. In today’s healthcare landscape, having a health insurance policy is essential to protect yourself and your family from the high costs of medical care.

With rising healthcare costs and the unpredictability of health issues, having a health insurance policy ensures that you have access to quality healthcare without the burden of large out-of-pocket expenses. From doctor visits to hospital stays, prescription medications to preventive care, a health insurance policy provides coverage for a wide range of medical services.

It offers peace of mind, knowing that you have financial protection in case of unexpected medical emergencies or ongoing healthcare needs.

Types Of Health Insurance

Health insurance is vital for safeguarding your well-being and ensuring access to quality healthcare. Understanding the various types of health insurance can help you make an informed choice. Let’s explore the common types of health insurance policies available in the market.

Health Maintenance Organization (hmo)

An HMO is a type of health insurance plan that requires you to select a primary care physician. This physician oversees your healthcare needs and provides referrals when necessary. HMOs typically offer comprehensive coverage with lower out-of-pocket costs.

Preferred Provider Organization (ppo)

A PPO offers more flexibility compared to an HMO as it allows you to visit any healthcare provider within the network without requiring a referral. While you have the freedom to see specialists without approval, out-of-network care may result in higher expenses.

Exclusive Provider Organization (epo)

An EPO is a hybrid between an HMO and a PPO. It provides coverage for in-network providers only, except in emergency situations. EPOs typically do not require referrals and offer cost-saving benefits when utilizing network providers for healthcare services.

Point Of Service (pos)

A POS plan combines aspects of HMO and PPO models. You choose a primary care physician like you would in an HMO, but you have the option to seek care outside the network, albeit with higher out-of-pocket costs. POS plans offer a balance between cost-effectiveness and flexibility.

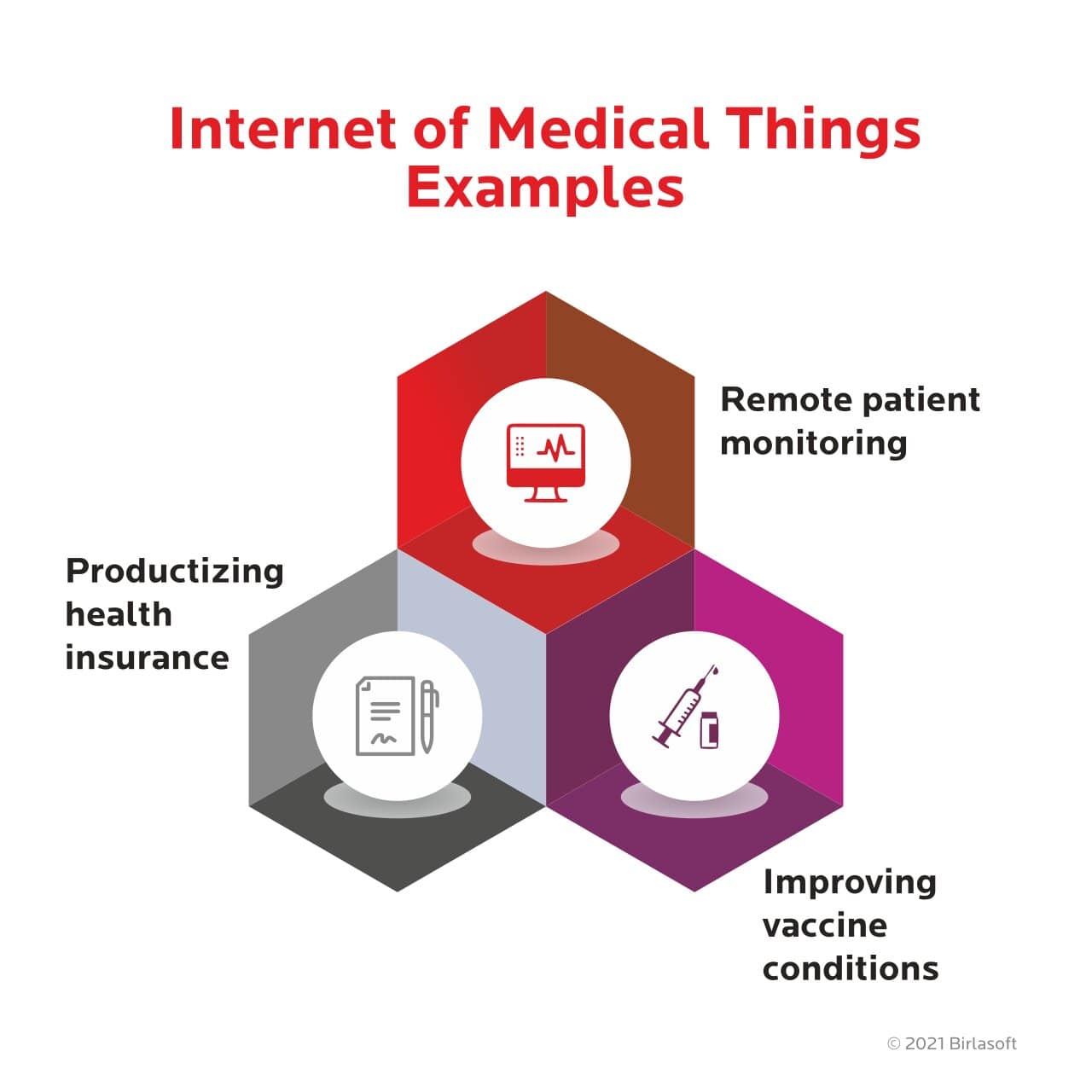

Credit: http://www.birlasoft.com

Key Features To Consider

Considering a Health Insurance Policy, prioritize coverage for major medical expenses, including hospital stays, surgeries, and doctor visits. Evaluate key features like network coverage, deductibles, copayments, and out-of-pocket maximums to ensure comprehensive protection and affordability.

Start of Key Features to Consider Section Coverage OptionsCoverage Options

When choosing a health insurance policy, one of the most important considerations is the coverage options it provides. It is essential to thoroughly understand what benefits are included and excluded from the policy. Look for the policy that covers a wide range of medical services including hospitalization, doctor visits, surgical procedures, and emergency care. Make sure the policy also covers preventive care such as immunizations and screenings.

Network ProvidersNetwork Providers

Another essential aspect to consider is the network provider of the health insurance policy. A network provider refers to the healthcare professionals, hospitals, and medical facilities with whom the insurance company has an agreement. Make sure the policy’s network providers are convenient and suitable for your needs. Check if your preferred doctors, hospitals, and specialists are included in the network. It is also important to determine whether the policy allows visits to out-of-network providers and how it affects the coverage.

Premiums and DeductiblesPremiums And Deductibles

When reviewing health insurance policies, it is crucial to consider the premiums and deductibles. The premium is the amount you will pay monthly or annually to maintain coverage. On the other hand, a deductible is the amount you must pay out of pocket before the insurance starts covering the expenses. Take into account your budget and financial situation when evaluating the premium and deductible amounts. Compare different policies to find a balance between affordable premiums and manageable deductibles.

Prescription Drug CoveragePrescription Drug Coverage

In addition to medical services, it is important to assess the prescription drug coverage offered by the health insurance policy. Check whether the policy covers the medications you regularly need or any specific drugs that may be required in the future. Understand the copayment or coinsurance associated with prescription drugs and ensure that it aligns with your budget. Some policies may also have restrictions on certain drugs or require pre-authorization, so it is crucial to review these details.

End of Key Features to Consider SectionChoosing The Right Policy

When it comes to choosing the right health insurance policy, it’s crucial to carefully assess your personal healthcare needs, compare plan options, and understand the policy terms and conditions. Making an informed decision plays a vital role in ensuring that you receive the coverage you require at a cost that fits your budget.

Assessing Personal Healthcare Needs

Before selecting a health insurance policy, it’s essential to evaluate your individual medical requirements. Consider factors such as your age, existing health conditions, and the possibility of future medical care. Additionally, think about any prescription medications or specialized treatments you may need. By understanding your healthcare needs, you can choose a policy that offers the most comprehensive and suitable coverage for you and your family.

Comparing Plan Options

With a myriad of health insurance plans available, it’s important to compare the options offered by various insurance providers. Look into the specific benefits, coverage limits, deductibles, and premiums associated with each plan. Pay attention to in-network and out-of-network coverage, as well as any co-payments or coinsurance requirements. By comparing plan options, you can identify the one that best aligns with your healthcare needs and financial situation.

Understanding Policy Terms And Conditions

When reviewing health insurance policies, carefully examine the terms and conditions outlined in the documents. Pay attention to coverage limitations, exclusions, pre-existing conditions, and the procedure for claims submission. Additionally, take note of any waiting periods, renewal terms, and possible restrictions on certain treatments or procedures. Having a clear understanding of the policy terms and conditions ensures that you are aware of the coverage and limitations provided by the insurance plan.

Credit: http://www.amazon.com

Navigating Health Insurance Enrollment

When it’s time to enroll in a health insurance plan, it’s important to understand the different enrollment periods and options available. Navigating health insurance enrollment can be complex, but knowing the key terms and concepts can make the process much easier. In this guide, we’ll explore the open enrollment period, special enrollment period, and employer-sponsored plans to help you make informed decisions about your health coverage.

Open Enrollment Period

The open enrollment period is the designated time each year when individuals can enroll in or make changes to their health insurance plans. It typically occurs in the fall, and the exact dates may vary depending on the state and the insurance provider. It’s essential to be aware of the open enrollment period because missing this window may limit your options for obtaining or modifying coverage.

Special Enrollment Period

Under certain circumstances, individuals may qualify for a special enrollment period outside of the annual open enrollment period. Qualifying life events such as marriage, childbirth, adoption, or loss of other health coverage can trigger a special enrollment period, allowing individuals to enroll in a new health insurance plan or make changes to their existing coverage. It’s crucial to understand the eligibility criteria for a special enrollment period and take advantage of this opportunity when applicable.

Employer-sponsored Plans

Many individuals have the option to get health insurance through their employers. Employer-sponsored plans often provide comprehensive coverage at a lower cost, as employers typically contribute to the premiums. It’s essential to carefully review the different plan options offered by your employer and select the one that best meets your needs and preferences.

Maximizing Health Insurance Benefits

To maximize health insurance benefits, policyholders should carefully review the coverage details and take advantage of preventive services, such as regular check-ups and screenings. Being aware of in-network providers and understanding the policy’s co-pays and deductibles can help individuals make the most of their health insurance.

Utilizing Preventive Care Services

One of the smartest ways to maximize your health insurance benefits is to take advantage of preventive care services. These services are specifically designed to help detect and prevent potential health issues before they become serious. By regularly scheduling check-ups with your primary care physician and undergoing routine screenings, you can catch any health problems early on and increase the chances of successful treatment.

Managing Out-of-pocket Costs

When it comes to health insurance, it is essential to understand your out-of-pocket costs. Familiarize yourself with your insurance plan’s deductibles, copayments, and coinsurance to avoid any surprises. To manage these costs effectively, consider setting up a health savings account (HSA) or a flexible spending account (FSA). These accounts allow you to save pre-tax dollars to cover healthcare expenses, reducing your financial burden. Additionally, research and compare prices for healthcare services to find the most cost-effective options.

Seeking In-network Providers

One important aspect of maximizing your health insurance benefits is ensuring you consistently seek care from in-network providers. In-network providers have established agreements with your insurance company, resulting in negotiated rates for services. This means you are likely to pay less out-of-pocket when visiting in-network doctors, specialists, or hospitals. Before scheduling any appointments or procedures, always verify that the healthcare provider is in-network to make the most of your insurance coverage.

Common Mistakes To Avoid

Discover the most common mistakes to avoid when choosing a health insurance policy. Ensure your decision-making process is smooth and hassle-free by staying clear of these pitfalls.

Underestimating Coverage Needs

Many individuals end up choosing a health insurance policy that doesn’t adequately cover their healthcare needs.

Ignoring Network Restrictions

It’s crucial to be aware of the network restrictions in your health insurance plan to avoid unexpected out-of-pocket expenses.

Not Reviewing Plan Changes Annually

Failure to review plan changes annually may result in missing out on better coverage options or cost-saving opportunities.

Credit: http://www.sandstonecare.com

Frequently Asked Questions Of Who Health Insurance Policy

What Does A Health Insurance Policy Cover?

A health insurance policy typically covers hospitalization, medical expenses, and sometimes preventive care. It provides financial security in case of unexpected medical emergencies and expenses.

How To Choose The Right Health Insurance Policy?

When choosing a health insurance policy, consider your medical needs, budget, network of hospitals, and the insurer’s claim settlement ratio. It’s essential to compare different policies and understand the terms and conditions before making a decision.

Why Is Having A Health Insurance Policy Important?

Having a health insurance policy provides financial protection against high medical costs. It ensures access to quality healthcare without worrying about the financial burden. It also promotes early detection and treatment of illnesses, leading to better health outcomes.

Can I Buy A Health Insurance Policy For My Family?

Yes, many insurance companies offer family health insurance policies that cover the entire family, including spouse, children, and dependent parents. It provides comprehensive coverage for the entire family’s medical needs, offering peace of mind and security.

Conclusion

To conclude, a health insurance policy plays a crucial role in safeguarding your well-being and providing financial protection during medical emergencies. Ensuring easy access to quality healthcare and relieving the burden of expensive treatments, it serves as a reliable safety net.

By carefully selecting a policy that aligns with your needs, you can enjoy peace of mind and focus on leading a healthy, worry-free life. Remember, investing in your health is an investment in your future.

Leave a comment