Public Liability Insurance in the UK is necessary for businesses to protect against claims of injury or damage. It is essential for small business owners, event organizers, contractors, and freelancers.

Public Liability Insurance provides financial protection in case someone is injured or their property is damaged due to your business activities. Accidents can happen unexpectedly, and having this insurance helps businesses avoid potentially costly legal expenses. It is a vital safeguard for businesses of all sizes to ensure they are protected from liability claims that may arise from their operations.

By investing in Public Liability Insurance, businesses can operate with peace of mind knowing they are financially secure in case of unforeseen accidents.

What Is Public Liability Insurance?

Public Liability Insurance is essential for UK businesses, safeguarding against third-party claims for property damage or injury. It’s vital for businesses in all industries to protect themselves from potential legal and financial risks. Having this insurance provides peace of mind and financial security in case of unforeseen accidents.

Public Liability Insurance is a crucial aspect of risk management that helps protect businesses, self-employed individuals, and professionals against claims made by the public for injury, property damage, or other losses that occur as a result of their business activities. Whether you are a small business owner, a contractor, or a freelancer, having Public Liability Insurance UK is essential to safeguard your financial well-being and reputation. Let’s dive deeper into the coverage and protection as well as the legal requirements of this indispensable insurance policy.Coverage And Protection

Public Liability Insurance provides coverage and protection to businesses and professionals in the event that they are held legally liable for injuries or damages caused to members of the public. This can include:| Benefits of Public Liability Insurance: |

|---|

1. Compensation for bodily injury:

|

2. Property damage:

|

3. Legal expenses:

|

Legal Requirements

While Public Liability Insurance is not a legal requirement for all businesses in the UK, many industries and professions require it as part of their legal obligations or contractual agreements. For example:- Contractors working on construction sites are typically required to have a minimum level of Public Liability Insurance coverage before commencing work.

- Event organizers often need to provide evidence of Public Liability Insurance to secure venues or obtain permits.

- Some trade associations or professional bodies mandate Public Liability Insurance as a condition of membership.

Credit: http://www.nerdwallet.com

Who Needs Public Liability Insurance?

Benefits Of Public Liability Insurance

Public Liability Insurance offers crucial protection for businesses and individuals in the UK. It provides financial security and safeguards reputation, easing potential risks and liabilities.

Financial Protection

Public Liability Insurance shields you from costly legal claims arising from accidents or damages on your premises. It covers compensation and legal expenses, preventing financial setbacks.

Reputation Management

Having Public Liability Insurance showcases your commitment to safety and professionalism. In case of accidents, it helps maintain your business’s credibility and trust among customers.

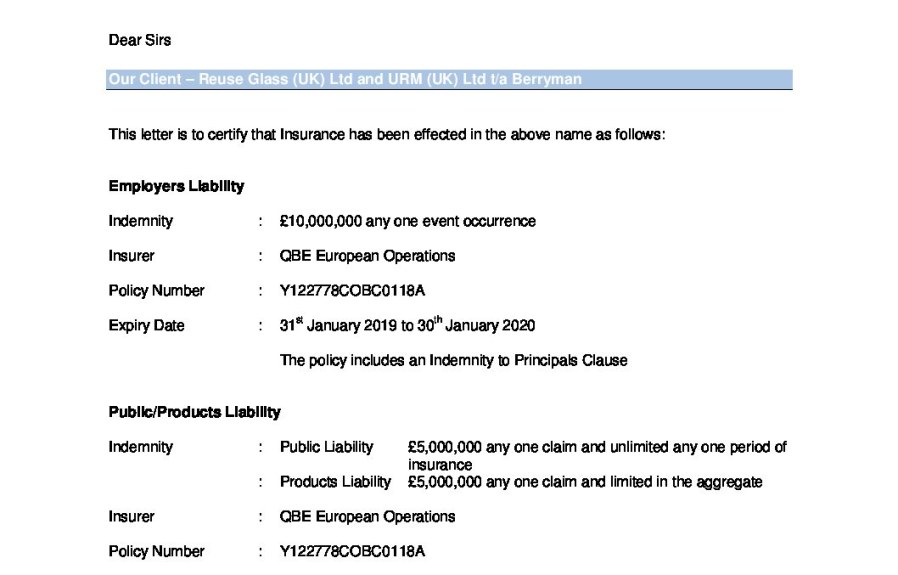

Credit: http://www.urm.co.uk

Understanding The Cost

Understanding the cost of public liability insurance, it’s essential for any business operating in the UK to protect themselves from potential legal and financial risks. This insurance is crucial for anyone managing a business, organizing events, or offering services to the public, ensuring peace of mind in case of accidents or incidents.

Factors Affecting Premiums

Public liability insurance premiums can vary depending on several factors. Before you commit to a policy, it’s crucial to understand what affects the cost. Let’s take a closer look at some of the key factors that can impact your premiums: 1. Type of Business: The nature of your business plays a significant role in determining your premium. Businesses that involve higher risks, such as manufacturing or construction, usually have higher premiums compared to low-risk businesses like consulting or retail. 2. Business Size: The size of your business, including the number of employees and turnover, can influence the cost of your public liability insurance. Generally, larger businesses may require higher coverage limits and may face higher premiums as a result. 3. Coverage Limit: The amount of coverage you choose also affects your premium. Higher coverage limits mean higher premiums, as the insurer would potentially have to pay out more in the event of a claim. 4. Claims History: Your claims history can impact the cost of your insurance. If you have a history of multiple claims or large payouts, insurers may view your business as higher risk and increase your premiums accordingly. 5. Industry: Different industries have varying levels of risk, which can influence the cost of public liability insurance. For example, businesses in the hospitality sector may face higher premiums due to potential injury risks compared to businesses in the IT sector. 6. Location: The location of your business can also affect your premiums. Insurers consider factors such as crime rates and the prevalence of certain risks in your area when calculating the cost of coverage.Comparing Quotes

When it comes to choosing the right public liability insurance policy, it’s essential to compare quotes. Comparing quotes allows you to find the best coverage at the most competitive price. Here’s how you can go about comparing quotes effectively:- Get Multiple Quotes: Contact different insurance providers and request quotes for the coverage you need. This will give you a range of options to compare.

- Review Coverage: Don’t just focus on the cost. Pay close attention to what’s included in each policy and ensure it meets your specific requirements.

- Compare Premiums: Take note of the premium amounts for each quote. While price shouldn’t be the sole deciding factor, it can be an important consideration.

- Consider Extras: Some policies may offer additional benefits or extras. Assess these extras to determine if they add value to your coverage and are worth the additional cost.

- Read Reviews: Look for reviews and feedback from other customers to get an idea of each insurer’s reputation and customer satisfaction level.

- Speak to an Insurance Broker: If you’re unsure about which policy is best for your business, consider seeking advice from an insurance broker who can help guide you through the process.

How To Choose The Right Policy

When it comes to public liability insurance in the UK, selecting the right policy is crucial for businesses. Assessing coverage needs, evaluating insurers, and understanding the specific requirements are essential steps in choosing the right policy. Here’s a comprehensive guide on how to make an informed decision when it comes to public liability insurance.

Assessing Coverage Needs

Determining the necessary coverage for public liability insurance is the initial step in choosing the right policy. This involves assessing the scope of operations, potential risks, and industry-specific liabilities. It’s essential to evaluate the nature of business activities and the level of interaction with the public. Identifying the maximum potential exposure to liability helps in selecting an adequate coverage amount.

Evaluating Insurers

Another crucial aspect of choosing the right public liability insurance policy is evaluating insurers. Researching and comparing different insurance providers is vital to find the best coverage. Look for reputable insurers with a proven track record of handling liability claims effectively. It’s important to consider the financial stability and customer service reputation of the insurers. Assessing the range of coverage options, policy features, and the ability to tailor the policy to specific business needs is essential in the evaluation process.

Credit: benharmantreesurgery.co.uk

Common Claims Covered

Slips, Trips, And Falls

Public liability insurance in the UK covers accidents where a person has been injured due to a slip, trip, or fall on your premises. It provides financial protection in case someone suffers an injury while on your business premises, ensuring that any resulting medical expenses or legal fees are covered.

Property Damage

This coverage also includes property damage caused by your business operations. Whether it’s accidental damage to a customer’s personal belongings or damage caused to the property you are renting for your business, public liability insurance can financially protect you from bearing the cost of such incidents.

Risks Of Not Having Public Liability Insurance

Understand the risks of operating without public liability insurance in the UK. Protect your business from potential legal and financial consequences if any accidents or injuries occur on your premises. Ensure peace of mind and safeguard your company with public liability insurance.

Financial Loss

Public Liability Insurance is not just an option, it’s a necessity for businesses and individuals alike. Without it, you expose yourself to various risks that can result in significant financial loss. The reality is that accidents can happen anytime, anywhere, and to anyone.

One incident, no matter how small, can potentially lead to expensive legal disputes and compensation claims. These unexpected costs can quickly escalate and put your finances at stake. Public Liability Insurance gives you the peace of mind that your business is protected from such financial burdens.

Legal Consequences

When it comes to legal matters, ignorance is not bliss. In the absence of Public Liability Insurance, you expose yourself to potential legal consequences that can have long-lasting effects on your reputation and stability. Without insurance, you may find yourself facing costly legal battles, settlement payments, or fines.

Consider this scenario: A visitor slips and falls on your property, injuring themselves in the process. If you do not have Public Liability Insurance, you may be held responsible for their medical expenses, rehabilitation costs, and even potential loss of earnings. Failing to fulfill these obligations can result in legal action being taken against you.

Moreover, legal requirements and regulations in the UK often demand that businesses have Public Liability Insurance in place. Failure to comply with these requirements can result in severe penalties and damage to your professional reputation.

It’s important to remember that accidents are unpredictable, and anyone can become a victim. Protecting yourself, your business, and your finances with the right insurance policy is not just a wise choice, but a necessary precaution to ensure that you are equipped to handle any unexpected situation that may arise.

Final Thoughts

Public Liability Insurance UK is crucial for businesses to protect against potential risks and liabilities. It provides financial coverage for accidents or damages that may occur on your premises or during work activities. Having this insurance safeguards your business and helps build trust with clients and partners.

Peace Of Mind

Public Liability insurance provides peace of mind knowing that your business is financially protected.

In the event of a claim, you won’t have to worry about paying out of pocket expenses.

Professionalism And Trust

Having public liability insurance showcases professionalism and trust to your clients and partners.

It demonstrates that you take your responsibilities seriously and are committed to protecting your business and customers.

Frequently Asked Questions For Who Needs Public Liability Insurance Uk

What Is Public Liability Insurance Uk?

Public liability insurance in the UK provides protection against claims from third parties for injury or property damage.

Who Needs Public Liability Insurance?

Anyone who interacts with the public, such as business owners, contractors, or event organizers, can benefit from public liability insurance.

How Does Public Liability Insurance Protect Me?

Public liability insurance protects you financially if someone makes a claim against you for injury or property damage due to your business activities.

Is Public Liability Insurance A Legal Requirement In The Uk?

Public liability insurance is not a legal requirement in the UK, but it’s highly recommended for businesses and self-employed individuals to protect themselves.

Conclusion

Protecting yourself and your business from unexpected accidents is crucial, which is why having public liability insurance in the UK is a necessity. This type of insurance offers financial protection and peace of mind, covering costs related to property damage, personal injury, or any legal claims made against you or your business.

By investing in public liability insurance, you can safeguard your reputation, finances, and future success. Don’t risk it, get the right coverage today.

Leave a comment