Life Insurance Company is a financial institution that offers life insurance policies to individuals or groups. With a range of coverage options, Life Insurance Company aims to provide financial protection to policyholders and their beneficiaries in the event of death.

Life insurance policies are crucial for ensuring the financial security of loved ones, providing them with financial support to cover expenses such as funeral costs, debts, and ongoing living expenses. We will explore the different types of life insurance policies offered by Life Insurance Company and the benefits they provide.

Understanding the importance of life insurance and choosing the right policy can bring peace of mind and financial stability to individuals and their families. So, let’s dive into the world of life insurance and discover how Life Insurance Company can help safeguard your future.

Credit: http://www.bostonmutual.com

History Of Life Insurance Companies

Origins Of Life Insurance

Life insurance dates back to ancient times, with early forms originating in Roman, Greek, and Babylonian societies.

- Life insurance provided financial protection for families in case of a member’s demise.

- It evolved to ensure economic stability for loved ones left behind.

Evolution Of Life Insurance Industry

The life insurance industry has seen significant growth and innovation over the centuries.

- Modern life insurance as we know it emerged in the 18th century.

- It evolved to include various types such as term, whole life, and universal policies.

Importance Of Life Insurance

Life insurance is essential for individuals as it provides financial security to loved ones. A life insurance company offers protection and peace of mind by ensuring beneficiaries are taken care of financially in case of unforeseen events. It is a crucial way to safeguard one’s family and assets, making it a vital investment for the future.

Life Insurance Company is essential in securing the financial future of your loved ones. It provides a safety net that can protect your family from financial hardships in the event of your untimely demise. Life insurance ensures that they are taken care of even when you are no longer around to provide for them.

Financial Security For Loved Ones

Life Insurance Company offers financial security to your loved ones by providing them with a sum of money, known as the death benefit, in the event of your passing. This money can be used to cover daily expenses, pay outstanding debts, or fund future expenses such as education or healthcare.

It gives you peace of mind knowing that your family will have the necessary funds to maintain their lifestyle and meet their financial obligations, even if you are not there to support them. Life insurance provides a financial buffer during a difficult time, allowing your loved ones to grieve and heal without the added stress of financial worries.

Debt Repayment And Estate Planning

In addition to providing financial security for your family, Life Insurance Company can also play a crucial role in debt repayment and estate planning. If you have outstanding debts, such as a mortgage or car loan, life insurance can be used to settle these debts, relieving your loved ones from the burden.

Moreover, life insurance is an effective estate planning tool. It can help you leave an inheritance for your children or cover any estate taxes that may be owed on your assets. By having a life insurance policy, you can ensure that your beneficiaries receive the financial resources they need to manage your estate efficiently.

With the help of Life Insurance Company, you can secure your family’s financial well-being, protect them from the burden of debt, and ensure the smooth transfer of your assets. It is an investment that offers peace of mind and demonstrates your love and care for your loved ones even after you are gone.

Types Of Life Insurance Policies

Life insurance is a critical financial tool for providing security and peace of mind to your loved ones in the event of your untimely passing. There are various types of life insurance policies available to cater to different needs and financial goals.

Term Life Insurance

Term life insurance provides coverage for a specific period, known as the term, which could range from 5 to 30 years. If the insured passes away during the term, the designated beneficiaries receive the death benefit. It is cost-effective and straightforward.

Whole Life Insurance

Whole life insurance policy is a permanent type of life insurance that offers lifelong coverage. It also accumulates cash value over time, which can be accessed through withdrawals or loans. The premiums are usually fixed.

Universal Life Insurance

Universal life insurance is a flexible policy that combines a death benefit with a savings component. It provides the policyholder with the ability to adjust the coverage amount and premiums. The cash value grows based on the interest rates set by the insurer.

Credit: http://www.instagram.com

Factors To Consider When Choosing A Life Insurance Company

When selecting a life insurance company, several crucial factors come into play. This can be a pivotal decision that will impact your financial security and peace of mind. Understanding the critical aspects to evaluate will help you make an informed choice. Below are the key factors to consider when choosing a life insurance company:

Financial Stability Of The Company

Ensuring the financial stability of the life insurance company is crucial. A financially sound company is more likely to fulfill its commitments to policyholders. You can assess this by checking the company’s ratings from independent rating agencies such as A.M. Best, Standard & Poor’s, and Moody’s.

Policy Options And Flexibility

Evaluating the policy options and flexibility offered by the life insurance company is essential. Look for a company that provides a wide range of policy options to suit your specific needs. Flexible policies that can be adjusted as your circumstances change can be highly beneficial.

Customer Service And Reputation

Assessing the customer service and reputation of the life insurance company is paramount. Research customer reviews and ratings to gauge the level of satisfaction policyholders have experienced. Additionally, consider the company’s reputation within the industry and its track record of handling claims efficiently and fairly.

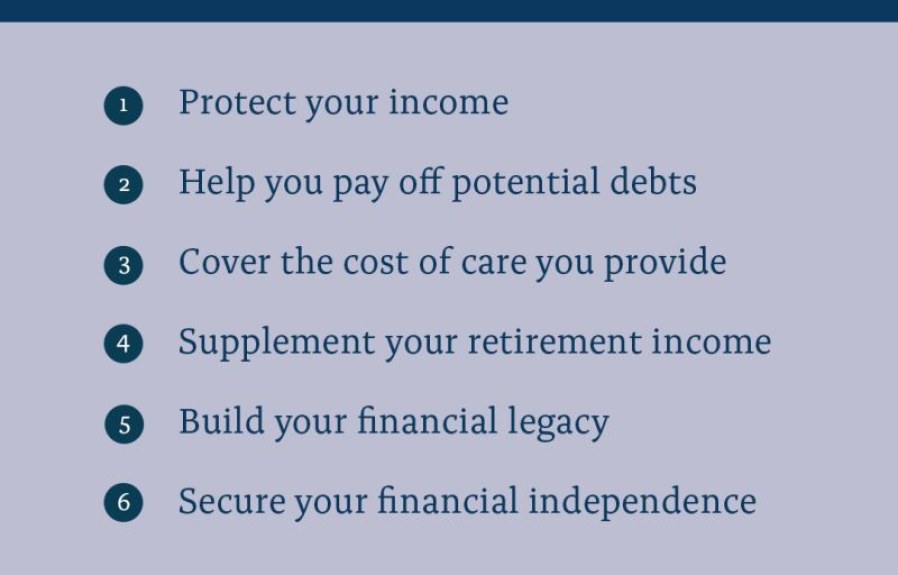

Benefits Of Life Insurance For Financial Planning

Life insurance plays a crucial role in ensuring financial security and stability. It offers a range of benefits that help individuals and families achieve their long-term financial goals. Incorporating life insurance into your financial planning strategy can provide you with a safety net and peace of mind. Below are the major benefits of life insurance that contribute to effective financial planning:

Income Replacement

Life insurance serves as a vital tool to replace lost income due to the untimely death of the policyholder. In the event of the insured’s death, the beneficiary(ies) receive a lump sum or regular payments, effectively replacing the lost income. This ensures that loved ones are financially protected and maintain their standard of living, even after the loss of the primary breadwinner. Income replacement through life insurance can prevent financial distress, allowing the family to continue meeting financial obligations, such as mortgage payments, education expenses, and daily living costs.

Investment Opportunities

Life insurance not only provides financial protection but also offers investment opportunities. Many life insurance policies, such as whole life or universal life insurance, accumulate cash value over time. This cash value grows tax-deferred and can be accessed through policy loans or withdrawals. The accumulated funds can be utilized for various purposes like funding educational expenses, supplementing retirement income, or even starting a business. By integrating life insurance with investment options, policyholders can effectively grow their wealth and meet their long-term financial objectives.

Tax Advantages

Life insurance also comes with significant tax advantages that aid in overall financial planning. The death benefit received by beneficiaries is typically tax-free, allowing the full amount to be utilized for various needs. The cash value growth within certain types of life insurance policies is tax-deferred, which means policyholders can enhance their savings without immediate tax liabilities. Additionally, policyholders may benefit from tax-free policy loans and withdrawals, enabling them to access funds without incurring significant tax burdens. These tax advantages make life insurance an attractive option for effective financial planning strategies.

Credit: applewoodindependent.co.uk

Challenges And Controversies In The Life Insurance Industry

In the life insurance industry, several challenges and controversies have emerged, bringing to light the darker side of an industry that is built on providing financial security to individuals and families. Understanding these challenges is crucial in navigating the complexities of the life insurance landscape.

Mis-selling And Fraudulent Practices

Unscrupulous agents and entities engaging in mis-selling practices have tarnished the reputation of life insurance companies. Misleading policyholders or pressuring them into purchasing unnecessary or unsuitable policies can have devastating consequences for individuals and their financial well-being.

Regulatory Issues And Compliance

Life insurance companies often face regulatory challenges and stringent compliance requirements imposed by governing bodies. Non-compliance with regulatory standards can lead to fines, reputational damage, and even the suspension of operations. Ensuring adherence to regulations is paramount for maintaining the trust of policyholders and the stability of the industry.

Trends And Innovations In Life Insurance

In the ever-evolving world of life insurance, several trends and innovations have been shaking up the industry. From digital transformation to personalized policies, the landscape of life insurance is undergoing a significant shift.

Digital Transformation

With technological advancements shaping various aspects of our lives, the life insurance industry is no exception. Digital transformation has revolutionized the way life insurance companies interact with their customers. From offering online quotes to providing seamless policy management platforms, insurers are leveraging digital tools to enhance customer experience and streamline operations.

Usage-based Insurance

Usage-based insurance has emerged as a game-changer in the life insurance sector. This innovative approach allows insurers to tailor premiums based on the individual’s behavior, promoting safer habits and incentivizing policyholders. By utilizing telematics and IoT devices, insurers can gather real-time data to adjust premiums according to the insured’s risk profile, fostering a more personalized and fair insurance model.

Personalized Policies

Ensuring that each individual’s unique needs are met, personalized policies are becoming increasingly prevalent in the life insurance industry. By leveraging advanced analytics and AI, insurers can craft tailored coverage plans that align with specific lifestyle, health, and financial circumstances. This shift from traditional one-size-fits-all policies to personalized solutions signifies a remarkable advancement in catering to the diverse needs of policyholders.

The Future Of Life Insurance

The future of life insurance is rapidly evolving with the integration of AI and machine learning, as well as a focus on holistic financial wellness. These advancements are reshaping the industry, leading to personalized offerings and enhanced customer experiences. As life insurance companies adapt to the changing landscape, the role of technology and a broader approach to financial well-being are pivotal in driving innovation and meeting the diverse needs of policyholders.

Integration Of Ai And Machine Learning

Life insurance companies are leveraging artificial intelligence (AI) and machine learning technologies to enhance risk assessment, streamline underwriting processes, and improve customer service. Through data analysis and predictive algorithms, insurers can provide more accurate premiums and better anticipate the needs of policyholders. This integration of AI and machine learning is revolutionizing the industry, making life insurance more accessible and tailored to individual circumstances.

Focus On Holistic Financial Wellness

Embracing a holistic approach to financial wellness, life insurance companies are expanding their services beyond traditional coverage. They are offering comprehensive financial planning, investment advice, and retirement solutions to support the long-term well-being of their customers. By addressing broader financial needs, insurers are fostering stronger relationships with policyholders and aligning their offerings with evolving financial landscapes.

Frequently Asked Questions For Who Is Life Insurance Company

What Does Life Insurance Company Do?

Life Insurance Company provides financial protection to individuals and families in case of unexpected events, such as death or disability. They offer various insurance products to help secure the financial future of their policyholders.

How To Choose The Right Life Insurance Company?

When choosing a Life Insurance Company, consider factors such as reputation, financial strength, customer service, and the range of insurance products they offer. It’s essential to compare quotes and understand the terms and conditions before making a decision.

Why Is Life Insurance Company Important?

Life Insurance Company plays a crucial role in providing financial security and peace of mind to individuals and their loved ones. It offers a safety net in the event of unforeseen circumstances, ensuring that beneficiaries are protected from financial hardships.

What Are The Benefits Of Having Life Insurance Company?

Having Life Insurance Company provides a range of benefits, including financial protection for loved ones, coverage for outstanding debts and expenses, potential tax advantages, and peace of mind knowing that your family’s future is secured.

Conclusion

The Life Insurance Company stands as a reliable and trustworthy option for securing your future. Their extensive coverage options, competitive rates, and outstanding customer service make them a top choice in the insurance market. With their innovative policies and commitment to meeting clients’ needs, you can have peace of mind and protect your loved ones financially.

Choose the Life Insurance Company today and ensure a secure future for yourself and your family.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What does Life Insurance Company do?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Life Insurance Company provides financial protection to individuals and families in case of unexpected events, such as death or disability. They offer various insurance products to help secure the financial future of their policyholders.” } } , { “@type”: “Question”, “name”: “How to choose the right Life Insurance Company?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “When choosing a Life Insurance Company, consider factors such as reputation, financial strength, customer service, and the range of insurance products they offer. It’s essential to compare quotes and understand the terms and conditions before making a decision.” } } , { “@type”: “Question”, “name”: “Why is Life Insurance Company important?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Life Insurance Company plays a crucial role in providing financial security and peace of mind to individuals and their loved ones. It offers a safety net in the event of unforeseen circumstances, ensuring that beneficiaries are protected from financial hardships.” } } , { “@type”: “Question”, “name”: “What are the benefits of having Life Insurance Company?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Having Life Insurance Company provides a range of benefits, including financial protection for loved ones, coverage for outstanding debts and expenses, potential tax advantages, and peace of mind knowing that your family’s future is secured.” } } ] }

Leave a comment